Summary of key points: -

- Potential candidates to cause a NZD correction downwards

- GBP/USD forex market changes view on Brexit outcome

Potential candidates to cause a NZD correction downwards

In a similar fashion to the cars I owned as a teenager that vibrated and rattled when you pushed them over 60 mph, the Kiwi dollar is displaying all the hallmarks of getting the “speed wobbles”.

Over the last 10 days the NZD/USD has spiked higher to 0.7100 and promptly reversed to the 0.7020 area on two separate occasions in volatile intra-day trading.

Strong gains by the Aussie dollar last Friday 11th December to 0.7570 against the USD has once again pulled the Kiwi up to the 0.7100 level.

The wild short-term swings indicate a FX trading market that is unsure whether the sharp appreciation will continue, or a correction downwards is imminent. The large intra-day shifts also typically signal the ending of a major trend.

The courage and conviction of those currency speculators holding long-NZD positions is being severely tested as the end of the year approaches.

We have been anticipating that the punters will be taking profits by unwinding their long-NZD positions, however there is not sign yet of concentrated Kiwi dollar selling from this source. There needs to be a catalyst such as negative news for the NZD or AUD, or alternatively positive news for the US dollar, to prompt the FX traders to sell-out of their NZD positions. Otherwise, they stay with the trend, which has been strongly upwards for the Kiwi dollar for several months now. Over recent weeks there has been no specific event or development to act as that catalyst for change.

