Summary of key points: -

- Economic/market response enters third stage of the Trump regime

- RBNZ selling Kiwi dollars on the low!

- Australian Labor Party landslide election victory – implications for the AUD

Economic/market response enters third stage of the Trump regime

It seems the financial/investment markets and the US economy have both now arrived at a critical juncture in timing in respect to the juggernaut that is President Donald Trump.

As we have observed many times over history, populist politicians promising the earth to get elected, invariably get found out when they discover it is impossible to deliver on the bribes offered up to the voters. Despite blaming others and stating that the American economy “will be OK”, Trump is staring down the barrel of the US economy sliding into recession this year. It has been his on again/off again tariff policies that have caused so much uncertainty that US households have curtailed spending and businesses have halted investments. Trump has imparted enormous damage on the US economy, which is now being confirmed as the weaker economic data come through to the markets.

The economic rubber is now hitting the road, and the game is up for Donald Trump.

Since Trump we elected in early November, we have seen three distinct and separate phases in terms of the market’s responses, and the response from the wider US economy to the policy changes being implemented: -

Stage 1: October to January - Trump trade euphoria. The equity markets rallied, and the US dollar appreciated as investors anticipated that Trump’s policies of lower taxes and reduced regulation would be positive for the US economy, the same as eight years prior when Trump was first elected President. No policy details had been announced; the buying was largely based on hot air.

Stage 2: February to April – Collateral damage of tariff policies reverses market sentiment. Equity markets are sold, and the US dollar’s value plunges as foreign investors pull their capital out of the US following Trump’s announcement of much larger tariffs than anyone imagined. The Americans always seem to want to blast away and accept that there will be some collateral damage. Except on this occasion, Trump has shot himself in the foot by failing to understand the dramatic changes and advancement in global trade and manufacturing over the last 40 years. US consumer and business confidence levels have plummeted, and it is difficult to see what will change over coming months to prevent the US economy falling into recession (two successive quarters of negative GDP growth).

