Summary of key points: -

- Market lead-indicators for the USD start to turn

- Abrupt U-turn in FX rate forecasts

Market lead-indicators for the USD start to turn

The US dollar “bulls” in global currency markets (the speculators who hold long USD positions against other currencies as they expect to profit from further USD strength) are holding their own against mounting odds against them.

The USD Index remains near its 40-year highs at 103.90, however some cracks are starting to appear in the “mighty US dollar” story. Completely opposite to a few years back, when many economies were seeking to devalue their currencies to help their exporters in what was at the time “a race to the bottom”, the current situation is considerable worry about local currency devaluation against the USD as it adds to the inflation problem for many countries.

Both the US economy and the world economy would be better off from a weaker US dollar. However, the US dollar bulls have to be firstly convinced that the US economy is slowing, US inflation is peaking, and the Fed sometime soon will have to ease its foot off the monetary policy brakes. As the evidence mounts in this respect, watch for the US dollar to also peak-out and reverse to a depreciation path as the US dollar bulls unwind their market positions.

The latest June US consumer survey on inflationary expectations was slightly lower than the previous month. The sharp increase in inflationary expectations last month in May was the main reason the Fed convinced themselves they needed to do a more aggressive 0.75% hike in interest rates. Already, retail sales, housing starts, and industrial production economic data in the US were all abruptly weaker in May.

Next Friday’s ISM Manufacturing data for June seems likely to decline as well from above 56 to potentially below 55. The Fed will need to see clear evidence that inflation is peaking before easing-off, however the data tells us that demand is reducing in intensity in the US economy. The supply problems that caused the dramatic increase in inflation may also reducing, the Baltic Exchange shipping cost index has decreased 30% over the last month.

The price action in financial and investment markets over recent weeks is also instructive as to whether we are now going to see a reversal in direction for the US dollar value: -

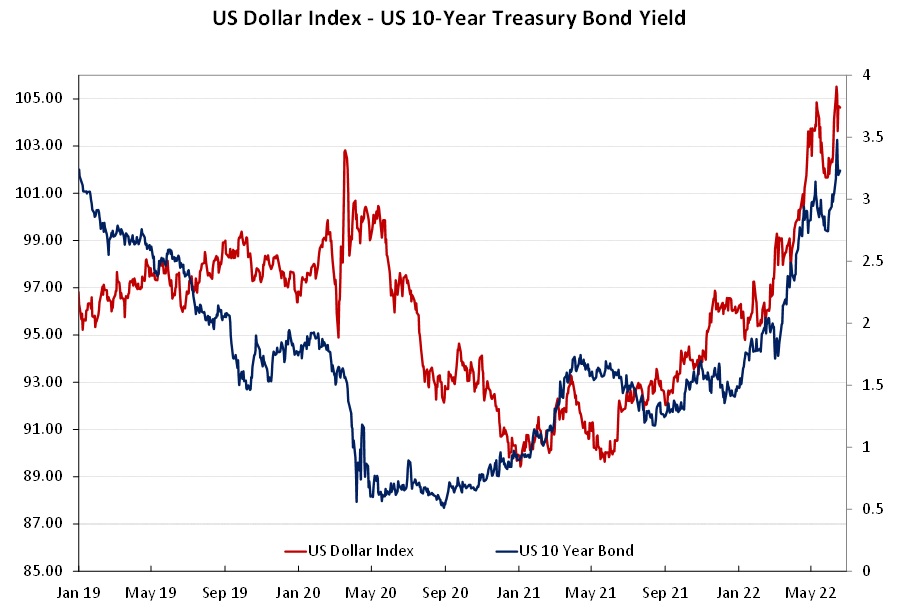

- US 10-year Treasury Bond yields after racing up to a high of 3.50% two weeks ago when the Fed were panicked into their 0.75% hike, have since retreated with some gusto to 3.14%. As yields reduce, the bond market is pricing-in a greater probability that the Fed has done enough to bring inflation back down. The is a strong correlation between 10-year bond yields and the USD Index (refer chart below). Further falls in the 10-year bond yields to below 3.00% would suggest that the USD Index would decrease by over 3% to 100 and the NZD/USD rate contemporaneously lift to 0.6550.

- US equity markets have staged a tentative recovery over the last week, with the Dow Jones Index up 5.7% as investors seek bargains on the bet that US market interest rates will not go any higher and may start to fall on weaker economic data.

- Oil prices (WTI) have promptly reversed back down from the US$122/barrel highs of mid-June to currently trade at US$107/barrel. Further falls would add to the view that the worst may be over with inflation increases. Supply of oil disruptions from the Russian/Ukraine war are being worked through and slower global GDP growth is negative for the demand side of the oil price equation. In years gone by, the USD value moved in the opposite direction to oil prices, however in this high inflation environment the old norms are out the window and a lower oil price today would be seen as negative for the USD.

