The latest Real Estate Institute of New Zealand (REINZ) monthly housing figures, released on Thursday, make sobering reading for people who bought their first home during the period of record low interest rates in 2020-2021, with the REINZ House Price Index down 17.5% from its November 2021 peak.

This adds to the sense I have that those buyers have been let down by the system. Along with people who may lose their jobs as the Reserve Bank tries to engineer a recession as a step to stabilise prices and rein in inflation, they risk being the sacrificial lambs of an extraordinary period in NZ's economic and financial history.

In 2020 there was a sense that we're all in this together, we've got your back, no one will be left behind. Do your bit, borrow and buy. Now, just a couple of years later, some of those first home buyers face being thrown under the monetary policy bus.

When the Covid-19 pandemic hit in March 2020, tipping the world into what was probably its greatest period of uncertainty since World War II, the Reserve Bank slashed NZ's benchmark interest rate, its Official Cash Rate (OCR), to a record low of just 0.25%.

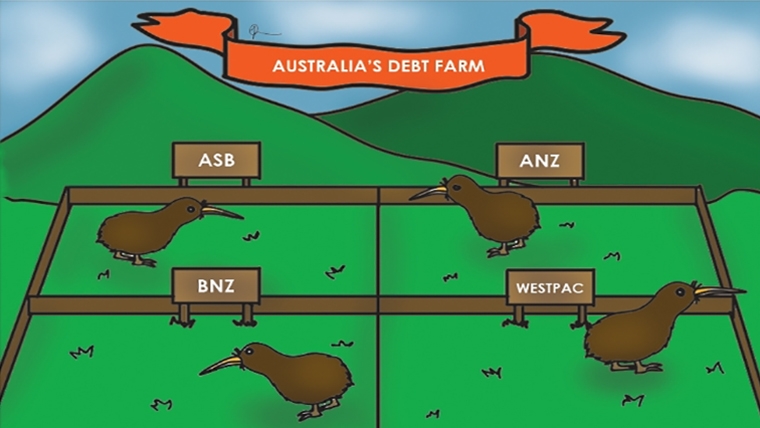

It also embarked, for the first time, on quantitative easing, or QE. This saw the Reserve Bank buy about $53 billion worth of government and local government bonds from a range of banks including ANZ, BNZ, ASB's parent the Commonwealth Bank of Australia and Westpac. This increased the supply of money, helped suppress interest rates, provided liquidity to the banking system encouraging banks to lend, thus helping drive the explosion in bank mortgage lending and house prices in 2020-2021.

Additionally home lending banks were able to access $19 billion of three-year money priced at the OCR through the Reserve Bank's Funding for Lending Programme, and the Reserve Bank removed loan-to-value ratio restrictions on low deposit mortgages as Governor Adrian Orr urged banks to be "courageous."

At the same time, with Covid-19 restrictions in place, the Government introduced a Wage Subsidy Scheme, and teamed up with banks and the Reserve Bank to implement a mortgage deferral scheme for struggling borrowers.

Then, with borders closed, lockdowns implemented and vaccines emerging faster than anticipated, the dire forecasts from both the public and private sectors as to the potential damage Covid-19 could wreak on both people and the health system, fortunately didn't materialise.

With low interest rates, job security, encouragement from the authorities, enthusiasm from lenders, plus media stories and real estate agents inducing FOMO, or the fear of missing out, New Zealanders plunged into mortgage debt boots and all. The value of new mortgages taken out during that peak period was running at an annual rate of about $100 billion as banks shoveled money out the door.

In February 2021 Shayne Elliott, CEO of Australia's ANZ Banking Group, parent of NZ's biggest bank ANZ NZ, highlighted record volumes in ANZ's NZ home loans business saying; "we’ve been really run off our feet there in terms of supporting Kiwis into homes."

ANZ NZ, for which housing now comprises 71% of its total lending, certainly wasn't alone. In the two years to March 2022 BNZ grew its housing lending $9.7 billion, or 22%, to $54.5 billion. As a share of BNZ's total lending, housing increased to 55% from 50% over that two-year timeframe.

Ultimately some tension emerged between the Reserve Bank and the banks it oversees.

Questioned in October 2020 against the backdrop of a housing market taking off, Orr said rather than reining themselves in "the [banking] industry always just wants to have it done to them." The point here was that whilst the Reserve Bank influences how the playing field's configured, it's the banks themselves that do the actual lending.

I put Orr's comments to ANZ NZ CEO Antonia Watson in May 2021.

"If someone comes to me with a good deposit and wants to buy themselves a home, I'm not going to turn them away. What I am going to make sure is that they've got a decent deposit and I've got some equity and some protection in their loan. I'm going to make sure that they can afford to pay a higher interest rate because that's always one of the risks that interest rates go up and your [mortgage] serviceability gets different. So we make sure customers can pay around 6%," Watson said.

In May 2021 the average bank two-year carded, or advertised, mortgage rate was about 2.5%. Now it's about 6.5%. That's because as inflation began its surge, a Reserve Bank copping criticism from all directions, started increasing the OCR in October 2021. It's now 500 basis points higher at 5.25%.

Borrowers who've refixed their mortgage are feeling this in the pocket. Statistics NZ's household living-costs price indexes rose 7.7% in the 12 months to March, with mortgage interest costs up 38%.

Falling house values & rising interest rates

If you bought a home for the first time in 2020-2021, the value of your home may now be lower than what you paid for it, and the interest rate on your mortgage is either significantly higher, or poised to become significantly higher.

In its recent Financial Stability Report the Reserve Bank said about a quarter of total outstanding mortgage stock was taken out in the period from late 2020 to late 2021, with about a fifth going to first home buyers. That's a total of about $87 billion, of which first home buyers' share would be more than $17 billion. Many of those borrowers are now paying interest rates above the level banks' stress tested their ability to repay at.

Thus in interviews with the CEOs of ANZ NZ, BNZ and Westpac NZ following their banks' recent interim financial results, I raised the spectre of negative equity and mortgagee sales, which all three CEOs played down.

Negative equity is when a house price falls in value to the extent the owner owes more on their home loan than what the house is valued at. A mortgagee sale can be an option for a lender when a borrower can't pay back money they owe to the lender and the lender sells the property to get back the money it's owed.

"Mortgagee sales, look they're so much a last resort I wouldn't even want to talk about them at the moment," ANZ NZ's Watson told me.

"Negative equity's only an issue if within relatively short order you need to sell," Westpac NZ CEO Catherine McGrath said.

With house prices down 17.5% since the November 2021 peak and borrowers refixing at significantly higher interest rates, the conversations between lenders and borrowers will get more difficult if there's not firm evidence of a changing trajectory soon.

No one had a playbook when the Covid-19 pandemic swept the world, and I acknowledge an element of hindsight in what I'm writing. In a rare move for a central bank, the Reserve Bank has acknowledged it should've moved sooner to tighten monetary policy away from the ultra low OCR and QE settings.

Nonetheless these tougher times for borrowers and workers are "business as usual with monetary policy" as Orr told a parliamentary select committee recently.

Perhaps that's so if you're sitting at the central bank and looking at the housing market from a macro perspective. But that's cold comfort for a struggling mortgage holder.

Hearing and seeing some contrition and empathy would be nice for people who were encouraged to make the biggest purchase of their lives and just a couple of years later find themselves in a very tight spot.

Sure they ultimately made the decision themselves to take the plunge. Caveat emptor and all that. But given the extraordinary times, encouragement they received, low interest rates available, and FOMO inducing headlines as prices soared, they could almost be excused for believing they were doing some sort of patriotic duty by buying when they did.

