Heartland Bank

Kiwibank launches a one year fixed mortgage 'special' of 2.99% and is the first major lender to offer a home loan rate below 3%

7th May 20, 6:23pm

73

Kiwibank launches a one year fixed mortgage 'special' of 2.99% and is the first major lender to offer a home loan rate below 3%

China Construction Bank launches a 2.80% one year fixed rate 'special', now the third bank to offer home loan rates below 3%

4th May 20, 2:07pm

27

China Construction Bank launches a 2.80% one year fixed rate 'special', now the third bank to offer home loan rates below 3%

RBNZ offers banks more help to encourage them to keep lending... but at a cost, as it restricts them from paying dividends until the economic outlook improves

2nd Apr 20, 10:03am

71

RBNZ offers banks more help to encourage them to keep lending... but at a cost, as it restricts them from paying dividends until the economic outlook improves

ASB tests the low end of term deposit offer ranges with a range of cuts up to -20 bps. Other banks sure to follow and loan demand is expected to dive and mortgage rates fall

27th Mar 20, 9:55am

34

ASB tests the low end of term deposit offer ranges with a range of cuts up to -20 bps. Other banks sure to follow and loan demand is expected to dive and mortgage rates fall

Fixed mortgage rate offers below 3% arrive with HSBC's Premier new one year and eighteen month rates. They cut all other fixed rates too

26th Mar 20, 8:57am

3

Fixed mortgage rate offers below 3% arrive with HSBC's Premier new one year and eighteen month rates. They cut all other fixed rates too

More banks make fixed home loan rate cuts and match them with steep term deposit rate cuts and the overall level of interest rates sink lower

25th Mar 20, 10:42am

28

More banks make fixed home loan rate cuts and match them with steep term deposit rate cuts and the overall level of interest rates sink lower

Interest rate changes are now fast-moving and volatile, at both the wholesale and retail levels. We update what that means for term deposit investors

21st Mar 20, 4:24pm

38

Interest rate changes are now fast-moving and volatile, at both the wholesale and retail levels. We update what that means for term deposit investors

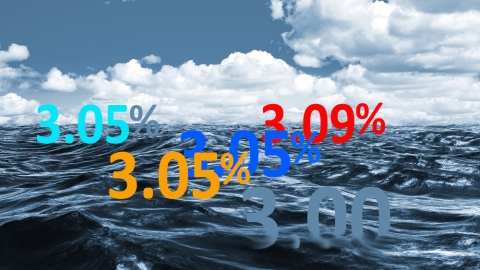

Bank of New Zealand launches a market leading 18 month fixed mortgage rate offer at just 3.05%, the lowest rate for this term by any bank. They also change term deposit rates

20th Mar 20, 6:17pm

17

Bank of New Zealand launches a market leading 18 month fixed mortgage rate offer at just 3.05%, the lowest rate for this term by any bank. They also change term deposit rates

Kiwibank is cutting 1-year fixed mortgage rate 'special' by -36 bps from Monday to 3.09%, and cutting savings rates by between -10 and -50 bps

19th Mar 20, 1:23pm

29

Kiwibank is cutting 1-year fixed mortgage rate 'special' by -36 bps from Monday to 3.09%, and cutting savings rates by between -10 and -50 bps

ANZ sets a record low one year fixed home loan rate and slices -25 bps off of almost all term deposit offers. Other banks expected to follow soon

18th Mar 20, 4:49pm

44

ANZ sets a record low one year fixed home loan rate and slices -25 bps off of almost all term deposit offers. Other banks expected to follow soon

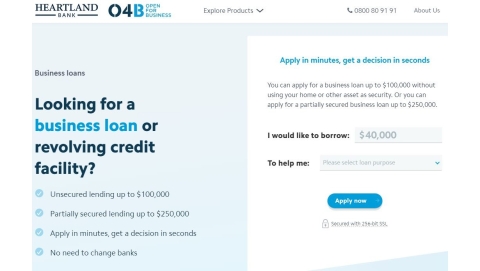

Heartland Group Holdings says home loan offering well received, sees overall lending growth continuing and is comfortable with its capital, liquidity and deposit reinvestment levels

18th Mar 20, 9:53am

Heartland Group Holdings says home loan offering well received, sees overall lending growth continuing and is comfortable with its capital, liquidity and deposit reinvestment levels