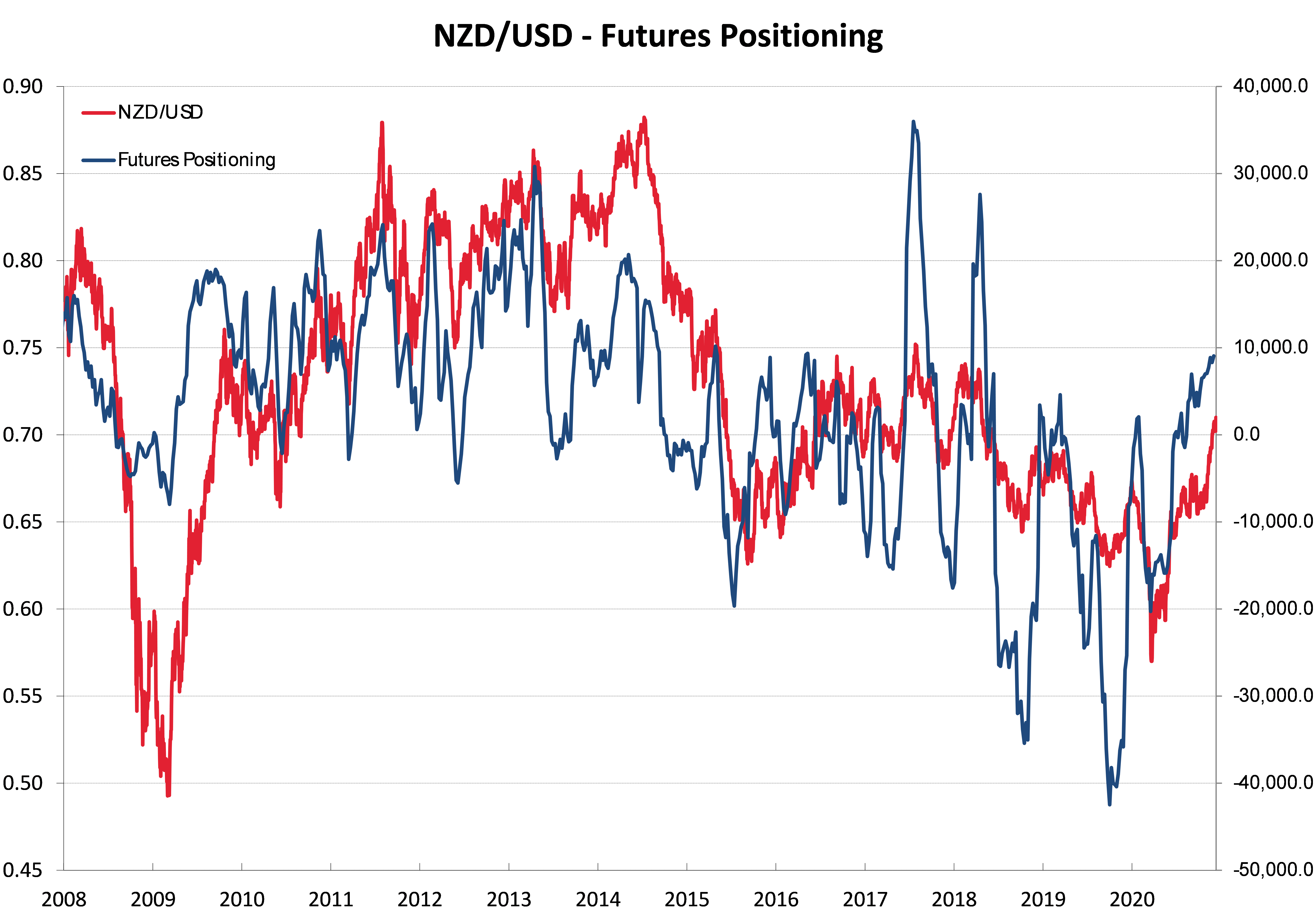

As the chart below depicts, there always comes a point when those holding long-NZD positions do suddenly reverse out, reducing their positions and thus become NZD sellers in the process. Picking that inflexion point is never precise or easy, however the current time of year with only two weeks before the Christmas holiday period does suggest we will see some serious book-squaring very soon.

Potential candidates that could act as a catalyst over the short-term to cause a NZ dollar pullback include: -

- New Zealand GDP growth figures being released on Thursday 17th December printing well below the forecast +12% to +14% expansion for the September quarter (low probability).

- Whole milk powder dairy commodity prices in the GST auction on Wednesday morning suddenly diving (unlikely, dairy futures pricing suggests another modest increase).

- A sizeable correction to the Covid vaccine rally on Wall Street. Again on profit-taking by equity investors who have benefited from the spectacular gains over recent months (reasonably high probability). A change to an investor “risk-off” mode invariably hurts the Kiwi dollar.

- Media statements from the RBNZ or RBA along the lines that recent exchange rate appreciation is unhelpful to the economic recoveries as it makes monetary conditions tighter that what they desire (lowish probability as both are reluctant to say anything outside of scheduled statements).