I believe the system risks letting down many of those 2020-2021 first home buyers and we need to acknowledge that.

Scarily in March 2020 the national median house price was a then-record high of $665,000. That's still $115,000 below April 2023's $780,000, which in turn is $145,000 below the November 2021 peak.

And at 7.2x nationally and 8.9x in Auckland, the latest house-price-to-income multiples are still way above a multiple of 3x which is traditionally considered a good marker for housing affordability.

Even by NZ standards 2020 and 2021 prices were massively overvalued. And it's easy to make a case that NZ houses are still overvalued, cold comfort indeed to 2020 and 2021 buyers.

A generation was burnt by the 1987 share market crash. Once this Covid-era bubble plays out, where might another generation's feelings towards home ownership be? Or maybe house prices will take off again, interest rates fall, and unemployment not rise significantly, effectively bailing out the 2020-21 buyers.

Either way the system still feels like it needs major surgery if home ownership's to be a more sustainable and less speculative option. But as October's election inches closer, there's nothing on offer from either major party that may lead our next government to suggest it's coming. That will only happen if enough New Zealanders demand it. Only then, if the politicians realise there are significant votes in it, will they be brave enough to campaign for major change to a system featuring debt serfdom and significant uncertainty.

*Also see: Would it be possible and/or desirable to engineer a housing market correction?

*This article was first published in our email for paying subscribers early on Friday morning. See here for more details and how to subscribe.

167 Comments

Dopey govt creating a boom then bust. Those home buyers need to hang in there if they can, it's going to turn upwards soon...

And if that's a serious comment, in it lies the very issue and problem that Gareth is highlighting.

If there's one thing he alludes it's that those who think "It's all going back to normal soon, you wait and see!" haven't yet realised - what we thought was 'normal'....is over.

You've become a real Chicken Little bw.

Those saving for a home will have a healthy deposit by now. Beware falling for the following rip-off.

Police suspect ‘mule’ after Auckland real estate agent loses $100k in elaborate investment scam

https://www.nzherald.co.nz/nz/police-suspect-mule-after-auckland-real-e…

HW2, what exactly are you trying to communicate? Is it an REA got scammed or in this downtrend market, those FHB's with healthy deposits should, through scam avoidance, buy now? Lets watch while their deposit slowly disappears in declining equity, as it's better than losing the lot all at once - right?

If this is your investment advice, it reeks of desperation.

edit

Repeated just for you Retired: "Beware falling for the following rip-off"

I see you want to create diversions and red-herrings. Its good you read the article in its entirety, you're a little bit smarter now. Though it doesn't show

"Property investors who bought in the last five years are facing the equivalent of paying a 10.5% interest rate due to rates rises and the phase-out of mortgage interest deductibility"

HW2, I think these people are getting scammed too, especially when they could reap 6% on a bank term deposit. What investment advice are you giving them - lol!

"you're a little bit smarter now. Though it doesn't show" more desperate ad-hom.......sigh.

Did your wife serve your tea scalding hot, you're on fire this morning. You were supposed to make her a cuppa for once this year for Mothers' Day. Remember!

As for investment advice its pointless giving you any. Clearly

by HW2 | 14th May 23, 8:15am

"Did your wife serve your tea scalding hot, you're on fire this morning. You were supposed to make her a cuppa for once this year for Mothers' Day. Remember!"

So for 364 days a year your wife performs the role of being your Mother? That speaks volumes!!!!!

Seeya!

Misses the point. Again!

Nobody should mention TDs, its the sole preserve of Retired-Poppy the Great

HW2, TD's are healthy. However, a DTI to a vested property investor, is much like an STI is to a Prostitute. Its much more difficult to make an income.

Knowing TD's temporarily hold the upper hand in anticipation of some real value, lets leave it there shall we :)

And misses the point. Again!

Yes you like to run the narrative but the article was about the risk to term deposit holders of scammers and fraudsters. This should be a genuine concern to income investors. It would be helpful to have a convo about it, as opposed to retired poppy steering us around to his pet hate of property.

No doubt you'll have another bite back instead of any constructive point.

You guys need to get a room........

No we don't

I put up an article for everyone's benefit. If R-P chooses to get triggered by it and can't stop commenting that's his problem imo.

Im going to respond to keep him on track

HW2, How come nobody benefits then?

They certainly do. This article is one of the best about property for sometime. Instead of fighting like two old men with handbags they should be solely discussing the fact that many bought at the high and now some of them are screwed. They were told to buy and they did as agents, parents, brokers, banks and spruikers said the market would never drop in value. They were young , trusting and naive and face huge inflation including rising interest rates and housing values that have dropped and will continue to drop in some locations. It is a bloody mess.

It's pretty sad seeing the narrative telling young people the reason they couldn't buy a home was through frivolousness (latest iphones, cars, avocado on toast). Despite this, young people worked their arse off to save a big enough deposit to buy, as encouraged by older folk. When the property market crashes, they're then blamed for making poor financial decisions. "You should have known Interest rates couldn't stay low forever".

And we wonder why mental health in young is so low, and "boomer resentment" is so high. Like a mirror, reflecting the bad attitudes they receive back to the sender?

Support this with evidence or I will never believe it, I only see more indications of further price drops.

Harvey W, I sense a tone of panic in your comment. Upturn by years end has now morphed into "soon". Want to be taken seriously? Share some valuable insight.

Soon = 7.5months🙂

Yeah well, insight void forecasts like this serve little purpose other than make Zachary Smith nervous and call people names. What shape will the economy, job market look like for people to once again have confidence to buy, lift sales volumes and therefore prices? All this by years end mind you.....

Im guessing like everyone else, but let's see what happens....

The market will start to rise, but when? end of the year? ( I think so) but who knows, end of 2024? Might be that long if we get a crap govt elected

Can Luxon give me 1.99% special loan again please I need it

Ah, but do you expect it?

"Once this Covid-era bubble plays out, where might another generation's feelings towards home ownership be?"

This is the rub, and personally I think it is the end game. The shine needs to disappear from property forever. Expensive housing is a massive social negative.

Dopey peoples FOMO Psychology instilled into them by a evil and manipulative RE industry more like it.

Any half wit, even HW2, ( but not the economists) could see the writing on the waĺl as early as late 2020 ( even home.co's sale price graphs showed it) that prices were rising hugely and thus would fall hugely as interest rates increased!

I and many others saw the November 21 peak when sales slowed and divested some property stock for TD investments.

No sympathy for overindulgence by rich white elite kids suckling the coin from mummies cash fund so they can live comfortably on the banks of the river denial.

“…..No sympathy for overindulgence by rich white elite kids suckling the coin from mummies cash fund.”

if they were rich they will be fine. It’s the average kiwi who will suffer. I might be a bigoted racist but you seem a complete c@nt.

Good post CL

Shaft will be silenced sooner or later

Yawn! I think the powers that be now see the social commentary on fiscal concerns actually matter.

Which is why they are more open minded.

It not the money in your life it's the life in your money bro

Feck off. The average kids can't afford a house. THAT'S WHAT I AM TRYING TO SAY!... MORON!

IT'S THE rich kids ( using the bank of M&D and don't have to Wait to save a deposit) that are buying and holding the prices up!

Comprehend now bro?!

If not go back to school and learn comprehension!

"Social commentary on fiscal concerns"

Maybe turn down the volume just a little

Kettle black .

