QE

ASB economists rue the whiplash derived from last week's big 'dovish' shift by the Reserve Bank, while Westpac economists still see a further Official Cash Rate hike in August and ANZ economists expect one in November

29th May 23, 1:55pm

18

ASB economists rue the whiplash derived from last week's big 'dovish' shift by the Reserve Bank, while Westpac economists still see a further Official Cash Rate hike in August and ANZ economists expect one in November

Raghuram Rajan shows why monetary policymakers must bear some of the blame for the latest US and EU banking-sector turmoil

28th May 23, 3:16pm

1

Raghuram Rajan shows why monetary policymakers must bear some of the blame for the latest US and EU banking-sector turmoil

[updated]

Reserve Bank raises interest rates as expected but throws in a major surprise by indicating this will be the last rise

24th May 23, 2:11pm

150

Reserve Bank raises interest rates as expected but throws in a major surprise by indicating this will be the last rise

BNZ economists say the Reserve Bank's next move is likely to be heavily influenced by its assumptions of the supply and demand impacts of a net migration inflow that is 'much stronger than anyone believed'

17th May 23, 12:05pm

65

BNZ economists say the Reserve Bank's next move is likely to be heavily influenced by its assumptions of the supply and demand impacts of a net migration inflow that is 'much stronger than anyone believed'

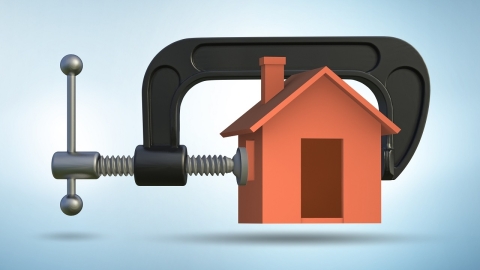

Gareth Vaughan argues borrowers who bought their first home in 2020-21 face being let down by the system

13th May 23, 10:01am

167

Gareth Vaughan argues borrowers who bought their first home in 2020-21 face being let down by the system

Ex-Bank of England Deputy Governor Paul Tucker on how quantitative easing has exposed government finances to rising interest rates

7th May 23, 4:20pm

20

Ex-Bank of England Deputy Governor Paul Tucker on how quantitative easing has exposed government finances to rising interest rates

Martin Whetton on how overseas investors view New Zealand government debt

The Government's debt management unit isn't seeing increased interest in its inflation-indexed bonds despite high inflation

19th Apr 23, 7:45am

21

The Government's debt management unit isn't seeing increased interest in its inflation-indexed bonds despite high inflation

Could, or should, the RBNZ cut the interest rate it pays on banks' settlement cash accounts in order to reduce the Government's interest bill?

15th Apr 23, 9:20am

25

Could, or should, the RBNZ cut the interest rate it pays on banks' settlement cash accounts in order to reduce the Government's interest bill?

The banks are demonstrating that they won't hike interest rates just because the Reserve Bank would like them to - so it might be better for the RBNZ to adopt more of a waiting game

13th Apr 23, 9:45am

75

The banks are demonstrating that they won't hike interest rates just because the Reserve Bank would like them to - so it might be better for the RBNZ to adopt more of a waiting game

BNZ's head of research says the RBNZ should have opted for a smaller Official Cash Rate rise and caution that further rate rises might be needed; approach taken 'will most definitely generate heightened volatility'

6th Apr 23, 8:45am

103

BNZ's head of research says the RBNZ should have opted for a smaller Official Cash Rate rise and caution that further rate rises might be needed; approach taken 'will most definitely generate heightened volatility'

The Reserve Bank has double-pumped the Official Cash Rate with its surprise 50 basis point hike in an effort to blindside the markets. But is it now going to run out of ammo?

5th Apr 23, 2:55pm

115

The Reserve Bank has double-pumped the Official Cash Rate with its surprise 50 basis point hike in an effort to blindside the markets. But is it now going to run out of ammo?

