Summary of key points: -

- Currency markets pause USD selling – however there is more to come!

- On the verge of a new US dollar cycle

- NZ employment data defies the negative forecasts

Currency markets pause USD selling – however there is more to come!

The movement in the US dollar against the major currencies has gone into something of a holding pattern over recent weeks as the currency markets await fresh developments on the US’s trade war with the rest of the world and also a clearer direction and messaging from the Federal Reserve as to when their next change will be with interest rates.

It has to be expected that the US dollar will have a period of consolidation following the rapid collapse from 110.00 on the Dixy Index in January to lows of 98.00 last month. The USD Index has returned to 100.00 as the EUR/USD rate has corrected back from highs of $1.1550 to the $1.1200/$1.1300 area. The pause in US dollar selling is also related to a view that perhaps the worst is behind us in terms of the impact of Trump’s tariff attack on the US and global economy. If progress is made by de-escalating the negative impact of tariffs on the US economy by negotiated trade deals and lower tariff levels finally agreed, the reasons for selling the US dollar over the last three months would be reduced.

As a consequence of the USD recovery and stabilisation, the NZD/USD exchange rate has not been able to push through higher above the 0.6000 barrier and has remained in its tight trading range between 0.5900 and 0.6000.

The Americans and Chinese have agreed to meet in Geneva this weekend to discuss tariffs and trade. A long history of mistrust and bickering in the US/China trade relationship will not be resolved in this one initial meeting. The financial markets would be expecting far too much if they think that a deal to reduce tariffs to workable levels on both sides would be a result of this first meeting. As a BBC report concludes “Geneva will only produce anodyne statements about “frank dialogues” and the desire to keep talking”. These trade discussions are likely to go on for months as the Chinese will be slow to give any inch. They did not start the trade war, and they are in a position to replace the lost manufacturing export sales with stimulated domestic spending. On the other side, Donald Trump will be forced to concede more and more as the negotiations make slow progress, and he observes his own US economic data softening in front of his eyes. He does not want to be seen as responsible for creating a recession in the US economy and he needs to restore business confidence by ending the trade war and cutting taxes and regulations. The trick will be how the Trump regime packages a tariff backdown as some economic win.

Against the backdrop of more settled FX markets over recent weeks, there are still three good reasons why the US dollar is still at risk to a further leg downwards from current levels: -

- Asian exporters selling out of USD cash surpluses: Asian exporting companies have hoarded massive US dollar cash reserves over the last decade as US “economic exceptionalism” has resulted in a long-term appreciation of the USD against their own Asian currencies. An outsized jump in the Taiwan Dollar last week may be a sign of things to come and potentially trigger further USD selling from these cash reserves. It has been reported that up to USD2.5 trillion is currently held in USD’s by Asian exporters and institutional investors. The buying of the Taiwan Dollar was seen as the FX markets front-running a possible concession by Taiwan to revalue their currency as part of a trade deal with the US. China, Taiwan, Malaysia, Thailand and Vietnam all run trade surpluses with the US and to date those surpluses have been held in USD. As one FX market commentator noted” there is an important imbalance in the world that puts the US dollar in a vulnerable position”. The Asian holders of USD cash reserves have a big incentive to sell before the USD depreciates any further.

- Global fund manager’s reducing USD portfolio weights: Arguably, we have so far only witnessed the start of fund managers around the global reallocating investment asset classes to lower USD weightings. The rebalancing of their investment portfolios and revisiting currency allocations is a process that takes time to obtain approval and implement. Fund managers have been over-weight USD asset classes over the last five years as the US economy and currency have consistently outperforming other markets. The prospect of the US’s spectacular productivity gains driving economic growth coming to an end, is a good reason to re-balance away from the USD. Australia’s Future Fund Chief Executive, Raphael Arndt has warned that “the Trump administration’s protectionist policies threaten the US dollar’s status as the dominant global currency and could force investors to reduce their holdings”. As a sovereign wealth fund, the Future Fund at USD240 billion in assets is ranked 17th largest in the world behind Norway, China, Arab nations, Singapore and Turkey. Should the larger sovereign wealth funds heed Mr Arndt’s warning, and act accordingly, the US dollar is at risk to a longer-term depreciation.

