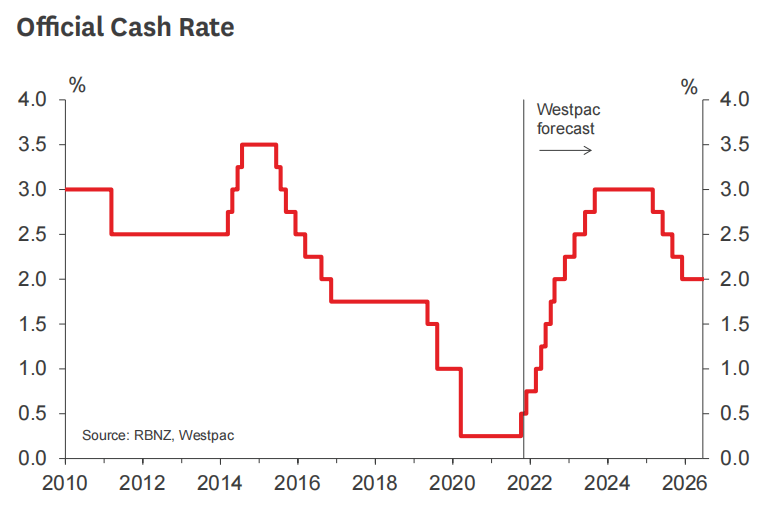

Westpac economists are now picking the Official Cash Rate (OCR) will hit 3% by 2023 and they say that the Reserve Bank (RBNZ) will need to run a "tight" monetary policy for some time.

The move by the Westpac economists after the release of Wednesday's incredibly strong employment figures represents a further move by economists into expecting more and more action will be necessary by the RBNZ to dampen inflation that's now looking likely to be stronger and longer than economists - and global central banks - were hoping.

The RBNZ began raising interest rates last month with a hike in the OCR from 0.25% to 0.5%. It's widely expected to raise the OCR again in its next review on November 24.

Generally major bank economists have been picking that the 'peak' of this hiking cycle would be a fairly mild one of around 2% and that inflation pressures would dissipate. That thinking is gradually evolving as the inflationary pressures start to look stronger and probably more persistent.

Westpac acting chief economist Michael Gordon said with Wednesday's labour market surveys, "another major data point for the New Zealand economy has shot the lights out".

"...The starting point for the economy is wildly stronger than the RBNZ expected, and the upside risks for inflation are growing," he said.

Westpac's Gordon said the "accumulated evidence" was clear that demand is running very hot, and that the Reserve Bank will need to take more action to cool things down.

"What’s more it’s looking increasingly unlikely that the RBNZ will be able to achieve a smooth glide path towards a long-run ‘neutral’ level of the cash rate, and that interest rates will need to be meaningfully higher for some period of time."

He's now forecasting that the RBNZ will have to take the OCR above what would be regarded as a 'neutral' level - and to actually have to run tight monetary policy.

That's a departure from what other economists have been saying to this point.

"We’re now forecasting the Official Cash Rate to rise to a peak of 3% by mid-2023, from its current level of 0.5%. While that wouldn’t be particularly high compared to history, it would represent much more than just an unwinding of the stimulus that was put in place in response to Covid-19. And it would be some way above where the ‘neutral’ cash rate is generally assessed to be (around 2%).

"We’d emphasise that we’re predicting that monetary policy will need to be ‘tight’ for some time in order to bring demand under control, before settling back towards a ‘neutral’ setting. With that in mind, we’ve also pencilled in a series of OCR cuts back to 2% in 2025.

"But we’re really trying to convey the general direction rather than the timing – predicting the next phase of interest rates is hard enough, let alone the next two phases."

In terms of what the RBNZ might decide to do later in the month with the OCR, Gordon said on the RBNZ’s own framework, "there’s a reasonable case for a 50bp hike this month".

"But there’s rarely a ‘smoking gun’ argument for these kinds of tactical decisions. And the uncertain impact of the current Covid outbreak offers a counter-argument for more cautious action.

"...We’ve come down on the side of 25 basis point moves, but as we’ve noted before, the odds of a 50 basis point move are reasonably high. For one thing, the RBNZ itself said that it actively considered this option in its August review – and the economic case for it is stronger now than it was back then."

81 Comments

Another day, another economist, another OCR prediction. Nothing to see here folks.

Well, you don't have to listen to them if you don't want to, but just remember that they are the ones who determine your actual mortgage rates in the end.;)

The OCR is not going to 3%, very happy to have a virtual wager with anyone. The fact that WBC have said this is gives me complete confidence.