Yes Shane and Bronwyn (pregnant with twins) also foresaw this property crash and decided to stay in the caravan another few years .. whew

"they could almost be excused for believing they were doing some sort of patriotic duty by buying when they did" That's taking it too far. Naivety is a more likely reason.

To be fair, the RBNZ didn't encourage people to load up debt to buy houses in terms of their messaging, they said people need to invest and take risk as they forced savings rates to abysmal levels. That in itself was a pretty dubious message not suitable for the retiree etc. But their actions rather than words were much worse in that they in fact did encourage house prices and personal leverage up by not regulating where the money would go i.e. into business investment.

To be fair, the RBNZ didn't encourage people to load up debt to buy houses in terms of their messaging, they said people need to invest and take risk as they forced savings rates to abysmal levels

They have however manipulated the price of money to modify the behavior of the sheeple though. I'm not talking about recent years. From the late 90s might be a good starting point.

Absolutely. Stepping in multiple times over the past decades - and especially during COVID-19 - prevented free market corrections of pricing from occuring. The only reason prices are going down now is the RBNZ and govt have lost control of the situation in the face of global inflation.

You can't prevent market corrections and free market price discovery only then to put the blame on younger generations of buyers whom your actions only serve to transfer wealth away from - to existing owners.

Simple solution: Free market!

End the RBNZ.

Yes! Let interest rates be set by the market with no OCR to corrupt the level. Guess where mortgage rates will go? (A clue. Down from here isn't it)

Heartily agree. It is way too much to expect central planners to get anything right.

I hope the erosion of purchasing power of fiat currencies accelerates as govts go bust so more of us turn our backs on it and find alternative real money.

EndTheFed (and its little buddies)

Excellent article, one of the best for a while.

Agree, excellent article

Having lived through the 87 crash I know it made me so risk adverse.

Before the crash came no one believed it could end, people everywhere we’re talking about our much money they had made on their shares

The were buying new cars on the profits, borrowing on their shares, banks were lending on shares

Property investors were leasing new BMWs and the country partied like there was no tomorrow

I was a conservative banker at the time and was telling people this couldn’t last, finally I gave in and went down to see my my local share broker, I know you are conservative he said so we will only buy blue chip shares for you, you won’t make as much money but you won’t loose money.

A few weeks later the crash came, my broker closed his doors as the firm went bust, they were buying shares in advance to sell to clients and take the profit as the share price increased. My safe “Blue Chip” shares turned to worthless bits of paper

My solicitor eventually went bankrupt as he borrowed heavily to buy shares.

I spent the next few months trying to comfort customers who had lost their life savings, in one case a retired couple had invested their daughter’s property sale proceeds while the daughter had gone on an OE, they lost the lot.

Then came the mortgagee sales, yes it has happened before, house prices dropped and the borrowers had negative equity.

I never bought shares again(probably to my detriment) but it reminds me of the recent housing boom ,people have been using their homes as an ATM to buy cars and boats etc. Can’t go wrong at 2% they said, all added to the 30 year mortgage and now they are paying 7% the car is depreciating in value but the loan is for 30 years.

Gareth made a good point , perhaps this time people will learn from the past and we may not see another boom for a while until the memories fade.

I was hit fairly hard by the GFC, learnt a lot, certainly made me more cautious.

Lots of people will learn some lessons over the coming year.

See! That's it in a nutshell!...

Experience is everything,

I got fiscally rogered in the 80s but learnt!

I got relationship rogered in the later 90s and learnt

2000 I only had a TV and a Tooth brush.

2000 to GFC working and weekends investing in flipping yachts.

Come the GFC I was prepared. Waited for the fall and invested $515k In a lifestyle block in Northland and waited...

Waiting ...

Waiting

Boom 🌩🌞 19 months - sold - and Huge profit.

And all I've really done is see a rising market and buy then see a falling market and sell. And work in the meantime.

Many houses later 😁😁😁😁😁😁😁😁😁😁

Your a genius 😂 memento mori

May you live to 1000 and remind us of this from time to time.

Thank you for sharing, very interesting

Thank you for sharing your experience.

Each generation of new investors learns the same lessons as previous generations of new investors.

Those who fail to learn the lessons of history are doomed to repeat them.

The system has been throwing young New Zealanders under the bus for years. The idea that rising house prices is good for the average Kiwi is a load of crap. Obviously its worst for those who don't own a home, but for those who own just the home they live in, it hasn't really been at all beneficial - sure the value of your home has gone up, but you are really no better off unless you sell up and go overseas or significantly downgrade your housing.

The Government gets to pretend we have increased prosperity through nominal GDP growth. Banks make a fortune from "risk free" housing lending with low capital requirements. The 10% of people who own multiple properties make millions in Tax free capital gains.

And who pays for it all? Young working Kiwis. New Zealand has the highest levels of homelessness in the OECD, highest levels of rental stress in the OECD and home ownership rates that have been falling for those under 40 since the early 90's. Every productive export industry suffers, as high housing costs make us less competitive as we need to pay higher and higher wages to cover those housing costs.

What a fucking waste. It was always a pyramid scheme, where those who got in last were eventually going to be left out in the cold, it was just a matter of time.

What a fucking waste. It was always a pyramid scheme, where those who got in last were eventually going to be left out in the cold, it was just a matter of time.

Yep. Worse than even the scammiest of cryptocurrencies. Why? The scale and network effects are on a whole other level. 1. It creates an illusion across a whole economy, including the wealth effects; 2.) It encompasses everyone, even if you choose not to be part of the pyramid scheme.

It's not necessary to copy and paste a large part pf the previous comment. It's just sitting there directly above. I'm seeing this too often. Save pixels!

Fair point. It's useful for identifying what point you're responding to.

I will admit that it adds to my pixel consumption and I need to consider these things as a responsible citizen. On that note, I still don't have an e-bike. Stuff those Ponsonby / Grey Lynn virtue signalers. I have a somewhat clunky Trek cross-bike frame that's about 15 years old that's been ridden on in 3 different countries. It's a little skanky and beaten up. But it's a man's bike.

"It's a maaaaan's bike!!"

- James Brown

Got to agree as you see 10 old people and 50k cycling past on the footpath

Not true. The recent system has.

As governments wrongly embrace to many ŵoke minority projects they then end up forgetting what is important.

Councils are a classic for spending/ wasting money on social paraphernalia while the infrastructure burns!

Government should stop land developers monopolizing areas and control land prices thru staged developments. (Supply demand manipulation )

Well said, frank and true. I don't want nor need multiple properties. Sure I could one day have a second as part of an investment portfolio to tick along if the yield worked out over the long term, but this would only be to compliment other investment avenues to reduce overall exposure.

I just want to have a home to start a family, to make memories with my wife, to share good times with family and friends, to have projects and hobbies at, to try my hand at bits and pieces building-wise, to feel secure in the knowledge that if by any chance I die or have a significant injury, my family is secure with a roof over their head. To have a hub for the longer term and branch out to start contributing back to the local community more and giving back to help those around me, be it helping an elderly neighbour with shifting some furniture to helping a new neighbour move in. In my circles I'm no alone in this mentality (early-mid 30's), we just want the life we grew up with which it seemed everyone else had, simple, happy and community driven. The sheer barrier to accessing housing coupled with the magnitude of social division added from this and other govt policies since 2020 are what shreds this community mentality and is the problem pulling at the heart of being a New Zealander.

Now I have access to money through parents and this money came from 1./ My fathers job, and 2./ Their investment housing. They had to sell a few places off to pay for my fathers care to pay for his treatment when he got Ill at 55, which undid a lot their portfolio, but they had a couple left after the passed. So am I privileged, hell yes, but do I feel that the entitled views held by my mother are warranted, hell no, and we have intricate discussions around this to help.