A downbeat economic outlook is seeing more banks cut their term deposit offers and the trend is probably only just starting

12th Mar 20, 10:46am

33

A downbeat economic outlook is seeing more banks cut their term deposit offers and the trend is probably only just starting

Big market opportunity seen for Heartland Group Holdings' push into the residential mortgage market

9th Mar 20, 9:27am

2

Big market opportunity seen for Heartland Group Holdings' push into the residential mortgage market

The Red Bank takes a sharp knife to its three, four and five year fixed home loan rates, making them all much lower than their main rivals. They also trim term deposit rates

5th Mar 20, 5:08pm

18

The Red Bank takes a sharp knife to its three, four and five year fixed home loan rates, making them all much lower than their main rivals. They also trim term deposit rates

Heartland launches online home loan offers with aggressive one to three year fixed rates and a floating rate as it tests appetite for digital mortgages

5th Mar 20, 7:35am

31

Heartland launches online home loan offers with aggressive one to three year fixed rates and a floating rate as it tests appetite for digital mortgages

Heartland Bank says enquiries about reverse mortgages are the highest it has experienced to date, helped by the ongoing low interest rate environment

20th Feb 20, 2:18pm

3

Heartland Bank says enquiries about reverse mortgages are the highest it has experienced to date, helped by the ongoing low interest rate environment

Heartland Bank CEO Chris Flood sees opportunities in several areas as his bank's bigger rivals wrestle with new RBNZ-imposed regulatory capital requirements

19th Feb 20, 7:38am

Heartland Bank CEO Chris Flood sees opportunities in several areas as his bank's bigger rivals wrestle with new RBNZ-imposed regulatory capital requirements

Financial Markets Authority says peer-to-peer lending was designed to provide a new investment opportunity for New Zealanders, and continues to do so despite Harmoney quitting the retail investor market

14th Feb 20, 9:42am

2

Financial Markets Authority says peer-to-peer lending was designed to provide a new investment opportunity for New Zealanders, and continues to do so despite Harmoney quitting the retail investor market

New Zealand's largest bank leads with term deposit rate increases to their core rate card, taking offers to among the best by a main bank

12th Feb 20, 5:56pm

New Zealand's largest bank leads with term deposit rate increases to their core rate card, taking offers to among the best by a main bank

Annual advertising spending by New Zealand banks increased by more than a quarter in 2019 with all four major banks recording increases

7th Feb 20, 9:16am

Annual advertising spending by New Zealand banks increased by more than a quarter in 2019 with all four major banks recording increases

Heartland's not commenting on speculation it's one of the shortlisted parties vying to buy UDC from ANZ - but it has long been an admirer of the business

24th Jan 20, 8:30am

1

Heartland's not commenting on speculation it's one of the shortlisted parties vying to buy UDC from ANZ - but it has long been an admirer of the business

Kiwibank follows BNZ with new higher term deposit rate offers and sets its highest rate at just 200 days. And they have added a juicy incentive

23rd Jan 20, 4:41pm

Kiwibank follows BNZ with new higher term deposit rate offers and sets its highest rate at just 200 days. And they have added a juicy incentive

BNZ reverses the trend of ever lower term deposit rate offers with a Chinese New Year 'special' that is close to the best offer in the market for any bank

21st Jan 20, 10:46am

12

BNZ reverses the trend of ever lower term deposit rate offers with a Chinese New Year 'special' that is close to the best offer in the market for any bank

RBNZ increases its supervisory monitoring of BNZ and applies a 'precautionary' $250 mln increase to its regulatory capital requirements following the identification of weaknesses in BNZ’s capital calculation processes

19th Nov 19, 3:47pm

14

RBNZ increases its supervisory monitoring of BNZ and applies a 'precautionary' $250 mln increase to its regulatory capital requirements following the identification of weaknesses in BNZ’s capital calculation processes

CEO Jeff Greenslade says Heartland Group has launched its 'O4B' unsecured online small business lending service in Australia as it strives to improve return on equity

12th Nov 19, 10:42am

1

CEO Jeff Greenslade says Heartland Group has launched its 'O4B' unsecured online small business lending service in Australia as it strives to improve return on equity