Summary of key points: -

- Abrupt slowdown in the US economy – the Fed yet again asleep at the wheel?

- Our immigration policy contributing to stagflation

- Chinese equity markets turn positive – good news for the Kiwi dollar

Abrupt slowdown in the US economy – the Fed yet again asleep at the wheel?

The theme and thrust of view of this column over recent months has been that when US inflation peaks, the US dollar value will also peak, and a weaker USD from that point on will allow the NZD/USD exchange rate to recover to near 0.7000 (where it was at the end of March).

The US dollar side of the NZD/USD exchange rate pair continues to totally dominate the day-to-day movements of the rate.

The New Zealand economic, or NZD, side is really failing to get a look in these days. As a prime example of the one-sided influence, the NZ dollar did not blink an eyelid at the worse than expected GDP growth performance in New Zealand for the March quarter released last week.

The 0.30% contraction in economic activity over the quarter was considerably weaker than the 0.0% to +0.60% prior market forecast range and the +0.70% forecast made by the RBNZ less than a month ago on 25 May 2022. The RBNZ’s forecast for the June quarter of +1.30% looks to be well wide of the mark as well!

Following the US Federal Reserve’s 0.75% hike of their official interest rate last Thursday morning, as could have been expected, the US equities markets were sold down aggressively.

The pattern over the last 12 months has been that the US dollar strengthens when equities are sold and “risk” currencies such as the NZD and AUD depreciate. However, for the first time in a very long time the US dollar failed to appreciate on tumbling equity prices last Thursday, it lost ground from 105 on the USD exchange rate index to the 103 level.

The NZD/USD rate lifted from the lows of 0.6220 to 0.6380 (the Kiwi has since recoiled somewhat to 0.6320). The change in the currency market’s reaction to higher US interest rates from the Fed could prove to be a watershed moment. It does appear that the FX markets are once again looking well forward to future US economic conditions and performance and concluding that a weaker US economy (due to the aggressive monetary tightening) is now negative for the US dollar value.

Adding to that change in FX market outlook could be some early pricing-in of the scenario that the Fed causes a “hard landing” for the US economy i.e. a recession later this year or in early 2023, which in turn forces the Fed to be cutting interest rates next year in response. An expectation of decreasing US interest rates in 12 months’ time is negative for the US dollar value today.

The decision by the Fed to increase by 0.75% appears to be a late “knee-jerk” reaction to the higher May inflation outcome (however the annual core inflation rate at 6.00% was only fractionally above prior forecast at 5.90%) and the result of a survey of inflation expectations which recorded another increase.

Both inflation results were contrary to Fed expectations, hence the more aggressive 0.75% interest rate increase.

The RBNZ also places a lot of importance on surveys of inflation expectations when adjusting their monetary policy. However, the writer’s observation over the years is that these surveys are very poor predictors of where actual inflation rates will be in the future. The observed pattern is that the survey respondents always believe that future inflation will be at the same level as the current inflation rate. They really have no view as to whether it will be higher or lower in the future, they just state that it will be at the same rate. Therefore, it cannot be any great surprise that inflationary expectations are increasing, the survey results are just reflecting recent increases in actual inflation.

US inflation clearly did not peak in the month of May with rents, airfares and auto prices still increasing, thus the annual inflation rate still moved higher. The markets will now be focused on the June CPI inflation figures being released on 14th July. A reduction in the annual headline and core inflation rates does seem likely with the June 2022 price increases being lower than the June 2021 monthly increases (which drop out of the annual numbers).

Fed Governor, Jerome Powell, stated in the media conference following last Thursday’s rate hike that “there is no sign of a broader slowdown that I can see in the economy”. The view of this column is that, once again, the Fed appear to be unbelievably slow in reading the lead indicators for the US economy. Consider the abrupt change during the month of May with all the following pieces of US economic data: -

- Retail sales in May decreased by 0.30% (prior forecasts were for a small increase) and that was before adjusting for 8% inflation i.e. retail sales volumes were down by a much larger amount. The historically record low Michigan consumer confidence index at 50 is finally adversely impacting consumer spending in the shopping malls.

