Summary of key points:

- The US dollar set to follow the sharply lower bond yields

- Measures to reduce the risk premium from “boom/bust” economic cycles

- Australian dollar breaks out of its downtrend

The US dollar set to follow the sharply lower bond yields

Global financial and investment markets are being forced to change their tune rather promptly in respect to the extent and longevity of this US monetary policy tightening cycle.

Just a few short weeks ago the bond and currency markets were pricing interest rate yields and the US dollar value both progressively higher and higher as they foresaw even more aggressive monetary tightening by the Federal Reserve in response to inflation and inflationary expectations lifting by more than what was anticipated. However, as this column has highlighted over recent weeks, forward-looking lead indicators on the US economy were already signalling an abrupt slowdown in consumer spending, housing and manufacturing across June and July.

It was highly instructive that the Fed’s very first sentence in their monetary policy statement last week recognised that “spending and production had slowed more than expected”. The markets had widely expected another 0.75% interest rate hike and that is what was duly delivered.

There were several hints in Fed Governor, Jerome Powell’s media Q & A after the statement last Thursday morning that weaker than forecast economic data would result in the Fed nearing the end of its tightening cycle at an earlier time than originally expected. Governor Powell was adamant that he did not see the US economy being in recession as the labour market remains so strong with a record low unemployment rate and record high job vacancies. His confidence in this respect was effectively smashed the very next day when GDP growth data printed at a negative 0.90% for the year to June.

On top of the -1.60% in the March quarter, the US economy is technically already in recession. Inventories, retail spending, services and manufacturing sectors were all weaker across the board. Whilst supply bottlenecks have contributed to the large increase in inflation, the demand side of the US economy is rapidly reducing to better align with tight supply, and thus in doing so automatically reducing inflationary pressures. The Michigan consumer survey on inflation expectations reduced in July after Mr Powell highlighted his surprise at how much higher this survey was in June.

Yet again, it is the US long term interest rate market that is the first cab off the rank in reacting to the rapidly changing economic circumstances. The US 10-year treasury bond yield falling further away to 2.63% following the Fed statement and GDP data. Equity markets perversely rallied on the weaker economic data, as they factor in the positive side of things in the form of interest rates not going as high as they previously feared. The overall value of the US dollar, as measured by the Dixie Index, has already pulled back 3.00% from its high of 109.00 in mid-July to 105.70 on Friday 29th July. Further depreciation of the over-valued US dollar over coming weeks and months has to be expected as the forex markets start to price-in US interest rate cuts next year, no longer pricing-in interest rate increases this year. The US dollar Dixie index is highly correlated to the 10-year bond yields, however, in a lagged fashion. As previously stated in earlier columns, the US dollar Index has a lot of catching up to do to the sharply lower bond yields which have reduced from 3.50% three weeks ago to 2.63% today. Tracking the 2.63% bond yields, the US dollar Index looks set to depreciate to 101.00, which is the equivalent of an NZD/USD exchange rate of 0.6600. Whilst our forecast “V” and “W” shaped recoveries back up in the NZD/USD rate have not eventuated over recent months, the odds are that in the now abruptly changed market conditions described above, we could well see a return to 0.6500/0.6600 reasonably quickly.

Measures to reduce the risk premium from “boom/bust” economic cycles

Whilst local New Zealand economic and market factors continue to have absolutely no influence over the NZD/USD exchange rate direction, we feel the need to comment on the overall state of the NZ economy as the debate and criticism hots up on how the Government and the RBNZ have handled things in recent years.

There is no question that both bodies poured excessive amounts of cash into the economy in response to the Covid health emergency, much more than other countries. Both have contributed to the “boom/bust” outcome in asset values and economic activity levels witnessed over the last two years. “Boom/bust” economic cycles are not new for New Zealand, we have seen plenty of residential property and commodity price related boom/bust cycles since the 1960’s. The latest boom/bust cycle is only different in that it was caused by Government fiscal policy and RBNZ monetary policy actions.

Instead of harking for an independent enquiry into the RBNZ’s past decisions, our energy and intellectual horsepower is better off spent addressing the changes that we could make as an economy that results in us being less vulnerable to boom/bust cycles.

The volatility of economic performance from boom/bust cycles adds an extra risk premium on our interest rates compared to the rest of the world and also adds a vulnerability to the Kiwi dollar’s value at times. As every business knows, a higher volatility of profitability from year to year detracts from enterprise value.

In the writer’s view, the following three broad areas should be addressed/rectified to reduce the risk of boom/bust cycles dragging down our overall economic performance and thus our standard of living here in New Zealand: -

- Build more economic resilience: As many of our export industries are already doing, move up the value chain in food and fibre and away from producing commodities and being a price-taker. Adding more value to product within New Zealand requires business investment, infrastructure and labour resources.

- Even up the investment playing field: Buying and selling existing residential properties with each other adds no economic value to the nation. New Zealanders prefer to invest and speculate in property because in the past the tax rules have biased them to this activity.

- Reduce the excessive bureaucratic overhead: Over the last decade we have allowed excessive regulation and compliance to slow/prevent economic expansion and add a layer of additional cost that makes us uncompetitive globally. A detailed examination of the high domestic, non-tradable inflation over the last 10 years is evidence of this overhead burden. For the size of the economy the overhead cost ratio is completely out of whack. Sustainability is a much over-used word; however our overhead cost appears unsustainable!

