- “History never repeats” – Yeah Right!

- Global market turmoil caused by the Fed – someone had to step up

- The case for the RBNZ to intervene to halt the NZD nose-dive

'History never repeats' – Yeah Right!

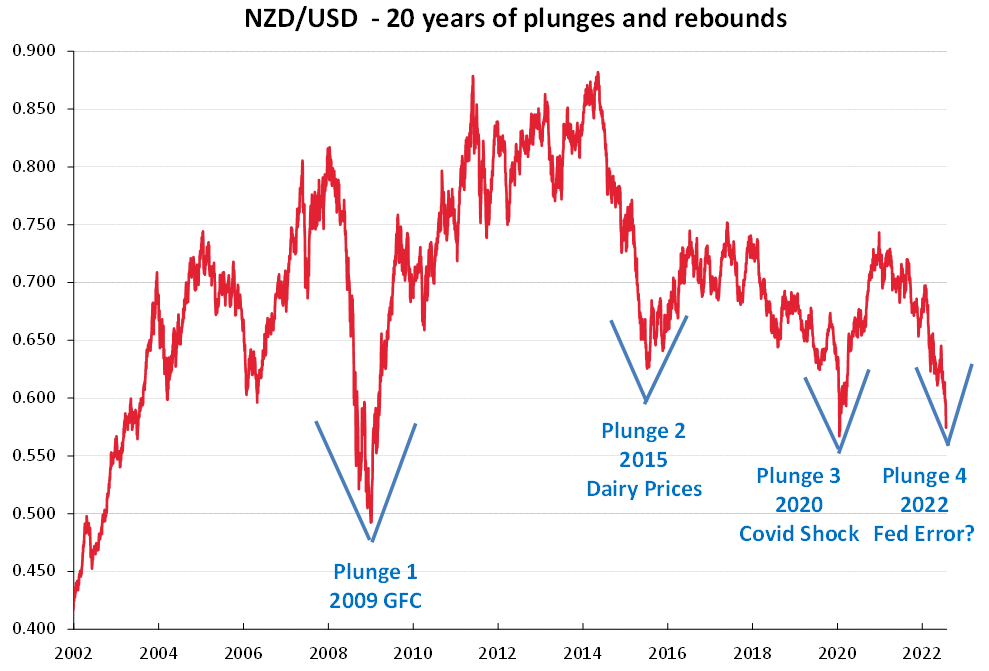

The historical movements and patterns of the NZD/USD exchange rate over the last 20 years have been punctuated by occasional sharp and deep plunges in value, followed by equally dramatic recoveries back up. The Kiwi dollar sell-off’s and subsequent equally dramatic appreciation are always fully explainable in perfect 20/20 hindsight as to the reasons for the selling and buying activity.

When you are in the middle of a plunge it can be more difficult to explain, however we need to give it a go!

The Kiwi dollar selling is typically very short-term and speculative in nature, often triggered by global events and economic shocks. The very nature of the trader speculative selling is inevitably followed by the NZD short-position holders buying back the NZ dollar in equal volumes to take their profits and close-down the positions.

The latest Kiwi dollar plunge commenced at 0.6450 in mid-August and in the space of the last six weeks the NZD/USD exchange rate have nose-dived 8.5 cents (13%) lower to 0.5600 on 30 September 2022. The route cause on this occasion is the US Federal Reserve belatedly panicking about their inflation and much more aggressively tightening monetary policy over this period.

Our view is that this latest Kiwi dollar plunge will quickly reverse in the same fashion as the three previous NZD sell-off’s have displayed. The chart below highlights the four Kiwi dollar plunges since the GFC in 2009: -

- Plunge 1: GFC 2009 – The Kiwi dollar plummeted 30 cents from above 0.8000 to 0.5000 as global trade came to a halt and all commodity prices collapsed. The renowned growth/commodity currencies, the AUD and the NZD, were mercifully caned. The almost immediate recovery back up to 0.7000 within 12 months was due to the US Federal Reserve loosening monetary policy and the US dollar depreciating against all currencies.