- Housing starts plunged 14.4% in May (a 13-month low) as the doubling in mortgage interest rates from 3.00% to 6.00% over the last four months takes its toll.

- Industrial production only increased by 0.20% in May, lower than prior consensus forecasts of between +0.40% and +0.70%. The over-valued USD exchange rate is hurting US manufacturer’s export competitiveness and local manufacturers cannot compete against cheaper imported product.

Upcoming US economic data releases to watch out for in terms of further evidence of a sudden slowdown include the June ISM Manufacturing (should be lower than the previous months’ 56.1) on Friday 1st July and Non-Farm Payrolls employment data for June on Friday 8th July (consensus forecasts are again for a lower 310,000 monthly increase in new jobs).

High inflation, higher mortgage interest rates and a high US dollar value are all negatively impacting the US economy.

Our immigration policy contributing to stagflation

NZ Labour Government politicians probably do not understand this (or ideology does not allow them to!), but their current immigration policy is adding to our current stagflation predicament. Last year we highlighted the fact that the NZ economy would be severely constrained in terms of growth in 2022 due to chronic labour shortages in our key primary industry and manufacturing export sectors. Productive output was being limited by labour shortages. Last week’s GDP growth data for the March quarter provided clear evidence of lower productive output in agriculture and manufacturing.

The current immigration policy also requires semi-skilled immigrant workers to be paid a minimum of $27/hour before they are allowed in to the country. Many companies cannot afford that wage cost, or if they do pay up to get the workers, the rest of their local workforce quite rightly demand wage increases to retain relativities. Wage push inflation is already occurring from the immigration policy, not that you would read about this as one of the sources of inflationary pressures in RBNZ statements.

Chinese equity markets turn positive – good news for the Kiwi dollar

Chinese sharemarkets have rebounded upwards over this last month (the opposite to US equity markets) as investors position for much more positive Chinese economic data ahead as they come out of Covid lockdowns. Already, Chinese export, industrial production and retail sales figures for May were well above expectations.

