- Fed was “transitory“ on inflation and are now “permanent” on inflation

- Japanese Yen FX market intervention, will others follow?

- NZ monetary policy not as tight as required

- Why the NZ dollar has been sold down further than the AUD and EUR

Fed was “transitory” on inflation and are now “permanent” on inflation

Yet another plunge of US equities on Friday 23 September and further skyrocketing of the US dollar value against all currencies underlines just how much the “fear” factor has ramped up with investors since the US Federal Reserve re-exerted their hard-nosed monetary tightening two days earlier. Investors are now much more fearful of a US and global economic recession. The longer the Fed hold their line the greater the risks increase of an unnecessary economic recession. The collapse of all major currencies against the USD is reminiscent of the panic in March-May 2020 period when the pandemic shock hit, and the world was short of US dollars. The Fed was forced by global events to change their stance then and may they well be forced to do so again. The Kiwi dollar spectacularly reversed back up from the 0.5700 level 30 months ago and stands to do the same again as the Fed are forced to back off.

A year ago the US Federal Reserve was heavily criticised for making a monetary policy mistake by believing for far too long that the increase in inflation at the time was merely “transitory” (i.e. temporary) and nothing to worry about. The inflationary pressures were coming from their own policy of 0% interest rates and printing money some 12 months earlier. As is transpired, they were too late in increasing interest rates in late 2021 and earlier this year. Now they are well through the monetary tightening cycle they appear to be running a high risk of making another monetary policy blunder of tightening too far (i.e. overcooking it) just when inflation is showing clear signs of turning lower. They risk sending the economy into an unnecessary recession. Fed boss Jerome Powell mentioned at last week’s FOMC meeting that gasoline prices were now falling back, and housing indicators pointed to a sharp slowdown. However, the message from him and the accompanying “dot-plot” interest rate forecasts was that interest rates needed to go higher still and stay higher for some time to bring inflation down. It appears that the Fed need to see the unemployment rate rise and job vacancies fall substantially before they believe the inflation risks have subsided. By that time the US economy may already be in deep trouble.

There is a good chance that they will realise too late that they have got it wrong again!

We remain with the view that the energy, food and rents components of the US CPI inflation rate will fall over coming months as fast as they increased over the first six months of 2022. The Fed will be forced to pivot, and thus a reversal in the USD’s fortunes could be a lot earlier than current market pricing suggests.

Japanese Yen FX market intervention, will others follow?

The Japanese monetary authorities have been threatening the markets that they would intervene directly in the FX markets to stop the “one-sided” depreciation of the Yen. They followed through on their threat with action last week, forcing the JPY/USD rate back to 141 from above 146. The sharply higher US interest rates and USD value will be severely damaging emerging market economies with US dollar debt to service and repay. The Brits and the Europeans cannot be happy with the increase to their already higher inflation rates from this latest bout of currency depreciation. Older FX market participants will recall the Plaza Accord joint market intervention by central banks in 1985 to stop the US dollar’s strength. They did the same again in the mid-1990’s with the Mexican Peso crisis. The pressure is about to build on the Fed to consider the global economy ramifications from an overvalued USD, yet another variable that forces them to pivot on monetary policy sooner rather than later.

NZ monetary policy not as tight as required

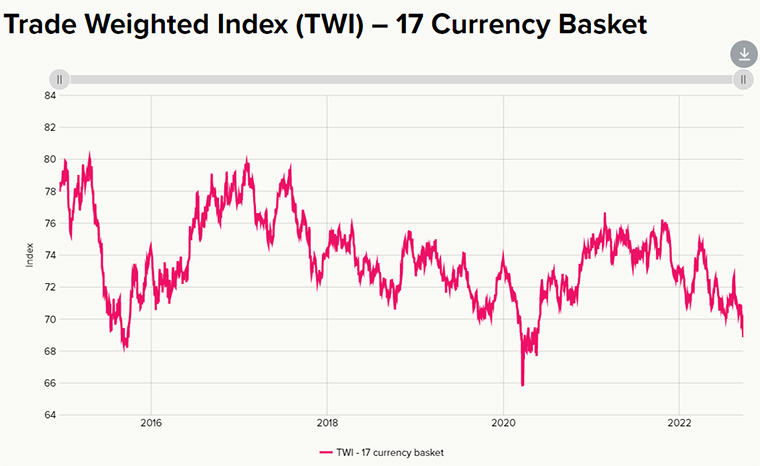

In their last monetary policy statement in August the RBNZ factored in a stable TWI currency value of 71.7 for their inflation and economic forecast period out over the next three years. Since than the NZ dollar has been sold down more heavily than many other currencies against the rampant US dollar on global currency markets. The two standout examples that evidence this is the sharp depreciation in the NZD/AUD cross-rate from 0.9000 to 0.8800 and the NZD/EUR cross-rate which has dropped from 0.6200 to 0.5900. As a result of the NZ dollar under-performance the NZ Trade Weighted Index (TWI) has fallen away to 68.8 on 23 September. The 4.0% TWI depreciation since early August and the even larger 10.8% deprecation in the NZD/USD exchange rate over the same period (0.6450 to 0.5750) has effectively loosened monetary conditions in the economy.