- Plunge 2: Stronger USD and lower dairy prices 2015 – In a two stage collapse the NZD/USD rate fell 24 cents from 0.8700 to 0.6300, initially a stronger USD on the global stage and then a collapse of whole milk powder commodity prices to below US$2,000/MT in 2015.

- Plunge 3: Covid shock 2020 – There was a world shortage of US dollars in March 2020 as many economies locked down to control the spread of the pandemic. The Kiwi dollar dropped 12 cents from 0.6700 to 0.5500. However, the US Federal Reserve made the correct response by providing swap lines to supply sufficient USD’s at the time. The Kiwi dollar rapidly recovered all the way back up to 0.7400 as the USD weakened on the subsequent Fed money printing programme.

- Plunge 4: Excessive US Federal reserve monetary tightening 2022 – There is a better than even chance that the current Fed tightening (which has sent the USD to record 20-year highs) will prove to be far too much, too late to bring inflation down. The argument is that US inflation has already peaked and when the Fed are eventually forced to pivot on their policy the USD will depreciate as fast as it has appreciated in recent months.

There is no guarantee that history will repeat with this latest Kiwi dollar sell-off, however when FX markets make extraordinary and extreme movements there is normally no permanent shifting of capital across borders, merely speculative bets that are ultimately unwound.

On the greater probability that history does repeat, USD exporters should be going to their respective Boards for special approvals to hedge larger amounts forward and USD importers should stand back and use up existing hedges.

Global market turmoil caused by the Fed – someone had to step up

The financial and investment market turmoil and disruption caused by the excessive monetary tightening by the US Federal Reserve over recent weeks has sent currency, bond and commodity markets into total tailspins of panic and fear. Someone had to step up and stop the carnage of the “doom loop” that was developing. The Americans seemingly have little understanding of the damage they are causing for the rest of the world, and even if they did, they do not really care.

Enter stage-right, the “Old Lady of Threadneedle Street” (The Bank of England) who in an unprecedented move of intervention in the markets to stop the rot, reversed their selling of UK Government Bonds “(Gilts”) to a GBP65 billion emergency buying of Gilts. The Bank of England were petitioned by London’s bankers and fund managers that the dramatic decrease in the value of Gilts was potentially sending UK pension funds into insolvent situations. The intervention worked, with Gilt yields reversing back down and the Pound exchange rate value recovering from a low of $1.0400 on 26 September to $1.1200 on 30 September.

Whilst not a direct intervention in FX markets to stop the deprecation of the Pound, the Bank of England’s action has caused sufficient doubt in the minds of the currency speculators who have fuelled the one-way bets on all currencies against the surging US dollar. Over recent weeks, Japanese, Indian and Swiss central banks have all directly intervened in the FX markets to buy their own currencies against the USD. The Americans will have no interest in joint and coordinated FX market intervention by central banks to stop the over-valuation of the USD. However, the Brits, the Europeans, the Japanese and the Koreans will be talking to each other about potential FX market intervention if their currencies continue to plummet in value. All these central banks could increase their interest rates in an attempt to stop their currencies falling, however rapid increases in interest rates can create too much damage for their domestic economy, so the FX intervention method may have less overall cost.

The case for the RBNZ to intervene to halt the NZD nose-dive

There needs to be extreme and extraordinary circumstances before direct FX market intervention is justified by any central bank. Here in New Zealand, the RBNZ’s criteria or prerequisites for intervening directly in the NZD FX market are very clear: -

- The exchange rate must be exceptionally high or low – CHECK!

- The exchange rate must be unjustified by economic fundamentals. Our largest economic fundamental is dairy prices, and they currently suggest the NZD/USD rate should be near to 0.7000, not 0.5500. The PM informs us that the economy is in great shape because Standard and Poors said so! All the CEO’s of our largest businesses have the opposite view – CHECK!

- Intervention must be consistent with the Policy Targets Agreement. The latest bout of NZ dollar depreciation will increase inflation further through higher import costs – CHECK!

