Summary of key points: -

- World risk events dominate and send the NZD/USD rate sharply lower

- Did the RBNZ score an own goal?

- What should highly-hedged USD exporters do now?

World risk events dominate and send the NZD/USD rate sharply lower

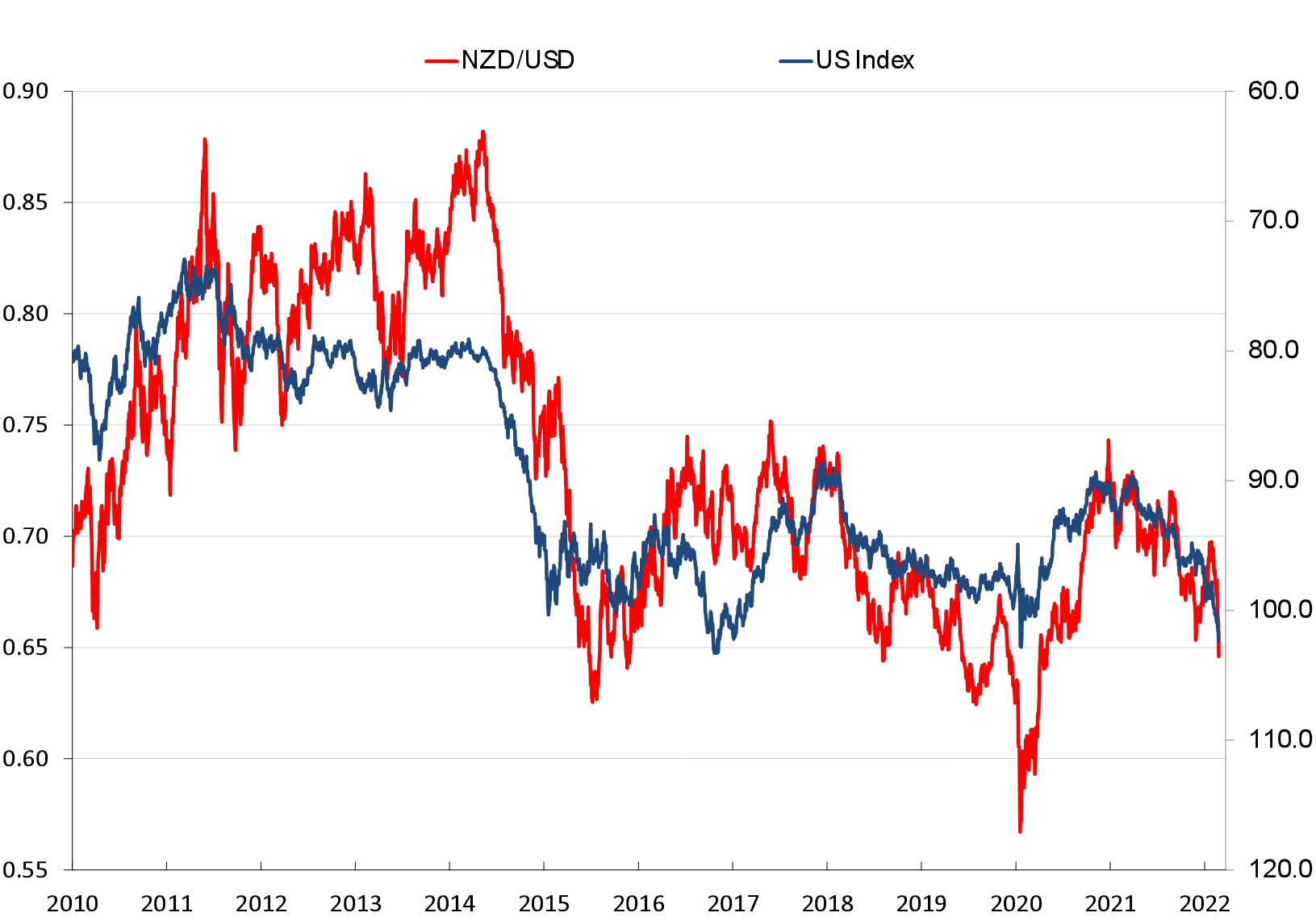

The NZD/USD exchange rate has been pushed to its lowest level since July 2020, as a multitude of global events has sent the US dollar soaring to new highs and currencies/economies related to China plunging downwards.

The Kiwi dollar ended last week at 0.6460, with the previous support around the 0.6700 level falling away as chart/technical levels were broken.

None of the NZ dollar selling appears related to concerns or worries about the New Zealand economy. To the contrary, the local NZ factors influencing the NZ dollar value remain very positive i.e. higher and rising interest rates and high commodity prices.

Perhaps a lack of sufficient daily liquidity in the NZD/USD inter-bank FX market has contributed to the speed and extent of this latest sell-off. Price direction can be rapidly one-way when there is little local or offshore interest to buy the Kiwi on the other side of the market.

Whether this sharp Kiwi dollar sell-off proves to be as short-lived as the late January 2022 dip to 0.6530 remains to be seen.

One of the causes of the current selling is the same as January, a US equity market sell-off forcing investors into their “risk-off” mode.