The above plan may read like an Act/National political party election manifesto, however if we desire a better standard of living, New Zealand has to make some changes to its current economic direction (in my humble opinion). Perhaps carbon emissions and ESG need to be added to the plan, as they seem to be added to everything nowadays.

New Zealand basically needs more people living here who work and pay taxes and thus we spread the bureaucratic overhead cost across a larger economic activity base. Strong inwards immigration is also nothing new for New Zealand. In the 1950’s and 1960’s the Dutch and English arrived in droves and contributed to the building of the economy. In the 1960’s and 1970’s Polynesian Islanders came to work in the factories to produce consumer goods that were prevented from being imported. More latterly, Asians, Indians and South Africans have come in and contributed to many industries.

New Zealand’s immigration policies require a major revamp to address our chronic labour shortages that are currently restricting public services and private sector output alike. However, the current Government’s ideology prevents them from going there.

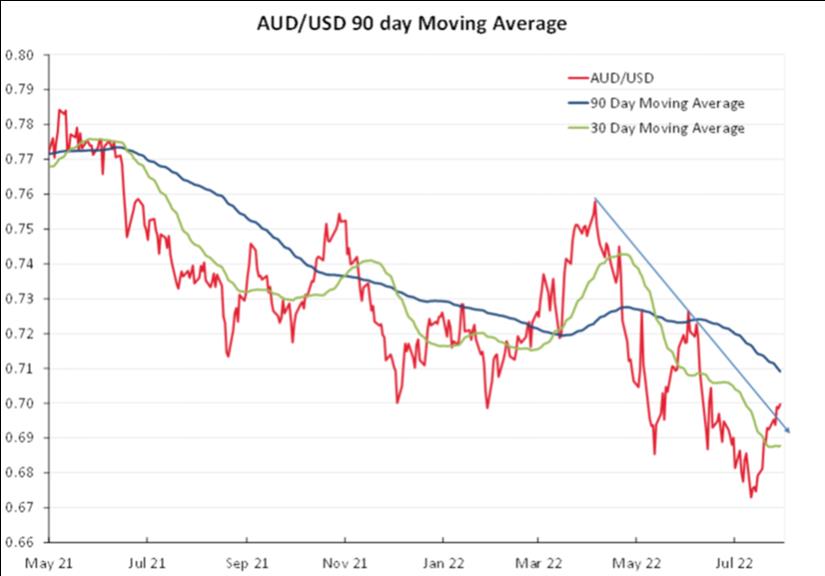

Australian dollar breaks out of its downtrend

The recovery in the Australian dollar exchange rate to 0.7000 against the USD after several weeks in the 0.6700 to 0.6900 trading range, points to likely further AUD gains as downtrend lines are broken to the top-side (refer chart below). The NZD/USD rate will religiously follow the AUD/USD rate higher.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

10 Comments

Great article. Except this part.

The above plan may read like an Act/National political party election manifesto

Unfortunately not at present. National is currently only addressing one of the three points raised - being 'less bureaucracy'. The other two components unfortunately are not being pushed, quite the opposite.

Rather as i see it from the press - the National party MPs and leaders are bulk owners of investment property and planning to reintroduce policies that are aimed to reinflate the investment led housing market instead of trying to drive investment and focus away from it toward more productive, innovative export oriented businesses.

We need a party leader with the confidence and vision to sell the value of, and drive through a Capital Gains Tax, and start to make it unattractive to invest in property vs business. In fact to drive capital away from property and make property more affordable so we attract and develop more young professionals and entrepreneurs. Currently the leaders are just giving people what they want rather than selling a vision for NZ and proposing policies that support that vision, even if they upset a few wealthy individuals on the way.

So its ACT then as the only rational answer

Would be good to know whether National are planning on taking a sword to the massive overbloating of the Wellington bureaucracy.

They should be.

... or will they do a "John Key " ... whinge & bleat about middleclass socialism , whilst in opposition ... then do absolutely nothing to unwind it once in power ...

9 wasted years , John & Bill !

Taxes are not the answer they always have unintended consequences if you want less of something tax it.

The answer to NZs residential property problem is to provide more supply, deregulate as much as possible every part of the equation, supply chains, materials, land supply, compliance processes as well enabling and supporting councils to fund development infrastructure. It needs a complete and comprehensive package. That’s where to pollical courage is needed.

But first we need a party that actually wants to make prices affordable - i.e. without a vested interested in increasing prices

Or, limit population growth and the "problem" goes away. Hey, I never thought of that?

So, if we tax accumulated or unearned wealth, we will have less unearned wealth? Sounds alright.

Agreeon supporting councils to fund infrastructre, but unregulated markets in small countries tend (quickly) towards a concentration and abuse of market power. Market regulation is very necessary. But, it could be smarter.

Shows how absurd it was for us to tax productive work while exempting speculators from tax, eh. We needed more productive enterprise and less land speculation.

Taxing bare unimproved land value while lowering company income taxes and taxes on housing development, now that would give us much more of what we need.

"New Zealand basically needs more people living here who work and pay taxes and thus we spread the bureaucratic overhead cost across a larger economic activity base." So when do we get that benefit from the mass of immigration we've already had? Obviously stuck in the alternative reality box.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.