Summary of key points: -

- The US is now seriously lagging behind in monetary easing cycles

- US employment trends much softer than what media headlines paint

The US is now seriously lagging behind in monetary easing cycles

President Donald Trump’s regime of higher tariffs has upended and disrupted many things in the world over the last four months.

He has caused a massive exit of capital from the United States, as evidenced by the tumbling US dollar value, as global investors conclude that the US economy and the US markets will underperform others over coming years after 15 years of US outperformance. An additional consequence of Trump’s tariffs is that the US Federal Reserve has moved into “hold” mode with their monetary policy easing cycle. The Fed are waiting to see how much the tariff increases on goods imported into the US will push up their inflation rate. As they are managing monetary policy by looking backwards at historical economic data trends, it may be some months yet before the Fed see the evidence of higher inflation they are looking for. In the meantime, by postponing US interest rate reductions they could be doing additional damage to the US economy which is already weakening on all the uncertainty surrounding tariffs.

A comparison of how far through central banks are with their respective monetary easing cycles (reducing interest rates) is brewing as the next significant influence on future exchange rate direction. The European Central Bank (“ECB”) head, Christine Lagarde confirmed last week, as they cut their interest rates to 2.00%, that “the central bank is in a good place and was getting to the end of the monetary policy cycle”. European inflation is at 2.00% and their interest rates are at 2.00%. Reserve Bank of New Zealand (“RBNZ”) temporary Governor, Christian Hawkesbury more or less confirmed two weeks ago that they were also nearing the end of their cutting cycle. The RBNZ have reduced their OCR from 5.50% in August 2024 to 3.25% today and the indications were that there may be one more 0.25% cut to 3.00%. However, after that last cut, they are “done and dusted” with their easing cycle. The New Zealand inflation rate is 2.50% and our interest rates will be 3.00%.

There is now a stark contrast in these inflation/interest rate comparisons with the US Fed Funds interest rate still at 4.30% and US PCE headline inflation at 2.10% for the 12 months ending 30 April 2025. US companies and households are currently paying a whopping 2.20% premium over inflation for their base interest rate, all because the Federal Reserve has become incredibly “gun-shy” on continuing their monetary policy easing cycle. The US has fallen a long way behind Europe and New Zealand in terms of timing and quantum of interest rate reductions. The Fed appear to be unprepared to project forward calculations on what 10% or 20% or 30% tariffs on imported product will do to their inflation rate over the next six months. They also do not appear to have a firm handle on whether the one-off tariff related price increases will cause wider “secondary effects” on other prices in the economy. If consumer demand in the US economy is weak (the consumer confidence surveys tell us that this is the case) then retailers, distributors and importers will have less pricing power to increase their prices by the full percentage increase of the tariffs. The more likely scenario is that the Chinese exporter, the US importer and the US retailer all share a proportion of the tariff cost and therefore the price increase to the consumer is much less then feared by the Fed. The adverse inflation impact is likely to be a lot less than current Fed fears.

There are some expectations that the first signs of tariffs will show up in this Wednesday’s US CPI inflation data for the month of May. Forecasts are for a 0.20% increase in May, lowering the annual CPI increase from 2.50% to 2.30%. As the final tariff percentages are a long way off from being agreed, a more likely scenario is that the Fed will not see tariffs pushing up inflation until August or September at the earliest.

The question for the FX and interest rate markets is whether soft US economic data coming through well before that time will forces the Fed to capitulate on their “hold” stance and force them to recommence their interest rate cuts. A highly probable scenario over coming months is that the US are reducing interest rates by more than 1.00% from their current 4.30% levels, whereas the RBNZ here have finished with interest rate reductions. Forward pricing on the New Zealand terminal OCR interest rate level has already shifted from 2.50% a month ago to just under 3.00% today. The interest rate differential between the NZD and the USD looks likely to close up a lot further yet with the US recommencing their cutting cycle over coming months.

