So here we go. First Official Cash Rate (OCR) decision of 2026. And fair to say the tone of the build-up going into this one is very different to that seen before the last OCR review of 2025.

The short version of what to expect from the decision on Wednesday, February 18, is that there'll be no change to the OCR, currently at 2.25%. But that's where any sense of certainty ends. It's not clear what the outlook expressed by the Reserve Bank (RBNZ) will be, and we will need to work out how to read the new Governor, Anna Breman, fronting her first major set piece event. This 'reading' of the Governor will entail trying to interpret whether she is naturally a 'hawk' or a 'dove' or whether she is bold and adventurous or conservative and cautious (though even at this early stage the money is definitely on the latter, you would have say).

So, to go back to the build up, and the anticipation and the different tone to this OCR review, well the huge change in tone is partly a product of the inordinately (too) long break from November to well into February and partly down to the big shift in emphasis hinted at by the RBNZ itself in the November decision.

What happened? It was all so long ago...

To refresh memories, because I suspect we need it, all the talk in the lead up to the last OCR review was on the likelihood of a further cut to follow on from what could be slightly flippantly described as the "come on you lot cheer up" 50 basis point cut made in October.

The October double-cut was clearly aimed at encouraging a reluctant New Zealand to get out and start spending again in order to restart a stuttering economic recovery.

After such a big cut, there was really no question of the RBNZ being able to bring the cutting to a halt in the following decision in November. That would have just looked bad and caused an adverse market reaction. So, the expectation was that the RBNZ, as well as cutting, would leave the door open for at least one further cut after that.

But in the event, while we duly got the expected 25 basis point cut in November, the accompanying commentary from the RBNZ suggested that there would be no further cuts. That was definitely not expected.

Well, that changed fast

This, therefore surprised the markets and prompted a big change in direction. If the markets can no longer speculate and bet on when the next cut will happen, the logical extension is that the bets start being placed on when the HIKING will start again.

So, with truly alarming speed really, everything changed. Wholesale interest rates started rising in anticipation of when the hikes might start.

And rising wholesale interest rates are not an event of merely entertainment value - they have real implications because it all means the banks' funding costs are rising and when those rise, well, they pass the cost on to us. And this duly happened, far faster than anybody could have anticipated, with mortgage rate rises starting in December, within two weeks of the last OCR decision - when all the hope in advance of course on the part of the public might have been for continued falls.

