- US factors – dominating

- Chinese factors – contributing

- NZ factors – irrelevant

US factors – dominating

The NZD/USD exchange rate has plunged back to the low of 0.6140, last seen in June, following the speech at Jackson Hole by US Federal Reserve Governor, Jerome Powell on Friday 26th August.

The Kiwi dollar was hit hard by the “risk aversion” investment market sentiment as the Dow Jones index on the US equities market dropped over 1,000 points on the day following the Powell speech.

The message from Powell was short, sharp and direct (his speech was just eight minutes long), the Fed will use their interest rate tool forcefully to beat inflation down, the higher interest rates will persist for some time, it will cause some pain to the US economy and the historical record cautions against prematurely loosening monetary policy. Whilst the equity markets seemed surprised at the ultra-hawkish tone and reacted violently, to some degree the FX and bond markets were already positioned beforehand for such a reaffirmation of the Fed’s stance. The USD only making marginal gains and the US 10-year Treasury Bond yield perversely pulling back to 3.03% having been as high as 3.11% prior to the statement.

So, the official line is that the Fed are some time away from pivoting on monetary policy and will maintain interest rates “higher for longer” to reverse the upwards inflation trend. However, the rapidly emerging reality in the US economy may well turn out to be something entirely different and the financial/investment markets will reflect that reality sooner than what you may think. Having made a major monetary policy blunder last year in thinking the inflation increases were “transitory” (i.e. temporary), the Fed are today running the risk of another “policy error” by keeping monetary policy too tight for too long and thus causing a hard landing for the US economy i.e. recession.

Jerome Powell stated that it will take more than one or two months of softer economic data to convince the Fed to deaccelerate the pace of interest rate hikes. As is always the case, everything depends on the upcoming economic data. Already major parts of the US economy have abruptly slowed up in activity levels across June/July/August – retail, services, manufacturing, industrial production and housing are all weaker. The July inflation increase was less than expected with the annual rate decreasing to 8.50% from 9.10% in June. The August data is due for release on 14th September and is likely to result in further reductions in the annual inflation rate. The evidence of significantly weaker demand in the USD economy is already mounting.

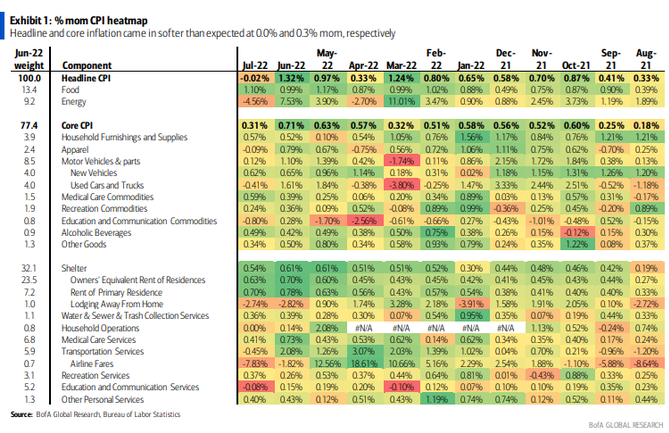

To understand the near term outlook for US inflation you need dissect the component parts to ascertain where the price increases are occurring and whether they will continue. A year ago it was supply chain disruptions that caused shortages of consumer goods and therefore massive price increases. Today it is the 40% of core inflation weighting of “shelter” (housing costs) in the CPI index that is causing the inflation increases with repeating 0.50% increases every month over the last six months. The Bank of America inflation “heat map” table below confirms the issue with the dark green increases for shelter totally dominating the overall figures. Several lead indicators for the US housing market (such as the NAHD Housing Index) point to a rapid decline into a housing recession with new builds/existing house sales off sharply and house prices starting to fall. It is very difficult to see rents and implied rents continuing to increase in these housing market conditions.

Given the much more stable food and energy prices, the Fed’s inflation problem is already solving itself!

The FX markets always look forward to expected future changes, therefore on the above evidence the balance of probability is that US inflation could reduce over coming months as fast as it went up. The FX and bond markets will reflect that future state and therefore the US dollar may have seen its last surge higher. The risk of further USD gains pushing the NZD/USD rate below 0.6000 is diminishing alongside the trend of lower US inflation.

The next key dates for the FX markets in terms of US economic data will be the August jobs figures on 2 September (a much lower increase less than 300,000 is forecast) and the Fed meeting on 22 September.

Chinese factors – contributing

The Chinese authorities are very busy stimulating economic activity through looser monetary policy as the Covid lockdowns and energy shortages (due to severe drought weather conditions) cause weaker retail and industrial trading conditions. The PBOC is cutting interest rates and allowing the Yuan currency value to depreciate to 6.87 against the USD. The NZD and AUD exchange rates remain correlated to the USD/CNY rate, therefore the reversal lower in the NZD, from 0.6450 just two weeks ago, is partially due to these China-related changes.

The stimulus measures will have a positive impact on economic data, therefore improving numbers coming out of China over coming months will be positive for the NZD and AUD.

NZ factors – irrelevant

Very similar to the All Black’s recent rugby performance, the NZ economy looks tired, lack-lustre, demotivated, complacent, poorly managed and bereft of fresh ideas. We are arguably already in recession conditions with the June quarter’s retail sales decrease proving just how out of touch economic forecasters are with the reality on the ground.