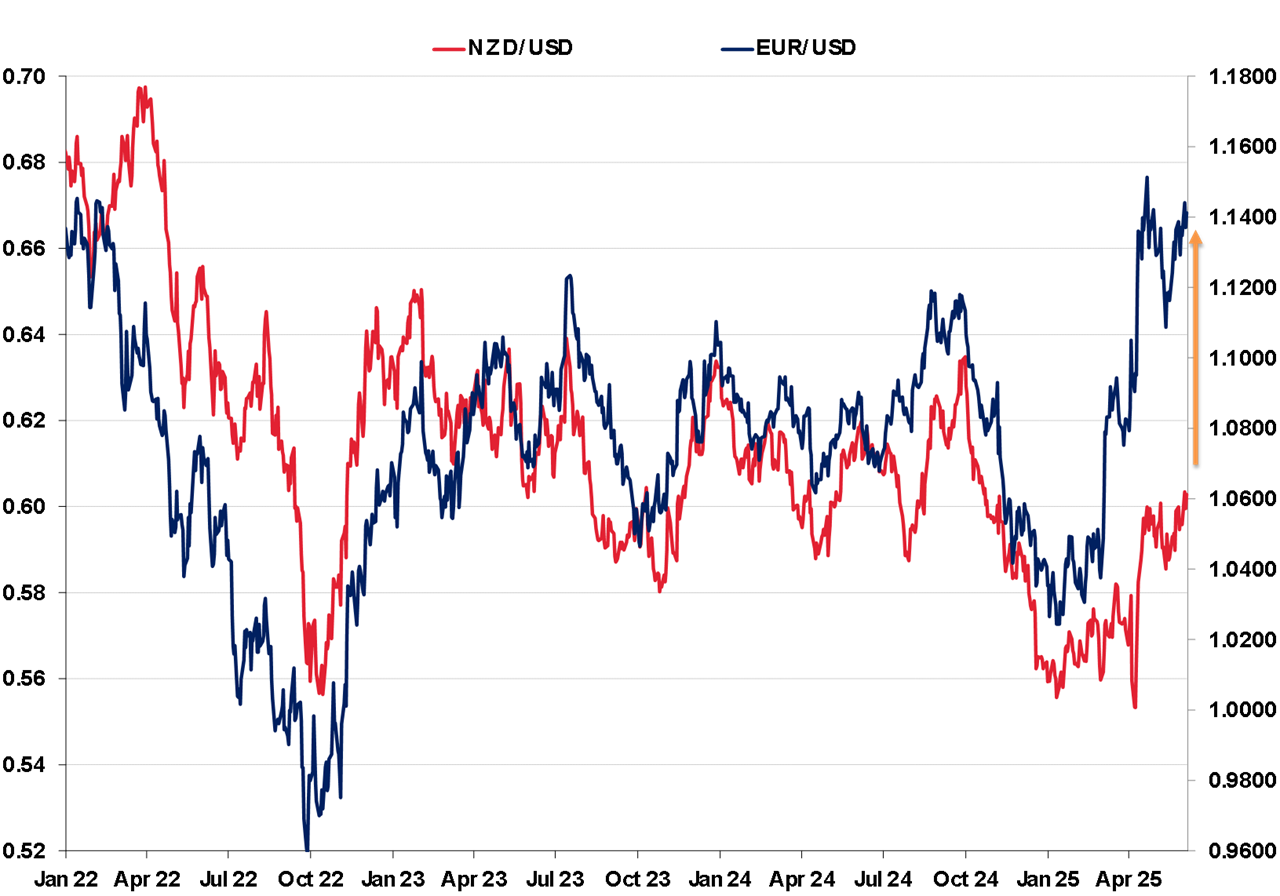

The fact that NZ interest rates have been well below US interest rates to date has meant that the Kiwi dollar has lagged the Euro’s appreciation against the USD. The Euro has benefited from massive capital flows leaving the US and returning to Europe. The Kiwi dollar has not seen those inward capital flows and has been held back in its appreciation against the weaker USD by the fact that the currency speculators have to “pay away’ the forward points to go “long NZD’s”. The forward points are added to the spot rate because NZ interest rates are below those of the US. As US interest rates increase over coming months and NZ interest rates remain stable, the forward points will reduce and the current disincentive to buy the Kiwi dollar will reduce. When that occurs, the Kiwi dollar should have a much better opportunity to catch up on the strong Euro gains against the stumbling US dollar.