For those in my position who have opportunity thanks to the property ponzi taken advantage of by our folks, we have a social responsibility. It is our responsibility 1./ Not to flaunt this and waste this by keeping prices pumped up through overpaying for houses, do your research and make offers based on the market, and 2./ Contribute back to society as much as you can, volunteer, help your neighbours, get involved in local initiatives. Take it as the cost of having this financial opportunity or you too will end up with the same mentality of pumping asset for your own gain and be a drain on society. Those with less mortgage stress have more time and money to keep the kiwi spirit alive and well.

Emergency low rates were only ever going to be for short time this pushed up house price’s and many borrowed beyond what they can afford pay as this unravels house price’s will just continue to crash. Compared to average income in NZ property price’s are way overvalued and needs to crash to realistic levels.

Compared to current interest rates then many of New Zealand’s houses are overvalued as many can’t afford to buy.

When interest rates come back down then this will change.

Always three components to working out affordability: Interest rates , wages and consequently price.

You missed Point 4.

(4) Current regulations.

WHEN the RBNZ gets serious and brings in restrictive DTI ratios then the capacity of most buyers, to borrow, evaporates. Only when the DTI fits the new equation will property prices 'bottom' - and that is quite some way off both in terms of time and price.

In a higher interest rate environment, DTI doesn't really matter. It's a legislative tool at the bottom of the cliff.

An example: a couple earning 110k get $7,162 after tax (assuming no student loan).

The $594k mortgage they take out on the $660k first home (at a DTI of 5.5) costs them $4,153 per month (7.5% FHB low deposit interest rate). That's 58% of their income - without taking into account home maintenance, rates, various required insurances, etc. How much are they then left to live on? Take it to a DTI of 6.3, and it's 68% of their income. New investors are already locked out of these DTI levels, as their rental income is below these figures already (rental income being a percentage of the prospective FHB's income) - though investors with multiple properties and no current mortgages will be fine.

And these interest rates are still low by historical standards (pre-GFC the average mortgage rate was closer to 9%) - the silly rate reductions since have distorted the long term figures somewhat, as the asset bubble got blown up.

I agree it should exist, but mainly because it gives FHB a significant edge over investors at low interest levels, as the FHB can leverage all of their income, but the investor only their rental income; and in the grand scheme of things, rent is much less than income. Which is why I'm so disappointed with the RBNZ's discussion document on DTI - they're doing their best to look like they're implementing one, without actually implementing one.

You are right bw. Dti will become a factor in as few months.

I’ll be happy the day we can all move on from the moronic idea that a wage multiple is a measure of affordability.

''With low interest rates, job security, encouragement from the authorities, enthusiasm from lenders, and media stories inducing FOMO, or the fear of missing out, New Zealanders plunged into mortgage debt boots and all.''

No - not at all. A very SMALL proportion of New Zealanders plunged into more mortgage debt - certainly less than 20% (given that only about 40% of people live in a house with a owner mortgage attached to it to begin with).

I do know of a fair number of 'investors' who added to their portfolio during this time. They deserve what comes their way.

Exactly.

Buying houses is like any investment .. and comes with risk.

It was the lack of risk management that caught people out. Take it on the chin.. learn and move on.

most people buy a house to live in, not as an investment

No it is an investment. The counter would be I will rent and avoid rates and depreciation (wear and tear). Maintenance is not my concern. With my spare capital I will invest in other areas eg shares. This was the position advanced by Shaquel E the ex BNZ economist for many years. What a CF his advice turned out to be.

Well unlike many on here at least Shaquel admitted that he screwed up and pivoted and finally bought a house many years ago now. I doubt he would tell you that was a mistake because its still going to be worth way more than he paid for it.

Why did you fail short of saying corrupt system.

The people who are responsible for putting excess of cheap money in the system are responsible and if a crime is committed, they should face the law.

But as they say, law has two faces.. One for the rich and powerful and other for the poor and weak.

You must be advocating for every central bank’s decision makers to be locked up then, not just New Zealand’s. As they all printed money during that time.

The question you need to ask yourself is: what would have been the consequence if they all had done nothing?

Do we really want to create a situation where the RBNZ refuses to act decisively in extreme times due to fear of being locked up?

Why then not hold them accountable for their lack of decisive action on the inflation problem?

Or do you only want decisive action if it means pumping up asset prices higher?

Do you see the conflict/contradiction in your view?

Interest rates have risen at the fastest pace ever causing large falls in asset prices.

I would say that’s some decent action. Contrast that with Australians softly softly approach.

How are you suggesting they should have acted differently when inflation started taking off?

Let's have an example, you create a business and you pump up the asset prices artificially and con a few people into paying more and then enjoy on their misery.

Wouldn't the regulatiors come and ask you questions and if found guilty you will be tried with the full force of the law?

The bureaucracy is found to be wrong in those decisions they made, it's just that they are the one's who own the law, so no action will be taken.

Yip I get the feeling the argument is that it is okay to act decisively if it means pumping asset prices upwards.

But it is much better to have a 'wait and see' (its transitory...) approach if the shoe is on the other foot.

Then again - now that the Fed have stopped actively trading (rule change near the peak in 2021) they no longer seem at all interested in pumping asset prices! Could just be a coincidence but its almost too perfect not to be true.

FHB's who bought in 2020/21 expected to feel ongoing pride and security with home ownership, but they were spruiked. If they feel less a Patriotic Kiwi and more like caged battery hen with a pre-determined financial fate, its entirely understandable. As this downtrend continues, Its likely that countless more who purchased earlier than 20/21 will find themselves financially exposed.

Perhaps the powers that be need to grow some cahunas, admit their mistakes and refinance those FHBs away from the banks. With 10y GBs yielding ~4% they could lend at cost and save a fortune in long term social costs, broken families, accommodation supplement etc.

The rising debt levels and unhinged prices struck me as an obvious risk so I didn't buy. I really cannot feel sorry for those who borrowed and indulged themselves. They believed the bullshit and will now have to take their chances. They may be lucky or not, but I will resent subsidising struggling borrowers when it comes to that.

We're in the same boat. Chose not to play that game back in 2015 - and under-estimated how hard those in power would work to keep it going.

Now watching FHB friends from before the peak who didn't put up their own deposit, a) struggling to pay their mortgages, and b) listing their homes for double what they paid in the hope some 'cashed up retiree' will buy it and thus award them a windfall for occupying a house.

If they get lucky, it's going to be hard not to be a little resentful. And if they don't, it'll be an 'I told you so'. And if the government bails them out, that will be a real kick in the teeth.

There wont be a bail out. What would a bail out even look like?

Its a house price crash.. it booms then it busts.. its natural.

When it booms we dont subsidise the lost opportunity for those that didnt gamble and buy at stupid prices...

Imagine we bail them out. House prices would gk stratospheric next time as there is no risk. And what next.. bail out those whk lose at the casino, on bitcoin or the ETS?

Lol.. suck it up those that lost, well done those who got out sooner and lets all move on.

Interestingly enough, we're effectively bailing out commercial property owners in the Hawkes Bay right now.

Do you mean the farmers? I'm very critical of the idea of a residential housing bailout and I think that the situation with commercial farming land in the Hawkes bay is a different story.

How is it different. These people placed their businesses in a floodplain. Are you saying the housing market is more natural than a natural disaster?

Above it is said "Its a house price crash.. it booms then it busts.. its natural".

In this instance it's a river.. it flows normally then it floods.. its natural.

