The tide may well have turned against housing being a one-way bet for a generation of Kiwis, Reserve Bank (RBNZ) chief economist Paul Conway says.

In a speech titled Housing (Still) Matters – The Big Picture to the National Property Conference on Thursday, Conway said that "for several decades, we have traded houses among ourselves at ever-increasing prices in the belief that we were creating prosperity".

However, housing market dynamics in future are unlikely to be the same as in the past. "Given the importance of housing in our economy and national psyche, this will be a huge change."

Now, Conway said, we "need to keep building a new approach to housing and economic prosperity in Aotearoa-New Zealand".

He said that with strong demand and constrained supply, rapid house price growth over the past 20 years or more has meant that residential property, as an investment asset, has delivered strong financial returns for New Zealand house owners.

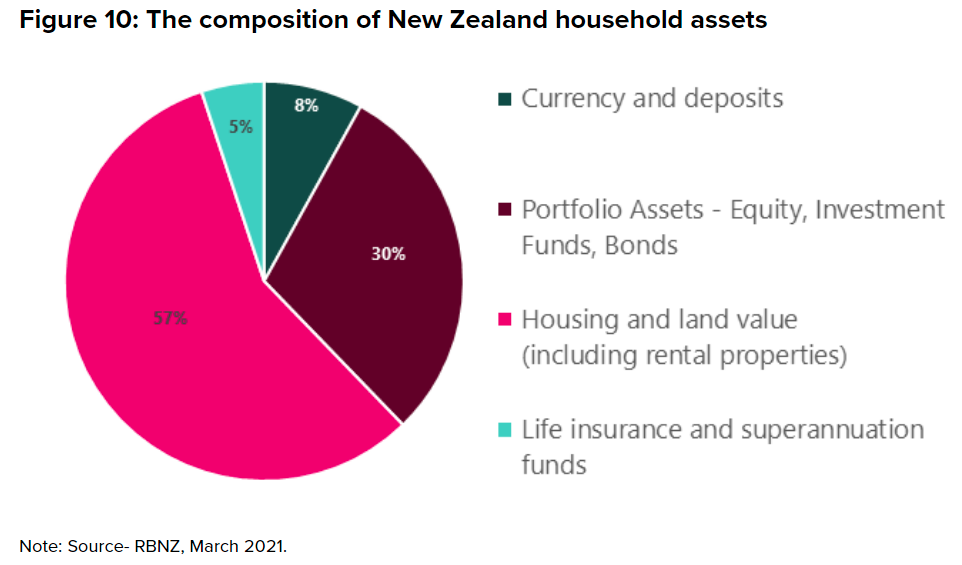

"With prices having been seemingly always on the up, it is no surprise that New Zealanders hold a relatively large share of their wealth in housing.

"The proportion of housing wealth in total wealth appears to be relatively high in New Zealand compared to other developed economies."

Given large house price increases, research based on portfolio investment theory shows that investing in residential property has been the logical choice for many Kiwis. In New Zealand, given policy settings, it has been rational for investors to flock into the housing market, Conway said.

