Summary of key points: -

- Timing/level of tariff deals will determine the Fed’s response, therefore USD direction

- Pricing of Aussie interest rate cuts appear too aggressive

- Stronger growth and higher inflation in New Zealand do not fit doomsayer’s narrative

Timing/level of tariff deals will determine the Fed’s response, therefore USD direction

The “pause” by the US Federal Reserve on their interest rate cutting cycle has been going for six months now and they seem no closer to reaching a conclusive consensus or decision on how much inflation will increase and employment decrease due to Trump’s tariffs. Their hesitation and confusion is somewhat understandable as actual levels of tariffs, and the timing of commencement are still not known with any certainty. On the other hand, the Fed must be increasingly concerned at the continuing weak US economic data coming through each week. Their prolonged indecision could be doing considerable damage to the US economy as monetary policy is maintained at an overly restrictive level for too long when the economy is clearly softening.

Perhaps what the Fed should be doing is providing three alternative scenarios to the markets, with likely monetary policy responses by them to each scenario, as the RBNZ now do. Three plausible scenarios of developments over coming months are as follows: -

- Tariffs are agreed with China and Europe at the lower end of the range in July/August and it becomes clear that all participants along the supply chain share a proportion of the tariff impost. The US economic data, particularly employment, continues to weaken. Fed response: Increase in inflation is muted and temporary, therefore they recommence cutting interest rates in September. Our probability rating for this scenario = 40%

- Tariffs are not agreed in July/August and Trump once again postpones the deadline date for another three months The Fed remain in their current state of limbo as the tariff/inflation impact is still unknown. Fed interest rate cuts are delayed until December. Our probability rating for this scenario = 10%

- Early tariff agreements are forged with Europe, China and many other countries in early July at the lower end of the range. US economic/employment data deteriorates more rapidly than expected in June, resulting in the Fed cutting interest rates in July on the employment side of the mandate, not the inflation side. Our probability rating of this scenario = 50%.

Fed Governor Chris Waller (who stands in the middle part of the spectrum of Fed members with dovish to hawkish views) stated last Friday that he does not see tariffs boosting inflation significantly and his compatriots at the Fed should be looking to cut rates as early as next month’s FOMC meeting. He added “if you’re waiting to worry about downside risk to the labour market, move now, don’t wait”.

The key financial market indicator to monitor as an early warning sign as to what scenario is more likely to play out over coming weeks is the US two-year Treasury bond yield. The two-year yield is currently 3.90%, pricing in two x 0.25% cuts this year (the same as what the Fed are indicating). The two-year yield decreased to 3.50% in September 2024, indicating four to five x 0.25% cuts over the next year by the Fed at that time. It increased to 4.40% when Trump was elected last November, however fell away again to 3.60% in March this year. Since tariff “liberation day” in early April, the market yield has increased again to the 4.00% area. Significantly weaker US economic data over coming weeks under the third scenario above is likely to force a change in the two-year bond pricing from the current 3.90% towards 3.50%. The foreign exchange markets tend to price-in these likely future conditions earlier than the short-term treasury bond market. The USD Dixy Index falling away below 98.00 again, would foreshadow the two-year bond yield dropping to 3.50% and therefore, a much higher probability of the Fed cutting in July.

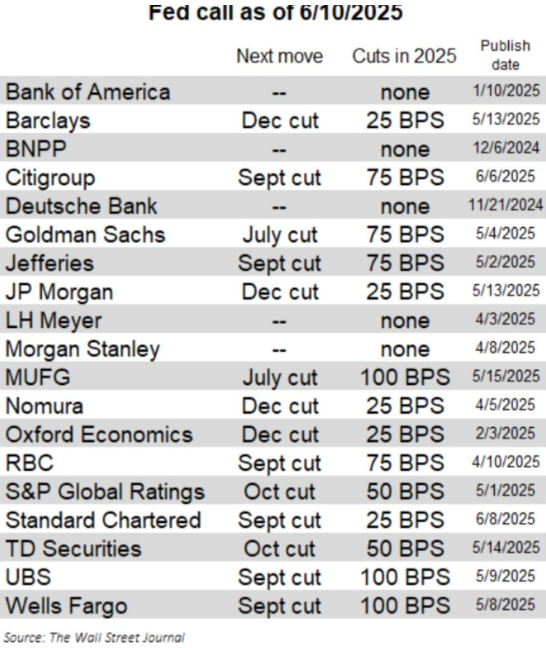

The changes to the “dot-plot” interest rate forecasts of individual Fed members confirmed wildly divergent views on inflation and interest rate changes. Seven of the 19 Fed members see interest rates remaining unchanged at 4.25%/4.50% this year. Two members forecast one cut, and the remaining 10 members expect two or three x 0.25% cuts this year. The Fed may be confused and divided as to short-term US economic outcomes and therefore the timing and extent of interest rate cuts in 2025; however, so are the guru economists on Wall Street. The table below confirms the extraordinary divergent range of views on how the Fed will act over the remainder of this year.