I'm sure you were also more than happy to take the Gov subsidies during covid. Are you against subsidies for 2020/21 home buyers because it wouldn't benefit you?

Same here. With TDs in the bank earning 1%, I have to admit that at one point I thought about purchasing a batch or holiday home. After going to a number of open homes, it didn't take long to realize that this was not a good option. I've lived in a number of countries and I'm always amazed that Kiwis keep thinking their properties are even close to being worth the home's RV, let alone above it. People need to start thinking rationally and looking at risks/rewards instead of believing the bullshit. Gold was a good option and I took it.

"Mortgagee sales, look they're so much a last resort I wouldn't even want to talk about them at the moment," ANZ NZ's Watson told me.

These types of comments are problem. So she doesn't want to talk about it, well she has a responsibility to damn well talk about it. More than happy to talk when OCR at .25% and they were throwing money around like confetti. A bit like "Inflation is transitory" and "Rates won't be going up anytime soon" comments, misleading to the extreme.

I kind of agree that mortgagee sales won’t be a big problem in the near future as they will just move people to interest only. But if unemployment goes up or house prices don’t go up in a the next 2 years it will become a problem.

Our politicians & the RBNZ+NZStats have completely screwed us over.

We are a basket case of mismangement.

a) High immigration, tight RMA laws, uncompetitive building supply oligopolies, low taxes on undeveloped but zones land, sell off of social housing & failure to rebuild it, and no capital gains tax.

b) Direct house prices removed from CPI pushing interest rates way too low & now way too high, & the liquidity dump pushing interest rates to historic lows.

NZ politicians & RBNZ should be ashamed of their incompetence.

Not sure it's incompetence when they've been full-on speculating on property for the last few decades while perpetuating this mess. Looks more like insider trading/abuse of power for personal gain. They've felt so entitled to free wealth from following generations via property that they've sacrificed long-term stability and productivity for their short-term gain.

We were told back then they were taking the least regrets option. I’d hate to see what the most regrets option was!

Least regrets for their personal property portfolios. I've long wondered if they waited till they'd all dumped them till they turned the narrative around.

I strongly disagree with the framing of this article, particularly the claim that the reserve bank/officials were extolling people to take on debt and spend on housing. My recollection of events is that the messaging was that prices were unsustainable, unjustified, and people needed to take care.

The offending quotes here:

“In 2020 there was a sense that we're all in this together, we've got your back, no one will be left behind. Do your bit, borrow and buy.”

“With low interest rates, job security, encouragement from the authorities, enthusiasm from lenders….”

Lets be honest about what happened.

A group of people who wanted a first home saw that dream pull further away from them and made decisions out of FOMO. I feel sorry for them, it felt like a no win situation, but they should have been stress testing their affairs at 7%.

Another group of people dreamed of easy wealth from a ride on New Zealand’s never ending property escalator. These people made decisions out of greed. I have no sympathy for them. That’s an investment decision any person with a basic understanding of economics knew it was a poor one. It also did a lot of harm to the people in the first group who just wanted a home to live in.

I’m sorry mum and pop investors are selling for a loss. But it’s just another investment fad where people were trying to get in after the good days were already over. Diversification, cashflow, low or no leverage, these are fundamentals. That people ignored them is on them.

The rapid decline in house prices and high interest rates is important to reset the New Zealand psyche. Nobody is saying now how house prices can’t go down are they. It’s a tough lesson but we’ll all be better off in the long term for it.

FHBs were struggling to buy even at 2.5%. Stress testing yourself at 7% back then would just mean buying nothing after watching everyone else get rich for decades. I probably would have done the same as them if I was in that situation.

Buying anything expensive to get rich (because its value increases quickly) is massive risk. Leveraging significantly to do so is a significantly larger risk.

The only reason so many people did so was the human sheeple (safety in numbers.. or everyone else is doing it so it must be right) behavior.

Lesson 1.. do your own research when taking any risk.

2. Dont ever do anything just because others are doing it (no matter how many).

Her, here.

But in defence of the article, I read the offending comments as part of the Vibe rather than took them verbatim.

When any market corrects, someone always gets hurt. Like you, I sympathise with anyone who got FOMO'd into buying a home. But that's what fear does, and we are about to get FOMO all over again. But this time it will be the vendors on the end of that fear as the realisation emerges of just how far prices are going to fall.

The sky is falling!

Actually it is.

But a lot of multi-property owners aren't looking in the right direction to see it. They are still looking at the road behind them to see what they think will come ahead even as it keep getting darker overhead.

For balance, here's another quote for you from December 2020

"Prime Minister Jacinda Ardern says she would like to see small increases in houses prices, acknowledging most people “expect” the value of their most valuable asset to keep rising."

https://www.interest.co.nz/property/108301/pm-jacinda-ardern-says-susta…

"Prime Minister Jacinda Ardern says she would like to see small increases in houses prices, acknowledging most people “expect” the value of their most valuable asset to keep rising."

'Frown, Tilt and Pout' was little more than a populist.

The Reserve Bank also clearly signalled to the market they were going to work to prevent free market price discovery during Covid.

Reserve Bank (RBNZ) chief economist Yuong Ha referred to house prices falling as a "deterioration of wealth", which could not be afforded during the COVID-19 economic recovery.

"The worst situation we could face right now would be to see house prices fall," Ha said.

They then pumped out the money to prop up the market and released LVRs. Can't turn property into a welfare scheme then blame younger generations for jumping on board before the RBNZ pushed rates into the negative (true welfarism territory) as they were saying they'd probably do.

Sorry the RBNZ doesn't get to dodge their share of the blame:

1/ They removed LVR limits - ostensibly, in their words "for banks to support their customers", and making it sound like it was part of the mortgage deferment scheme to stop people losing their houses. LVR limits only apply to new lending, so it was always going to have an impact on peoples ability to purchase new properties. Furthermore, removing LVR's should never have occured.

2/ They failed to remove monetary stimulus once it was clear what their policies were causing. They responded quickly to enact stimulatory policies as it was "urgent" but when it was clear the worst of the economic predictions were not coming to pass, they acted with zero urgency to revert stimulatory policies - essentially saying they promised the banks these facilities would last x amount of time, so we can't possibly change that.

3/ They insisted rates would stay low for a considerable, and possibly even go negative. Not only was this something they couldn't guarantee, it made people believe would provide them with some certainly over the medium term.

Sure, they hedged their bets by "warning" people prices were unsustainable. But at the same time all of their actions exasperated the problem.

Yes it was a monumental cock up. Although I do remember at the time the general consensus being that house prices and the economy were going to absolutely tank, it wasn’t just them that got it completely wrong. Agree though they were way too late to take the stimulus away.

Monetary policy is not the tool to address macro-prudential risks (monetary policy tools are tools to address the RBNZ's inflation and employment remit)

The extreme house price risks were preventable back in 2016 when the then Finance Minister did not give the RBNZ the tools they requested to address macroprudential risks.

[RBNZ's DTI plans hit by Government changes | interest.co.nz](https://www.interest.co.nz/property/85201/reserve-bank-confirms-meeting…)

If a debt to income ratio of 5 was imposed back in 2017, then a significant amount of lending would not have been made (and house prices would have been less likely to have reached their record levels).

Based on RBNZ data, the lending commitments made by banks in 2021, that were on a debt to income of 5 or above were NZ$58.8bn (about 59% of total lending commitments made in 2021). For the period of 2019-2022, total loan commitments on a debt to income of 5 or above totalled NZ$99.8bn (about 32% of the total loan commitments for that period)

https://www.rbnz.govt.nz/statistics/series/lending-and-monetary/residen…

The higher the debt to income ratio for a borrower, then the higher the probability of default.