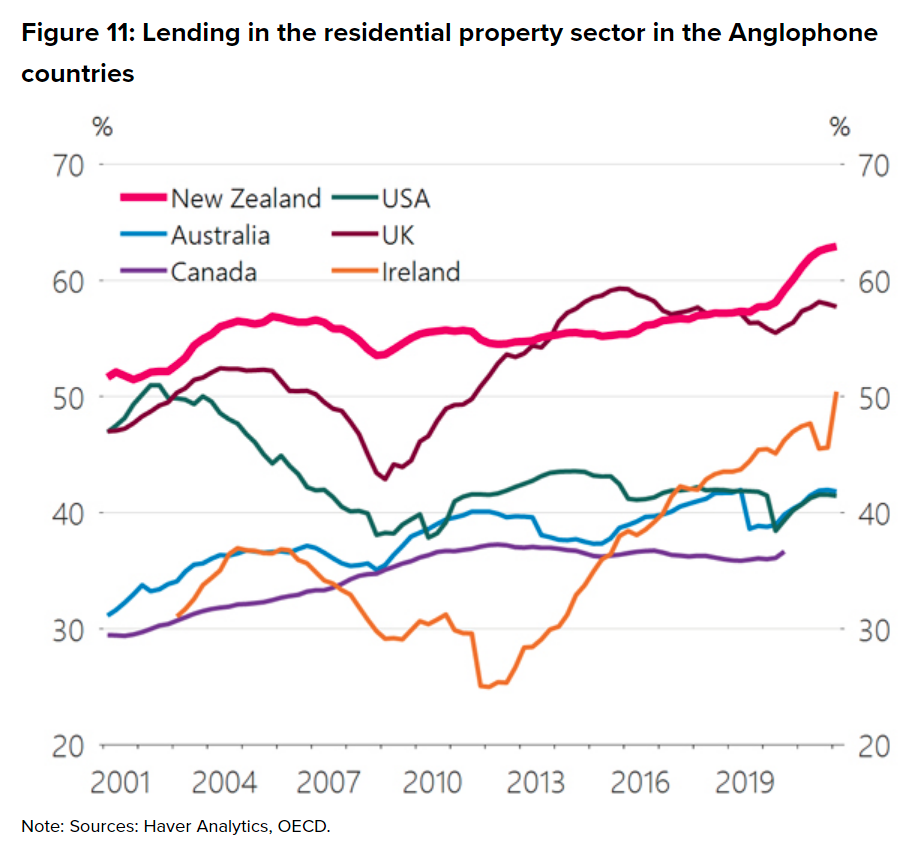

Because housing can be leveraged, the flip side of strong investment in residential property is that mortgage lending makes up a larger proportion of commercial bank balance sheets compared to other OECD economies, he said.

"While investing in housing has been rational, the implications of channelling a very large share of our savings and debt obligations into housing goes beyond optimal portfolio theory. The housing market has become the default savings vehicle for many New Zealanders and the key source of collateral or security for borrowing by households and small and medium businesses.

"It may also be that investing in housing in the hope of perpetually higher house prices may ultimately lead to a potential misallocations of resources that generates relatively little economic value."

He said that over a longer time frame, there are reasons to think that some of the core market fundamentals that determine sustainable house prices may be changing.

"On the demand side, as the pandemic slowly recedes and international travel restrictions unwind, many New Zealanders are heading overseas seeking new experiences. On the other hand, immigration is unlikely to return quickly to pre-pandemic levels, contributing to slower population growth overall."

Conway said over the years, the demand side of the New Zealand housing market was boosted by strong population growth, steadily declining neutral interest rates and a favourable tax system.

"The supply side, however, has been held back by strict land use regulations, and a construction sector prone to boom-bust cycles, while carrying very high building costs. Excess demand led to New Zealand’s experience with some of the highest house prices relative to income in the world."

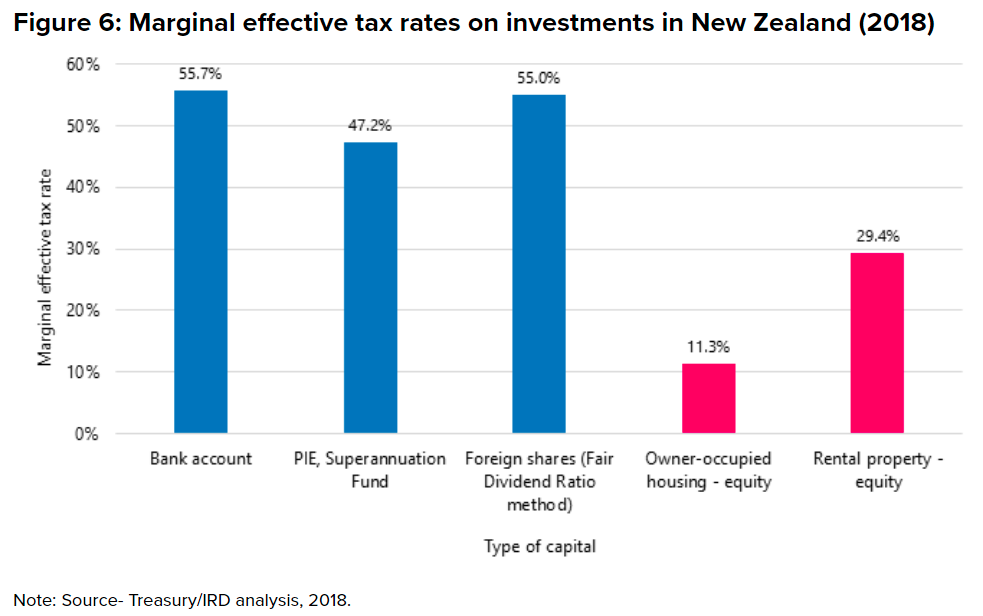

He also said our tax system may have also contributed to higher house prices over recent decades.

If the tax system had been more ‘neutral’ in its treatment of housing, house price increases "would have been milder over the two decades to 2021 as interest rates fell".

"Figure 6 is taken from the Tax Working Group (2018) and shows that our tax system has historically favoured housing as an investment asset."

Capital gains on housing are often not taxed, whereas other forms of income are. Imputed rent (the rent owner-occupiers effectively pay themselves) is not taxed whereas other forms of investment income are. And GST is charged as a lump sum when a house is built, rather than on the flow of housing services as they are consumed, be that via rent or owner occupation.

"These tax distortions that favour housing become more potent when interest rates are low, amplifying the effects on house prices. So, as interest rates fell between 2002 and 2021, it is likely that the upward impact of tax settings on house prices increased.

"Of course, a fully non-distortionary neutral tax system is merely an economist’s fantasy; indeed, there are practical considerations that influence the design and implementation of tax systems. Nonetheless, understanding the impacts of tax distortions – and their interactions with other relevant factors such as interest rates – on the housing market is important for understanding house price dynamics."

