Summary of key points: -

- Russian invasion of Ukraine geo-political risk proves to be short-lived

- Change to RBA’s monetary policy stance remains the key for AUD gains (and NZD gains)

- RBNZ again fails to address the inflation 'elephant in the room'

Russian invasion of Ukraine geo-political risk proves to be short-lived

So far, it appears the NZ dollar may have weathered “Putin’s War”, the Russian invasion of the Ukraine storm that hit financial and investment markets last week.

It was somewhat surprising that the US dollar did not strengthen on safe haven flows over recent weeks whilst the Russians were threatening to invade. However, the natural reaction by markets was to buy the US dollar, buy oil and sell equities as the Russian tanks rolled across the Ukrainian borders last Thursday.

The NZD/USD exchange rate depreciated sharply against the USD from above 0.6800 last Wednesday after the RBNZ monetary policy statement to a low of 0.6630 on Thursday 24th February as all markets gyrated on the Russia/Ukraine event risk hitting the newswires.

Typically, the FX market’s reaction to such geo-political developments is very short-lived as the direct economic consequences often turn out to be a lot less than first feared.

Certainly, the WTI crude oil price spiking up to over US$100/barrel at one point is hardly positive for global economic growth. However, the oil price gains were not sustained and WTI oil prices just as quickly reversed back down to US$92/barrel.

Global financial and investment markets regained some confidence on Friday 25th February when the news came though that the Chinese were not backing the Russians and Chinese state-owned banks stopped letter of credit/trade financing for Russian commodity customers.

Geo-political risk would have increased further had the Chinese stepped in to buy Russian gas or financed Russian trade after the West imposed sanctions on Russian banks.

Thankfully, the Chinese have joined the West in imposing financial sanctions on the Russians.

Over the weekend the Germans finally agreed to support the ban on Russian banks using the SWIFT inter-bank international payments system after some initial reticence.

The Russians are currently holding more gold and US dollar reserves than they had at the time of previous sanctions and economic crises. However, being unable to trade their commodities with the world will have dire economic consequences and they will likely be large sellers of US dollars over coming months as they apply their USD reserves to shore up their domestic economy.

The war will continue in Ukraine, however there will be no fresh surprises for the markets, and they will move on to the next potential risk.

A strong rebound in equities on Friday 25th February quickly reversed the general USD buying, allowing the EUR/USD exchange rate to return to $1.1270 from lows of $1.1100. The Australian dollar also rapidly reversed engines from lows of 0.7100 to bounce up to 0.7240. The Kiwi dollar religiously follows the AUD/USD rate, therefore the NZD/USD rate also recovered by over one cent to 0.6750.

Whilst the Ukraine turmoil is front of mind for the markets right now, it is highly unlikely that the US Federal Reserve will be forced by the geo-political tensions to change their plans to start lifting interest rates next month. The US dollar will not strengthen on the Fed increasing interest rates as it is totally expected and therefore already fully priced-in to the USD value.

Change to RBA’s monetary policy stance remains the key for AUD gains (and NZD gains)

Prior to the Russian/Ukraine crisis sending the Kiwi dollar down on a short-lived plunge, the NZ currency was posting a slow, but steady recovery back up from the depreciation into the 0.6500’s in mid-January when the more hawkish Federal Reserve sent equity markets lower and risk currencies got punished.

For the first time since October 2021, the Kiwi dollar attracted some buying interest on its own account following the more aggressive monetary policy tightening by the RBNZ last week.

The USD side of the NZD/USD exchange rate equation has continued to dominate the day-to-day movements with the local positive factors such as higher NZ interest rates and higher NZ commodity prices not having any real impact.

Whilst the outlook for the New Zealand domestic economy has its challenges, our higher interest rates and commodity prices remain as positive influences for the Kiwi dollar in its own right if and when offshore currency investors/traders focus away from the USD and start looking for alternatives to open up bets on.

In reality, over coming weeks/months, the likelihood of the Kiwi dollar attracting fresh global investor interest will only occur when the Reserve Bank of Australia (“RBA”) are forced to change their current monetary policy stance.

It seems inevitable that the mounting economic evidence of rising inflation and wages in Australia will force the RBA’s hand sooner rather than later.

When such observers as former RBA board member, Warwick McKibbin tips that several interest rate hikes are required this year, you get a strong feeling that the game is almost up for the RBA intransigence.

When the RBA finally provide the signal that they will need to increase their interest rates earlier (i.e. this year), international currency investors will have the official go ahead to buy up the Aussie dollar. The RBA stubbornness is the only thing holding the AUD back it seems.

The counter-argument is that the RBA might be reluctant to change monetary policy so close to the Australian general election in May. Australia’s impressive economic fundamentals of superior GDP growth and large Current Account surpluses makes the AUD a standout and attractive currency to global players seeking alternative currencies to the USD.

RBNZ again fails to address the inflation 'elephant in the room'

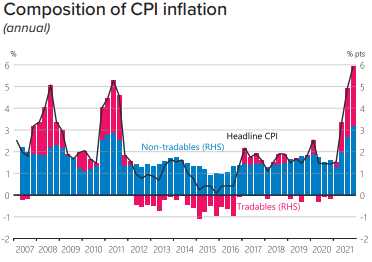

For all the RBNZ’s analysis and explanation as to why annual inflation has increased to 6.00% in New Zealand, they still failed to address the “elephant in the room” with our inflation problem, which is that the core domestic (non-tradables) inflation has been high and out of control for most of the last 15 years (refer to the RBNZ’s own chart below).

Local government rates and the cost to build a new house (including the land cost) have been running at annual cost increases of over 4% for many years due to central government imposed regulatory requirements and restrictive local city land zoning laws.

Several other economic commentators are also now waking up to the fact that the Government itself is the major cause of the persistent high non-tradables inflation. Negative or low tradables inflation from 2012 to 2020 (we imported deflation from price reductions in Chinese manufactured consumer goods) covered over and disguised the problem.

The RBNZ became complacent about the underlying causes of inflation and seemingly oblivious to the risk. Households and businesses are now paying the price in the form of sharply higher interest rates due the RBNZ’s failure over many years to address the root causes of inflation in New Zealand.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

1 Comments

An acknowledgment of the central contribution to inflation ofthe domestic non tradable sector needs to be addressed . This has.been kicked down the road for to long and the consequences of it are to large to continue to ignore. Housing is nzs number 1 problem and needs to be addressed as such , poverty and lack of affordable shelter go hand in hand.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.