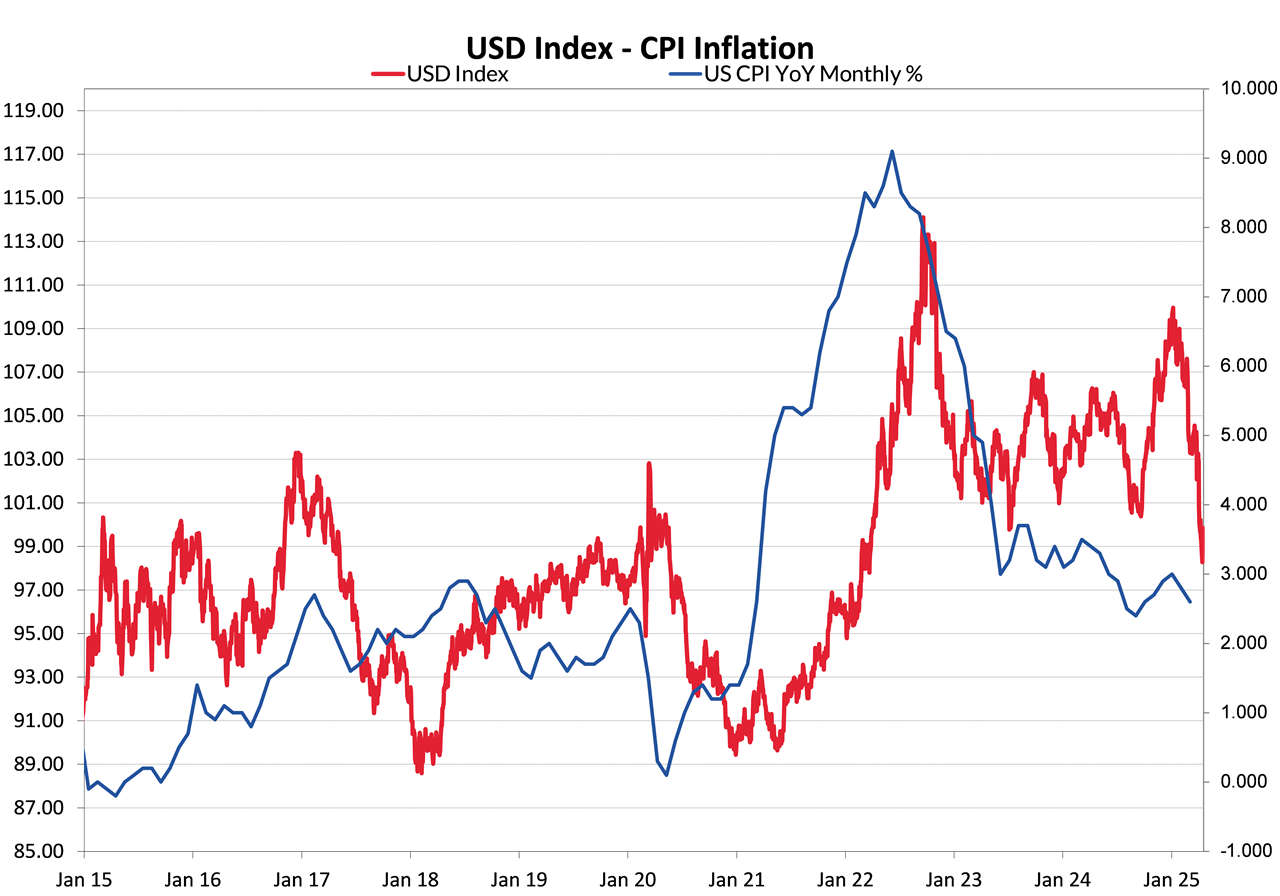

Stage 3: May to July – Economic consequences from tariff policy uncertainty. How the equity and currency markets will react to this third stage of the Trump regime will be played out over coming months. The US economy contracted by 0.30% on an annualised basis over the first quarter of 2025, despite retail sales being stronger as consumers purchased items in advance of anticipated price hikes from import tariffs. That increased retail spending will not be recurring. Some media reports claimed that the April Non-Farm Payrolls jobs increase of 177,000 (released on Friday night) was proof that the economy and labour market were still robust. The 177,000 increase was above prior forecasts of 140,000, however the previous 228,000 increase in March was yet again revised lower to 185,000. The pattern of subsequent revision to lower job increases than first announced has been occurring for a while now. Expect the same for the April number in a months’ time. Transportation and warehousing jobs increased in April as importers/retailers increased inventory levels before prices are forced up by tariffs. Many other economic and employment forward indicators point to continuing soft jobs numbers over coming months. Outside of tariffs, US inflation in trending downwards, as we anticipated, to the Fed target of 2.00% per annum. The delayed/lagged decreases in the shelter/rents component is now coming through in full force and pulling the inflation rate lower. If it was not for all the inflation uncertainty caused by Trump’s tariffs, the Fed would be cutting interest rates at this time.

How the Federal Reserve and the Trump Government respond to the weaker economic data now coming through will determine the equity and currency market direction over coming months.

Trump is already walking back on several tariff positions and as the evidence accumulates of further deterioration in the US economy, he will be forced to relent further. The whole tariff episode seems pointless, however Trump and his henchmen never understood how manufacturing and trade was so globally integrated. Trump may have achieved one worthy objective (from New Zealand’s free-trade perspective) of forcing many countries to reduce their import tariffs and non-tariff barriers of market entry. However, his other major objective of re-shoring manufacturing from Asia back to the US seems a pipe dream and is not likely to happen.

The Federal Reserve meet this Wednesday (Thursday morning NZT) and their message to the markets is that they still have to wait and see the consequences of tariffs on inflation and the economy before they can adjust monetary policy. The interest rate markets have moved to a June timing for the next cut to the 4.50% Fed Funds interest rate. The Fed are in a right pickle here, as they cannot really anticipate what Trump will do next. If they continue to adjust interest rates on only looking backwards at historical data, the evidence is mounting that they will need to cut by 0.25% in June and implement three further 0.25% reductions over the rest of the year. Trump’s Treasury Secretary, Scott Bessent pointed to the two-year Treasury Bond interest rate declining to 3.60% last week as evidence that the Fed should be cutting immediately. Only problem with that claim was that the two-year bond yield jumped back up to 3.82% over the subsequent two days!

The bond and FX markets will rapidly reflect an expectation of lower interest rates from the Fed over coming months as the US economic data prints on the softer side. For this reason, we expect another leg lower in the USD Dixy Index from the current 99.84 to somewhere neat to 95.00. US inflation averaging 2.00% from 2015 to 2020 maintained the US dollar value above and below 95.00. Global fund managers have only just started to reduce investment portfolio weights to the US markets; there is still a lot more US dollar selling to come as they work through the changes.

RBNZ selling Kiwi dollars on the low!