On that occasion, the sharemarkets recovered strongly through February and March, allowing the Kiwi to impressively climb back up to 0.7000. Being a very long way from the Russian/Ukraine war at that time also attracted NZ dollar buying.

The global cross-currents causing the turbulence for the Kiwi dollar are summarised as follows:-

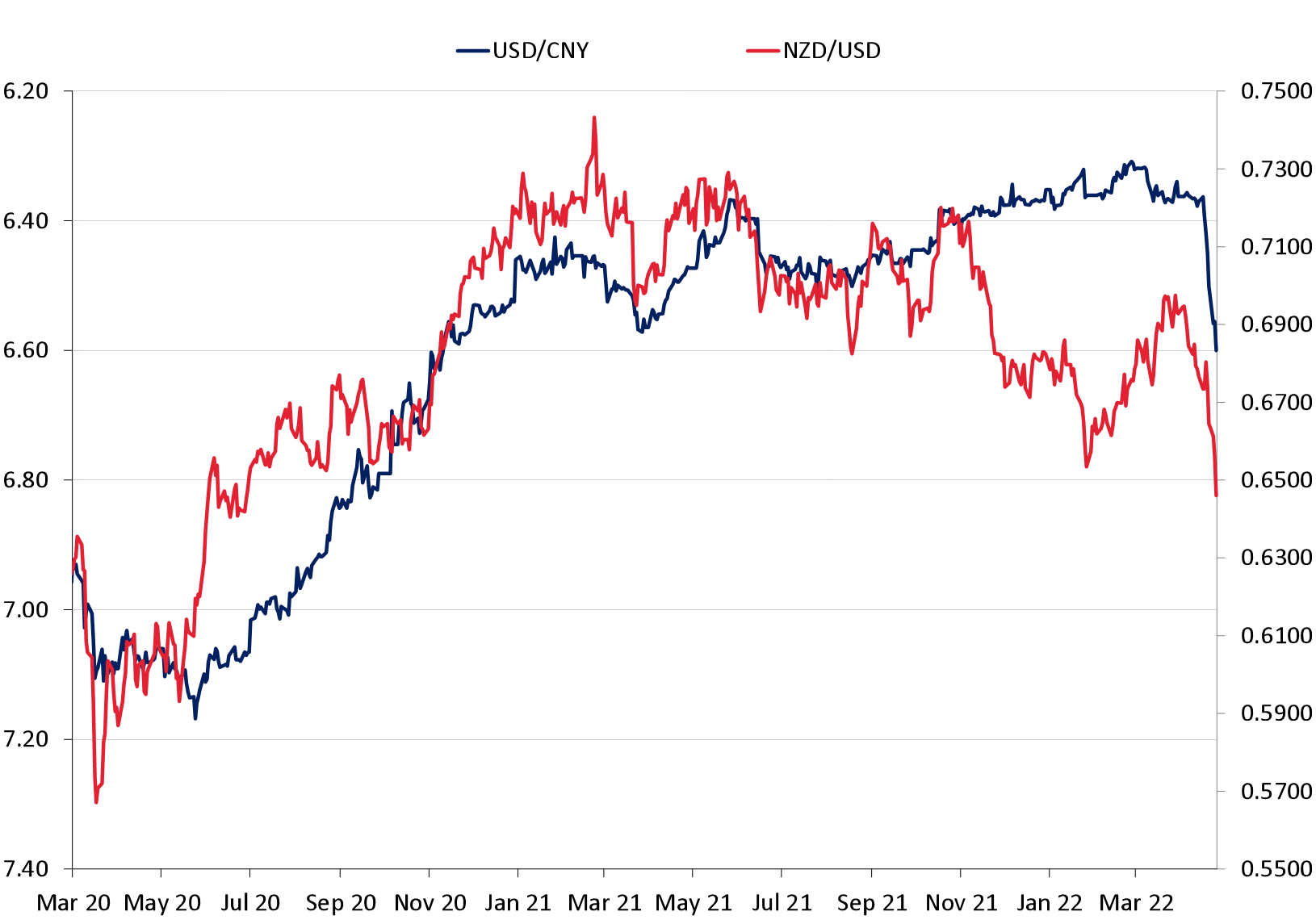

- Chinese Yuan depreciation: It was expected that the Chinese authorities would stimulate economic activity to keep their GDP growth rate up this year through looser monetary policy i.e. cutting their interest rates. They have not really actioned that yet, however they have abruptly loosened monetary policy by depreciating the USD/CNY exchange rate value from the stable 6.35 level to 6.60 – a 4% drop within two weeks. The NZD/USD rate has maintained a reasonable correlation to the USD/CNY (refer chart below), however that close tracking broke down last October when the Yuan was held below 6.40 despite the appreciation of the USD against all major currencies. Over the last two weeks the NZD and AUD connection to the Yuan has returned as FX markets reflect our two economies being adversely impacted if Chinese demand is lower due to their Covid lockdowns.