The TWI at 68.8 is approaching the previous record low levels witnessed in March 2020 when the world found itself short of USD’s when the Covid shock hit and in 2015 when dairy prices collapsed (refer chart below). The solace to our exporters who currently have FX forward hedged positions well above current spot exchange rates, is that these two previous spikes downwards in the TWI Index, were followed by an equal reversal upwards over the subsequent 12-month period.

The looser monetary conditions through the lower exchange rate mechanism is the opposite to what the RBNZ want at this time. The exchange rate depreciation pushes import costs upwards, thus inflation on consumer goods higher (including food). Therefore, when they report next on 5th October, the RBNZ must increase their June 2023 inflation forecast from the current annual rate of 4.50% to something well above that to reflect the much lower exchange rate value.

The RBNZ cannot just dismiss the currency depreciation as caused by US interest rates rising up to the level of NZ interest rates and therefore nothing to do with them. Their mandate is to get inflation back below 3.0%, therefore they have to take additional monetary tightening action with interest rates to stop the rot with the NZD depreciation.

Why the NZ dollar has been sold down further than the AUD and EUR

In our mid-week update commentary to our clients last week we listed a number of factors that were behind the NZD underperformance against the USD compared to the AUD and EUR. The NZD was being singled out for heavier selling due to: -

- Lower global growth forecasts for 2023. The Kiwi has some correlation to global GDP growth.

- Much lower GDP growth than Australia over the last year (+0.40% c.f. +3.30%).

- Ballooning overseas trade deficits as export volumes are hindered by labour shortages.

- The Ardern Announcement government having no new economic policy initiatives.

- NZ listed higher yielding dividend stocks no longer attractive to offshore investors as interest rates increase around the globe.

- The rest of the world perceiving that the Hermit Kingdom is not yet open again for business, investment, immigration and tourism (despite what Jacinda says!).

- The Ardern Announcement government has further estranged itself from the business community as the NZ Herald’s “Mood of the Boardroom” confirmed last week.

An additional source of NZD selling activity over recent months has emerged in the form of the NZ Super Fund being forced to reduce their NZD FX hedging on their NZ$57 billion investment portfolio, the majority of which is invested in international equities and bonds. The Super Fund operates a 100% FX hedge policy back to the NZD on both global equities and bonds (most local fund managers leave equities unhedged but have bonds 100% hedged). Therefore, when the value of their offshore investments reduces by $3.3 billion (as it has over recent months) they are required to reduce their bought NZD/sold USD hedge amount by selling the NZD. When equities ultimately recover back up, the Super Fund will increase their hedge amount to re-balance by being a buyer of NZD’s.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

19 Comments

How can people take your analysis seriously when it is so focused on slamming Ardern?

It's clouding your judgement hence statements like this from earlier in the year which are way off the mark and costing your clients $$$

"The NZD/USD rate at 0.6250 has now decisively broken upwards to be above the downtrend line that it has traded below since 0.7000 in late March (black line in chart below). Our forward view remains unchanged, the NZD will follow the AUD higher over coming months"

"Whilst the NZ economy paints a decidedly negative picture, the NZ dollar value is unlikely to suffer as a result as there has been absolutely no offshore interest in the Kiwi for quite some time. The NZD/USD exchange rate movement will continue to be dominated by the USD side and the local NZ economic factors will continue to be totally irrelevant."

Such muddled thinking, are NZ economic factors irrelevant as you previously suggested or is it Ardern's fault the NZD is sliding?

having said that,its easy to fall into thinking the PM is faffing about or spending inordinate time in ineffectual pursuits and even that our central bank is asleep while others are acting effectively.

Why would she be concerned about NZ's problems when she can be taking private plane rides to hobnob with the rich and powerful in New York, hanging with her mate Trudeau and the both of them pitching for the creation of AI algorithms to find people they can censor and confiscate bank accounts from. Priorities!

Yup, a bit more humility wouldn't go astray...but then again FX forecasters are about as reliable palm readers so why would you expect otherwise??

Markets capitulate as the Fed overcooks it

Was Fed not overcooking when dropped the rates to zero overnight. Why did no one raised any concern, the way are doing now instead they all not only believed but supported the Fed Governors for coining the word TRANSITORY INFLATION and giving everyone a cover to hide.

Today Inflation is Bigger and beyond control, should not everyone who supported and joined to be a part besides the perpetrator be............

Has Mr Orr ever acknowledged that they goofed up leave aside apology to the people of the country, who trusted them and is not on hindsight. It was and has been pretty much obvious as early as December 2020 and to rebut the data/information - to kick the can down the time.....coined new word Transitory Inflation to suit their biased vested interest.