In looking further at the nature of the housing market here, Conway said "a sense of ever-increasing house prices" – along with a lack of other quality local investment alternatives – may have also distorted the investment options of New Zealanders.

"The share of housing on household balance sheets is very high and commercial banks hold a high share of mortgages on their balance sheets."

Rapidly increasing land prices may have also led to a transfer of wealth to people who owned land as prices were rising from landless younger people and future generations, who have to spend more to buy land. This means that they save less, reducing the amount of alternative capital they own and possibly lowering lifetime consumption and incomes.

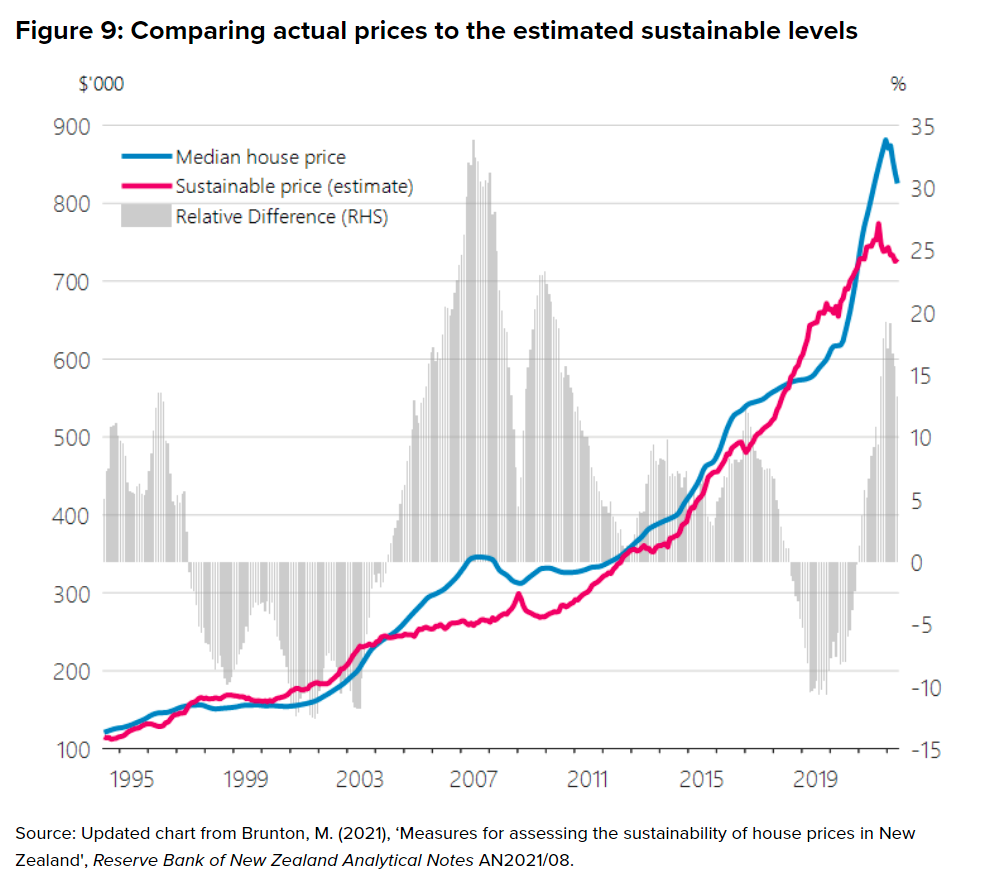

"Are these dynamics likely to continue in future? Since August 2021, the Reserve Bank has been tightening monetary policy, lifting the Official Cash Rate, to rein in inflation. This will likely see actual house prices move back towards sustainable levels that are more in line with market fundamentals. Indeed, in the May Monetary Policy Statement, we forecast a 15 percent decline in house prices from their peak, which would bring them roughly back to sustainable levels."

On tax, Conway said the removal of interest deductibility and the introduction of a capital gains tax on sales of residential property owned for less than 10 years – the ‘bright lines test’ – will have closed some of the gap between the effective tax rate on housing and other asset classes.

"At the same time, urban planning rules are being freed up to unlock more housing supply. The Resource Management Act is being replaced and the National Policy Statement on Urban Development directs councils to remove overly-restrictive planning rules and to enable higher housing density, which is a critical part of the solution.

"In the construction sector, the Commerce Commission is carrying out a market study into whether competition for residential building supplies in New Zealand is working well and, if not, what can be done to improve it.

"These changes are consistent with more houses being built and currently high building consents translating into more actual houses. They also imply that housing market dynamics in future are unlikely to be the same as in the past. Given the importance of housing in our economy and national psyche, this will be a huge change."

Conway said since the beginning of the Covid-19 pandemic in 2020, actual house prices have been above their sustainable level.

"Exceptionally low interest rates coupled with a “fear of missing out” would have contributed to this cyclical surge in house prices. In turn, stronger house prices supported consumer spending over this period through a wealth effect. This additional support to aggregate demand and spending in our economy played a key role in helping us avoid the worst effects of the pandemic on employment and income.

