QE

ANZ economists say it is 'possible but unlikely' a negative Official Cash Rate might be employed next year if the economic outlook became bad enough

9th Jul 20, 2:51pm

9

ANZ economists say it is 'possible but unlikely' a negative Official Cash Rate might be employed next year if the economic outlook became bad enough

The NZ dollar may have strengthened, but trying to weaken it wouldn't achieve as much as it would've before Covid smashed international tourism, argues banking consultant

3rd Jul 20, 2:56pm

29

The NZ dollar may have strengthened, but trying to weaken it wouldn't achieve as much as it would've before Covid smashed international tourism, argues banking consultant

Our central bank might have delayed any potential move into negative interest rates, but only a hardened gambler would bet against our Official Cash Rate having a minus sign in front of it by early next year

25th Jun 20, 2:09pm

15

Our central bank might have delayed any potential move into negative interest rates, but only a hardened gambler would bet against our Official Cash Rate having a minus sign in front of it by early next year

RBNZ says the balance of economic risks still remains on the downside and it is prepared to provide additional stimulus as necessary

24th Jun 20, 2:08pm

94

RBNZ says the balance of economic risks still remains on the downside and it is prepared to provide additional stimulus as necessary

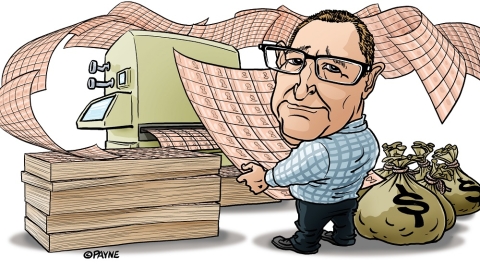

The flooding of capital markets with massive new money from the RBNZ's quantitative easing program calls for a fuller debate of what the central bank and the Minister of Finance are trying to achieve, says Keith Woodford

21st Jun 20, 6:02am

130

The flooding of capital markets with massive new money from the RBNZ's quantitative easing program calls for a fuller debate of what the central bank and the Minister of Finance are trying to achieve, says Keith Woodford

ANZ, ASB, BNZ and Westpac's advertised floating, or variable, borrowing rates unmoved so far since Kiwibank's 100 basis points rate cut

18th Jun 20, 2:16pm

18

ANZ, ASB, BNZ and Westpac's advertised floating, or variable, borrowing rates unmoved so far since Kiwibank's 100 basis points rate cut

Why the Government needs to start paying attention to where the money being pumped into the economy via QE is going, and who's going to pay for it

18th Jun 20, 10:51am

105

Why the Government needs to start paying attention to where the money being pumped into the economy via QE is going, and who's going to pay for it

With central banks' money printers fired up, Green Party co-leader James Shaw says there's an even stronger case for redistributing the cost of the COVID crisis through a capital gains tax

8th Jun 20, 1:37pm

229

With central banks' money printers fired up, Green Party co-leader James Shaw says there's an even stronger case for redistributing the cost of the COVID crisis through a capital gains tax

QE, the wage subsidy and nervous investors see banks sit with more cash to lend, than borrowers to lend to

4th Jun 20, 3:53pm

41

QE, the wage subsidy and nervous investors see banks sit with more cash to lend, than borrowers to lend to

Gareth Vaughan on a need for more banks, living in a burning building, New Zealand stacking up well, the collision of science and politics, the Psychopath in Chief & a song for Dominic Cummings

4th Jun 20, 10:02am

20

Gareth Vaughan on a need for more banks, living in a burning building, New Zealand stacking up well, the collision of science and politics, the Psychopath in Chief & a song for Dominic Cummings

Brian Fallow provides a timely reminder that NZ banks are reliant on imported credit, the flip side of NZ households’ collective tendency to spend more than their income

29th May 20, 9:01am

35

Brian Fallow provides a timely reminder that NZ banks are reliant on imported credit, the flip side of NZ households’ collective tendency to spend more than their income

Adrian Orr: More QE would be the 'simple' way for the Reserve Bank to boost the economy; Going further and getting the Bank to directly finance government initiatives would be ‘achievable’

22nd May 20, 11:44am

47

Adrian Orr: More QE would be the 'simple' way for the Reserve Bank to boost the economy; Going further and getting the Bank to directly finance government initiatives would be ‘achievable’