Now how many of these borrowers will experience significant cashflow stress, or default?

For some mortgages, the banks will allow some mortgage modification (such as extension of loan maturity date, or allow the borrower to go on interest only)

For other mortgages, the banks may require the borrower to sell the property. This will a key factor in determining the magnitude of house price falls.

Remember, that unemployment is currently low. What will happen when unemployment rises? How many more borrowers will be under cashflow stress?

Remember, that as at March 2023, there were 19,300 borrowers in mortgage arrears.

No, it's the bank's job to stress test mortgages properly, otherwise people should be able to stress test themselves at negative 5%.

Tell you what, stress test yourself at 15% and then try buy your first home when you're competing against investors who have put none of their own money towards a deposit, and have their rental income "stress tested" against interest only mortgages, and up until recently enjoyed a whole myriad of tax advantages for pretending to be a "business".

In retrospect they should have stress tested FHBs at a higher interest rate and investors at a lower interest rate. This would have meant a higher proportion of greedy investors would take most of the hit when the downturn inevitably came.

Questioned in October 2020 against the backdrop of a housing market taking off, Orr said rather than reining themselves in "the [banking] industry always just wants to have it done to them."

Who creates and imposes low bank capital risk weights (~35%) for residential property loans?

Banks have migrated away from lending to productive business enterprises because the risk weights can be as high as 150%. Thus around 60% of NZ bank lending is dedicated to residential property mortgages owed by one third of already wealthy households

"If someone comes to me with a good deposit and wants to buy themselves a home, I'm not going to turn them away. What I am going to make sure is that they've got a decent deposit and I've got some equity and some protection in their loan. I'm going to make sure that they can afford to pay a higher interest rate because that's always one of the risks that interest rates go up and your [mortgage] serviceability gets different. So we make sure customers can pay around 6%," Watson said.

For the 2020-2021 +80% LVR borrower who had to sell today for what ever reason. Their deposit is gone and the interest rate is well over 7% for low LVR borrowers. Prospective new buyers cannot pass the +8% stress test. Either interest rates go back down below 4% or property prices keep falling to a level that makes current interest rates affordable to service. Banks need to extend and pretend for as long as possible and pray that unemployment does not start to increase. Residential construction is New Zealand 3rd largest employment sector (300K people).So good luck with that.

Surely the value of a house should be commensurate with what it costs to build a house like that today, and reflective of any work that may be needed.

If the cost of building materials has skyrocketed then the cost to build a new house also skyrockets, and therefore the the price to buy that house will reflect that. And that would also mean the price that an existing house can be sold for also would go up.

What are needed in NZ are wages that reflect the reality of the cost of living increase over the last 50 years.

Why should the cost to rebuild an existing house dictate the purchase price of the house? The house is already built, the costs already sunk.

If anything, high building costs would point to further discounts on the existing house, as maintenance costs are increased.

People forget that new houses are a premium product. You don't pay premium prices for second hand, unless there's some very special point of difference.

Paying $600k for an ex-state house that cost $40k to build 30 years ago is just lunacy.

House prices in NZ have increased due to reducing interest rates, tax rules, bad statistics and loose monetary policy. The building prices increasing was people making hay while the sun shone (this is how businesses work). Don't mistake a symptom for the cause.

"You don't pay premium prices for second hand, unless there's some very special point of difference."

That special point of difference is almost always location.

"Property prices cannot drop, new production costs says so" Goes to show many are still in the early denial/disbelief phase, of this crash.

The Emotional Stages of an Investment Cycle | Main Street Financial (mainstfinancial.com)

I invest in many industries and its often the case in a downturn, that the finished product or commodity may crash well below the cost of production or extraction cost. This loss loss situation can last for long periods and has been the case since money/gold have been transacted!

Property should be no different. You could say it will actually be a much bigger crash comming for property, as the religious like belief in the "certain Tax Deductions" and "certain Cap Gains" - are finished! They were the only game and aspect that investors were buying in for.

We are in a new Paradigm - just like the hard lessons learned after the 87 crash. This time Property will be the poison that taints the investment well for a generation.

Great stuff Gecks. It's all about psychology. You get it.

Its just guess work. Anyone who bought a place as little as 3 years ago is still long way into the black, add to that 3 years of wasted rent you would have spent and you are ahead a couple of hundred thousand plus still.

Its just guess work. Anyone who bought a place as little as 3 years ago is still long way into the black, add to that 3 years of wasted rent you would have spent and you are ahead a couple of hundred thousand plus still.

Possibly. But it's just imaginary wealth on paper. And the psychology is important. For ex, if they are told around the water cooler that 'house prices have fallen 20%', they will likely accept that yardstick as a representation of their own reality. Remember, loss aversion - potential loss perceived by individuals is psychologically or emotionally more severe than an equivalent gain.

Its not as imaginary wealth as Bitcoin, its a physical asset. My house could drop down to being worth $1 tomorrow but I'm still going to get up in the morning and have a place to live.

Its not as imaginary wealth as Bitcoin, its a physical asset. My house could drop down to being worth $1 tomorrow but I'm still going to get up in the morning and have a place to live.

Bitcoin is a "digital asset" and a product of energy and resources. Whether you can live it or not is beside the point. You can live in a car. Doesn't necessarily mean it is "wealth."

Depends on the car.

So true especially if you can build on the back like I do so still get all the tax deductions for new build pay a fraction for the site only subdivision costs 20 to 40k the last couple I have done and then build costs which is what I do as a builder live on site in my caravan so rent free and house in front rented out. If only people look out side the box

Just have to look at the cost of building a house in Australia to know that our building costs

are so overinflated as to be useless as a gauge to price existing houses.

House prices don’t need to keep track with building costs…. Building costs need to correct as house prices settle back down to a sustainable

level.

People are flippantly throwing out the whole "houses just cost that much to build, it is what it is, nothing will change it" narrative. We had a huge credit fueled boom from low interest rates. Are people seriously suggesting all the components (materials, labour etc) have not seen their margins rise to capture this increased spending power?

Revelations in the supermarket industry, an industry where people don't tick up 30 years of groceries at 2.5% p.a, suggest price gouging could very well be at play.

Forty-six different small to medium-sized suppliers who sell food to both Foodstuffs and Countdown told Newshub the supermarkets are making up to a 55 percent gross profit margin on a product.

https://www.newshub.co.nz/home/new-zealand/2023/04/group-of-supermarket…

You could probably build a single glazed uninsulated 2br box for $200k now if you were allowed. Yet that box in Ōtara would probably cost you 800k.

My new build I am just digging pile holes as we speak. 4brm 2 bathroom subdivision cost permits etc comes in around the 250k. My last one I did last yr came in at 235k

If what you say is true I assume you are building it yourself. How many people can do that? They need to keep working to put food on the table for their family as well as pay for the build. Your comment has no relevance to FHBers. The labour costs on a build is a major part of the overall cost.

Actually the labour costs haven't gone up as much as everything else compared to a new building.

Example yrs ago all you needed to do was get a draughtsman and surveyor and file for a permit. Now you need geo tech engineer need a civil engineer both at around the 400 to 500 a hour. All new triple glazing now plus 6 by 2 exterior walls as more insulation. And as frames and trusses are made off site builders now do alot less on site as more subbies a used. But yes I do everything myself bar the electrical and plumbing and trusses

Triple glazing is a joke, the payback on that over double must be next to nothing, massive law of diminishing returns. Of all the North Island places I have lived in, it has seldom gone sub zero, perhaps a handful of times. Double glazing I can understand, its a massive upgrade over single, perhaps the biggest improvement is no condensation turning all the curtains mouldy. So what's the added cost of that and the walls on a typical house ? another $50k ?