Swap markets are already predicting a peak close to 3%. In your "complete confidence", probably you must know something that most market participants are not aware of.

Then place a bet with me.

I'll join you te Kooti.

BTW, where do you see it peaking? I had thought 1.5-1.75%, but I would now say (erring on the cautious side) 2%.

My view, clearly there is a lot of heat in the economy that in more orthodox times would see OCR well above 3%. However these are not orthodox times - the inflation spike is mostly self inflicted supply side (supply chain and cheap labour disruption). Add to that price increases from energy where the whole net zero agenda is going to be extraordinarily inflationary. The final piece is just how much more leverage there is on public and private balance sheets which means each 25bp hike now will be like 50bp 5 years ago. I also do not see the Fed/ECB/RBA tightening hard which means a higher TWI hitting exports.

So I think OCR hits 2% to 2.25% as the ceiling. That's my view, let's see.

Totally agree with your rationale.

Thanks for sharing your thought process! I tend to agree for similar reasons. I think the OCR will go up quickly, but will plateau lower than where many think it will.

At a retail level, I can sense many are rushing to banks to break and fix. This may be because they've missed out on the 2.99% 5 year rates and are now panicking. This may mean people panic onto a 5 year rate. But, personally, I feel a 3 year rate is probably better value. What do you think?

I know you posed the question to Te Kooti, but my view is yes 3 years better.

The main reason for that is economies go in cycles, and I think there will be reason to cut the OCR heavily again within the next 2-3 years, perhaps as low or even lower than we are now.

It really depends on your personal circumstances. Generally you pay away a yield curve premium the further you go out but rates are still very low historically. If you are near your debt servicing ability then go 5 years and have the peace of mind. Also depends what it costs to break the fixed rate.

Thank you, well said.

To put in perspective how dumb Westpac's call is, you have to go back to pre-GFC to have a cash rate >3% (apart from a brief 6 month period around 2015 which was a monumental mistake)

… and talk about adding fuel to the fire for a generation of young home owners already feeling burned about playing catch up to save a 20% deposit with huge YOY increases to house prices … yikes. If the swaps are similar you’d be talking about rates higher than the current rates banks are testing affordability at.

Thanks for the reply. I agree that there will be a tightening cycle of 2-3 years, which will eventually cause some serious economic pain after which point the RB will have little choice but to cut the OCR.

One way or another, we've all already Placed our Bets.

Any decision is best based on "Can I afford to be wrong?" and if you have 40 years of Time left to recover, then risk-taking is part of the bet.

If you have none (you're retired, say) then blindly doing what you did 25 years ago "Because it worked then, and will now", may not be such a good idea. (My point being, bets are best placed between equals; age, financial capacity, employment qualifications etc, and I doubt that's what we all are.)

So you reckon it might be 6.5% after all?! Could be.

None of us know - not even the RBNZ. That's the problem with Risk and Debt. We all only know, after the event.

(NB: Risk Management is about probability. And in simple terms, when something is as high or as low as it's ever been, the probabilities are higher than not that some sort of correction will occur. The skill is deciding, "How much could that be?" OCR of 3%, to me, doesn't look nearly enough. But we'll all know in due course!)

WBC were the ones who went against the pack and predicted house prices rising a couple of years back and got flak from every commentator on this site as everyone believed it was the peak.

Didn't WBC also pick epic falls after the April 2020 lockdowns?

This was what I meant Te Kootu...

https://www.interest.co.nz/personal-finance/113067/westpac-raises-mortg…

COH

Agreed.

It seems that people like Passerby and others below can't read beyond the headline.

The message here is that in the economy has done better than expected (unemployment down) and inflation has been higher than expected . . . two key factors that RBNZ will be taking into consideration and so yes, the reality is that the OCR is likely to go higher and possibly more quickly.

Anyone with a bit of financial nous will be reading and considering these comments. The reality for most on this site is that the implication is that mortgage rates may go higher and more quickly than expected.

Economics is not an exact science and those who make successful financial decisions will consider a range of comments and come to their own conclusion and not simply bury their head in the sand. I take comments such as that by Passerby as either naive or reflecting a need for an ego boost.

Interestingly there were plenty of signals three months or so ago that there was upside to interest rates. I posted at the time that the then BNZ 5 year rate of 2.99% looked attractive - and that was not because I am a soothsayer, but rather it was based on informed reasoning from comments being made by Orr and bank economists. As you say they are the ones who determine interest rates.

