- US inflation and employment start to turn

- Has the Chinese Yuan currency adjustment run its course?

- Australia continues to be a large step ahead of sleepy New Zealand

US inflation and employment data starts to turn

Global financial and investment markets are still reeling in the aftermath of the US Federal Reserve’s onslaught two weeks ago to jawbone interest rates higher for longer to combat inflation.

Tough talking and hawkish speeches and statements by Fed governors Daly and Bullard before the Jerome Powell Jackson Hole blitz was followed up by similar hawkish messages by governors Williams and Fester over this last week.

As a result, US 10-year bond yields have moved higher again from 3.10% to 3.20% and US equity markets continue to head south with the Dow Jones Index at 31,318, down 8% from the peak of the July/August “bear market rally” in mid -August. In these “risk-averse” market conditions the US dollar has strengthened again to new highs of 109.60 on the US currency index.

The Kiwi dollar is hanging in there to some extent, coming off lows of 0.6056 at one point on 2 September and trading back above 0.6100 by the market close.

Until there is a change in direction to lower US bond yields and higher US equity markets, the NZD/USD exchange rate will struggle to make meaningful gains. However, the negative reaction to the Fed has already played out in the markets, therefore we still see a low probability of the NZD/USD exchange rate moving below 0.6000.

It has become apparent that the timing and rationale for the renewed Fed hawkish jawboning was that they were unhappy at bond yields sliding to lows of 2.60% following the lower than expected inflation result for July. US mortgage lending interest rates had climbed sharply from 3.00% at the start of the year to 6.00% by July (reflecting a rapid tightening in monetary conditions). However, the movement lower in bond yields caused bank lenders to reduce mortgage interest rates to below 5.50%. According to the Fed this was a premature easing in monetary conditions, and they acted aggressively to stop it. Mortgage interest rate have now been quickly adjusted higher and this will act to slow consumer spending demand in the US economy.

The question going forward over coming weeks and months is whether the emerging US economic data that is released supports the Fed view that inflation has not peaked, and the labour market remains robust (or not). The evidence is mounting, with sliding oil prices to below US$90/barrel and food prices also now falling back, that the annual US inflation rate that spiralled up from 3.00% 12 months’ ago to above 9.10% in June, could decrease over coming months as fast as it went up. As discussed in detail in last weeks’ report, the housing (“shelter”) cost component of the US CPI inflation index holds the key.

As all the indicators point to the US housing market plunging rapidly towards recession, the rent costs and implied rent costs cannot continue to increase at 0.50% a month as they have done over the last six months. The August inflation numbers are due for release on 14th September and consensus forecasts are for a decrease of 0.10% for the month. That result will again reduce the annual inflation rate to somewhere near 8.0% from the current 8.50%. Two months of a declining annual rate may not be conclusive evidence to the Fed that inflation has peaked, however the markets will quickly start to reflect the fact that the Fed will eventually be forced to pivot and signal that interest rates do not need to go any higher. Ahead of the next Fed meeting on 22nd September, retail sales data on the 16th and the NAHB housing index on the 20th will be key pointers for the markets. The Fed will lift their official interest rate by 0.75% to 3.25% on the 22nd, however that will not be fresh news to the markets and is already priced in.

The US jobs numbers for August were released on Friday 2nd September. Whilst the 315,000 increase was in line with prior consensus forecasts, it provided some early warning signs that the labour market is starting to slow as well. The unemployment rate increased from 3.50% to 3.70%, being the first lift since the Covid shock in March 2020. Within the detail of the employment data were pockets of weakness. The increases were in part-time jobs and full time jobs actually decreased. The Hispanic and Black unemployment rates increased by much more than the overall 0.20% increase, up to 4.50% and 6.40% respectively (previously 3.90% and 6.00%).

The jobs data is starting to confirm the anecdotal evidence of big US corporates now implementing hiring freezes and displaying a lot more caution as consumer spending wanes. Joe Biden in the White House will not be happy if the Fed’s renewed hawkish stance causes a hard landing into economic recession and therefore a rising unemployment rate ahead of the upcoming mid-term Congressional elections on November 8th.

Has the Chinese Yuan currency adjustment run its course?