What this analysis and market insight means for the future NZD and AUD direction against the USD boils down to upcoming weaker US economic data being negative for the USD, and rapidly improving Chinese economic data from here being positive for our two currencies.

Abrupt U-turn in FX rate forecasts

Everyone understands that it takes contrary opinions about the future to make a market in anything. Buyers and sellers reach price discovery and transact when they compromise sufficiently on their differing future views to strike a deal.

Our view for some time has been that the US dollar is well overvalued and if was not for the unexpected Russian/Ukrainian war in February driving oil prices and inflation higher again in the US, the US dollar would have been weakening in 2022. Our view remains that all the economic ingredients for a weaker USD are still present once the markets and the Fed believe US inflation has peaked.

Therefore, it was interesting to receive a totally contrary view on the future USD value last week from two large Aussie banks, CBA and Macquarie. Both banks have abruptly reversed their previous AUD/USD forecasts for December 2022 from 0.8000 to a new forecast of 0.6500. They now cite continuing USD strength as the US economy goes into recession and lower commodity prices hurting the AUD and NZD.

Historical comparisons of how the USD value reacted to US economic recessions in 1980, 1990 and 2009 would strongly suggest that the USD weakens in such conditions, the opposite to what these Aussie banks are pontificating. Their updated currency forecasts also seem to totally ignore the dominant influence of China over the Australasian economies and currencies.

The Australian dollar is often used by global hedge funds as a proxy for all things related to the Chinese economy. The Aussie dollar is a highly traded and liquid currency, therefore easy to get in and out of to fit with the hedge funds’ view of all things China. Rebounding out of their Covid lockdowns over recent months, there is no question that Chinese economic data releases are all going to be very positive going forward.

Add on large-scale monetary and fiscal stimulus for the Chinese economy so that they achieve their 2022 GDP growth targets, the implications for the AUD and NZD are seriously positive.

It could be that these abrupt U-turns in exchange rate forecasts are nothing more than what we have seen before from the Australian banks. If the AUD has depreciated 10% over recent months it will continue in the same direction by another 10%.

The same happens when the AUD puts in a strong upward performance, the forecasts are always that it will appreciate further. Could be something to do with scarring the unsuspecting into doing more FX derivative transactions which helps the banks’ profitability!

Whilst the US and some other economies may go into a shallow economic recession (two successive quarters’ of negative GDP) over the next 12 months, it does not automatically mean a collapse of food and metal/mining commodity prices that CBA and Macquarie are now forecasting.

The world (particularly China) still needs to import food and iron ore. New Zealand and Australia export both in a constrained global supply situation. It is also useful to remember that over the last 12 months that both the NZD and AUD have depreciated (due to a strong USD) in a period of significant commodity price increases.

The NZD and AUD are therefore not in over-valued positions to be left vulnerable to some decreases in commodity prices on weaker global demand.

Our view remains unchanged, the AUD is significantly undervalued at 0.6900 against the USD against to backdrop of superior Australian economic performance, high commodity prices, a recovering China and are now hawkish RBA.

Global funds exiting over-weight USD positions over coming months will be seeking out the AUD as the currency to switch into with much more upside than all others.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

5 Comments

Excellent analysis from Roger Kerr. The only caution is, what if inflationary forces in the U.S. are more persistent than expected?

The same author wrote a similar piece a couple of months ago stating about the same as in this piece. NZD/USD would increase to 0.6800 but this never happened. Allthough all his reasoning makes sense, it is written from an USD perspective and I agree with his analysis. But there is an other side of the coin: the NZD.

The NZ economy is performing far worse than government wants us to believe through the statistics. We have still close to 350000 main benificiaries. The job growth is mostly realized through government departments and semi governmental service- and community work providers. These are what I call "soft" jobs and clearly preferred above jobs in a manufacturing environment where you have to "sweat it out" most of the times.

Other indications are our trade and current account deficits which have grown to highest levels for years. meaning we have to borrow to fund our imports.

Last but not least NZ has simple low value export commodities concentrated in one basket: China. This makes us very funerable for geo political developments. This in spite of all great words of diversifying. The international money markets will see increased risks in the New Zealand economy.

It is 400,000 beneficiaries--plus their children.

It may take international investors some time to realise how vulnerable NZ is.

NZD will weaken against the USD until there is a bottom in the US Equity markets.

NZD was .575 at COVID Crash bottom 2020

NZD was .50 at GFC Bottom 2009

NZD was .40 at .COM crash bottom 2000

Expect further downside in the NZD in the near term.

I'm hopeful he is correct, but it seems that no matter what the direction of the currency is, Kerr forecasts a lift in the NZD vs USD. I'm becoming less confident despite his pieces appearing well researched, perhaps he's just looking at the wrong [piece of data, perhaps he's just too far ahead of the others......

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.