"Importantly, ‘sustainability’ and ‘affordability’ are very different concepts. While sustainability is determined by fundamental drivers in the housing market, affordability is about where the cost of purchasing a house sits relative to the income of the home-buyer. Unfortunately, for many New Zealanders trying to buy a home, the current level of sustainable house prices – determined by market fundamentals – is still by no means affordable."

86 Comments

CGT and also inheritance tax rather than this complex nonsensical mess please.

nktokyo,

I dealt with both CGT and Inheritance Tax for clients while working in the UK and while people grumbled about them, pretty much everybody accepted them as a necessary part of the fiscal landscape.

If the trade-off is we get a bloated and wrecked civil service like the UK then it's a bad deal. Possibly the worst deal in history.

Every time, without fail, I hear some state sector leader spurting out lines about concern and expectations defending some piss-poor government department performance, I can almost without fail predict the accent I'm going to hear in advance. If they want to tax people in death fund that sort of low-bar for their public sector then let them, but if you're going to tax me after I'm dead then I'm going to expect seriously better performance from the state while I'm alive as part of the deal.

If the trade-off is we get a bloated and wrecked civil service like the UK then it's a bad deal. Possibly the worst deal in history.

NZ doesn't have a overweight, dysfunctional civil service already?

Also quite a few of them are either migrants from the UK or Kiwis who spent their OE years in the UK. The largest export from the UK to NZ is surely bureaucracy.

Every time you here a bureaucrat on the radio they have a British accent. We should do a deal and send them back some bureaucrats in exchange for some doctors and nurses.

I agree, we're overweight middle management Brit's who are admin types and bring zero skills, in fact negative. The UK is a basket case over-run with bureaucrats who generate zero value, computer says no types.

Also, the RBNZ have so little credibility now they should just keep a very low profile . In fact, National should announce a formal review of their performance like in Australia with the RBA.

Hey, hey. My wife is one of those British bureaucrats. Some of them are trying to make a real change against the tide of she'll-be-righters and tall poppy brigade.

Maybe she's the exception NM, but I can name a few inneffective ones. I thought Rob (FMA CEO) was pretty good to be fair.

She is (though I would say that). To be fair, from what we've seen, the good ones don't stick around for long.

I'm probably biased from seeing a few shokers. In general, anyone who is prepared to uproot their lives and relocate has some get up and go about them.

It's not a nationality thing. There are tonnes of home grown kiwi managers in the government bureaucracy who are just as bad if not worse.

Right on that one

And second rate property professionals

If the trade-off is we get a bloated and wrecked civil service like the UK then it's a bad deal. Possibly the worst deal in history.

Seems a pretty illogical assumption.

Moreover, the point is more why other taxpayers should be carrying wealthy non-contributors.

NZ had inheritance taxes/ death duties for over 100 years. Getting rid of these envy taxes (& other ticket clipping economic inefficiencies such as stamp duties) was the quid pro quo electoral mandate for the original introduction of GST.

Hmm, getting rid of a tax that overwhelmingly impacts wealthly groups and replacing it with one that overwhelmingly impacts low income groups..... yikes

And basing our tax primarily on envy of those who have the skills and knowledge to achieve more highly instead of a broader base including unearned income... yeah, no wonder we have poor productivity and stupid house prices.

Except the plan there was to comp GST for lower income earners through targeted assistance AND then bring in a flat tax rate to absolutely nail the compliance costs to almost zero when it came to income tax and a capital gains tax on the other side to bring in capital receipt revenue. They lost their nerve and we got a half-done system with all the shit bits and none of the stuff that was meant to make it work

Yes the Flat Tax was Roger Douglas's unfinished business, I seem to recall a suggestion of 20%.

Progressive tax rates are explicitly socialist envy, no other logic beyond stealing from the perceived undeserving "rich" to give to the deserving poor. My recollection from Cullens Tax working group is that, after income tax credits (eg WFF), half the households in NZ pay no net tax at all.

GST is an incredibly efficient tax. Effectively taxing consumption rather than production. In an ideal world, you would have a higher rate of GST and a financial transaction tax (say 0.1% of every banking transaction) and nil income tax.

Key is you cannot avoid or evade a consumption tax. Those who are paid under the table still pay their share of tax. And criminals pay their share of tax. High income tax rates essentially target the middle class. The wealthy employ accountants to avoid tax. The wealthy and finance sector are happy with the status quo, and will push the GST impacts the poor line to avoid tax reform.

The top 5% are already paying more tax than the bottom three-quarters of taxpayers combined.

https://www.treasury.govt.nz/information-and-services/financial-managem…

I've been poor more than once in my nearly 70 years. It's not a label that needs to define your whole life.

I'd never heard of this woman before. Not your average 17 yo pregnant high school student:

America's richest self-made woman: From dairy farm to $11.6 billion net worth

https://www.cnbc.com/2022/06/28/richest-self-made-woman-in-us-diane-hendricks-grew-up-on-dairy-farm.html?