Yep but here's the real twist to triple glaze over dble glazed. It has to be glazed at source so how the f... do you lift it on dble glazed most joinery two man lift the bigger stuff gets glazed on site so with triple you now have to hirer a hi ab to lift it in as too heavy. Not true about dble glaze with no condensation. Just put dble glaze into a old bungalow rental in Christchurch well insulated already the glazing replaced as rotten timber joinery. The tenants don't open the windows went back a couple of days after fitting and the whole windows covered in condensation as tenants crank up the heat pump bit keep windows shut. Worst condensation than when the old windows were in.

Both those who bought a house and those who have no hope of doing so are both screwed. Can't think of a more comprehensive clusterf##k.

But it's not "the system" Gareth. It's a stupid and arrogant government (a series of those) who don't put New Zealanders first.

They have protected the interests of cartels and monopolies over the people. Energy, finance, groceries, local and central government.

And also the borrow and hope crowd who wrongly call themselves 'investors'.

Outcome - New Zealanders are here to serve them. Not the other way around.

I have a right wing point of view. But it's time to put New Zealander's at the front.

And yet if you warned against the behaviour that was leading us towards this cluster, you were shouted down as a 'doom gloom merchant'.

What a society we've become. And why did we bother listening to people who wanted to further entrench this cluster, for their own vested financial interest?

It never made any sense to me - then again my interest was and still is the social and financial stability for NZ society as a whole - as opposed to trying to maximise the value a property portfolio with no care for the consequences of the financial gain.

And yet if you warned against the behaviour that was leading us towards this cluster, you were shouted down as a 'doom gloom merchant'.

Those with their own vested financial self interests needed to persuade buyers to buy to maintain or increase their own incomes, resorted to name calling in order to discredit those who gave warnings of potential house price risks.

We the people are 'the system'.

We created this mess because we were too afraid to stand up against people and groups who were benefiting from it for their own political or financial gain.

I tried but constantly got belittled by vested interests. Should we care if it all comes crashing down and the pain this causes?

Or should you let ignorance suffer to learn the fate of its own ways? Obviously philosophical questions for which i don't know the answers to.

No, it IS the system. Government is a key part of said system, for sure. But the majority of voters have been complicit in voting for variations on the same theme, WRT housing. There’s also a huge amount of vested interest in perpetuating the system from the business sector, and lobbying governments is part of that.

Yeah, it's entrenched entitlement mentality all the way down. Folk expecting to live beyond their means by saddling following generations with huge debt.

There is a whole lot of pain coming. And after the fire the cockroaches like myself will emerge and look for opportunities. There may be a distressed seller off-loading a near new Toyota Corolla so I can retire the 2002 Honda Jazz.

Still blown away by those without 2 cents to rub together still spending $14 on a beer in a bar. Planning an overseas holiday whilst mortgaged to the hilt. Financially naive/ignorant

Agreed.

Plenty still spending up at restaurants

I was away all week for work and went to several restaurants and mostly full and the menu prices where eye watering.

$18 beers

No slow up of spending that the RBNZ was hoping

The OCR will go higher and there will be more housing carnage. Eventually it will flow through. Like a campylobacter infection

Not much movement on the amount of people receiving income support even with mass immigration in progress.

Record food prices

RBNZ engineered recession is yet to materialise. Eyes on 24th

The spending at NZ inc consumer/dining companies is way too strong. The RBNZ should go 50bps minimum. NZ needs to pay attn to slash spending......The RBNZ has been way too timid!!

We are on our way to a well past 6% terminal OCR rate. I see it as a dead cert currently.

Taylor says it must be well above inflation.

18 buck beers....

1 buck beers in Spain.

I thought we sold on the international market. !

A near new Toyota Corolla will always get a premium price. People are waiting months for a new one.

There is a rush on for a decent new ICE car, expect to wait for up to 12 months and the order books have been CLOSED for some cars as demand has outstripped production capacity. Actually it all makes no sense at all, I'm noticing that spending is really beginning to tighten up and yet the new car market is still crazy. Some of it could be the underlying fear that ICE cars are about to be banned, in which case you ain't seen nothing yet with prices, ICE cars will skyrocket.

We bought a Subaru Outback new 2.5 years ago for 45k. Seeing used ones of the same age and mileage selling for circa 40k.

They aren't the ones buying second hand ones privately. You can sometime pickup a great deal privately

Its all good as long as you don't want to buy a NEW car right now. Some makes and models are basically impossible to get if you want something a little different....say a GR Corolla even ? try the one on trade me at present its a bargain at $89,990 LOL

Here's a thought experiment.

You have a kid in primary school, in 15 years they can live in a country where

A) they can buy a house for 500k

B) same house costs 2.5m

In both scenarios their income in the same.

Which scenario is better?

I feel bad for the bag holders, but I'm rooting for A.

A isn't happening, and thank God for that. Imagine New Zealand as a whole being as desirable as the west coast is now.

Probably somewhere in between, 1.2 - 1.5m in 15years if inflation is indeed already on it way down.

Yeah dreams are free.

Australians are feeling the chilly wind of reality as well. "If you can't borrow, you can't buy"

Home buyers have been priced out of suburbs they could afford a year ago because their borrowing power has been cut faster than house prices have fallen. Single buyers on an average Australian income have been worst hit, no longer able to borrow enough to buy a house....CoreLogic analysis shows. Couples have been priced out of 59 suburbs where they could have bought a house last year. Property values have fallen by 9.6 per cent since peaking in February last year, but borrowing capacity has dropped by 30 per cent. Single home buyers’ borrowing capacity has been slashed by $144,000 since April last year, from a maximum $509,000 to just $365,000, according to Canstar. Couples have had their buying power cut by $335,000.

https://www.theage.com.au/property/news/the-melbourne-suburbs-where-you…

"Property investors who bought in the last five years are facing the equivalent of paying a 10.5% interest rate due to rates rises and the phase-out of mortgage interest deductibility" In five of the last 12 months, Stats NZ recorded the rental prices of new tenancies dropped compared to the month before. https://www.stuff.co.nz/business/property/132018727/property-investors-…

As people lose their jobs they'll move back in with Mum & Dad do anything to cut costs. Rents will fall.

It then filters through to renters who will have to pay more. That then increases inflation even more, so interest rates have to increase again. Like a never ending circle.

Or pack up and export themselves and their skills/tax to Straya. The next group can can take an ever growing number of houses from KO.

Specuvestor greed is hollowing out the educated middle class and future taxpayer. Same reason som many emigrated to NZ in the 1800s and early 1900s, to escape the exploitation of miLord landowner.

Those lenders from the bank of mum and dad who lent to buy properties in 2020-2021 are at risk of incurring losses on the amounts lent.

Yes - very true. I guess that's their penalty for thinking past performance guarantees favorable results...

Just like back in the early 90s. Fletcher was developing houses in Sth Auckland Clendon. 500 dollar deposit pay mortgage over two yrs and supposedly have equity built up to refinance. Low and behold no equity built up and most of the houses were 5000 to 10000 cheaper. Owners were devastated

Sorry to disagree but that doesn't sound right, 93 to 97 was a good up-phase

Anyone watching trademe numbers will be seeing falling levels of houses in Auckland and elsewhere. A strong move is underway

From my experience, he's correct.