- The Federal Reserve’s next big decision: President Donald Trump may well prove to be correct when he roundly criticises Fed Chair, Jerome Powell for being “too late” in cutting interest rates. Chair Powell at the Fed meeting last week was adamant that he has the luxury of time to wait and see how the economic data emerges over coming months before making a decision to adjust interest rates downwards again. The uncertainty and risk around rising inflation and softening employment had escalated in the Fed’s view; however, they are reluctant to cut rates when they do not know how far the tariffs will push up inflation. The second question is whether the tariff-induced inflation increase will just be temporary or more permanent as it causes “second-round” effects to other price increases. Doing nothing is the least risk position for the Fed right now. The danger in not reducing interest rates soon enough when the economy is sliding into recession is that the recession is more severe as a result of the delay. The Fed also seem reluctant to recognise the forward-looking “soft” economic data such as deteriorating consumer and business confidence surveys. The danger in only looking backwards at the “hard” economic data such as employment (as the Fed are currently doing) is that the changes are always lagged in time and are absolutely no reliable indicator of the future economic conditions. One piece of economic data the Fed should be taking note of is the real signs of cracks in the strong advertising growth on social media platforms. Chinese online retail giants such as Temu and Shein are already rolling back their advertising spend big-time as a result of Trump’s tariffs. US retail sales were artificially strong over the first three months of the year as households purchased items in advance of price increases from tariffs. The second quarter will see the opposite impact. The Fed need to trust the soft forward-looking data and act sooner rather than later with interest rate cuts. When they realise the risk is greater with rising unemployment than permanent inflation, they should have sufficient evidence to cut interest rates at their 18th June meeting. Such a shift in the Fed’s stance would be negative for the US dollar.

All three of the above-described forces on the US dollar working in tandem at the same point in time, certainly increases the probability of another leg lower in the USD Dixy Index to 95.00 over coming weeks/months.

On the verge of a new US dollar cycle

Standing back from the daily market noise of Trump social media posts and financial market reactions to said posts, an examination of the much longer-term up and down cycles of the US dollar value is appropriate given the heightened discussion around the world today as to whether the US dollar dominance is reducing.

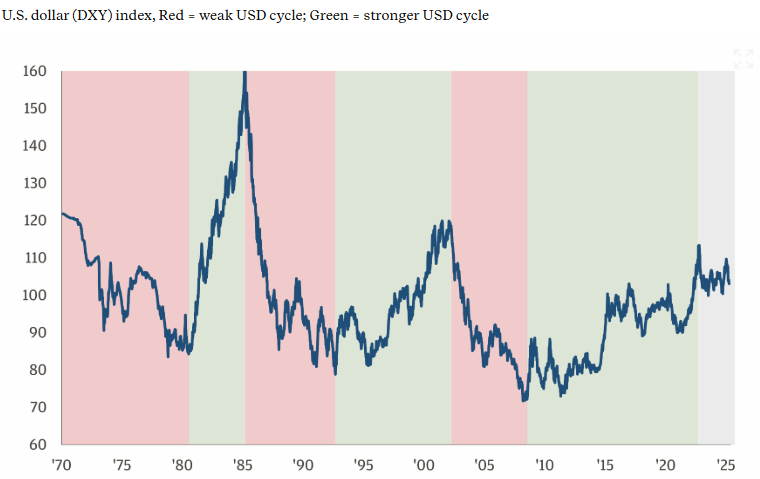

The chart below plots the US dollar’s fortunes since the 1970’s.

Over the last 55 years since 1970, the US dollar has posted three major up-cycles (green shading in the chart, being 1980-85, 1992-2000 and 2010-2024) and three major down-cycles (pink shading in the chart, being 1970-1980, 1985-1992 and 2000-2010). Previous cyclical lows for USD in the 80.0 to 90.0 region were in 1978-1980, 1991-1995 and 2009-2012.