We highlighted in this column as far back as 12 months ago that worker shortages (due to the Government’s immigration policy) would inhibit export industry productive output and damage economic performance. Evidence of that was displayed by kiwifruit exporter, Zespri, last week as they reported their worst crop in terms of fruit quality for a long time due to being forced to use inexperienced labour in the orchard and packhouses. Large monthly overseas trade deficits confirms the export industry restrictions. The “Announcement” Government we currently have is contributing to the difficult economic times by keeping the orange Covid setting in place which signals to offshore travellers, business folk and investors that we are not yet open for business.

Whilst the NZ economy paints a decidedly negative picture, the NZ dollar value is unlikely to suffer as a result as there has been absolutely no offshore interest in the Kiwi for quite some time. The NZD/USD exchange rate movement will continue to be dominated by the USD side and the local NZ economic factors will continue to be totally irrelevant.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

19 Comments

It's the 2022 and Zespri still continue picking kiwifruit by hand. Ridiculous.

It's not just the picking that needs doing. Harvesting of many fruits is only a small portion of the input required, more important (and intensive) is the pruning and upkeep, which is far harder to mechanize, even in 2022.

There is ongoing development in this field, but full mechanisation is quite some while off, potentially requiring a ground-up change to how plants are grown and trained.

So some time away still, in the meantime people are still fairly critical.

New Zealand will have the same economic status as Zimbabwe 3 years from now if the current government is re-elected, with the Greens holding the balance of power. The government's economic and apartheid policies are very similar to those brought in by Robert Mugabe after he assumed power in Zimbabwe. We will get similar results, and those who invest in NZ and who also create jobs will leave for Australia.

Really?

Forced re distribution of all agriculture as a matter of policy.

Armed bands pushing farm owners of thier land?

Exactly. We're close already with just 6 years.

We have armed bandits taking from dairy owners nightly. Farmers are now not allowed to defend their property. Perhaps not a massive leap as one may think..?

Last week I suggested that people would do well to store their savings outside of the $NZ.

I suggested storing it in overseas shares, or PMs or anywhere else that the RBNZ cannot touch, or devalue.

I got a "LOL" in reply, and 7 people liked the LOL. Good luck to all of you LOLlers... you can keep your NZimbabwe sh/tcoin. My advice to get out of the kiwi dollar might just be the best financial advice you ever blindly ignored.

Yes, and even if you are wrong, there is no cost in protecting yourself anyway.

Kiwis have no idea how small we are in the financial world, things can blow up in an instant. The Kiwi $ is worth only what the global demand for our export products says it is.

Warnings have been loud and clear, one look at Grant and Orr is enough.

Exactly.

We are a dipsh/t little country with a reserve bank guv'nor who thought it was a good idea to make all homeowners "feel rich" by fandangling each of them hundreds of thousands of dollars of windfall "wealth" in the middle of a pandemic. Of course our dollar is at risk of becoming South Pacific pesos. Just wait till the property crash and economic carnage REALLY gets going.

I got my savings out of NZ about a year ago, told all my friends to do the same, and it was well worth the move.

The people who LOL'd at me on this site are in the same class of investor as the overleveraged property investors who LOL'd at all the crash warnings. Just blind.

Can I ask where you are keeping your vulture fund? I was looking at moving some to a foreign currency account at a NZ bank but no deposit guarantee makes me a bit nervous honestly.

I'd imagine that the banks would bleed you dry with fees if you do that. Mine is in USA shares mostly.

You could buy precious metals.

Funny enough I have 3 groups of people all wanting to shift significant amounts of wealth to NZ, from the US.

So basically in the 2020s most people everywhere seem to want to be anywhere other than where they are.

Why on earth would they want to shift to a currency that has been crumbling since 2021? Have they not seen the graph in the article above? ⏫

I guess they're looking at their own economy, and feeling less than optimistic about it.

2021 isn't a very long timescale. In 2000 it was around 45 cents (maybe less). A few years ago, over 70.

Basically you'd need to be making a call that NZ is heading for Turkish/Lebanese/etc levels of currency devaluation to want to move serious amounts of money out of NZ. Pretty big call.

We don't agree often Fitz but I'm with you on the NZD going down, I have moved my NZD into CHF over the last 3 months, but maybe I haven't move enough of it, quickly enough.

Right on the money.

Been keeping most of my assets (apart from house) outside NZ for years. NZ does not have the skillset on shore to properly manage investments or run world-class companies. There are a few around, but very few and far between.

Plus, obviously, you have idiots running the country, and they make everything more expensive, more costs on business, and therefore our ability to compete goes down. It's a lose-lose with Labour, unless you are a property speculator. but the chickens have come home to roost there too now.

Inflation in NZ will become more stubborn the lower the NZD trends.

The retreat of the speculative tide, globally. More to come.

Given the much more stable food and energy prices, the Fed’s inflation problem is already solving itself!

Really ! Very recent crop inspections in the U.S. predict probably severe shortfalls in the corn crop, and this coupled with even "official" Chinese warnings about a collapse in their autumn rice harvest and very dire predictions coming out of Europe about the impact the drought and outrageously priced fertilisers makes this a fanciful statement at best.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.