The Reserve Bank (RBNZ) will probably "sit out" its July review of the Official Cash Rate - making no change and keeping a close eye on "which of the competing growth and inflation drivers will dominate over the balance of the year", Westpac chief economist Kelly Eckhold says.

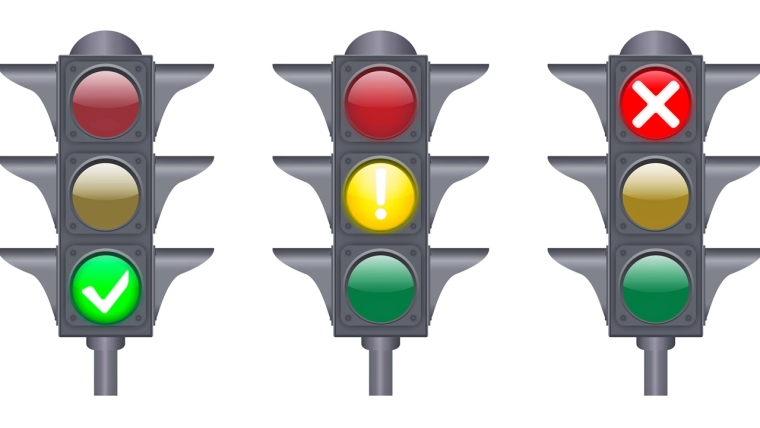

Recent economic news has thrown up conflicting signals. GDP for the March quarter grew by 0.8%, which was double the RBNZ's pick. But more recent high frequency economic data has suggested the apparent growth in the first quarter may have markedly slowed in the second quarter. Meanwhile inflation is sparking up again.

In Westpac's Weekly Economic Commentary Eckhold says we are in an environment of better, albeit still bumpy, growth and rising inflation that is testing the limits of the RBNZ’s 1-3% inflation target range.

"Economic indicators and news have been all over the place in recent weeks. We see elements of the data that look consistent with the baseline view that 2025 will be a year of gradual recovery. But at the same time there are many potentially severe crosscurrents that could mean the recovery is bumpy"

So, the Westpac economists think there will be no change to the OCR, currently at 3.25%, after the next review on July 9.

"We still have an easing pencilled in for the August Monetary Policy Statement [the next OCR review after July], but might it be that the RBNZ will be watching, worrying and waiting for the rest of 2025? Perhaps so," Eckhold said.

"There’s certainly plenty of scope for global uncertainties to overshadow the growth outlook in coming months. But we should also remember that uncertainty is a transitory factor that will ultimately pass. The strong level of the terms of trade and especially the low level of interest rates, held at current levels for long enough, will be more persistent influences on New Zealand’s growth and inflation trajectories."

In terms of the worsening Middle East situation, Eckhold said it will take time to assess the implications for the macroeconomic outlook.

"Worst case scenarios include some variation of a global supply shock if energy supplies are threatened. Oil prices would rise likely reducing New Zealand’s terms of trade," he said.

In such a scenario, short term, inflation would rise further, increasing the RBNZ’s discomfort with the inflation outlook and potentially increasing inflation expectations. Medium term, the weaker terms of trade and global growth would impact on domestic growth and inflation, he said.

"Better scenarios are ones where the conflict ends more quickly and, as in Top Gun’s Maverick, the key protagonists jet off into the sunset. More reasonably, there may just be a period of calm if the Iranian’s response is not deemed excessive.

"Our best guess for now is the RBNZ will be watching, worrying and waiting to see how this all plays out. Certainly, it’s difficult to take any proactive actions in the face of this sort of uncertainty," Eckhold said.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.