- Conditions in markets must be opportune and allow intervention a reasonable chance of success. A subjective decision around understanding current FX market liquidity and positioning. The RBNZ used to employ managers who understood and monitored this stuff. However, they have all long departed and been replaced by climate change and communications experts! A tentative CHECK!

The fourth prerequisite above is a toughie, it is always much easier for the RBNZ to have success with FX market intervention when the NZD is excessively high, and they sell it to buy USDs. They can print the NZD they need to sell. At the opposite end of the scale with the present situation, the RBNZ need the USDs in reserves to sell to buy NZDs. They have limited USD reserves and they may not be enough if currency speculators take the RBNZ head-on in the FX markets. The RBNZ will not intervene by themselves. The RBNZ would only intervene if they did it in tandem with the Aussies and Canadians. If the RBNZ officials are doing their job, they should be in daily contact with these other central bankers about FX market conditions and the likely success of direct intervention.

It will be interesting to see if RBNZ Governor, Adrian Orr mentions the NZ dollar depreciation and its adverse impact on our inflation rate in his Monetary Policy Review statement on 5 October (only a one-page statement, but precision jawboning can be effective!)

Upcoming key economic indicators to influence future NZD/USD direction will be the NZ CPI inflation for the September quarter on Tuesday 18th October, US September employment data on Friday 7th October (a lower 250,000 increase expected) and US CPI inflation for September on Thursday 13th October (8.10% expected from 8.30% in August).

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

32 Comments

Does it look likely that the Feds will behave like in 2020 and 2009 and start loosening monetary policy when there is ongoing inflation? The preferred Fed measure (PCE) just rose in the last reading.

Good luck to the NZD. I wouldn't be holding my breath.

Important to note that Roger didn’t give a timeframe for the Fed loosening.

I think they will start loosening around mid 2023.

I think the Fed will pivot earlier. Before christmas 2022. For reasoning see the first lines of David's breakfast article about the stalled M&A deals. Maybe tomorrow this time we know more.

Maybe. But does not appear credible to be pivoting so quickly?

I still struggle to see them loosening by end of 2022. But maybe earlier than mid 2023, perhaps Feb/ March.

See it this way. Economics is partly psychological and what would be better than pivotting in the time people are looking at their wallets and credit cards just before christmas.

Sh**s already hitting the fan, it's going to be hard to be hawkish when your economies collapsing...

Oddly the opposite is also quite crazy....to be dovish while your economy is collapsing (which has been the view of CB's the last 20 years, or you could say that last 40 years from the early 1980's) - especially when you've just had 0% interest rates and that has caused the current problem we are facing.

So let's be dovish ASAP and create even more of the problem (excess money supply relative to the productive capacity of the economy) creating even more zombie companies and even more beneficiaries who live of the state and never address the fact we have too much debt relative to producitivity/income. i.e. dropping rates makes the future worse, not better. Like an alcoholic having another drink thinking that it has fixed its problems...it hasn't, its just delayed and amplified them.

Yeah, I think this is the difference from the last c.20yrs.

If we start seeing international bank runs, liquidity drying up, et cetera, and the RBNZ pulled out an emergency rate cut - the NZD would get slaughtered very, very quickly, and we'd see inflation far beyond what we have now.

Not if all countries start doing the same thing...

Bit soon to be drawing a bottom under our current walkback, I'd suggest.

Expectations for our monetary policy relative to other central banks is clearly low and I'd suggest the market doesn't have confidence that we can tighten enough to get ahead of external inflation without nuking our own economy in the process.

So either we are going to live with high inflation or we severely restrict domestic spending and individual living standards will take a hit. Either way, it is little mystery as to why we are not in favour, but there's also no reason to see that changing any time soon. I suspect we have a way to drop yet.

Well said, agreed.

The RBNZ is now more concerned about climate change theories than communicating with other central banks. Most of the economic expertise at the RBNZ and also at Treasury are long gone.