The top 5% are already paying more tax than the bottom three-quarters of taxpayers combined.

That's an undue focus strictly on earned income, rather than the important matter of unearned income. People doing productive work are carrying far more people than just the poorer ones.

Most of the top 5% are probably grateful (if not they should be) for the circumstances that enable them to be top 5% earners. What a burden, earning so much money that you're a top tax contributor.

I'm grateful to be a net tax contributor earning well above median. I don't know how much income tax I pay because I'm not a selfish prick. I've worked hard to get to where I am, but also been blessed with opportunity and a decent IQ. And I'm not deluded into thinking my success is because I've worked so much harder than anyone else.

..

how many contradictory comments have been given from all sorts of economists over the past decade?

anyone got it right? or just make safe comments on what they observe at that very moment? they are jokers with a pretty title.

It's more the ones from our PM and Finance Minister about the expectations that house prices should increase at a slower rate that I want to know about. As in:

1) Do they now accept that was a poor pivot away from their promised campaign goal of improved housing affordability, and;

2) Do you think that Kiwis should have any confidence in their abilities now that house prices are dropping?, and;

3) Will they keep trying to have it both ways, or will they do the honourable thing and resign?

Be quick!

The latest Demographia survey is worth a look. Of the countries studied, only Hong Kong has a higher Median Multiple. I am sure we all have a 'great sense of pride' that little NZ is on the podium yet again. Of the 92 cities studied however, we are 'only' 85th, so more work to do lads.

having spent most of my life in Scotland and much of that in Glasgow, I was interested to see it as one of the most affordable cities with an MM under 4. That's very different to when I came here in 2003.

can you post a link?

Wow. Parts of Scotland might be quite a nice equation then, especially as the world warms.

I think that's a fair summary of the situation but I still have no idea what "sustainable" means when the government and RBNZ use it.

The dictionary defines the word as "able to be maintained at a certain rate or level" or "able to be upheld or defended" surely it should not be able to go down 7% or so in year. Is the estimate method flawed or is this a meaningless word? (that's rhetorical)

I think they should only be looking at affordability, but of course to make housing affordable would require a much larger correction.

For every dollar over the affordable level, we loose a certain amount of young people that we've invested in and educated, forever.

In a way I think that's the point - with the RBNZ/Govt not defining 'sustainable' by default they cant be measured against it

It would be very interesting to see what those figures are if you exclude the residence that is occupied by the owner.

Hutt Valley Market Update 27th June

For those that didn’t see last weeks headlines – 2 lower hutt suburbs – Petone and Alicetown have had the biggest fall in house prices since the peak at the end of last year.

For Petone “considered this time last year” a hot Wellington suburb (think Ponsonby 5 years ago) with most houses selling for 200-300K over their valuation, growth YOY is now just 2% and it’s likely the current average house price of $1.05M will fall below the $1 Million mark before spring.

Current Market Listings

583 houses on the market- Down 11 on last week –whilst lower than in April and May when listed number of houses peaked at 652 houses in early April, there are still 2.5 times the number this time last year when 230 houses were for sale

Based on the REINZ data which showed that 96 sold in Feb and 104 sold in March and 98 in April and 96 in May giving an average sale of 25 houses per week– 583 houses means there is 23.5 weeks stock on the market.

House Price Reductions

312 houses have a listed price

63% of the houses listed with a price have reduced their price since listing

The average markdown has increased to 96K. (last week 91K)

Of those that have listed prices (pool 312) -51 have reduced their prices by 100K

11 have reduced their prices by over 200K, 6 have reduced their prices by 300K and 1 now has reduced their price by 400K with the biggest reduction been 425K (a total 25% reduction)

The data continues to show the majority of houses listed are under 900K. The Median house price for all 583 listings is now 830K. (Down 9K last week)

The latest QV valuations (valuations by QV which are updated every month and give an approximation of a houses value) have dropped $130K since Jan for the Hutt.

In April the QV valuation had dropped 80K – approximately 20K a month since the start of the year but this escalated in May – dropping 50K in one month.

Meanwhile Homes based on last weeks update is inline with QV and indicating there has been an approximate $160K drop on house prices in the Hutt valley– since the peak which they are indicating was early Nov 21. According to homes prices are back to June 21 prices – so flat with this time last year.

Houses sold vs houses removed

My records show 213 houses listed with a Price have sold YTD (up 4 from last week).

I have records of a further 179 houses (up 9 from last week) that have been removed from the market unsold YTD.

28 of those houses removed from the market have been listed on the rental market

Length of time on the Market

- 432 houses have been on the market for over 30 days - 74% (last week it was 430)

- 306 houses have been on the market for over 60 days - 52% (last week it was 311)

- 189 houses have been on the market for over 90 days – 32% (last week was 197)

- 120 houses have been on the market for over 120 days (last week was 121) - 20%

- 77 of the houses have been on the market for over 150 days - 13%

The number of houses on the market over 60 days is now over 50%. This has risen from 32% of houses in mid March (one in three) and just over 1 in 3 houses have now been on the market more than 3 months , almost 1 in 5 have been on the market over 4 months and 1 in 8 have been on the market over 5 months.

