- The markets start to bet on US inflation peaking

-

The oil price and the US dollar value: A broken paradigm?

The markets start to bet on US inflation peaking

The US dollar appreciated to a new high of 110.77 early last week following stronger than expected ISM manufacturing and PMI services data (not really stronger, the survey results were not as weak as expected by prior forecasts). The economic data was seen as supporting justification for the Federal Reserve’s renewed tighter monetary policy attack over recent weeks.

However, since that time the US dollar has retreated back to the 108.50 area on profit-taking and a recovery back up in US equity markets over the last three days. There are signs that the financial and investment markets are starting to question the Fed’s increased hawkish tone in the face of emerging evidence that US inflation increases peaked in July and the annual inflation rate could reduce as fast as it went up over the first six months of this year. We have long held the view that the US dollar uptrend of the last six months will peak and reverse in direction when US inflation peaks and reverses downwards.

As a result of the general US dollar strength against all currencies, the NZD/USD flirted with trading below the key “big-figure” level of 0.6000 on September 7th. However, follow-through NZD selling was not evident at the time, and it has since recovered back to 0.6100 as risk aversion reduced in the markets with Wall Street posting three up days.

The Federal Reserve will still increase their official interest rate by 0.75% at their next FOMC meeting on 21 September, however that will not propel the USD back up again as it is already 80% priced-in to interest rate markets. There will be no more speeches and statements by Fed Governors about the need to keep interest rates higher for longer over the next 10 days as they are prohibited from doing so by a blackout period.

The markets will be totally focused on the US August CPI inflation release this Wednesday 14th September with consensus forecasts for a 0.10% decrease in inflation in August compared to July. The reduction in prices will cause the annual inflation rate to decrease from 8.50% to 8.10%. The sharp pull back in global oil prices to below US$90/barrel and falling shipping/freight costs set to halt food price increases will reduce the headline inflation number. House rents are also set the stop increasing at the rate they have been in the core component of the inflation measure. An outcome that confirms inflation reducing by more than 0.10% in August will be negative for the US dollar.

Whilst the Fed’s updated economic forecasts and individual Governor’s “dot-plot” forecasts for interest rates next year at their meeting on the 21st will paint a picture of still high inflation risks, the evolving economic evidence from the CPI numbers beforehand will be that inflation has already peaked and the inflation risks are reducing.

The currency markets in pricing the US dollar movements will take their lead from the level of US 10-year Treasury Bond yields. The bond yields tumbled from a 3.50% high in mid-June to 2.60% by early August as US data evidenced a sharp slowdown in the economy. The NZD/USD exchange rate spiked up to 0.6450 at the time as the US dollar was sold off by the markets. The bond yields were forced back up to 3.34% last week by the Fed’s hawkish jawboning and the US dollar climbed to its fresh highs. The inflation release this week is likely to send bond yields tumbling lower again as the markets conclude that the Fed are again well behind the 8-ball in rapidly changing conditions in the US economy.

The oil price and the US dollar value: A broken paradigm?

It has been a historical paradigm that the USD currency value has a reliable inverse price relationship with crude oil prices. In the past, when oil prices increased the USD value decreased (and vice-versa) – thus an inverse price correlation. There have been several explanations as to why the two respective prices have moved in opposite directions. Two plausible reasons being: -

- They act as an automatic shock-absorber/self-adjustment to keep energy prices stable in non-USD economies i.e. the Europeans and Japanese cannot afford the higher USD oil prices, therefore the currency markets adjust their currencies stronger against the USD to compensate.

- The oil producers in the gulf states (Saudi, Kuwait and the UAE) are big sellers of USD’s when oil prices are higher, and they buy other currencies. Remember the recycling of petro-dollars in the 1970’s and 1980’s with the Arabs buying half of the properties in London’s central CBD.

