Guest

Latest articles

Willem Buiter refutes the notion that decentralised private cryptocurrencies could ever be a sensible investment

All rural sector groups are now more buoyant about the outlook for the agri economy, with both dairy farmers and sheep and beef farmers significantly more optimistic than last quarter

Cam Harper of Southern Cross Partners says there's lot of opportunity in P2P, but it’s a niche industry that will never really take on the banks and change the way lending works

Steven Dooley doesn't see much lingering impact on the NZD from the Government's housing moves. But he does see it turning and supported by global growth and rising commodity prices

29th Mar 21, 4:33pm

by Guest

Steven Dooley doesn't see much lingering impact on the NZD from the Government's housing moves. But he does see it turning and supported by global growth and rising commodity prices

Gary Hughes points out that those who 'merely' add restrictive clauses to a mundane commercial contract risk becoming accidental cartelists. The consequences can be severe

29th Mar 21, 10:41am

by Guest

Gary Hughes points out that those who 'merely' add restrictive clauses to a mundane commercial contract risk becoming accidental cartelists. The consequences can be severe

Anthony Grant points out that if you are paid to advise on trusts, you must make sure the initial settlor is aware of the meaning and effect of the Trusts Act 2019. The risks of consequences have risen

29th Mar 21, 10:26am

by Guest

Anthony Grant points out that if you are paid to advise on trusts, you must make sure the initial settlor is aware of the meaning and effect of the Trusts Act 2019. The risks of consequences have risen

In periods of economic contraction and low rates, gold has generated relatively attractive returns compared to stocks and bonds, and improved risk-adjusted returns for Australian investors says Ray Jia

Kent Harrington highlights recent studies warning of social and political unrest following the current COVID crisis

27th Mar 21, 9:40am

by Guest

Kent Harrington highlights recent studies warning of social and political unrest following the current COVID crisis

[sponsored]

The post-COVID world of investing is highlighting exciting alternative opportunities, as businesses pivot to profit from rapid change and new ways of working. The Syndex platform is where these opportunities live

27th Mar 21, 8:51am

by Guest

The post-COVID world of investing is highlighting exciting alternative opportunities, as businesses pivot to profit from rapid change and new ways of working. The Syndex platform is where these opportunities live

Nick Prince notes the British agriculture industry is confronting major policy changes and a sharp exposure to global markets. There will be opportunities for New Zealand but competition will be strong at a time when UK demand drivers are shifting quickly

Zhang Jun urges the country's leaders to raise the retirement age and loosen family-planning rules

It is time to consider options for addressing traffic congestion and air pollution, argues Professor Basil Sharp

Massey's world-first, machine-learning GDP predictor "GDPLive" got an intense lesson on how to handle the unexpected in 2020. Christoph Schumacher looks at how it has handled the challenges

High-protein animal feed based on insects has major potential, claims Rabobank. The next challenges are updating regulation, and building scale, so that the environmental benefits can be delivered

Trusts lawyer Tammy McLeod reviews the fishhooks trustees should know about as the new transparency provisions of the Trusts Act 2019 come into force

Angela Huyue Zhang explains the bureaucratic logic behind the curtailing of the fast-growing fintech conglomerate Ant Group's recent moves

14th Mar 21, 10:04am

by Guest

Angela Huyue Zhang explains the bureaucratic logic behind the curtailing of the fast-growing fintech conglomerate Ant Group's recent moves

Brendon Harre explores how housing can be restored to its central place in a move back to recovering our Egalitarian Dream

Eric Posner cautions that trageting market-dominant firms will require overcoming cultural as well as legal obstacles

13th Mar 21, 9:59am

by Guest

Eric Posner cautions that trageting market-dominant firms will require overcoming cultural as well as legal obstacles

Paola Subacchi applauds the US treasury secretary's leadership in supporting IMF action to help low-income countries

Risky returns or safe havens. How investor sentiment can impact your exchange rates

José Antonio Ocampo identifies two key reforms that would boost the impact of the International Monetary Fund's reserve asset

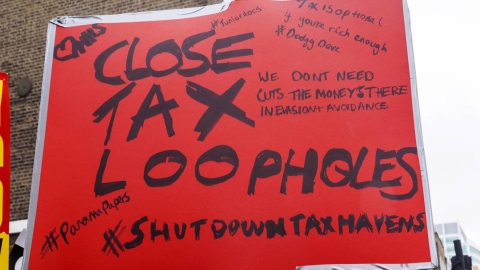

Yu Yongding shows how illicit financial flows undermine development - and suggests several ways to stop them

Koichi Hamada explains what Larry Summers is getting wrong about the Biden Administration's COVID-19 rescue plan

Interest rates have been a key driver for gold in both 2020 and 2021. As interest rates have moved higher, the gold price has decreased but higher inflation expectations may provide some support for gold

Chinese demand for imported liquid milk has grown by 50% per year for more than a decade and the prospects are that this growth will continue even as their domestic supply rises: Rabobank