Despite the increase in the crude oil price from US$60/barrel to US$74/barrel (WTI) over the last week due the Israel/Iran war potentially pushing up US inflation again, the USD Index has hardly shifted away from its 98.00 pre-war level.

Hard US economic data released over this last week was weaker than forecast across the board: -

- New York Empire State Manufacturing Index June: Actual -16, Forecast -6.

- Retail Sales May: Actual -0.90%, Forecast -0.70%.

- Industrial Production May: Actual -0.20%, Forecast +0.10%

- NAHB Housing Index June: Actual 32, Forecast 37.

- Housing Starts May: Actual -9.80%, Forecast -0.80%.

- Philadelphia Fed Manufacturing Index June: Actual -4, Forecast +1.

The Michigan Consumer Confidence Index did bounce back up from 52.2 in May to 60.5 in June as households reduced their fears about higher inflation. The next piece of important US economic data is the PCE inflation result for May on Friday 27th June. Another low +0.10% result is expected.

The following week, the Non-Farm Payrolls jobs figures for June on 3rd July is highly likely to be a very soft outcome again, around the +100,000 region, with revisions downwards in the previous +139,000 May result.

Pricing of Aussie interest rate cuts appear too aggressive

Current market forward pricing for Reserve Bank of Australia (“RBA”) interest rate cuts over the next year is four x 0.25%, reducing the current 3.85% rate to 2.85%. That pricing appears to us to be too aggressive against resilient Aussie jobs and inflation numbers. Last week, the unemployment rate held steady, yet again, at 4.10% in May, even with a surprising fall in part-time jobs. The US Federal Reserve are clearly being patient with cutting rates and perhaps the RBA needs to be more cautious (as well), than what they signalled in their last dovish monetary policy statement. Last Thursday’s employment data was stronger than RBA forecasts. Economist forecasts are moving to a “hold” decision for the RBA at their next 8th July meeting. A pause from the RBA would certainly reduce the current four x 0.25% interest rate forward pricing. Such a change would, in turn, be positive for the AUD exchange rate against the USD and also against the NZD.

Important Australian economic releases over coming weeks to watch out for include: -

- Monthly CPI Inflation Indicator for May on Wednesday 25th June: a possible increase from the current annual rate of 2.40%.

- Retail Sales for May on 2nd July.