For all the criticism of the RBNZ on their handling of monetary policy over the Covid and subsequent years, there are two issues that stand out to us as being ill-considered and poorly managed. One can debate whether monetary policy was loosened far too much in 2020/2021 and that caused all the inflation and recession problems after wards, however they were judgement calls at an extraordinary difficult time and therefore it is unfair to criticise those decisions.

The first issue that the RBNZ mishandled was the Funding for Lending Programme, which provided cheap money to the banks from December 2020 to December 2022. There were no controls or strings attached to the funding, and it went on for far too long, contributing to the boom/bust in the residential property market. It seemed that the RBNZ’s own internal bureaucracy prevented them from terminating the Funding for Lending Programme much earlier. It did a lot of damage to the NZ economy.

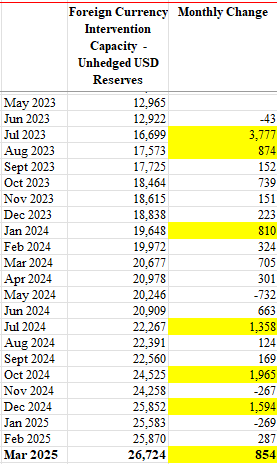

The second issue arose on 2023 when the RBNZ announced that they were increasing the amount of unhedged reserves held in US dollars to be utilised for currency market intervention purposes if ever the need came about. The “Foreign Currency Intervention Capacity” amount held in USD’s stood at NZD13 billion in June 2023. The table below confirms the build-up in the USD reserves over the last 21 months to NZD26 billion today. The RBNZ has deliberately not disclosed what USD reserve amount they are ultimately aiming to hold or the timing in achieving that. What has become apparent, as the table confirms, is the totally random and erratic approach to buying the USD’s and selling the NZD over the last 21 months to progressively increase the reserves.

Any corporate, fund manager or government agency with a NZD13 billion FX exposure over a two- year time period would adopt a prudent and considered strategy to spread and smooth the FX risk evenly over the time to achieve a weighted-average conversion rate close to the market average. In other words, sell NZD540 million each and every month so as not to disrupt the FX market and not to push down the NZD/USD exchange rate against themselves. Not the RBNZ. They started off by selling NZD3.8 billion in one hit over a concentrated two-week period in July 2023. Subsequent NZD selling transactions have been ad-hoc and lumpy as highlighted in yellow below.