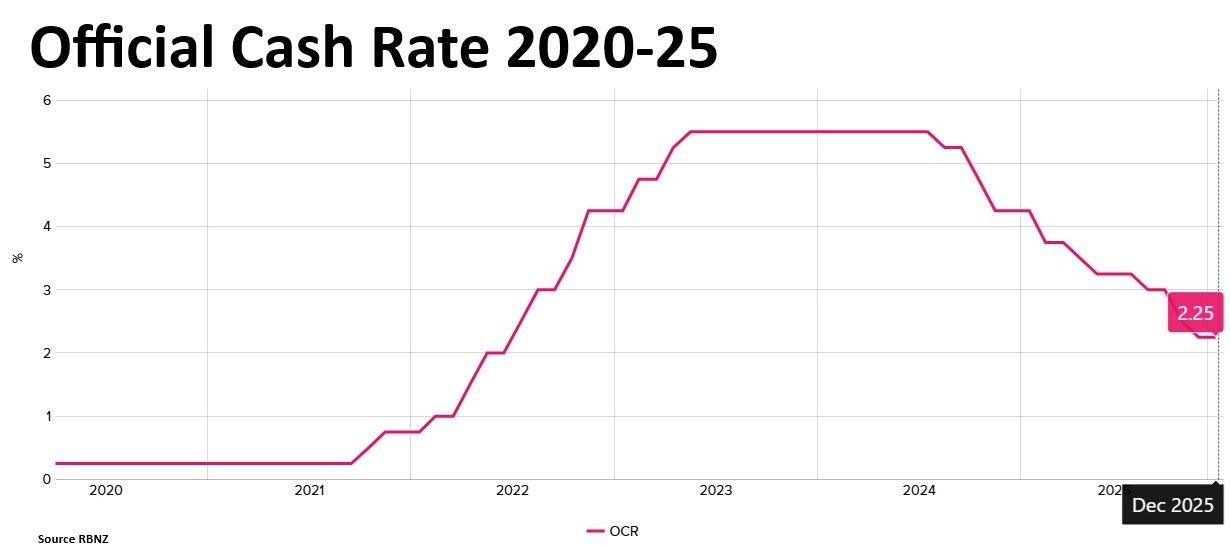

So, for now at least, we can be reasonably sure the OCR will be staying put at 2.25%. Below is the ride it has been on since early 2020.

Current financial market pricing is giving about a 75% chance of a 25 basis points rise to the OCR in September.

But what will the RBNZ say about that? Well, probably not much, directly. But as ever its OCR projections contained in the back of the new Monetary Policy Statement (MPS) will be intently studied.

In the last MPS issued in November, the RBNZ incorporated about a 20% chance of another cut to the OCR early this year. The first rise in the OCR was not projected to happen, probably, till the second quarter of NEXT year.

Well, as stated above, financial market pricing (at time of writing and these things do change quite quickly) currently has about a 75% chance of the first hike by September of THIS year.

So no future cuts - but rises?

It is to be expected that in its latest projections the RBNZ will take out the possibility of another future cut. But what about projections for rises? Well, this is where the central bank will be probably cagey. I mean, if the RBNZ suggested potentially a first rise in September, then the markets would fall over themselves to have this happening earlier and would start pricing in a first move, possibly as soon as May. This is just how the whole market pricing thing works.

So, the RBNZ won't want to 'set off' the markets and probably would be happy for the first rise - when it comes - to be as unanticipated as possible by the markets.

Which brings us to what the RBNZ's thinking might be. As ever, it will be taking its steers from what the economy is doing. So, what has the most recent economic data been suggesting?

Well, the long-awaited economic recovery is kicking in.