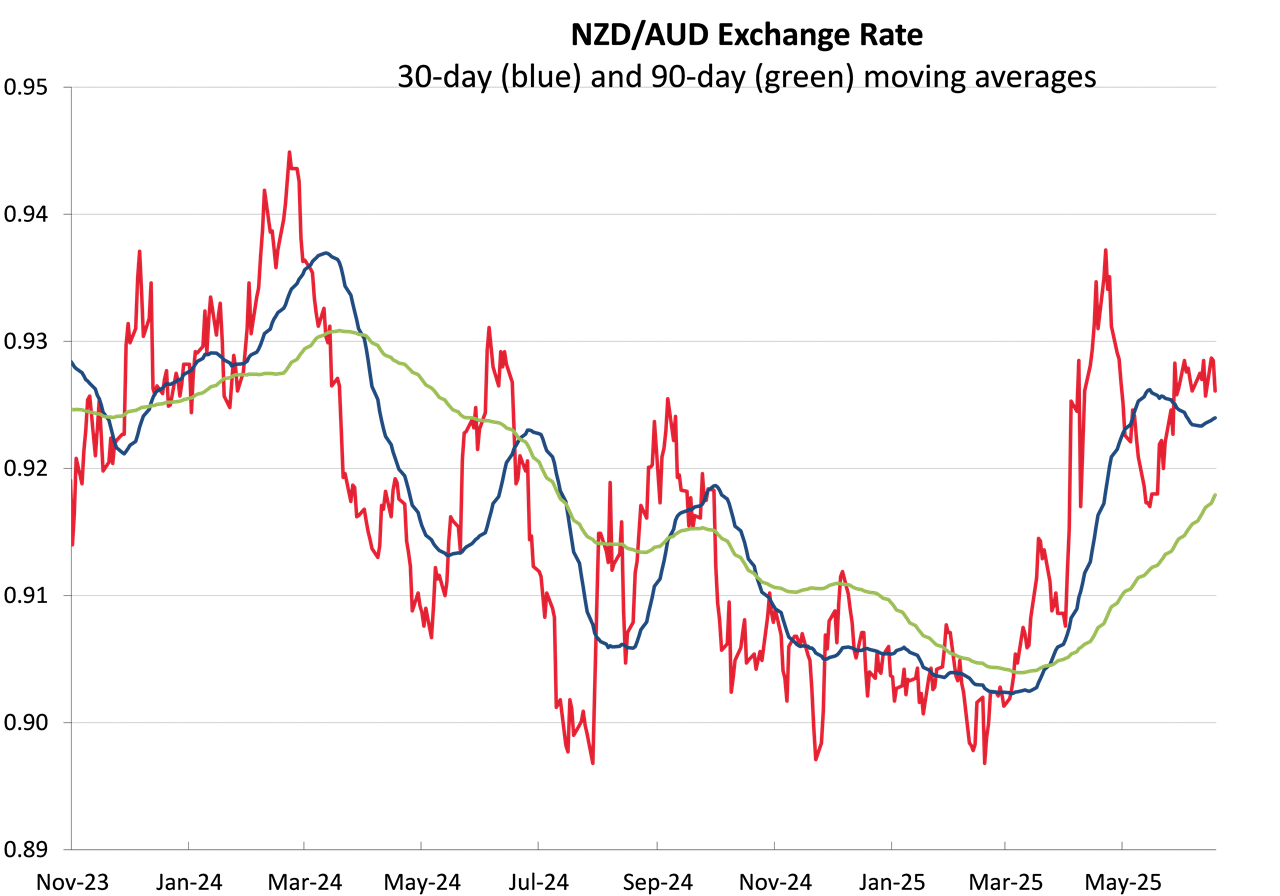

The Kiwi dollar has outperformed the Aussie dollar over recent month as the RBNZ near the end of the interest rate cutting cycle, and the RBA was more dovish than expected with potential four more x 0.25% cuts coming in Australia. As a result, the NZD/AUD has lifted from below 0.9100 to near 0.9300. Looking ahead, a more cautious RBA with a pause to cuts in July would send the NZD/AUD cross-rate back down again. The currency speculators who play the NZD/AUD cross-rate have made nice profits on the NZD gains from 0.9000 to 0.9300. A change to the Australian interest rate forward pricing to fewer cuts this year would entice the punters to take their profits by selling the NZD against the AUD.

Once again, local AUD exporters should remain patient and target lower NZD/AUD rates to below 0.9100 before recommencing forward hedging activity.

Stronger growth and higher inflation in New Zealand does not fit doomsayer’s narrative

Higher than generally expected GDP growth and food price inflation in New Zealand announced over the last week was not the “economy still has major problems” confirmation many of the economic doomsayers were hoping for. Yet again, the negative narrative on the economy coming from several bank economists calling for the RBNZ to cut the OCR to 2.50%, has proven to be wide of the mark when actual data is released. The export-led economic recovery is going very well under its own steam and clearly does not need any turbocharging of additional interest rate cuts from the RBNZ over and above the 2.25% (from 5.50% to 3.25%) already delivered since last August.

- GDP expanded 0.80% in the March quarter, above prior market forecast of +0.70% and considerably above the latest RBNZ forecast of +0.40%.

- Food price inflation accelerated to an annual +4.40% in May, up from +3.70% in April and well above forecasts. Meat, poultry, dairy, seafood and grocery products led the increases.

The recent negative economic commentary came from flat electronic retail card spending in May and a surprisingly large drop in the Manufacturing PMI survey in May to 47.5 from 53.3 in April. The Services PSI survey also fell away sharply from 48.5 to 44.0. Perhaps this latest pessimistic outlook was a delayed response to Trump’s tariffs and what it means for the global economy.

The PMI and PSI survey results may well prove in time to be “rouge outlier” results, as the reality is that NZ exporters are enjoying high prices and strong demand in their overseas markets currently. Any worries about tariffs hurting the Chinese economy and thus reducing demand for our export products is not well foundered either. The Chinese Government authorities will replace any drop in their manufactured exports (due to US tariffs) with higher domestic economic activity stimulated by fiscal and monetary policy. There is not much risk around this not happening.

Given these recent developments with the hard economic data being much more positive, whereas the soft (surveyed) data being more variable, the RBNZ is now expected to hold off from any further interest rate cuts at their 9th July meeting. Such a decision, if delivered, has to be positive for the Kiwi dollar in its own right as the rest of the world conclude that the RBNZ has finished with its easing cycle.

With our record high export commodity prices remaining up at their elevated levels over coming months and our annual GDP growth climbing dramatically from the current -0.70% level to somewhere nearer to +3.00% by 31 December 2025, our spectacular economic recovery will not go unnoticed around the world. It is not a scenario for the Kiwi dollar to be pulled down by inferior relative economic performance. Indeed, the opposite is highly likely, and coupled with continuing USD depreciation, our April forecast of the NZD/USD rate climbing from 0.6000 to 0.6500 by December appears to be on course.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.