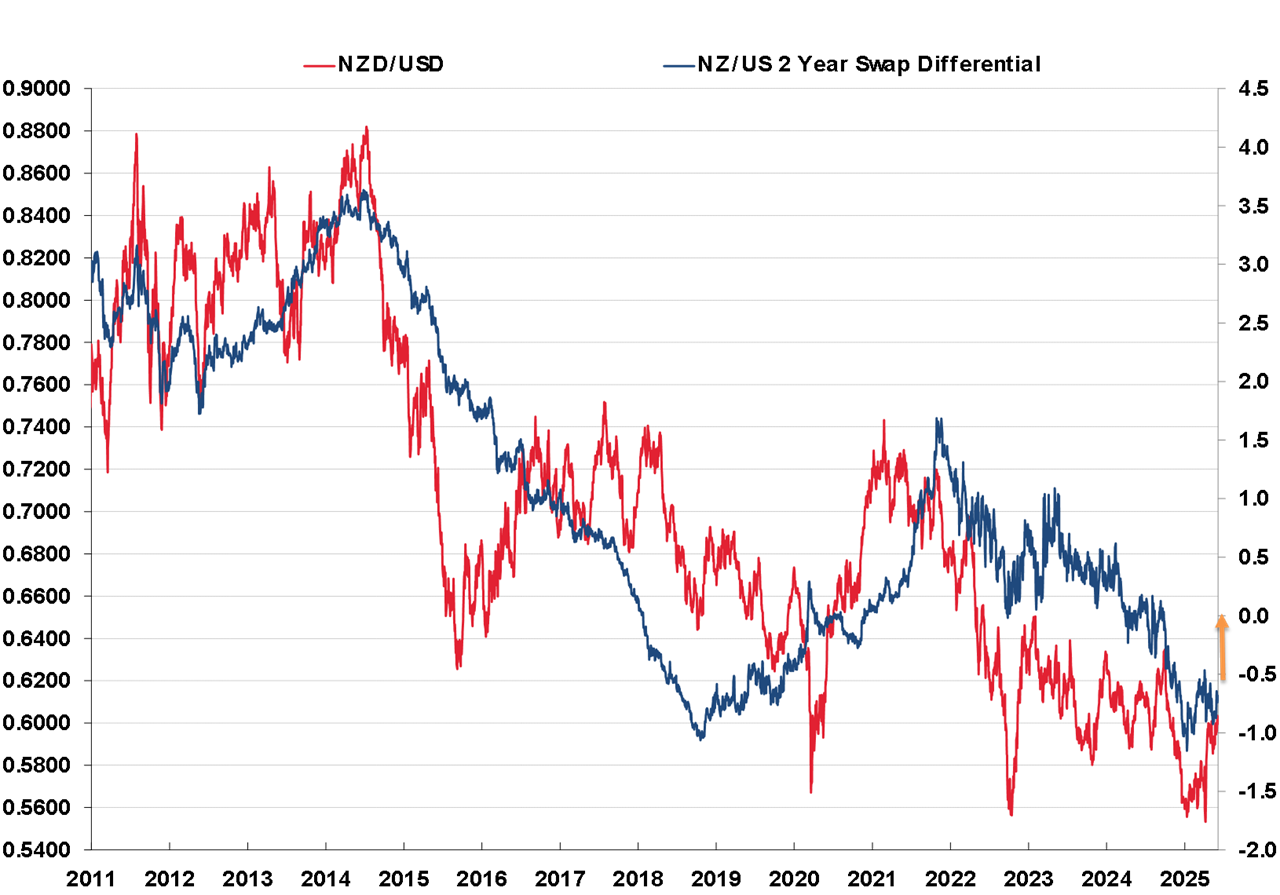

Based on the strong historical correlation between the NZD/USD exchange rate and the US:NZ interest rate differential (refer to the chart below), a 0.50% decrease in US two-year interest rates from current levels would return the differential to zero. The last time the differential was zero the NZD/USD rate was 0.6350. A 1.00% reduction in US interest rates would have the NZ two-year interest rate 0.50% above the US. The last time that was the case, the Kiwi dollar was in the 0.6500 to 0.6800 trading range.

US employment trends much softer than what media headlines paint

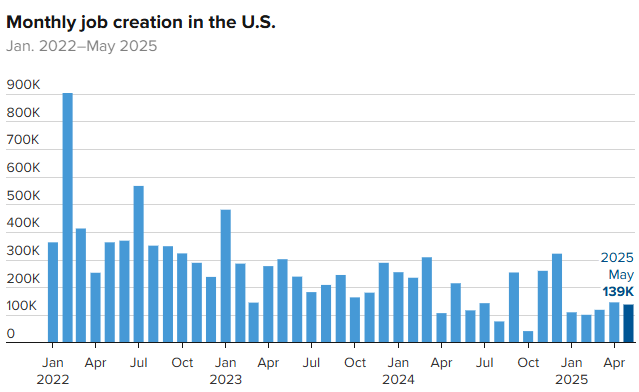

The media headlines in the US were that the May Non-Farm Payrolls jobs increase was “strong”, however as we have pointed out on several previous occasions it pays to look beyond the headlines with US employment statistics. Accompanying the May result of a 139,000 increase in jobs (marginally above prior consensus forecasts of +120,000 to +130,000) was, yet again, massive revisions downwards in the previously reported March and April employment increases.

- April jobs increases were lowered by 30,000 from the originally reported +177,000 to +147,000.

- March jobs increases were lowered by 65,000 from the originally reported +185,000 to +120,000.

The disturbing inaccuracy in the first released data of the number of jobs increases each month does really question the financial/investment market’s reaction to pure headline numbers that are radically overstated. Back in early April when the March numbers were released, the markets would have reacted entirely differently to a correct and very soft 120,000 increase than the reaction to a “robust +185,000” at the time. A more accurate depiction of the real trend in US employment is the three-month rolling average of the revised monthly Non-Farm Payrolls data. The three-month rolling average decreased to +135,000 in May from +209,000 as of 31 December 2024 and +178,000 as of 28 February 2025.

Let us hope that the Fed are looking through the noise of highly inaccurate monthly jobs numbers and are observing the underlying trend of continuing weakness. Adding to the evidence of significant weakness now showing up in the US labour market was last week’s private sector ADP Employment Change. Under this measure job only increased by 37,000 in May, well below prior forecasts of 70,000 to 115,000 increases. The second household measure of US jobs, which is used to calculate the unemployment rate, reported a worrying 696,000 decline in jobs in the month of May. Clear evidence of the US labour market weakening should convince the Fed to start adjusting the rhetoric on its “hold” stance when they next report on 18th of June. Up until now the Fed have seen the employment situation as stable and therefore no need to reduce interest rates under the second employment part of its dual mandate.

The Fed might be worried about the tariff impact on inflation, however arguably they should now be more worried about employment and the economy weakening at a faster pace than their previous projections.

It will be of no surprise to see more individual Fed members adjusting their interest rate forecasts lower in their “dot plot” projections at the 18th June meeting. The expected change to the Fed’s stance will soon have the US interest rate markets pricing-in much earlier and more substantial interest rate decreases over the balance of 2025. Lower US interest rates will add to the US dollar’s downward momentum.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.