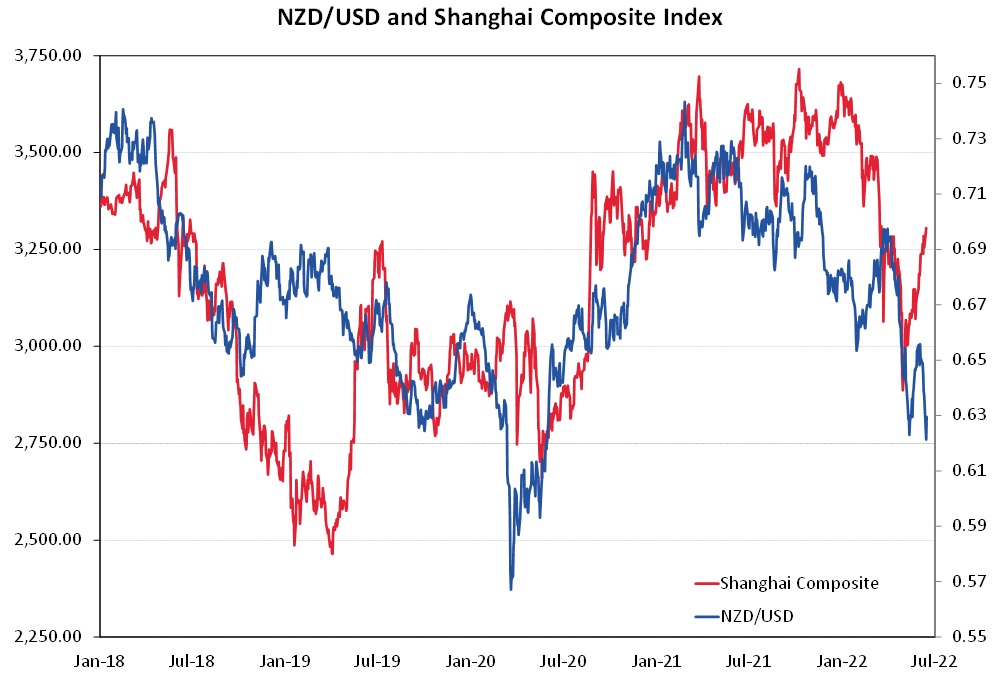

The chart below indicates that the NZD/USD rate is to some degree determined by positive and negative Chinese economic data (given our high reliance on trade with China), the Shanghai Share Market Index representing China’s economic fortunes up and down. It appears that global hedge funds and fund managers are now buying into Chinese equities as they anticipate monetary and fiscal stimulus packages for the economy and the lower Yuan currency value makes for a more attractive entry point as well.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

10 Comments

I don’t rate Mr. Kerr as a contributor. Not only is he almost always woefully out with his predictions but his constant partisan jibes are a stain on what is meant to be independent journalism

When you've grown up in a box, the box is all that you know. The box itself is a part of a wider universe.

Looking out into the world from a NZ investor's lens, the comments made Kerr has made have logical sense and many would accept it none the wiser however, they're completely out of wack on how the actual global economy works and the USD works.

I don't agree with his neoliberal views but I always have time for a new bit of information like the relationship between the NZ dollar and the Shanghai composite. I'm not sure that it is a short term prediction tool but it certainly looks like a good indicator tool.

Likewise even a Keynesian like myself can see that using immigration settings to get better wages for for some groups at the expense of others is all sorts of wrong. The Greens and the Labour party really do not like 'Pakeha farmers in the South Island' and it shows.

Mr Kerr always wants lower wages for workers, that's a given, but the way Labour is playing with immigration settings to disadvantage it's political opponents is really bad news. Labour's inability to reverse bad policy when it is obvious that the policy is not only bad but politically damaging is a big Achilles heel for it.

In regards China, bit issue is that with their continued zero covid policy - until they change, they will be constantly going into lock-downs as outbreaks occur.

Then key to China is $/Yen rate - if that continues to weaken then as one of Japan's major trading partners - China will need to weaken Yuan to remain competitive - and that should see further selling of AUD and NZD as proxies for China market.

Finally yes the US other advanced economies might be pushed into recession via Central Bank policy - but in regards easing - will the Fed ease or be able to ease, if inflation continues to be strong?

Roger Kerr's comments are always helpful. Nobody can always get predictions right as conditions change, but his analysis is excellent and give a good basis. Thanks interest.co.nz for publishing his columns. They are excellent.

Business needs to make capital investment into automation to lessen their reliance on cheap labor. Last nights Country Calendar episode a case in point. An orcharding operation with limited access to RSE workers. Investing in mobile picking platforms to make the pickers they do have more productive also innovative automation in the pack house to lessen the number of workers required. An infinite supply of cheap labor is not the answer to the productivity question.

WAJ you are correct re investing in automation - but the cost of both the investment and the ongoing running costs (power, fuel, IT etc) are also climbing fast and offsetting the return

It is also important to note that in NZ there is no longer such a thing as cheap labour. I know people re struggling to live on what they get paid but that doesnt mean the labour is "cheap"

I also used to be critical of Roger as his analysis didn't fit with my positioning.

After following his column for a number of years however I can say that he is pretty close to the mark.

His political commentary is just presenting the facts as they stand.

“Our immigration policy contributing to stagflation”

Stagflation is becoming a reality with supply constraints really taking its toll on GDP growth.

Inflation in the US & NZ is on an upward trajectory

We have the wrong Government for the economic times we’re in. I think Roger Kerr’s entitled to say that.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.