When one examines the complete economic incompetence of the current New Zealand government, the prospects for the NZ dollar are not good. The Greens and Labour are doing all they can to undermine agriculture, the mainstay of our exports and foreign currency reserves.

When one examines the complete economic incompetence of the current New Zealand government, the prospects for the NZ dollar are not good.

Well you might want to reflect on what has happened in the UK - tax cuts to the wealthy worth 4% of GDP and the world's reaction to those.

National are proposing tax cuts worth 4.5% of GDP that would also go to the wealthy.

You might not like the current government's fiscal management, but the opposition are looking to be FAR worse.

This is a completely misleading statement.

1. Nationals Tax cuts - the majority are not tax cuts - they are primarily raising tax thresholds.

2. The tax changes are $2 billion a year - which is 1% of NZ's GDP- not 4.5%. 1.6B of this is the raising of the thresholds.

3. NZ has not raised thresholds in 12 years - an extraordinarily long time - that is resulting in median income earners paying approximately 6% more in tax than they did in 2010. A median income earner in 2010 paid 16% of their income in PAYE tax - now they pay 22% in PAYE tax

4. The amount of tax a PAYE worker pays in NZ is higher than the equivalent median worker in Australia who only pays 19% of their income in PAYE tax.

You're only looking at the threshold changes, you haven't factored in the other things National has promised like allowing landlords to write off interest an an expense again.

And yes the amount of tax that a PAYE worker pays in NZ is higher than the equivalent median worker in Australia. We need a 0% income tax bracket - National is not proposing that.

National's "inflation adjustment" of the tax brackets would deliver the average worker something like $2 per week in tax relief, while Christopher Luxon, were he to be Prime Minister, would get $18,000 per year from ditching the 39% bracket.

Australia's top tax bracket is 45%.

Here is the breakdown for you - based on the interest article for this- I'm not aware their policy has changed since releasing it in March

https://www.interest.co.nz/public-policy/114679/why-tax-cuts-national-p…

In the United States, tax thresholds are raised each year to account for inflation. New Zealand has not done that since 2010.

Yes, it's unfortunate that National refused to support that policy when Michael Cullen proposed it ahead of the 2005 election.

Winston Peter's labelled it the "chewing gum tax cut". Following the election, Labour did not have enough votes from their coalition partners to pass the policy (automated indexation of tax thresholds to inflation).

National could have chosen to support the policy at that time, but they did not.

NZ’s current account deficit (Exports - Imports) of $27 billion for year ending 30 Jun 22 or $5k per person shows that NZ is living beyond its means. This deficit has to be funded from overseas cash inflows.

The drop in NZD shows an increasing lack of confidence in the NZ economy.

The Reserve Bank continues to lose its credibility, given that it has forecasted 13 consecutive quarters of GDP growth between 0.0% & 0.6%. This is way too optimistic given the current NZD trajectory.

Hard landing is now a greater than 50% probability & stagflation (no GDP growth, high inflation) is the probable outcome in next 12 months.

NZ’s debt keeps increasing so we are using borrowed money to implement our policies. If we are going to borrow a certain amount to survive would you rather have Labour or National spend it?

If it’s the same amount of money, I would rather see the public sector employees reduced back close to what it was in 2017 & adjust tax thresholds relative to inflation (i.e. give more money back to the private sector).

Money post. Like your style Tony.

This is truely an undeniable reality.

There is no way intervention will do any good for more than 1-2 weeks, more likely to be days or the next negative news comes out.

Why would you try something that has so little chance to succeed and is unlikely to do any lasting good. You are not going to divert or change the current trend in the US dollar or asset sell offs or the unfolding global instability.

First of all it is not a nosedive. When I look at the graph, the NZD has been much lower at teh start of this century.

Yes, investors and speculators are betting against the NZD. Our enormous, in NZD value, not % relative to GDP, account deficit forces New Zealand to look overseas to fund our imports and those 'investors' dictate the terms.

Dairy export is holding up in value but not in quantity. According Fonterra's own global report volumes are down more than 8% compared with the same period last year. Although milk collection is also down my educated guess is that about 100000 ton of dairy products is still sitting in warehouses collecting dust and absorbing costs. I will have a look at the Synlait ballance sheet later today to check if I am right.