That is the USD history, what does it tell us about the future?

The stronger USD cycle from 2010 to 2025 has been much longer in duration than the other cycles because of US economic exceptionalism due to superior productivity gains from technological innovation. The new Trump regime’s policies to put up a protective wall around the US economy and to stop being a policeman to global conflicts, suggests that the period of US exceptionalism is coming to an end, and therefore the USD cyclical gains are also coming to an end.

To make US manufacturing competitive again (as Trump pines for), it is clear that simple product costing and pricing requires a lower US dollar value. Given the massive capital exodus from the US over recent months for the reasons cited in the section above, the next cyclical downturn in USD may transform into a more structural weakening.

NZ employment data defies the negative forecasts

Consensus forecasts beforehand were for the New Zealand unemployment rate to increase from 5.10% in the December 2024 quarter to 5.30% in the March 2025 quarter. The result was an unchanged unemployment rate at 5.10%. Unfortunately, the actual more positive condition of our labour market in early 2025 did not fit the ongoing negative narrative from the mainstream bank economists. Analysing historical January to March employment data is akin to looking backwards more than six months for some evidence of how the economy will track in the future. It is a hopeless forward indicator and lags the real economic changes. As any business firm will tell you, their workforce adjustments take months to implement from the time the decision is made. Advocates for the RBNZ to cut the OCR by another 1.00% to 2.50% must be convinced that the NZ economy will not grow at all in 2025 and a recovery is a long way off.

The growing evidence from the export boom taking place in regional New Zealand would point to an entirely different GDP growth trajectory for the NZ economy this year. The public sector right-sizing in Wellington and Auckland construction firms reducing worker’s hours is certainly negatively impacting the retail and residential property sectors in our two big cities. However, economic conditions in the provinces have certainly turned up sharply. Record high dairy, beef and lamb prices (despite tariff uncertainties) are driving increased spending and investment. Any nationwide business in New Zealand today will tell you that sales in Auckland and Wellington are down on budget, but the rest of the country is well ahead of budget. Higher export prices stimulate increased investment and production, which in turn require more labour. Outside of Auckland and Wellington, employment is growing, and it is only a matter of time before in transfers through into the property-dominated Auckland economy.

The implications for the NZD/USD exchange rate from the local economic data being stronger than forecast over coming months, is that the interest rate markets will in response, reprice the current decreases to 2.50% back to above 3.00%. That change in forward interest rate pricing will be a positive factor for the Kiwi dollar in its own right. The only impediment to that outlook is that the RBNZ Monetary Policy Statement on 28th May will bias to too much of a focus on the domestic retail and property sector challenges. What we do not need is the RBNZ becoming as obsessed with house prices as much as the local media and banks are totally obsessed.

Correction and Apology: In last week’s report (published on May 5, 2025) under the sub-heading “RBNZ selling Kiwi dollars on the low” we erroneously assumed that the column in the table headed “Foreign Currency Intervention Capacity", $26.7 billion, was the total of unhedged USD’s held as reserves by the RBNZ. The correct amount for unhedged foreign reserves is recorded and disclosed in another column in the same RBNZ table headed "Net open foreign currency position” totalling $8.4 billion as of 31 March 2025. The RBNZ did buy foreign currency, sell NZD4.0 billion in a concentrated period in July 2023 to increase the “Net open foreign currency position” from $3.4 billion to $7.4 billion. We apologise for the misleading and incorrect information in our report that the RBNZ had “a totally random and erratic approach to buying the USD’s and selling the NZD over the last 21 months to progressively increase the reserves”. The Net open foreign currency position has only increased by $1.0 billion over the last 21 months.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

1 Comments

The stronger USD cycle from 2010 to 2025 has been much longer in duration than the other cycles because of US economic exceptionalism due to superior productivity gains from technological innovation

Interesting take, however I'd consider the impact of the GFC bailouts in 2008, and continued increases in deficit spending, to flow through to confidence in the USD more so than the technological impact.

The USD holds it's value based on confidence in it's economy and reliance for trade, of which we are seeing divergence from China, Russia, India.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.