It is unlikely there will be a "rush" for home owners to fix their mortgages for longer terms, according to BNZ chief economist Mike Jones.

In his latest Eco-Pulse publication, Jones has crunched some numbers on the current durations of fixed terms held by Kiwi home owners, as a follow up to work he did earlier this year.

Jones says mortgage fixing behaviour now appears less sensitive to current relative pricing, and more focused on the risks and opportunities from the shape of the next interest rate cycle.

"If that holds, we may see the gentle trend towards longer terms continue as borrowers gradually factor in the end of the Reserve Bank’s easing cycle," he said.

"We doubt there will be a rush toward longer-term fixes though. Not while the RBNZ maintains a bias to lower interest rates further, the economy remains weak, and the risk of rate hikes remains a long way off," he said.

"Our read of mortgage rate ‘break-evens’ (comparing our interest rate forecasts to implied market pricing) is also consistent with the idea that borrowers have some time up their sleeve."

Jones's comments follow the latest RBNZ Official Cash Rate review on Wednesday, in which the central bank lowered the OCR as expected to 3.00% from 3.25%. Much less expected, however, was a big switch by the RBNZ to now forecasting a low point for the OCR of 2.5%, possibly as soon as the end of the year.

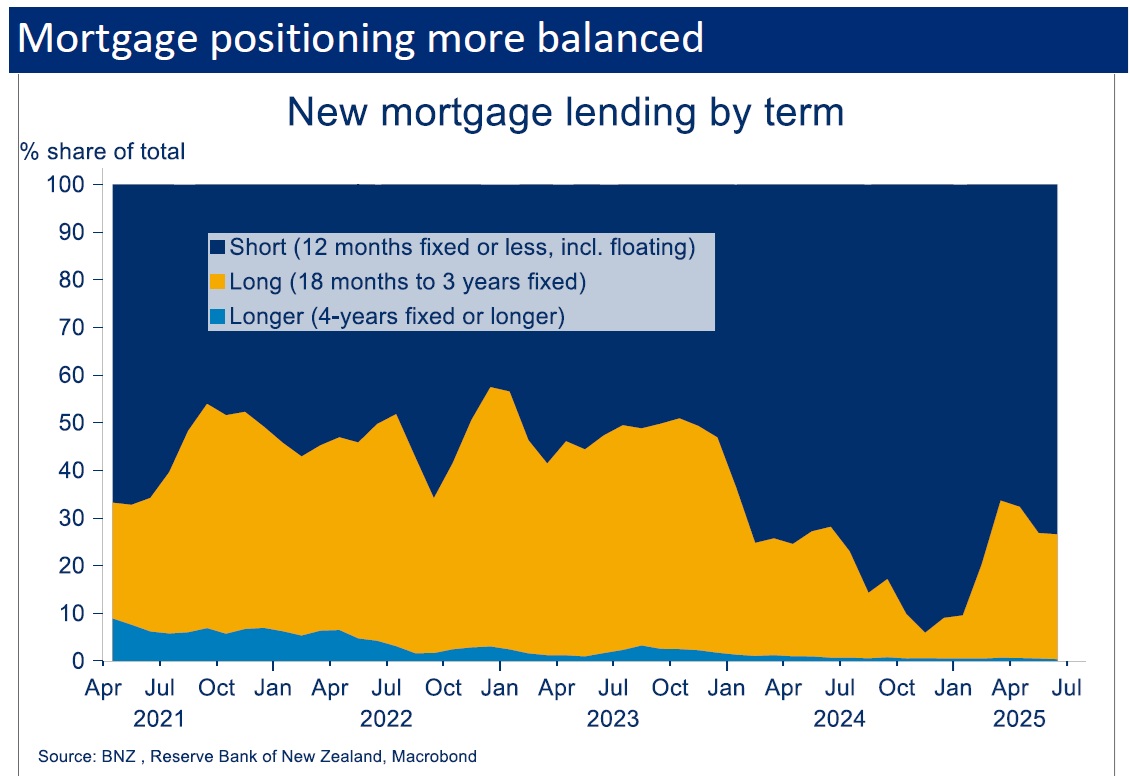

In his comments early this year, Jones expressed some unease about "extreme short positioning" by home owners.

"As it turns out, the sentiment shifted relatively quickly thereafter. Indeed, the November 2024 data referenced at the time turned out to be peak short for the mortgage book.

"The share of new borrowings on floating and six-month fixed terms has reduced a little, and there’s been snatches of increased interest in two-year fixed terms. Consequently, the share of new mortgage borrowing on terms of 12 months or less has fallen from a high of 94% in November, to an average of 71% over the three months to June."

Jones said the gradual shifts in term preference evident in new lending flows have been enough to nudge out the term profile of the stock of mortgage borrowing.

"For example, the share of outstanding fixed-rate borrowings with remaining terms of six months or less has declined from the highly concentrated 44% as of January, to 36% as at June. There’s now a slightly higher share with remaining fixed terms of 6-12 months, while the share in the 1-2 years bucket has lifted a solid six percentage points from January. The broad conclusion is that mortgage positioning is still shorter than average, but it’s more balanced than it was."

Looking at what might happen from here, Jones said as mortgage rates have come down this year, shorter term rates have fallen by relatively more.

"That is, the mortgage curve has steepened. We think this trend has a little further to go. Forecasts are, as always, only a guide. But the fact fixing for two years or longer may end up a little more costly (upfront at least), relative to fixing for six months or one-year, may encourage some to stick with those shorter fixed terms."

However, Jones said now, borrowers – in aggregate – appear much more inclined to absorb what might be unfavourable upfront costs in order to benefit in the longer term.

"For example, borrowers shortened their borrowing terms well ahead of the RBNZ’s latest easing cycle, despite the extra upfront costs of doing so at the time (with short-term rates above long-term). That proved prescient as rates were subsequently cut aggressively. But as the easing cycle has advanced, borrowers have now started to push out for longer terms even though longer-term rates are above shorter-term equivalents, for the most part," Jones said.

In terms of the RBNZ's current position, Jones said there still "could be an element of the Reserve Bank feeling its way to the bottom of the cycle".

"Whatever the exact low point turns out to be, we are edging onto the home stretch for the easing cycle. Borrowers’ small step away from shorter fixed terms appears consistent with this."

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.