I personally think we need to look at this problem differently....to solve our inflation problems I think we're far to focused on monetary policy and not enough on the fiscal side of the issue.

The excess spending by governments around the world is a large player in the problems we are facing.

But unless the Fed and the US treasury get their books in order, and while they have the reserve currency, they are going to create pain and misery for the rest of the world.

Perhaps the best option for the world is that the US collapse as quickly as possible....any other alternative is going to be slow and painful. If the US collapse quickly, it will mean the rest of the world will no longer be held ransom by a bankrupt nation that is creating inflation to prevent itself defaulting on its excess deficit spending. And the US now has so much debt relative to its productive capacity, it has no option but to continue creating more inflation to avoid defaulting - but that isn't going to be sustainable for other currencies around the globe. This is how wars are started. In many respects Putin is right on the money from a macro economic perspective...(but obviously not from a moral/ethical/principles perspective - I'm not a Putin fan before I get thrown that label....but he appears to be far more onto what is happening than anything being communicated by the leaders of the US/EU/Anglosphere nations who appear completely oblivious to what is unfolding).

Could be that this a plan and not a error by FED, US inflation is being exported out around the world, people and companies got pulled in by cheap debt rates at almost zero, now rates are climbing to normal levels anyone who is in debt will carry cost for next few years. Any country who does not come in line and raise rates will see currency lose value making inflation higher, this has been the case to a number of countries already hyper inflation and bankruptcy. The idea is to squeeze as much out of people through debt repayment ie mortgage payments. Big slump in assets prices will happen keeping people trapped in debt for years.

I don't think its a plan - its a reserve currency nation in the final throws of its dominance and is using its currency to bully the rest of the world. This usually means that it creates such pain for other nations that they eventually go to war with the reserve currency nation....and because the reserve currency nation is already highly indebted (relative to GDP) it is essentially bankrupt and can no longer fund its global dominance/military spending.

This has happened many times over the past 500 years.

As soon as a global reserve currency is forced to use QE, it signals the beginning of the end. And the US has been at it for quite a while now so it is perhaps surprising that we've experienced the geopolitical (and financial) stability we have had, for the period of time we have in recent years.

We have a alliance with US the same a most western countries. Before wars did not end the world if everyone went to war with US not much would be left just won’t happen. We will have a number of years of depression until a financial reset is formed the US will make sure it comes out on top why do you think they have spent so much on military it will not just turn over.

I can only disagree. These previous bounces all happened in a fundamentally deflationary environment. This is not temporary - it's a regime change, and it's not one that favours NZ. We don't have the productive capacity to put any kind of floor on the currency. The fact that we're tied to one commodity (milk) should be terrifying enough in itself.

Even at the current value, the IMF was quoted last week on this site as declaring the NZD overvalued by 22% based on key economic fundamentals such as the trade defecit. That unchecks at least one of the boxes.

Even at the current value, the IMF was quoted last week on this site as declaring the NZD overvalued by 22% based on key economic fundamentals such as the trade defecit. That unchecks at least one of the boxes.

I saw it as high as 28% overvalued from an analyst.

History does repeat, Rog's predictions are always wrong

Some more detail behind the BOE intervention ........

From Alasdair Macleod The crisis is upon us - Research - Goldmoney

The big news was the collapse of the UK gilt market’s long maturities, which required the Bank of England to intervene, buying £65bn in long gilts on Wednesday. The situation arose out of pension funds leveraging their gilt portfolios through interest rate swaps and repurchase agreements up to seven times in an attempt to match their actuarial liabilities through liability driven investing (LDI). With over £1 trillion outstanding, a doom-loop of selling to meet margin calls was an emerging crisis which had to be stopped.

It has been a wake-up call for investors who were not even aware of LDIs, let alone the Lehman moment they brought about. LDIs are also common in the EU and the US so the problem is unlikely to be confined to London.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.