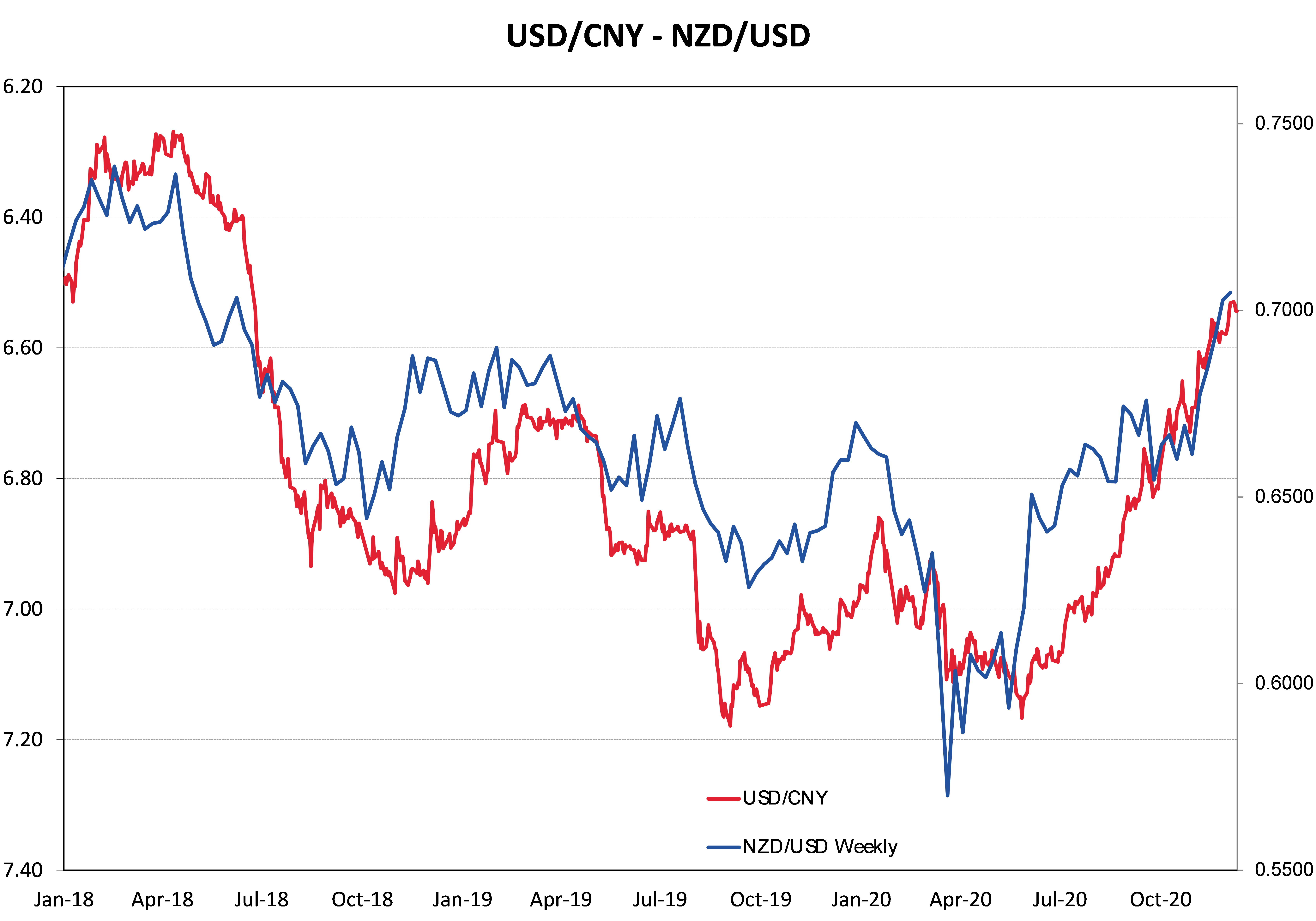

- Sudden intervention by the Peoples Bank of China (PBOC) on their daily exchange rate fixing to stop continuing appreciation of the Yuan. The NZD/USD rate is now highly correlated to short-term movements in the USD/CNY exchange rate (refer chart below). Moderate probability of happening as the PBOC do like to “burn-off” the currency speculators in the offshore traded USD/CNH FX market.

- The EUR/USD exchange rate also reversing/correcting the strong Euro gains to above $1.2100 over the last month. The Europeans will not be happy that their currency is unjustifiably appreciating (on economic performance grounds) at this time as it makes their exporters less competitive and reduces inflation when they want the opposite to occur. (Reasonably high probability).

The medium term view remains that the NZD/USD rate can progress into the mid-0.7000’s during 2021 on the back of a continuing weaker US dollar against all currencies.

However, a significant correction to the steep gains since the October levels of 0.6600 is more likely to occur beforehand for the reasons cited above. Whether that downwards correction is to 0.6900, 0.6800, 0.6700 or lower really depends on how deep the inevitable correction in US equities runs to. The share markets have already priced-in big increases in 2021 corporate profits as the US economy recovers post Covid-vaccines.

The success rate of the vaccines through the northern hemisphere winter and the economic response in terms of consumer spending and jobs will dictate how equities markets perform from here.

GBP/USD forex market changes view on Brexit outcome

The Pound recorded strong gains to the USD through October and November from $1.2750 to a high of $1.3450 on 3 December on the back of the UK government agreeing a trade deal with the EU.

The probability of an orderly Brexit with an acceptable trade agreement being signed has taken a nose-dive in recent days and therefore the currency markets have suddenly shifted their pricing from bullish for the Pound to negative.

The GBP/USD exchange rate has reversed to $1.3220 already and further losses seem likely. The GBP depreciation against the USD has sent the NZD/GBP cross-rate higher to 0.5360. Further increases to 0.5400 and 0.5500 seem on the cards if further GBP depreciation against the USD is not matched by NZD falls against the USD.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.