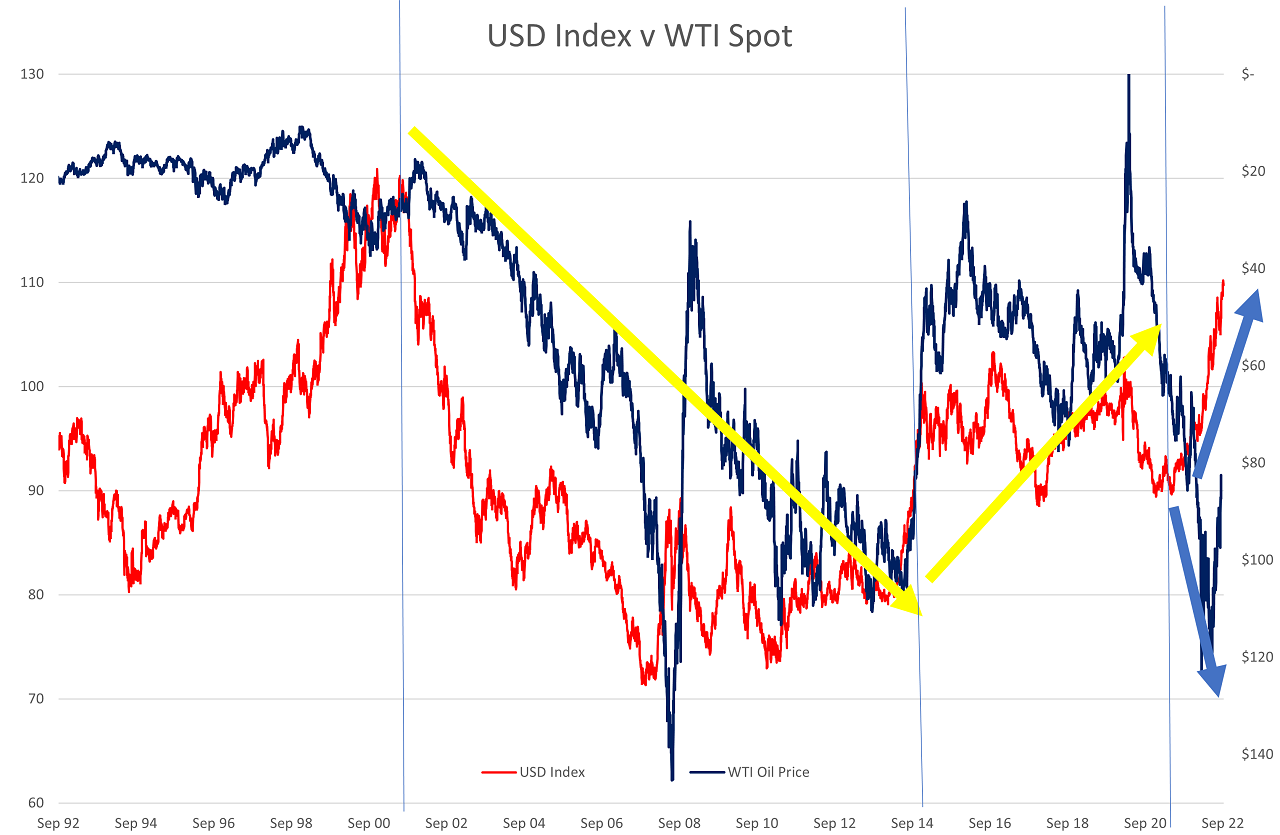

The charts below of the USD Index value (left hand axis) against the oil price (inverted on the right hand axis) confirms two multi-year periods over the last 22 years where the inverse price paradigm held firm: -

- 2000 to 2014: Higher oil prices $20 to $100, weaker USD 120 to 80

- 2014 to 2020: Lower oil prices $100 to $50, stronger USD 80 to 100 (the USD weakened back to 90 when Fed did QE and printed money following the Covid-shock in 2020).

However, the world has changed dramatically over the last two years and the unique events have seemingly broken the USD/oil inverse price paradigm. The oil price moved higher to US$120, and the US dollar value also moved higher to 110 on its currency index (refer to the blue arrows on the chart). The explanation for the breaking down of the inverse correlation being: -

- High US inflation (thus higher US interest rates and higher USD) due to the over-stimulation of the US economy from 0% interest rates and Fed money printing during Covid.

- The Russian/Ukraine war in February sent oil prices sharply higher as global supply was disrupted and risk aversion in the financial markets strengthened the USD against the Euro. The Euro weakening due to the close proximity of the war and the European energy crisis that has followed.

Oil prices over recent weeks have decreased sharply as the markets price-in likely weaker global demand on slower economic growth. In particular, the massive increase in oil prices in Euro and Yen terms will certainly reduce demand volumes. As oil prices decrease, US inflation will reverse back down, and the Fed will eventually stop hiking US interest rates. At that point the US dollar value is expected to weaken from its historically high level.

It is uncertain whether the world order will return to the previous paradigm of the inverse price relationship. A more likely scenario is a return to a middle-ground of oil around US$75/barrel and the USD Index returning to 90 to 95 (equivalent to a > 0.7000 NZD/USD exchange rate).

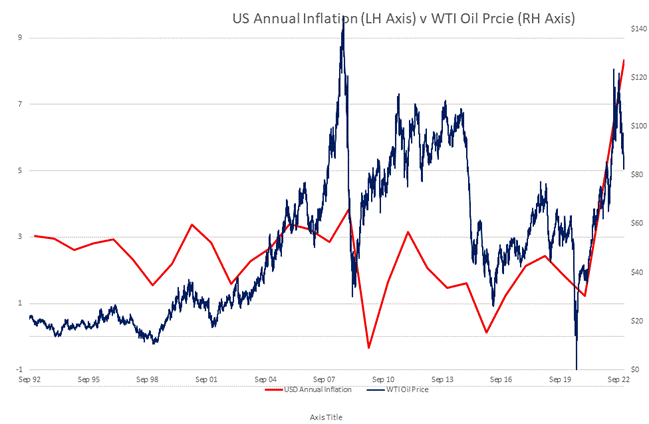

The second chart plots the oil price against US inflation. If the oil price stabilises around US$75 to US$80/barrel over coming months, the US annual inflation rate will rapidly return to the 4.00% to 5.00% area.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

2 Comments

Thanks for the perspective. Re USD/JPY, which is where the drama is really occuring, I think the issue is exacerbated because of the BOJ's recent behavior but the whole approach to yield curve control.

Thanks for the excellent article. Much appreciated. You always write such interesting articles.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.