The time to sell continues to get longer and longer.

Rental Market

As already noted the rental market has 207 properties for rent (down 8 on last week and 25 from 2 weeks ago) but up 102 on this time last year, – when just 105 houses were for rent. The number of rentals has now doubled on last year

Average rental price reduction is back at $51 a week

As noted last week I have also been noting how many properties are listed for rent over $650 a week.

At the moment the percentage of properties listed at $650 is 43% - last week it was 40%. Still well below the 53% of houses listed over $650 on the 23rd March.

"It may also be that investing in housing in the hope of perpetually higher house prices may ultimately lead to a potential misallocations of resources that generates relatively little economic value."

You couldn't make this stuff up. RBNZ has been spruiking the property market for decades, now they pretend they knew it all along and will come in and fix all the problems they have created. Classic hero syndrome from an organisation which if it was a person, would be described as a narcissist (believing their world view is perfect), psychotic (zero empathy, actively engages and believes in hallucinations) and completely dysfunctional.

You couldn't make this stuff up. RBNZ has been spruiking the property market for decades, now they pretend they knew it all along and will come in and fix all the problems they have created. Classic hero syndrome from an organisation which if it was a person, would be described as a narcissist (believing their world view is perfect), psychotic (zero empathy, actively engages and believes in hallucinations) and completely dysfunctional.

Yep. Blind Freddy could have seen what they have just announced.

RBNZ have no chance in fixing this, NZD hovering around .62 already lost 14% of value this year. Rates will continue to raise with inflation, house prices falling fast around 5k a week in some area in Auckland. Building companies going insolvent over leveraged in perilous position.

The landed gentry seem to be the ones with the money printer.

They've acted like a bunch of crack fiends for decades. The condition of their properties is as shocking as their credit addiction.

I'm sure they'll give up soon LMFAO..

Addicts are known for stealing to fund their habits, a bit like how the landed gentry steals money by diluting the New Zealand money supply, aka printing money and giving it to themselves and the inflation tab to everybody else.

So yeah, that's the reality lol.. printer goes brrrrrrrrrrr and the sheep go barrrrrrrrrrr.

I also like that their analysis and graph start at late 80’s /early nineties. They have built a model that has looked at property prices across 4 decades where average interest rates fell every decade.

Then they looked at the price appreciation that occurred and built a model that determines what a sustainable price is, based on what happened in that period. But their model is built on behaviour in an environment where rates trend down and prices always go faster than than general inflation. Once those two things are no longer true, their idea on what “sustainable prices” are will be proven to be woefully incorrect.

The RBNZs call of 10-15% price correction back to “sustainable” levels will look as stupid as the banks calling a 5% correction in late 2021

I think we need to start the RBNZ off with basic printer and animal sounds.. perhaps a picture book! Modeling and basic definitions might be a bit too advanced for some of them.

I also like that their analysis and graph start at late 80’s /early nineties. They have built a model that has looked at property prices across 4 decades where average interest rates fell every decade.

Early 90s was when the Anglosphere banking system cottoned on to the housing mkt as the magic money machine. So yes. quite relevant.

Happy realization Paul Conway !

Better Late Than Never !

Now when reset is happening, let it happen, once and for all for future stability.

Use this crisis to reset NZ economy and change the perecption that housing is the only economy in NZ (In last two years number of business people for fast and BIG money had switched to building house and some borrowing in extreme and may go bust).

Jacinda Arden in all probability will go by next election, so now should atleast allow to reset the economy and divert from vote bank politics to do some good before.....but........most probably will throw some lollies, dole next year being election year using recession as an excuse.

Next election 7-house Luxon will repeal the Brightline extension and re-instate interest deductibility.

On tax, Conway said the removal of interest deductibility and the introduction of a capital gains tax on sales of residential property owned for less than 10 years – the ‘bright lines test’ – will have closed some of the gap between the effective tax rate on housing and other asset classes.

Better for nats to abandon that line, boomers are dying, and nobody like 7 houses peps (you might have a lots of parasites around and call them friend, if you like, but generally people will not like you)

Can't just live off the wealth of younger generations in perpetuity, surely. Who's that entitled?

....ooooh ... better have some paramedics on standby in case Ashley Church reads this story...

Did he mention the ageing population, many of which will be looking at selling their investment properties soon to pay for their holidays / rest homes?

... or the younger generation , the unboomers ... who will tell us to get lost , they're not paying insane prices for our draughty rotten boxes ... they'll be off ... to Australia ... and who can blame them ... we created this mess , not their problem ...

✈️✅

The wrinkle farms will be full to the brim and all the nurses will have left for greener pastures.

Nice guy is Paul Conway. But he's attached himself to the Productivity Commission, BNZ, and now RBNZ (2nd stint I believe). He's seen it all. Except on the front lines.