ANZ economists now predict the Reserve Bank will increase the quantitative easing programme to $90 billion by August if not sooner

18th May 20, 10:39am

52

ANZ economists now predict the Reserve Bank will increase the quantitative easing programme to $90 billion by August if not sooner

The Reserve Bank has put forward three scenarios for how the economy might pan out depending on what level of pandemic containment measures will be required. None of the scenarios are rosy

13th May 20, 5:21pm

2

The Reserve Bank has put forward three scenarios for how the economy might pan out depending on what level of pandemic containment measures will be required. None of the scenarios are rosy

Reserve Bank says it will be 'closely monitoring' movements in retail interest rates and bank margins; sees house prices falling 9% over the rest of this year

13th May 20, 3:11pm

43

Reserve Bank says it will be 'closely monitoring' movements in retail interest rates and bank margins; sees house prices falling 9% over the rest of this year

RBNZ nearly doubles quantitative easing programme to $60 billion; Reaffirms forward guidance to keep OCR at 0.25%, but specifically says it's prepared to reduce the OCR further; Sees deflation occurring in 2021

13th May 20, 2:13pm

131

RBNZ nearly doubles quantitative easing programme to $60 billion; Reaffirms forward guidance to keep OCR at 0.25%, but specifically says it's prepared to reduce the OCR further; Sees deflation occurring in 2021

RBNZ expected to double QE programme on Wednesday, but will it provide more forward guidance and signal it might - just maybe - cut the OCR before next year?

9th May 20, 12:22pm

208

RBNZ expected to double QE programme on Wednesday, but will it provide more forward guidance and signal it might - just maybe - cut the OCR before next year?

The onset of the Covid-19 crisis has sent expectations of inflation over the next two years plummeting to new lows in a new influential RBNZ survey; house price drop of nearly 5.5% seen in next year

7th May 20, 3:22pm

41

The onset of the Covid-19 crisis has sent expectations of inflation over the next two years plummeting to new lows in a new influential RBNZ survey; house price drop of nearly 5.5% seen in next year

Economist Brian Easton points out that a fiscal deficit creates a liability for the government. Somewhere outside government in the private sector there is a private asset matching this public liability

3rd May 20, 9:21am

36

Economist Brian Easton points out that a fiscal deficit creates a liability for the government. Somewhere outside government in the private sector there is a private asset matching this public liability

Raf Manji on the lessons from Christchurch for a COVID-19 world, and a lesson from Japan pointing the way to fixing local government funding and building infrastructure

3rd May 20, 6:31am

62

Raf Manji on the lessons from Christchurch for a COVID-19 world, and a lesson from Japan pointing the way to fixing local government funding and building infrastructure

Westpac chief economist and Triple T Consulting founder expect the RBNZ will have to take the OCR into negative territory earlier than indicated

28th Apr 20, 10:00am

135

Westpac chief economist and Triple T Consulting founder expect the RBNZ will have to take the OCR into negative territory earlier than indicated

Mauldin Economics' Patrick Watson bemoans that massive central bank intervention in financial markets allows zombie companies to stand in the way of progress and creates meaningless market pricing

24th Apr 20, 2:01pm

34

Mauldin Economics' Patrick Watson bemoans that massive central bank intervention in financial markets allows zombie companies to stand in the way of progress and creates meaningless market pricing

Brian Fallow looks at where the Government is getting the money from for its dramatic increase in spending, concluding direct monetary financing is possible down the line

22nd Apr 20, 10:17am

71

Brian Fallow looks at where the Government is getting the money from for its dramatic increase in spending, concluding direct monetary financing is possible down the line

Finance Minister warns we're in for a long haul; Says the govt is considering extending the Business Finance Guarantee Scheme and buying stakes in big business

18th Apr 20, 12:24pm

94

Finance Minister warns we're in for a long haul; Says the govt is considering extending the Business Finance Guarantee Scheme and buying stakes in big business

Brian Fallow looks at the dire economic prognosis thanks to COVID-19, and probes the key issues and options for policy makers as they look ahead to a time when the virus is under control

8th Apr 20, 3:26pm

67

Brian Fallow looks at the dire economic prognosis thanks to COVID-19, and probes the key issues and options for policy makers as they look ahead to a time when the virus is under control