My parents built in Clendon in 1988 - 4 bedroom, single builder, took 6 months and cost $100k all up.

Dad was working two jobs to pay for it come 1989 - then one of his employers went belly up and they had to sell the house for a $20k loss in 1990. They lost money elsewhere at the same time, and it took them a further 6 years to clear the resulting debt.

But they lost less than the neighbours, whose houses were double the price, and lost double the value.

Thanks but I'm sad to hear what happened. That bad experience would impact how you see things

It's is true Fletchers told the buyers your house is worth 100k with a 500 deposit and it will value up after two yrs for you to reborrow to pay us. Of course fletchers charged interest etc. Come the two yrs the houses didn't value people needed to sell as couldn't get finance. Why you never trust what Fletchers are saying or doing

Isn't the problem that we refer to buying a house as getting on the ladder, and once you are in the ladder. Then I recall the governemnt saying they didn't want to see house prices drop very much and people saying that if you don't but now you will get priced out of the market. So these FHBs who wanted a house and didn't want to continue paying rent went in and purchased. Even the banking experts didn't expect this. If you include inflation, then we must be close to the 20% crash, and it will be over 20% in areas. Imo no one should expect to make money or capital gain from the home they live in.

Orr is just a puppet of the Labour Govt, they did Jacinda's bidding without argument. Its not like there were no voices calling it out for the stupidity of what it was.

https://www.rnz.co.nz/news/political/430415/act-party-leader-david-seym…

"Seymour said the country was monetising its debt, avoiding hard choices and instead giving itself artificially low-interest rates.

"Currently the Reserve Bank's irresponsible approach to liquidity of the New Zealand dollar is inflating asset bubbles, it is meaning a generation of young people watch the future get further away from them as a result and that is a recipe for political dissatisfaction and unrest," he said.

"It is time to identify the personality of the current Reserve Bank governor as a liability, because he is a risk taker, I think in his own mind a visionary and yet he is doing unconventional things that are actually quite perilous.

"They are not new ideas, but actually old ideas that have failed in a costly way before." "

Seymour has the luxury of saying anything he likes .

His opinions have no consequences.

Does Gareth have a short memory? Interest rates have been too low since at least 2015.

How is the RBNZ at all responsible? They are doing what they are supposed to do - supporting the monetary and financial system. They set OCR to tackle inflation. Employment rates are a secondary effect.

Besides, if you read the commentary, the "unemployment" forecast for future is not people losing their jobs because of a downturn, it is businesses not creating jobs because of a downturn. But so many industries are lacking skilled employees - we do not currently have an excess of workers.

From 1985 until now, the average OCR or equivalent is 6.7%. If commercial banks are buying houses on behalf and arranging mortgages with people unable to afford the mortgage rates at the average OCR, any hardship caused is on the commercial banks. Who will lose comparably little in the transaction.

It is not like the RBNZ has bombed the country or blocked out the sun. The real, tangibles still exist. The crops still grow and the cows still eat. The dams still flow. The buildings still stand. The factories still produce.

That the real estate bubble is being deflated should come as no surprise to anyone.

As far as I can see, the failure for successive governments over the last 30 years has been pretending commercial banks inherently act in the best interest of their customers, or that our society efficiently allocates resources. The current situation is a correction of an aberration.

First half of 2020, probably starting about March or April, I remember under every economic story there was a comment along the lines of "Money printer goes brrrrr..." The comments section seemed more informative of economic trajectory than the articles.

To address financial stability risks, central banks need the effective tools.

Monetary policy is not the tool to address macro-prudential risks (monetary policy tools are tools to address the RBNZ's inflation and employment remit)

The extreme house price risks were preventable back in 2016 when the then Finance Minister did not give the RBNZ the tools they requested to address macroprudential risks.

[RBNZ's DTI plans hit by Government changes | interest.co.nz](https://www.interest.co.nz/property/85201/reserve-bank-confirms-meeting…)

If a debt to income ratio of 5 was imposed back in 2017, then a significant amount of lending would not have been made (and house prices would have been less likely to have reached their record levels).

Based on RBNZ data, the lending commitments made by banks in 2021, that were on a debt to income of 5 or above were NZ$58.8bn (about 59% of total lending commitments made in 2021). For the period of 2019-2022, total loan commitments on a debt to income of 5 or above totalled NZ$99.8bn (about 32% of the total loan commitments for that period)

https://www.rbnz.govt.nz/statistics/series/lending-and-monetary/residen…

The higher the debt to income ratio for a borrower, then the higher the probability of default.

Now how many of these borrowers will experience significant cashflow stress, or default?

For some mortgages, the banks will allow some mortgage modification (such as extension of loan maturity date, or allow the borrower to go on interest only)

For other mortgages, the banks may require the borrower to sell the property. This will a key factor in determining the magnitude of house price falls.

Remember, that unemployment is currently low. What will happen when unemployment rises? How many more borrowers will be under cashflow stress?

Remember, that as at March 2023, there were 19,300 borrowers in mortgage arrears.

https://www.centrix.co.nz/wp-content/uploads/2023/05/Centrix-Credit-Ind…

Even after interest rates shot up, one of the biggest brokers in the SI stood by his decision to advise everyone to take the one year rate because it was "what had always worked for him".

We're supposed to call these people advisors.... I'm not sure why.

Thinking DTI.... will it pull regional prices up and push city prices down?

Will we move jobs more hunting income...

As you introduce DTI do we need to totally ban foreign sales.

Will we end up moving through more owned houses as we start small but save to move up? equity is going to have to be saved it cannot expand much in this system.

How do we build cheaper, I could see in this system improvements worth more then land... land in this system is stuck at wage inflation. A pay rise does not allow you to buy more if everyone gets it....

You can feel Stage 3 = Bargaining, out and about now. "Property Prices are falling. Had to happen. But I'll be fine. I bought some time back and will just sit it out and wait until things recover". We have just started down the road of economic reality, call it a Reset, or whenever you like, but we've started. And, we have a lot further to travel.

Something readers on here already know, that's now seeping out into the mainstream.

In 2022 Aotearoa New Zealand ran a current account deficit of nearly $34 billion – 9% of our GDP. The Department of Statistics reported “This is the largest annual current account deficit to GDP ratio since the series began in March 1988.” We are buying more from the rest of the world than they are buying from us, and we are paying for the shortfall by selling assets and racking up debt. This isn’t necessarily a problem if we are using this inflow of capital to build capacity to increase future earnings but, we are not doing that.

https://www.stuff.co.nz/opinion/132022958/damien-grant-we-arent-in-a-co…

Yes, truly ominous. Much more fundamental than chat about fiddling with LVRs and DTIs and OCR.

There is this chewing sound deep in the basement among the piles and floor joists...

It has to be coming. The UK being as good a template as any.

Most borrowers can expect to be able to borrow up to 4.5 times their annual income. Most mortgages in the UK have a maximum term up to age 70.

So at 40 years of age you can request a mortgage for 4.5 times your household income for 30 years. At 50, the maximum term reduces to 20 years etc - effectively increasing the DTI as the term shrinks.

It's not the "system" per se, as the market finds its own equilibrium, its Government intervention that is the issue.

NZ should do away with personal guarantees for mortgages as in the USA. That will force the banks to be a lot more diligent when lending for housing and enable people to walk away from their mortgage when under water, if they choose.

Well said Gareth, young people really have been let down by the events of the last few years. The real kicker is that so many will have used almost all of their pension savings for a large enough deposit which has now gone too! Kiwisaver should never have been messed with.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.