What he doesn't address is the known unknown related to the wealth effect. I know that either the RBNZ or Treasury has some research that seems to suggest that the impacts of the wealth effect are benign at most. Now, and I'm just guessing, I think that is probably woefully understated in terms of what could happen in a falling house price environment.

So when RBNZ was predicting the outcome of their actions for the last 10 years they say the outcome will all be good

but when they look back from from what became bad outcome, they say its the logical outcome of their actions for yhe last 10 years?

So tommorow guys 1+1=3. Definitely. Bank on it. In fact you can all bet your future income and asset prices on it. (But maybe ome back and check in case it is 2 like everyone else thinks it will be)

Ah yes, the classic housing market 'fundamentals', including such hits as:

- Houses only ever go up in value!

- Trust me - it's impossible for interest rates to get above 3% again, and

- The ratios and pricing methods that predicted house price crashes in other countries are all bunk - we just have a magical, mystical housing shortage/immigration problem/investment problem that these models don't account for

Turns out they're less 'fundamental' than previously thought eh?

Why is the RBNZ talking about houses anyway? They constantly remind the public that it's not their mandate or responsibility.

'Ever get the feeling you've been cheated?

- John Lydon aka Johnny Rotten

A drop of 15% is only considered palatable to appease the masses while keeping those with skin in the game happy. That is in no way affordable or sustainable on a social level. 15% from peak is early 2021 prices so get real.

I would like to see a fall somewhere close to the 2017 valuations. With time we could hope for DTI to be under 5 for the median house price and average wage. Only then would I see housing as sustainable and affordable.

Precisely.

Have you noticed that when the likes of the RBNZ, Tony Alexander, Corelogic, Banks, (add any vested party here), tell you that prices are only going to fall 11-15% they never give you a logical reason why they will stop at the level?

All they say is "We predict… “ like they are speaking from a position of authority on prices, values, demand and affordability.

The reality is when the levee breaks on a bubble it’s a long way down until there are buyers willing to take the risk that they have found the bottom, or very close to it.

TA should really be running his own property seminars rather than being a paid sideshow for others

https://www.instagram.com/p/CP1WNboJTmQ/?igshid=YmMyMTA2M2Y=

What you want to happen and what is actually going to happen are two different things. At this point and even bigger shock is required on a global scale to tip things into the toilet. I'm thinking China finally making a play for Taiwan or Putin getting serious with Ukraine because at present he is just the cat playing with the mouse.

I do wonder what the report from the commerce commission might announce in a months time. It could be a black swan type event if it shows anti competitive practices have been rife.

I mean how are people going to feel if we find out we have all been ripped off.

However I don’t think the commerce commission has been thorough enough. But time will tell.

I disagree Carlos only in as much as the fundamentals to bring about a suitable correction are already in play.

That is as long as whoever gets elected doesn't meddle and that is my biggest concern. A 15% drop is being pushed a lot so is this setting the scene for preventing a further drop under the guise of "fiscal stability". I'm just deeply cynical that economics won't be left to reset and we'll see outside interference.

Carlos - do you not honestly think it’s not already happening?

I’m surprised how many people believe a crash can’t happen here again - we had a -40% fall in the 70s.

We are showing all the classic signs of a bubble burst. We are almost textbook.

Prices are consistently falling with no signs of support to slow or stop the falls. The sentiment is getting worse.

Falling prices was an argument at the start of the year, but no longer.

Those hoping for affordable prices, just have to sit tight and be patient. It’s tough to do, but any trader will tell you that’s what it takes to win.

Anyone waiting on the sidelines to buy is short the market so needs to keep that position.

The myth being peddled is rates will rise for a few years of pain and then come right back down near where they were.

It’s BS, no one know’s where they will stop, but low rates won’t return.

It’s exactly what blew the whole thing up. They’re not going to repeat it, and they’re not going to do it to save the 20% of the market with DTI >5.

The average interest rate between 1985-2021 was 6.82% so we’re going to need to rise well above that before we can settle back near that level.

https://tradingeconomics.com/new-zealand/interest-rate

Ask anyone that’s lived in a country with high inflation and they’ll tell you falling house prices for those with a large mortgage is the least of an economies worries.

FHB’s? - they can’t get the finance, and if they did their numbers would see it’s far cheap to rent than service interest.

Investors? - again, it doesn’t stack up. It’s a mugs game without capital gain, let alone capital loss and increasing expenses.

Owner/Occupiers - buying and selling in the same market so not enough of either to create new demand.

The only argument left is where prices are going to stop, which no one knows but bubbles don’t break with 15% falls.

https://en.wikipedia.org/wiki/Housing_bubble#Historical_housing_bubbles

So far we’re looking good to take out our previous record of -9.2% falls in the first year of bubble burst.

Yup. Who can buy....and if you can, why would you right now vs waiting a bit for the ponzi to really come under pressure?

This! - "bubbles don’t break with 15% falls"

Cat playing with a mouse?

What a strange comment?