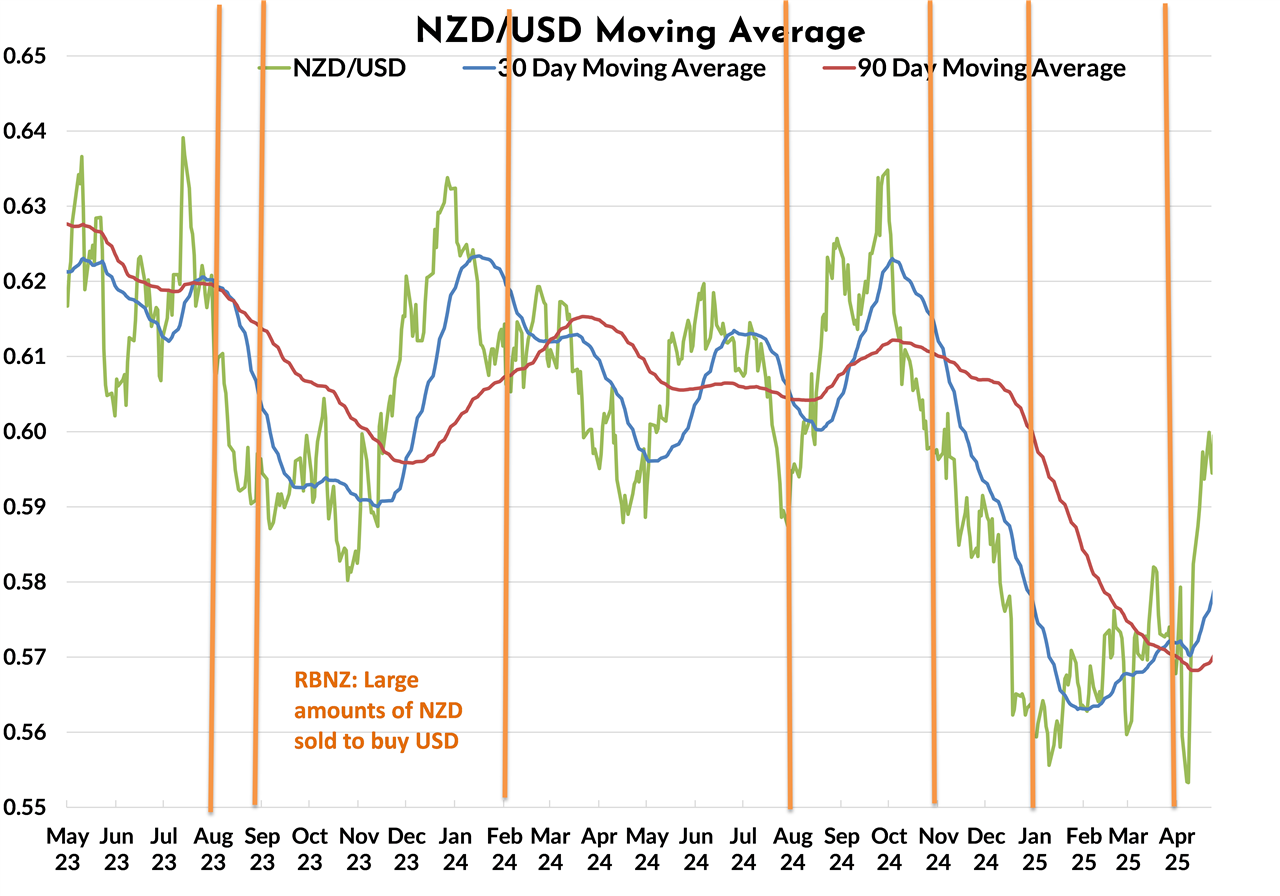

It appears that the RBNZ have achieved a weighted-average conversion rate over the 21-month period of around 0.5980. The chart below depicts the timing of the seven largest USD buying/NZD selling transactions.

Most local USD importers, buying USD’s on the regular spikes higher to 0.6200 and 0.6300 over the same period would have achieved conversion rates well above the RBNZ’s 0.5980. Other liquidity or funding constraints may be behind the RBNZ’s erratic USD buying pattern, however, form a FX risk management perspective it does not appear to be well managed. Not only are the RBNZ reporting large marked-to-market revaluation losses on their NZ Government bond holdings on their balance sheet, but they may also soon be reporting similar FX revaluation losses on their unhedged USD reserves.

Australian Labor Party landslide election victory – implications for the AUD

The stunning re-election win yesterday by Anthony Albanese’s Labor Government is not only a public vote for the status-quo, however a message that there is now a swing against politicians with Trump-like policies (Peter Dutton of the Coalition). Mr Dutton campaigned on populist Trump themes of anti-immigration, distrust of China and a nuclear energy push. Albanese campaigned on the cost-of-living issue of healthcare and housing. There is no question that the RBA’s cut to interest rates in February helped the Labor Government’s cause.

The implications of the election for the future direction of the Australian dollar is by no means clear-cut. Had there been a change to a more business-friendly Coalition regime the impetus for the AUD may have been more positive. However, Mr Dutton’s woeful election campaign put paid to that. The emphatic victory and increased majority for the incumbent Government is a vote of confidence from the public, therefore it is certainly not a negative for the AUD. The US dollar side of the AUD/USD currency pair is still expected to dominate near-term movements. Any progress on trade talks between the US and China to reach a tariff compromise is still expected to be more positive for the Australian dollar than any other country, as the Chinese economic outlook is enhanced which is always good for the AUD.

The AUD/USD exchange rate was already appreciating at a more rapid rate against the USD than other currencies in the lead up to Saturday’s general election. Recent Aussie dollar gains to 0.6450 against the USD have outpaced NZD/USD movements, sending the NZD/AUD cross-rate sharply lower from above 0.9350 to below 0.9230.