- US equity markets: The Fed shoving US interest rates upwards at a more rapid pace and worries about global growth have spooked the equity markets in April. The previous high-flying technology stocks have been under attack as investors lose their confidence that the high profit multiples will be achieved. The equity market “risk-off” mode has also stung the Kiwi dollar since the highs of 0.7000 in early April. One of the reasons that stocks such as Apple, Microsoft, Meta, Alphabet and the chip-makers are being sold is that over 50% of their profits/revenues come from outside the US and the very strong US dollar right now is damaging that profitability in USD terms. Large US-based multi-nationals generally have a low recognition of FX risk and do not hedge as European, UK and Australasian corporates routinely do.

- Euro under pressure from the Russian/Ukraine war: Europe’s reliance on Russian gas supplies for their energy has clouded their economic outlook and prevented the ECB from raising interest rates. If the unanticipated war had not started in February, the ECB would have been tightening monetary policy by this time (six months behind the Fed) and the Euro would be appreciating. Instead, the opposite has occurred, with the Euro nose-diving from $1.1000 to $1.0500 over the last week. There remains a possibility that the ECB will still signal the ending of their previous super-loose monetary policy settings when they next meet in June, as their annual inflation rate at 7.50% has to be addressed.

- The Aussie connection: Like it or not, the Kiwi dollar religiously follows the AUD/USD exchange rate movements. Since the highs of 0.7650 against the USD in early April the Aussie dollar has been slammed down six cents to 0.7050. Likewise, the NZD/USD rate is also down six cents. Over the last 12 months, the AUD has bounced back up again from rates between 0.7000 and 0.7100 on three previous occasions. Despite their general election only being three weeks away, the incredibly strong Australian economic fundamentals of 4.5% GDP growth this year and their ballooning Current Account surpluses must make the Australian dollar the most undervalued currency going around. There is a high probability the AUD will bounce back up yet again.

Three of the four above-listed risk events that have resulted in the Kiwi dollar trading at a much lower level than expected/forecasted, may have already run their course as negatives. No-one knows how the Russian/Ukraine war will be resolved that would allow Euroland to recover.

China will resolve its current economic challenges from Covid as they have always done in the past, through a massive fiscal policy stimulus package i.e. building infrastructure. Watch this space for that initiative, which is always good news for Australia and New Zealand.

Did the RBNZ score an own goal?

In rapidly tightening monetary policy to combat high inflation, the RBNZ need a stronger NZ dollar value to lower import costs.

However, one small and bizarre comment from the RBNZ in their 13 April OCR Review statement may have been a contributing factor as to why the NZD/USD exchange rate went down sharply following the statement, instead of increasing as most would have expected. In increasing the OCR by 0.50% to 1.50%, the RBNZ stated: -

“A larger move now also provides more policy flexibility ahead in light of the highly uncertain global economic environment”.

The comment may have indicated to offshore NZD currency players that the RBNZ wanted the OCR higher earlier so that they had room to cut the OCR if the NZ economy turned to custard later.

In wanting to have a “bob each way” so that they could not be accused of getting it wrong, the RBNZ may have lost some credibility and the confidence of the currency markets.

What should highly-hedged USD exporters do now?

On the premise that the NZD/USD rate at 0.6450 has already priced-in the global negative forces described above, local USD exporters should be taking advantage of the unexpected lower entry levels to add to their forward hedging.

Many exporters are already hedged to maximums of policy limits at weighted-average hedged rates of 0.6700/0.6800.

Given the unique set of circumstances that have caused the NZ dollar to be now significantly under-valued at 0.6450 vis-à-vis the positives of higher interest rates and commodity prices, the export companies should either be seeking special Board approvals to extend hedging beyond standard limits and/or buying NZD call options to secure the lower rates if bank credit restrictions prevent further hedging with forward exchange contracts.

Whilst it is never comfortable having a hedgebook that is “out-of-the-money” on a marked-to-market revaluation basis, it should be remembered that such positions can swing around the other way very quickly. The historical NZD/USD conversion rates achieved is the most appropriate and best measure of hedging performance, plotted against spot, benchmark and budget exchange rates.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

2 Comments

This is by far the best article this week catering for international investors in New Zealand. Keep up the good work.

It'll be interesting to see how the NZD performs or whether the world has officially entered into a risk-off environment with the Chinese lockdowns and Russian-Ukraine war. Commodity price inflation paints a different picture though and should be positive for AUD and NZD with the latter leading the FX majors in rate rises.

I agree that this is one of the author's better articles with less politics and more information.

It seems to me that the recent moves with a higher $US against the NZ, Aust, Canadian, SA,UK and Euro is a judgement that US is a safer haven than the rest of the world. I was listening to a commentator who was saying that the US consumer is still sitting on a lot of US govt Covid payout savings and so US firms are able to pass on higher costs in higher prices.

I'm not sure how the rest of the world's consumers are handling the higher costs for energy, freight and food. Perhaps many countries are just not in as strong a position in terms of aggregate demand as the US is.

I imagine that the higher the Fed pushes the interest rate the less the US householder that is paying a mortgage and driving a vehicle will have to spend and the US will eventually follow the rest of the world with the loss of demand.

I can't really see China getting it together in the next couple of months because it seems to be less about the economics and more about the politics over there right now.

I'm still thinking a mid year dip followed by an end of year rise for the $NZ.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.