... no one wants to stand out too far from the crowd , and call for a bigger house price fall ... for fear of ridicule if they're wrong ... as Bernard Hickey was , years ago for his 30 % fall prediction ... his timing was badly wrong ... kudos to him for having the kahunas to highlight an insane market for what is was ... sadly ... the insanity got 100 % worse after his ill fated call ...

Now as the process of fall is beyond likes of Jacinda Arden and Orr's manipulation, it will not be long as fundamentals have taken over ......

... worldwide , central bankers inflated us out of the GFC debt bubble with a brand new far far greater debt bubble ...

Perhaps it's all beginning to unwind now ...

... watch the action of NFT's & cryptocurrencies , they're the " canaries in the coal mine " ...

And used the Covid scam to continue the Ponzi. New Zealand just became a mini-America, using housing (consumption) as an ATM, massive unproductive government spending, trying to increase GDP through debt. Quantative easing anyone?

Wow, look at the NZ increase in Figure 11 from lockdown (March) 2020 onwards.....unsustainable.

Game Over

by Audaxes | 15th May 21, 1:05pm

RBNZ claimed - page 7 (13 of 48) PDF - around two thirds of NZ households have no mortgage debt - the debt to income ratio changes dramatically when those without mortgages are excluded. Moreover, given the iniquity of the risk weighted asset regulatory capital scheme, around sixty percent of bank lending is allocated to residential real estate for one third of households.

Can banks justify rising concentration and credit risks by extending mortgage debt to a minority of NZ households and at the same time starve the debt dependent means of production and wages anymore than they already do?

Audaxes - Interesting - who wrote this? I’m keen to read more

I've been saying for a while (years now) that the big cycle - whole of life or 75-85 years - is now a big factor in how we all should be thinking. How this fundamental change transpires is up to all of us, I suppose. Sooner or later govts will start to realize the tax take potential in death duties, or of similar legislation. They're already looking into undoing the trust structures, mostly designed to transfer wealth generationally, so they can get their grubby little mitts on the money that you & I worked hard for.

Big govt getting bigger is not the solution unless you want to be told what to do, how to do it & when to do it, which we've all had a taste of recently, haven't we? How did that go? Bloody awful for most of us I suspect. For the millions of us wanting to just get on, create a life & even enjoy it, this is a disaster. Less govt is better govt. End of story.

What's this got to do about houses? Well, people live in houses. They're our shelter from the storms, a home for our families, the centres of our lives no less. Houses are a basic. A fundamental. Ideally, everyone should be able to afford one. It's way better than sleeping on the streets, right?

The current reset in the pricing of houses is essential for all of us today & all of us tomorrow, whoever us is. But for what we get, houses are expensive in NZ. Often cold & leaky, sometimes downright unlivable, NZ homes need to reset to value for money, rather than the little value for too much money, which has been a common thread in the industry since the early 1970's.

What's happening has to happen. It should have happened earlier, but, thank God it's happening now. It'll hurt. Just like it did in 1988-91. But it has to happen. Sorry.

Houses have been on the receiving end of wealth transfers, in recent decades in NZ. Might make sense to recapture some of that unearned wealth, rather than further penalising productive work that's already the most taxed thing in New Zealand.

A mix of LVT and lower income taxes would go a long way to incentivising productive work over land banking, reversing our current policy that's the direct opposite.

"for several decades, we have traded houses among ourselves at ever-increasing prices in the belief that we were creating prosperity"

And today we have houses built on sections as low as 53 sq metres, floor area 109 sq metres, asking price $925,000, in Massey, Waitakere.

Or buy a do-up in a full section for $800,000, and hope that repairs to roof and a new kitchen/bath combo is less than $200,000.

Real estate is a very efficient market, we will soon find out where we all sit.

EVERY kiwi had the opportunity to sell late last year.....

Nope, only those who owned houses were able to sell late last year.

"At the same time, urban planning rules are being freed up to unlock more housing supply. The Resource Management Act is being replaced and the National Policy Statement on Urban Development directs councils to remove overly-restrictive planning rules and to enable higher housing density, which is a critical part of the solution. '

Wrong, The present urban planning rules are still trying to encourage high-density housing as a proxy for affordability when land economists will tell you the price to set affordability for all is set on the fringe, ie you need to have land planning rules that allow building up and out.

If density was a proxy for affordability then Hong Kong would have the cheapest housing in the world, not the dearest.

This will need to be the main reset requirement any political party needs to make when this thing hits rock bottom, whatever that is.

If they allow a truly free market to land supply, then the mental epiphany they will go through in allowing this, will make it clear what else they have to do, and much of what they are doing now either won't matter or can be removed without much effect on increasing house prices.

Time to sell your horse and bet on all blacks , thats a one way bet

(disclaimer; maybe take some advice from your sound financial advisor.... or staircase or propellor property or just your local bookie)

RBNZ has been repeatedly wrong since Orr took the wheel. I'm not sure anyone should read too much into Conway's view. Weren't these the guys that claimed that printing money wasn't always inflationary? (and forgive me while I snort with derision). And then, that inflation would be transitory? And then after it wasn't, it would be a short term phenomena?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.