If I had a mortgage rather than burying my head in the sand as argued by Passerby, I would be seriously looking at a range of comments and considering the implications if I had a mortgage and especially if I was in the process of re-fixing one or looking to buy a home.

Well argued, Printer8.

There are people who've got themselves donkey-deep in debt and they're in for a rough ride.

For others, as always, there'll be a silver lining.

TTP

The only question is whether the inflation will last long enough for the RBNZ to get to 3% in 0.25% increments every 3 months. Seems unlikely to me, once people have to fix at these new rates they will put their wallet away pretty quickly.

Really great to see some reasoned debate such as Te Kooti at 11.04am subsequent to my post . . . that is what this site should be about - discussion and consideration of a range of views and the rationale for them.

As said economics is not an exact science but one needs to consider the range of comments such as those of Westpac - and in particular the rationale behind them - to come to one’s own conclusion.

Will the OCR go to 3%? I’m not committing to that exact figure but clearly the takeaway is that there is likely to more upside and likely to be more quickly than has been previously thought.

On that basis and the likelihood of more significant and quicker upside, I would definitely take this into consideration if either I had an existing mortgage, or was looking to re-fix, or considering buying.

The unknown in this instance is what Orr will do to curtail inflation. How much of inflation is being driven by house prices, noting that most if not all are predicting that house prices will flatten or even retreat on the current conditions, vs house much is being driven by Government spending and Orr's own quantitative easing?

Orr has no ability to tell Robertson what to do (apart from dropping statements for the media to pick up on), and if house prices are stabilising, then increasing the OCR has a potential to cause more damage to the stability of the markets and the banking system, his overarching responsibility, and he doesn't seem the sort to want a reputation such as that.

So that leaves quantitative tightening, likely along with moderate increases in the OCR to send more of psychological message to the public hopefully to curtail "buying a boat on the house".

TLDR; I don't think there is much history or president to foretell what Orr will do.

Tighten things up until no one can qualify for any new finance and banks stop getting new businesses…

Westpac jump around like maniacs on predictions, and have a very poor record.

To be ignored.

But for fun and mockery I have made a note of this latest absurdity, to return to this time next year.

Westpac should keep this Acting Chief Economist, this is the first realistic forecast Ive seen from them in the last 2 years.

When I read a prediction from Westpac I hear the Benny Hill theme. Their trading business had a shocking year so I would look elsewhere for a view.

Well all their other predictions have come true

I think Westpac are being a tad cautious like all economists. We are going to see some frightening increases in inflation as we come out of hibernation in the north. Only one thing will stop it. More lockdowns if the hospital system collapses.

Have you read ANZ economists statements regarding the housing market: https://i.stuff.co.nz/business/300445514/house-price-crash-warning-its-…

She has always been unusually DGM though given her position & employer...

Interesting speech.One notes the words in a negative light..."speculator", "unsustainable", "multiple ownership", "five or more houses", "closing tax loop holes", and the following in a positive note..."more construction", "basic infrastructure", "developer package".

Big picture is favoring new developments, while targeting speculation on existing stock.

Dear I say it, but TDs are coming back in fashion.

If you can tolerate the risk its much better to put it into some of the top ten cryptos.

What use is a 3% TD when inflation is running at 5%

A hedge against higher inflation and money in the cash account?

3% OCR would put mortgage rates between 5-6% me thinks? Lets call it double the current rates. That is a serious increase in interest payments to deal with my goodness.

5% mortgages should be realistically expected by any one borrowing. The average rate over the last 20 years is probably between 5 and 6.5, thats just a guess.

Average 2 year fixed rate over the last 20 years is 6.3, according the the graph linked to here: https://www.rbnz.govt.nz/statistics/key-graphs/key-graph-mortgage-rates

That same chart shows that the average rate is meaningless as there's a clear downwards trend. Reversion to mean would be reversion to trend.

You're giving people way too much credit mate.

I don't think many would expect their mortgage repayments to double in just 2 or 3 years (and I am not convinced that will happen either)

Mortgage rates have been decreasing for the last 40+ years, which makes the average almost useless.

Stress testing is 6% thereabouts on any new loans, and role over of existing loans. Perhaps this could be for a reason vs. just for laughs...

Of course. But Joe Bloggs with the mortgage has either a) not listened to the bank when they informed him or b) listened but does not understand what it means or c) never thought it would actually happen.

Does it really happen on role over? What do they do, force you to sell?