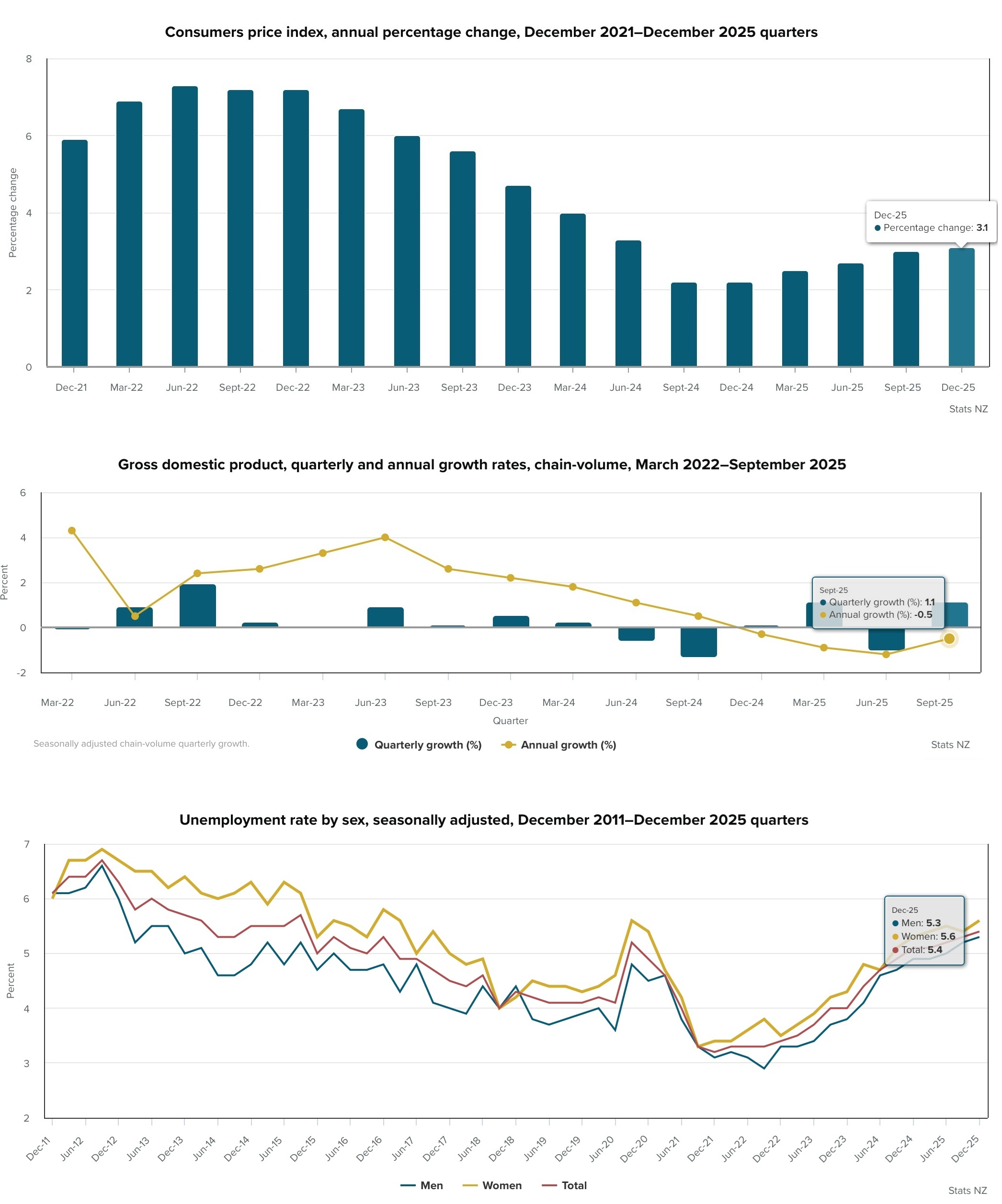

Since that last OCR review for 2025 on November 26 we've had releases of all of the three 'biggies' in terms of official economic information. The biggest of these, the Consumers Price Index (CPI) for the December quarter was released on January 23 and it showed annual inflation hitting 3.1% - so, outside of the RBNZ's 1%-3% target range and, crucially, well north of the RBNZ's own forecast of just 2.7%.

Likewise, the September quarter GDP figures, released on December 18, came in way hotter than the RBNZ's forecast of 0.4%, with a 1.1% surge (although to be fair to the RBNZ, virtually everybody thinks that 1.1% reading is overstated and will be revised down).

The labour market figures for the December quarter, released on February 4, were rather more in line with the RBNZ's forecasting, although the unemployment figure of 5.4% was slightly higher than the RBNZ's pick of 5.3%. But generally there was nothing in the labour market figures that would have unduly bothered the RBNZ.

The inflation figure will have bothered it though. A 3.1% rate versus the central bank's pick of 2.7% is a big miss. And while economists still think the inflation rate will ultimately behave and drop back into the target range, it is proving to be 'sticky', and 'sticky' inflation at elevated levels risks encouraging inflationary behaviour through the dreaded 'inflation expectations'.

Other 'high frequency' data since the November OCR review, such as the performance of services and performance of manufacturing indexes, has come in looking stronger as well.

The emerging picture now is one of an economy that is finding its feet and probably with (belatedly) greater speed than the RBNZ thought in November.

Wanted: Experienced juggler - apply here

It is to be expected therefore that the RBNZ will look to achieve a difficult balancing/juggling act of expressing caution on the inflation situation, while not committing itself to a start time for OCR rises. This could be a difficult balancing act indeed. Ideally the RBNZ will want to avoid further upward pressure on wholesale rates, which could lead to more mortgage rate rises - meaning we would be effectively getting a tightening of monetary conditions without the RBNZ moving the OCR at all.