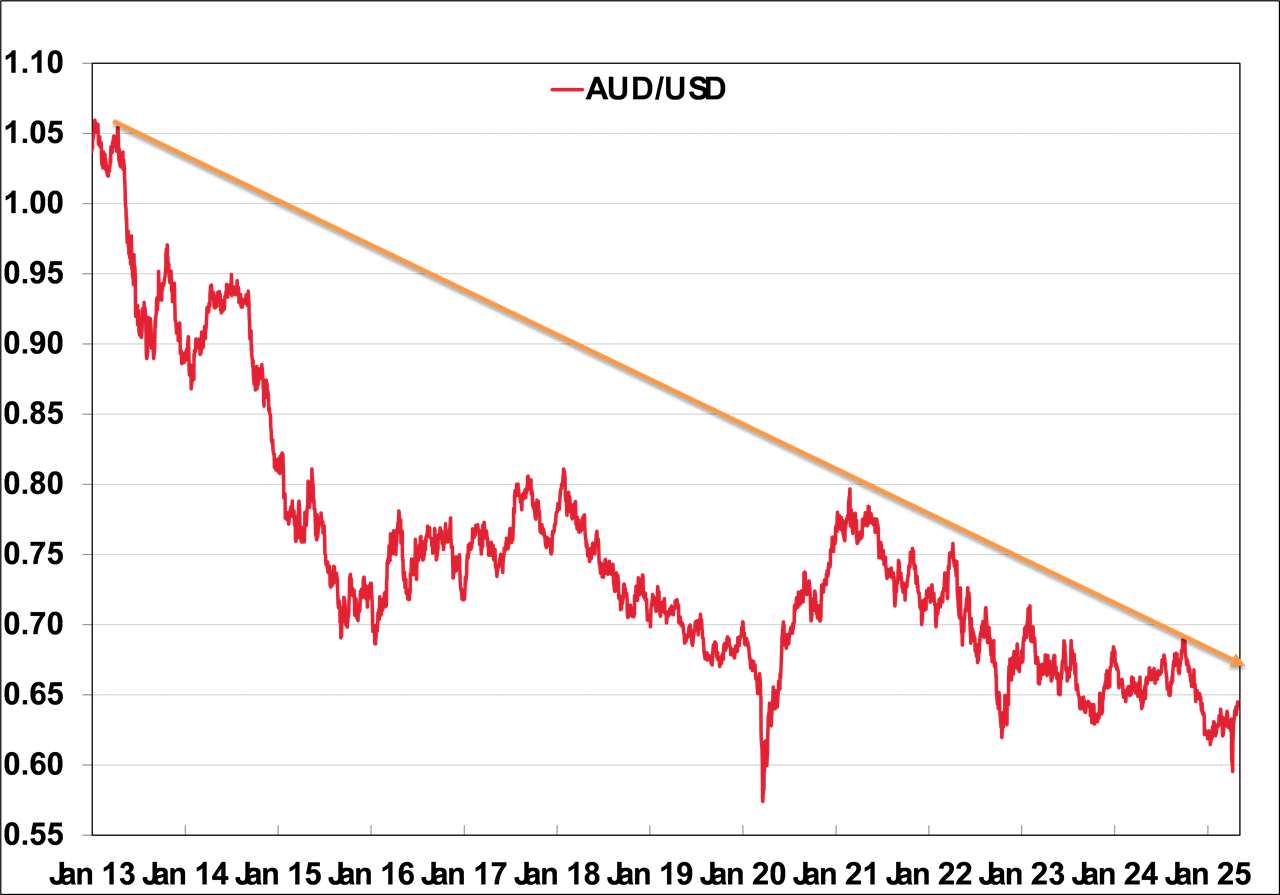

The AUD/USD exchange rate has remained below its downtrend line (refer chart below) for a very long time now. A movement higher to above 0.6750 would break out of that downtrend and suggest further gains over coming months for the AUD. Global fund managers in re-weighting investment portfolios away from the USD have preferred the Euro and Japanese Yen to date. It is only a matter of time before they see the undervalued position of the Australian dollar and increase their Australian market investment asset allocations.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

5 Comments

Stage Two : February to April, reveals that President Trump’s view of the status of world trade, and the world itself, was as if through a pair of binoculars, but held back to front.Therein is an explanation that his intentions and resultant policies are little more than to revert the USA to an era in which he was personally comfortable and successful, but is long gone. and for good.

Isn't this pretty much every Politician to some degree. Look at the promises Key made about making affordable housing, and the complete opposite happened. Same with prior Labour lead Govt.

"It seemed that the RBNZ’s own internal bureaucracy prevented them from terminating the Funding for Lending Programme much earlier. It did a lot of damage to the NZ economy."

Anybody got any more colour on this? How did "internal bureaucracy" delay terminating sooner this very damaging programme?

There's some background, largely from the RBNZ, on the FLP here; https://www.interest.co.nz/banking/116925/rbnzs-funding-lending-program…

If i recall correctly the justification at the time was " certainty"....the RBNZ had given a timeframe and to revoke it would lead to 'market uncertainty'....make of that what you will

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.