[updated]

Raghuram Rajan and Viral Acharya show how the US central bank's liquidity policies created the conditions for runs on uninsured deposits

29th Mar 23, 10:39am

7

Raghuram Rajan and Viral Acharya show how the US central bank's liquidity policies created the conditions for runs on uninsured deposits

Against the backdrop of a possible Commerce Commission probe into banking competition, Gareth Vaughan looks at how the actions & inactions of NZ authorities have helped maintain the dominance of the big four banks

8th Mar 23, 11:59am

45

Against the backdrop of a possible Commerce Commission probe into banking competition, Gareth Vaughan looks at how the actions & inactions of NZ authorities have helped maintain the dominance of the big four banks

Reserve Bank still has 'expectations' the country's banks will increase their term deposit rates - despite no moves from any of the major banks to date since last week's Official Cash Rate hike

3rd Mar 23, 9:26am

29

Reserve Bank still has 'expectations' the country's banks will increase their term deposit rates - despite no moves from any of the major banks to date since last week's Official Cash Rate hike

[updated]

'People who took out high leveraged loans in the 2020-21 period will be facing very high interest servicing costs'; RBNZ says gap between mortgage and deposit interest rates 'more extreme over recent times'

23rd Feb 23, 9:37am

71

'People who took out high leveraged loans in the 2020-21 period will be facing very high interest servicing costs'; RBNZ says gap between mortgage and deposit interest rates 'more extreme over recent times'

[updated]

The Reserve Bank says while there are early signs of demand easing it continues to outpace supply, as reflected in strong domestic inflation; sees recent storm damage adding 0.3 percentage points to inflation in the March and June 2023 quarters

22nd Feb 23, 2:11pm

138

The Reserve Bank says while there are early signs of demand easing it continues to outpace supply, as reflected in strong domestic inflation; sees recent storm damage adding 0.3 percentage points to inflation in the March and June 2023 quarters

Influential RBNZ survey shows substantial drop in expectations of inflation in two years time - albeit that at 3.3% the survey respondents still see inflation outside the targeted band in 2025

14th Feb 23, 3:25pm

48

Influential RBNZ survey shows substantial drop in expectations of inflation in two years time - albeit that at 3.3% the survey respondents still see inflation outside the targeted band in 2025

Motu Executive Director and ex-RBNZ Assistant Governor John McDermott assesses the state of the local & international economies as 2022 hurtles towards 2023

21st Dec 22, 7:30am

102

Motu Executive Director and ex-RBNZ Assistant Governor John McDermott assesses the state of the local & international economies as 2022 hurtles towards 2023

Harbour Asset Management's Hamish Pepper & Chris Di Leva look at the Top 10 risks and opportunities for 2023

16th Dec 22, 9:27am

24

Harbour Asset Management's Hamish Pepper & Chris Di Leva look at the Top 10 risks and opportunities for 2023

Reserve Bank Governor says our banks need to take a long term view on their customer base 'because it is a lifetime of earnings they get off each customer'

14th Dec 22, 2:33pm

46

Reserve Bank Governor says our banks need to take a long term view on their customer base 'because it is a lifetime of earnings they get off each customer'

Kiwibank economists say the RBNZ is 'doggedly determined to deliver' OCR hikes and it is 'likely to be too much'; see bigger house price falls now, of 21%, taking prices back to 2020 levels

7th Dec 22, 8:08am

78

Kiwibank economists say the RBNZ is 'doggedly determined to deliver' OCR hikes and it is 'likely to be too much'; see bigger house price falls now, of 21%, taking prices back to 2020 levels

ANZ chief economist Sharon Zollner says 'good on' the Reserve Bank for recognising the scale of the inflation problem 'and fronting up to the fact that hoping inflation just goes away is likely to lead to worse outcomes in the end'

30th Nov 22, 2:56pm

13

ANZ chief economist Sharon Zollner says 'good on' the Reserve Bank for recognising the scale of the inflation problem 'and fronting up to the fact that hoping inflation just goes away is likely to lead to worse outcomes in the end'

Kiwibank economists believe the interest rate hikes that have already been delivered will have a huge impact on households and discretionary income will evaporate for many mortgagees

28th Nov 22, 1:57pm

119

Kiwibank economists believe the interest rate hikes that have already been delivered will have a huge impact on households and discretionary income will evaporate for many mortgagees

[updated]

Reserve Bank Governor says the central bank is sorry that New Zealanders are being buffeted by significant shocks and inflation is above target; inflation is no one’s friend and causes economic costs

24th Nov 22, 8:56am

100

Reserve Bank Governor says the central bank is sorry that New Zealanders are being buffeted by significant shocks and inflation is above target; inflation is no one’s friend and causes economic costs