Wow our dollar is really tanking. The flow on effect of this over the next few months is going to be epic. All signs are pointing to a very nasty 2023 for us and there will be zero chance of Labour getting in at this rate. Its human nature to look for someone to blame, but you do not have to look far to see Labour stuffed this up.

The real stuff up was allowing the bubble to start blowing in the first place….. but go on.

National looks to be very panicky…. I assume they know full well what is coming.

I wouldn’t assume they will get back in.

Tbh I think a lot of it is due to war that was predicted not to be the case

I've been banging this drum for a while. The NZD will add headwinds to our falling property market.

Employment in NZ is still at high levels, the GDP data last quarter showed a small expansion rather than contraction and due to the Fed's ambitions the NZD is now importing inflation and will worsen trade imbalances. On the upside a good Summer of cashed up tourists taking advantage of the cheap NZD may help but with all the woes in Europe and their economies taking a hiding I'm not holding my breath.

All of those point to an aggressive hike in OCR. Higher than markets were expecting. The fact that. much of our wealth is based on property will be of no consequence to the international agencies. Once the 30% of covid froth has been removed from property prices (and we are approaching that), your average home owner is going to be affected by the decline. I see behaviours changing dramatically in the next 12 months as the wealth effect is rinsed away and then some with discretionary spending and perceived wealth disappearing simultaneously leaving our economy steep nose down.

The Fed has no choice, 8% inflation is unacceptable, end of. There will be pain, but some of it (asset prices) are just corrections. But yes, the falling Kiwi will be great for the tourism bounce back.

The tanking NZD will not save international tourism when flights are double the price they were pre-covid. Any potential "savings" from the weak dollar will be more than off set by the cost of getting here.

The NZD keeps tanking this will keep inflation well above target levels. rates will continue to raise all debt will become more expensive this will put huge burden on over leveraged the trouble is it same all over the world, so many people borrowed to top of the credit level now that interest on that debt will be doubled or more. It seems like governments made it easy for people to borrow pushing up prices with emergency low rates now people will either pay more for debt for years or go insolvent. We are already starting to see people biggest assets in NZ housing tumbling down in value and this just the start of downturn.

"True capitulation is when investors try to sell what they love and own"

And the buyers are nowhere to be seen. We aren't there yet, not by a long shot. BTD is still out there.

Its embarrassing. Even the Fiji dollar is holding up better than the NZ dollar (NZ$ has fallen from F$1.49 to F$1.31). Just wait until New Zealanders realise they can't even afford to holiday in Australia and Fiji and things will get really ugly.

Having read all of James Rickards txts kickstarting with Currency Wars https://www.amazon.com/Currency-Wars-Making-Global-Crisis/dp/1591845564

I'd recommend that Roger read them. They all give foretelling stepping stones to our current state of economic affairs including Inflation that seems to be in the headlines more than the History that led to it's cause.

Economic History is awesome to learn about. But our real life time frames so short so sometimes we only see what we have only just seen.

This Global Financial Crisis has years to go yet. How many kiwis can explain the use of M1 over the last 40 years to create unrealistic Asset bubbles and the precarious nature of our Financial System. The first GFC accelerated money printing with MMT turbo charging that process from 2010 onwards.

Zero - negative rates sent that unsustainable MMT situation to a critical point. Throw on a "Pandemic" and ....boom! Well predicted Risks well before Putin in March 2022 was used as the scapegoat by elected Politicians to galvanise their citizens.

A Financial system that may end up with even our own Central Bank launching Government controlled CBDC's to steady Society and its Financial Wellbeing. Of course at great cost to individual freedom and progressive democracy.

Let's hope that the West (including our own current PM) can avoid total European Hot War. So at this stage we have:

Currency War (Sanctions, SWIFT expulsion, DXY strength, Energy Squeeze caused by lack of Capital Investment in Energy (eg oil / gas (even here in NZ...)) .

AND

Hot War (even Kiwis are fighting Russians and we've sent our own Sovereign Funds to kill )

Bring on the next 12 months of Economic History....

The achievements of the New Zealand economy can be explained by:

a. Selling 11 bags of milk powder in stead of 10 bags to China

b. Circulating massive amounts of debt to feed our property habits (of which 10% is taken by our Australian banks)

On top of that both dairy as well as forestry have a massive chunk of foreign ownership so a considerable part of our export revenue goes overseas. It seems that only kiwifruit has a majority NZ ownership. Factor in the absence of tourism and voila, you have an enormous current account deficit.

Don't bank upon the return of tourism will improve it. They have to fill up their campervans with Diesel we have to import from overseas. Less money available for them to spend locally!

With a worldwide recession starting expecting a huge amount tourists is optimistic.I have also noticed quite a number of people moving to Australia. If you from Europe or America had money for a winter holiday how many would choose New Zealand over Australia.

Governments intervening in currency markets? That always ends well for taxpayers; Politicians are so well qualified for leveraged currency speculation.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.