In 87 they sold you up, which made the problem worse. In GFC they held the line as long as you could make payments. A lot of kids left private school education at that time for the local public school. I would suspect the latter would occur. Summary - don't loose your day job.

Would be north of 6%, and perhaps close to 7% for low deposit house buyers.

Won't happen, it will kill the economy.

Westpac and many commentators here are deluded if they think the RBNZ / govt will kill the economy.

A lot of myopic views (and wishful thinking?), that don't take into account the RBNZ's multi-pronged mandate.

Rampant inflation will also kill the economy, its already at 4.9% and going up. They will have no choice but to raise OCR significantly, Orr has made this crystal clear.

Yes he has made it clear, and he will raise it for sure.

But to 3%? I just don't buy that.

BTW, much of the inflation is supply-side not demand-side, and that will inform their decision making.

On a 650K mortgage, which is becoming pretty standard for FHBs, at 6% on a 30 year mortgage, that's a weekly payment of $900.

With insurances, rates, and body corporate let's say $1000.

That rapidly shrinks realisable demand for new housing. Especially as I assume banks would then stress test at 8 or 9%?

Watch the residential construction sector and property sector collapse if this happens. And watch discretionary spending in the wider economy drop back a lot.

What do those calculations reveal with a 50-Year Mortgage Term? (An option of diluting Principal Repayment. "Coming, soon", to a place near us all?)

(NB: Standard business practice is to extend the credit terms to debtors who can't pay. Better to try to recoup something over a longer term than risk your debtor going bankrupt, and you getting nothing, today)

Property sector collapse?? Err, immigration!

This is nothing new - swap markets are already predicting an OCR peak close to 3%.

Are Swap Markets foolproof?

I don't think so.

Of course not but my guess is, like with inflation, are better at forecasting than bank/central bank economists. At the end of the day however, what really matters is what happens in the (G4) US, China, Japan and Europe.

Looks like all the bank economists are signalling to investors to price in the rates with rent increments.

Rates and insurance increases (both significant and one-way) are the major drivers for my rental increases. Mortgage is locked in for 5 years so has no bearing on rent for me.

Tony Alexander calling an end to the property party on RNZ earlier today. I had to check my ears.

Only after one final dash this summer.

Summer and border reopening might be the high tide mark.

He has a big fan base amongst investors. Will be interesting to see if some decide to beat the rush to the doors...and thus bring forward his predictions.

Mind you, I don't think he's saying there will be a collapse in prices.

He seems to be implying flatness / small drop.

Zen20, T Alexander has been right predicting house prices over the last 30 years, you may want to pay attention and listen to him when he calls for an end to the property party

Think they'll run out of time on this market cycle long before 2023.

Lets get honest here, Economists have no long range prediction skills any better than the guy sitting next to them. All they can predict is what's right in front of their face and we can all do that. Some months ago they were not predicting interest rises until 2022-23 and everyone continued in party mode. Turns out some people should have quit drinking and called a cab.

Will headlines like this in Stuff start a rush for the exits?

Homed & Oneroof will be cranking out the puff pieces rapid fire

Sure will. Bring the popcorn, will be comedy gold.

Church will probably call flatness in the market in the short but pump up the medium- long term prospects.

Kind of wonder why stuff is coming out with these articles all of sudden. Theyve been pretty quiet on housing for sometime. Perhaps everyone's over covid articles?

Why did he move to a cheaper localation in Hawkes Bay...?

Cashing out, jumping to a "growth" area. Funnily enough he's bullish on Hawkes Bay in general, and Napier in particular, right now..

T Alexander has been saying for a while that the RBNZ is too slow to hike the OCR and that the longer they wait and delay, the higher the peak will have to be, I for one agree with him.

Agreed.

You can't pull inflation down with interest rates under the inflation rate. You must crush it from above.

Crush/manage...same thing really.

As usual rate increases will be too little too late: exact reverse of the cuts.

Current OCR 2% and inflation is 4.9%

Hence we have real rates of negative 2.9%

Big tightening up, not

Meanwhile wages up 2.1%

Recession rapidly approaching as in two negative quarters

Not sure we have enough oomph for rising rates to last too long. WBC is saying up & then down & that's my read at this point. Keep things short if you get stuck. It'll be fun, for sure, but don't right off RB & Govt to keep things open either.

As Passerby so eloquently puts it,.... yawn. Couldn't they all be retrained to do something useful like pick fruit?

In other news, Fiat is also going to close to zero in the next 20 years.

Cheers.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.