However, the current elevated inflationary pressures mean the RBNZ simply can't come across as too sanguine.

Here's some good summary paragraphs on the situation from big bank economists, starting with BNZ head of research Stephen Toplis:

The economy’s evolution is such that the RBNZ can confidently remove the last vestiges of any prospective easing from its rate track. Indeed, it will want to strengthen the case for less stimulatory monetary policy while being mindful that it will not want financial markets to price any more tightening than is already the case. This is likely to result in an on-hold interest rate decision on the day and [and OCR] rate track that is only modestly more aggressive than in its November MPS.

And ANZ chief economist Sharon Zollner:

On the day, we suspect the RBNZ would be happy with no market reaction at all; market pricing looks rational. On balance, we don’t expect that the RBNZ’s OCR track will be as hawkish as current OIS [fixed rate swap market] pricing, but only a small lift in the track is required to suggest a hike this year is probable. That would probably be enough to broadly satisfy a market that is likely to expect the RBNZ to keep its options open.

And Westpac chief economist Kelly Eckhold:

We see the RBNZ revising up their June 2027 OCR forecast by 40-50bp [basis points] to around 2.85-3% from the 2.45% projected back in November. We don’t think the RBNZ will be trying to scare the horses into pushing for an earlier start to tightening than markets have already priced. Hence the RBNZ is more likely to opt for more dovish messaging than more hawkish messaging.

And ASB economist Wesley Tanuvasa:

With headline inflation outside of the target band, the RBNZ will be stern in its messaging, but the Bank can cite enough disinflationary risks to justify waiting for more data. The muted housing market recovery, gradual domestic consumption growth, tempered migration and lower wage inflation mean there is evidence that disinflationary pressure remains, just less so than in November. Taken collectively, the February 2026 MPS will read less hawkish than market pricing suggests, but it will be a tone shift from the more non-committal November 2025 MPS.

Trying to get a read on the new 'Gov'nor'

So, that's some idea of how big bank economists are thinking. Then beyond all this, there's the new Governor. As indicated higher up the article, we will need to get to 'read' Breman. The indications to this point are that she will be about as different to previous Governor Adrian Orr as is possible. Particularly in the early stages of his stint as Governor, Orr was more than happy to pull the rug out from under the financial markets, surprising them with an unexpected OCR move - never more so than the 'double cut' of August 2019, which completely blindsided the markets. Orr tended to call a spade a shovel, which was a departure from what we had seen with Governors past.

The expectation is that Breman will be far more conventional. However, the early indications are she won't be any less committed/'laser focused' than Orr was to managing inflation. Which means if the situation demands it, then yes we could well see the OCR hiked in September or even a bit earlier, despite the looming November 7 election. That would certainly be a most interesting development.

All in all then, there's lots to look out for in the February 18 decision. As I said at the top, the only thing that seems not in doubt is that the OCR will be left unchanged.

I'm expecting it to be a bit more like it used to be from the RBNZ, with plenty of nuanced, 'raised eyebrow' language aimed at subtly guiding the markets. It will then be up to the markets to correctly decode these messages. And that could be the trick. The markets do infer the wrong message from time to time. "Did you say the left eyebrow was raised when they said that? I thought it was the right one?" It looks as though the Governor is going to be busily out and about explaining this latest OCR decision beyond just what happens on the day itself, so, it seems as though she's not wanting to take chances that the markets will react 'wrongly' to whatever the decision and accompany messaging may be.

There'll be no shock and awe, but there will be plenty of juggling. Enjoy the show.

*This article was first published in our email for paying subscribers early on Friday morning. See here for more details and how to subscribe.

1 Comments

That would probably be enough to broadly satisfy a market that is likely to expect the RBNZ to keep its options open.

If the rates market expected the RB to keep its options open, it wouldn't have moved rates higher at the end of last year.

The challenge now for the RB is to spin a narrative that doesn't prompt the market to take another leg up.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.