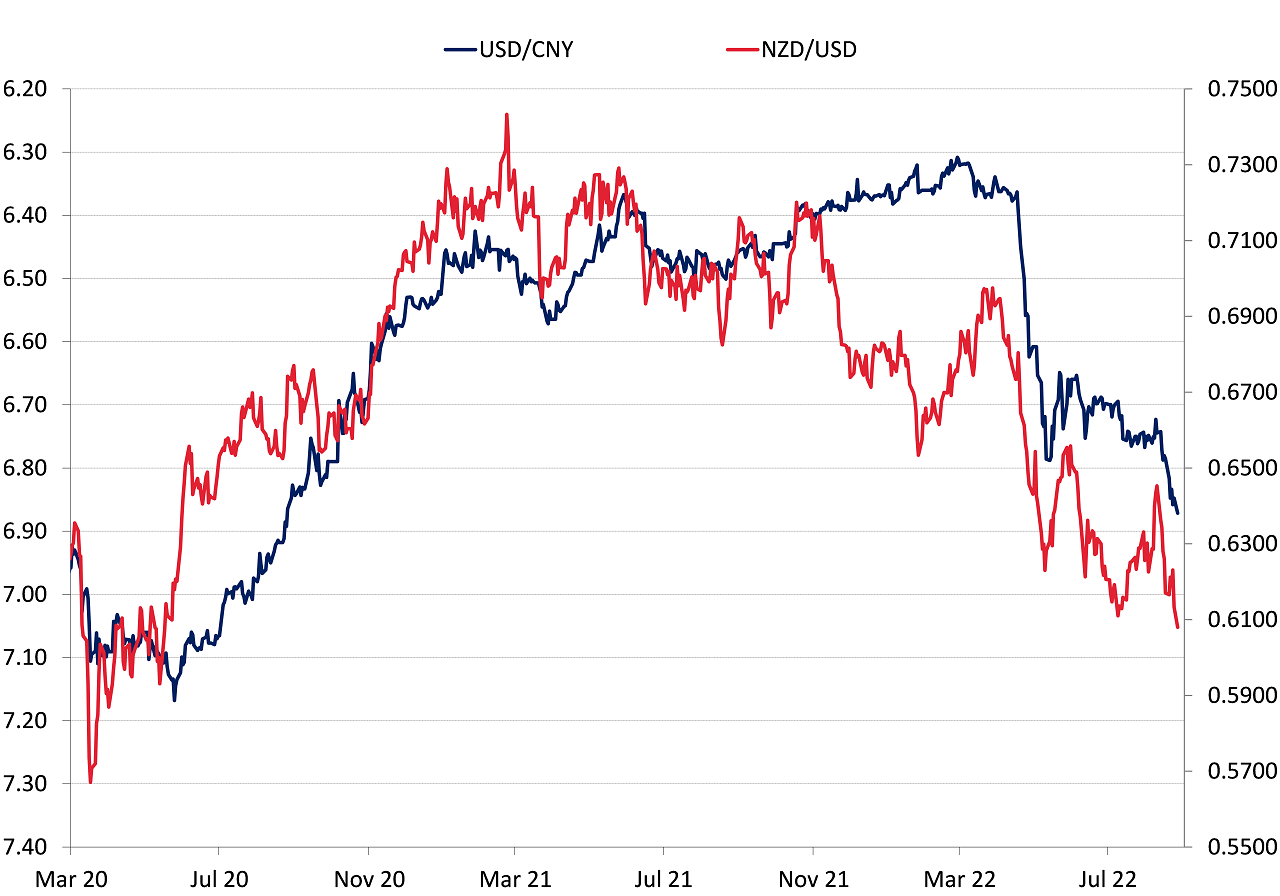

There are indications emerging that the Chinese monetary authorities are not that happy with the current level of speculative short-selling bets on the Yuan that have driven the USD/CNY value lower to 6.9000. There are several avenues available to the PBOC to burn-off the speculators, from adjusting the daily Yuan fixing to something different to the expected, or the changing bank foreign currency deposits/reserve requirements. Watch out for subtle interventions to stabilise the Yuan over coming weeks. The 8% depreciation in the Yuan from 6.4000 in April to the current 6.9000 has been a contributing factor to the Kiwi dollar’s 11.5% depreciation from 0.6900 to 0.6100 against the strengthening USD over the same time period (refer chart below). With the USD so strong and the Chinese wanting to loosen monetary policy the Yuan depreciation has been a tool to help their exporters, as China suffers from Covid lockdowns and an energy crisis (due to the drought).

Continued USD appreciation against all currencies seems less likely given the changing US inflation and employment situation outlined above, therefore the USD/CNY rate should stabilise below 7.0000. As Chinese economic data (retail sales and industrial production) improves over coming months the need for looser monetary policy with Yuan weakness reduces. However, more recent mega-city lockdowns under the Covid-Zero policy will be another impediment to improving Chinese economic data.

Australia continues to be a large step ahead of sleepy New Zealand

Right from the get-go when the Covid shock hit us in March 2020, the Aussies have always appeared to be a step ahead of a complacent and sometimes over-cautious New Zealand. Their economy is stronger and outperforming New Zealand in the post-Covid era as the lower NZD/AUD cross-rate at 0.9000 testifies. Australian exports are booming resulting in massive overseas trade surpluses. New Zealand has moved from an overseas trade surplus a year ago to deficit today as our export volumes are impeded by the chronic labour shortages.

Out of last week’s jobs summit in Australia the news was delivered that the Albanese Labour Government had trade union support to increase their annual immigration cap from 165,000 to 195,000 to immediately alleviate the labour shortages. The Ardern Announcement Government here in New Zsealand has an opposite immigration policy. Our Government announced last week the opening up of our borders to foreign students again. We are again far too late on this, as the Aussies did this a year ago and all the foreign students have gone there.

One suspects the Aussies will be now holding jobs promotion events in the UK and Europe to attract young skilled/professional immigrants into Australia. The outlook and prospects for young people in the UK and Europe looks particularly bleak currently, therefore a great time to be in front of them encouraging immigration. Such front-foot action to assist the economy would not have entered the heads of our increasingly incompetent Government (think recent botch-ups with Kiwi Saver fees GST and Jacinda’s helicopter money).

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.