SBS Bank

SBS Bank says it may face customer remediation payments or Commerce Commission action over credit contracts and consumer finance related issues

28th Nov 22, 9:17am

2

SBS Bank says it may face customer remediation payments or Commerce Commission action over credit contracts and consumer finance related issues

ASB the biggest user of the public money on offer via the Reserve Bank's Funding for Lending Programme

22nd Jul 22, 5:00am

27

ASB the biggest user of the public money on offer via the Reserve Bank's Funding for Lending Programme

SBS Bank, Co-operative Bank, Rabobank keen on 365-day payments move, Heartland Bank not in a hurry

16th Jun 22, 10:28am

1

SBS Bank, Co-operative Bank, Rabobank keen on 365-day payments move, Heartland Bank not in a hurry

SBS Bank happy with Reserve Bank's preferred capital instrument option for mutual banks

12th Jun 22, 2:44pm

SBS Bank happy with Reserve Bank's preferred capital instrument option for mutual banks

For the first time in almost seven years, a 4% one year term deposit offer resurfaces, this one from SBS Bank, as the OCR rate hikes finally start flowing through to savers. The main banks are laggards for TD savers

3rd Jun 22, 9:07am

37

For the first time in almost seven years, a 4% one year term deposit offer resurfaces, this one from SBS Bank, as the OCR rate hikes finally start flowing through to savers. The main banks are laggards for TD savers

New Zealand banks appear well prepared to meet their increasing regulatory capital requirements

18th Mar 22, 9:38am

New Zealand banks appear well prepared to meet their increasing regulatory capital requirements

Banks have talked the talk on reducing fees over the past two years. Have their actions matched this?

17th Mar 22, 5:00am

3

Banks have talked the talk on reducing fees over the past two years. Have their actions matched this?

New Zealand banks' annual funding costs sink as big banks tighten grip on lending market

9th Mar 22, 10:53am

1

New Zealand banks' annual funding costs sink as big banks tighten grip on lending market

Banks have tapped into the Reserve Bank's Funding for Lending Programme to the tune of more than $8 billion to date

2nd Mar 22, 11:55am

24

Banks have tapped into the Reserve Bank's Funding for Lending Programme to the tune of more than $8 billion to date

The nation's largest home loan lender takes a chance and pulls up some key home loan rates, with most of its fixed term offers now higher than all, probably hoping its main rivals will follow soon

14th Feb 22, 8:13pm

33

The nation's largest home loan lender takes a chance and pulls up some key home loan rates, with most of its fixed term offers now higher than all, probably hoping its main rivals will follow soon

Challenger banks make changes to some key home loan rates, some up as expected, others down unexpectedly

14th Feb 22, 10:37am

6

Challenger banks make changes to some key home loan rates, some up as expected, others down unexpectedly

RBNZ runs double whammy of bank liquidity and solvency stress tests, says there's more work to do for banks to withstand a one-in-200 year event

8th Dec 21, 10:36am

13

RBNZ runs double whammy of bank liquidity and solvency stress tests, says there's more work to do for banks to withstand a one-in-200 year event

Gareth Vaughan mulls whether our banks' strong profits in a time of Covid-19 induced upheaval warrant a one-off Covid tax

14th Nov 21, 6:00am

78

Gareth Vaughan mulls whether our banks' strong profits in a time of Covid-19 induced upheaval warrant a one-off Covid tax

SBS Bank names Mark McLean, currently general manager for member experience, its new CEO to succeed the departing Shaun Drylie

5th Nov 21, 1:29pm

SBS Bank names Mark McLean, currently general manager for member experience, its new CEO to succeed the departing Shaun Drylie

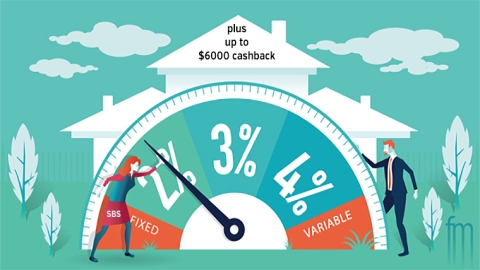

SBS Bank launches a comprehensive home loan offer for first home buyers featuring a 1.99% rate fixed for one year, boosted by four other incentives

6th Aug 21, 10:31am

17

SBS Bank launches a comprehensive home loan offer for first home buyers featuring a 1.99% rate fixed for one year, boosted by four other incentives

SBS Bank focusing on first home buyer, consumer and reverse equity lending as it calls time on rural lending and pulls back on commercial lending

4th Jun 21, 10:03am

5

SBS Bank focusing on first home buyer, consumer and reverse equity lending as it calls time on rural lending and pulls back on commercial lending

SBS Bank's new very low one year fixed rate offer is available for first home buyers with only a 10%+ deposit. Others need 20%. Investors need 40%.

7th May 21, 4:50pm

9

SBS Bank's new very low one year fixed rate offer is available for first home buyers with only a 10%+ deposit. Others need 20%. Investors need 40%.

The country's key home lenders detail where they're at with COVID-19 related mortgage deferrals as the year long scheme comes to an end

8th Apr 21, 10:14am

14

The country's key home lenders detail where they're at with COVID-19 related mortgage deferrals as the year long scheme comes to an end

SBS Bank raises its 2 and 3 year term deposit rates sharply. Have we reached the bottom for term deposit rates now that benchmark yields are on the way up again?

21st Mar 21, 9:17am

32

SBS Bank raises its 2 and 3 year term deposit rates sharply. Have we reached the bottom for term deposit rates now that benchmark yields are on the way up again?

SBS Bank extends its 2.29% home loan rate out to terms of 18 months and two years fixed, making the two year offer the lowest in the market. It is also offering up to $6000 as a cash incentive

12th Feb 21, 4:02pm

15

SBS Bank extends its 2.29% home loan rate out to terms of 18 months and two years fixed, making the two year offer the lowest in the market. It is also offering up to $6000 as a cash incentive

The RBNZ delaying moves to level capital playing field with Aussie owned banks disappoints NZ owned banks, and exclusion from the Funding for Lending Programme disappoints building societies and credit unions

12th Nov 20, 9:40am

3

The RBNZ delaying moves to level capital playing field with Aussie owned banks disappoints NZ owned banks, and exclusion from the Funding for Lending Programme disappoints building societies and credit unions

Another challenger bank has launched even lower home loan rate offers today, the first time any mortgage rate has fallen below 2%. These Heartland offers are digital-only

12th Oct 20, 2:07pm

42

Another challenger bank has launched even lower home loan rate offers today, the first time any mortgage rate has fallen below 2%. These Heartland offers are digital-only

Challenger bank SBS has grabbed the market leading home loan rate position with 2.49% fixed for 18 months, two and three years

12th Oct 20, 9:27am

20

Challenger bank SBS has grabbed the market leading home loan rate position with 2.49% fixed for 18 months, two and three years

New Zealand's big five banks felt the icy blast of COVID-19 during the June quarter, with profits and net interest margins down, and cost-to-income ratios and non-performing loans up

26th Aug 20, 9:49am

New Zealand's big five banks felt the icy blast of COVID-19 during the June quarter, with profits and net interest margins down, and cost-to-income ratios and non-performing loans up

Covid-19 update: Director-General of Health says two work colleagues and two people from a 'related household' of confirmed cases are suspected to have Covid

12th Aug 20, 4:39pm

115

Covid-19 update: Director-General of Health says two work colleagues and two people from a 'related household' of confirmed cases are suspected to have Covid