- Market reactions to US inflation result confusingly volatile!

- Shelter component in US core inflation is not representative of current pricing

- Warnings of a financial shock “event risk” increase

- No surprises expected with NZ inflation figures

Market reactions to US inflation result confusingly volatile!

Volatility continues in global financial and investment markets at elevated levels as the unanswered questions remain as how far the US Federal Reserve will go with monetary tightening (or have the gone too far already?) and will their actions send the US and world economy into recession?

The market volatility is reflecting the extreme uncertainty as to how all this pans out over the remainder of 2022 and into 2023. The immediate market reaction last week to the again marginally higher than expected US inflation in the month of September (with the annual core inflation rate increasing) was a real head scratcher. Contrary to all expectations, the Dow Jones equities index rallied higher by 800 points, US bond yields reduced, and the US dollar Dixy index weakened. Presumably, the equity markets’ positive reaction was on the pretext that future inflation will be lower than what has been recorded in August and September. Normal transmission was resumed the next day on Friday 14th October with equities down, bond yields up and the US dollar Dixy index returning to near its highs at 113.20. The Kiwi dollar temporarily lifted to 0.5680 last Thursday, however it has followed the Australian dollar lower since to trade at 0.5565 at the market close on Friday.

Shelter component in US core inflation is not representative of current pricing

US core inflation increased by 0.60% in the month of September, slightly above the prior consensus forecasts (+0.50%) for the second month in a row. The annual core inflation rate increased from 6.30% in August to 6.60% in September, supporting the view that the Fed has a lot more to do with interest rate increases as inflation is showing no signs yet of peaking and trending back down. The major increases in core inflation continue to be airfares, medical services/costs and shelter (rents). Most other core component prices are static or falling.

As the Fed will supposedly be well aware of, how the Americans calculate the rent/shelter prices (which have a dominant 40% weighting in the core inflation measure) is very odd indeed. People who live in their owned houses are asked by a survey what they think the rent would be if they were to hypothetically rent their house out to tenants. They label this “OER - Owners Equivalent Rent”. It is not up-to-date market-based price data. Most folks would have an inflated and out of date view on their imputed rent. Actual rents that tenants pay are only sample measured once every six months and then somehow adjusted to make it more up to date. The archiac measurement methods all lead to a very long, multi-month time lag from when the US housing market slows up (new builds and existing house prices reducing) to when the shelter component in core inflation reduces. Some commentators calculate the time-lag to be up to 12 months because of this measurement method. US house prices are no longer increasing at the rate they were six months ago. The annual rate of increase was 20% three months ago, it has dropped to 16% today and with new mortgage interest rates now over 7.00%, house price increases will continue to fall.

It is a long way from real-time economic data! The shelter price data within the CPI inflation numbers is not representative of current conditions and price-setting behaviour at all. Anecdotal evidence points to market housing rents already reducing in many US cities. The month of September shelter increase was +0.70%.

It would be a mistake for the Fed to maintain tight monetary policy just because core inflation is not reducing as fast as they would like due to shelter prices being so sticky. However, the Fed will need to observe convincing economic evidence of a rapidly slowing US economy before they consider “pausing” on their tight monetary policy stance and then “pivoting” to a less restrictive stance. Weaker manufacturing, employment, housing and retail data over coming weeks/months will convince the markets that a change in the Fed’s stance is not that far away. US retail sales in September were flat at 0.00% (prior forecasts were +0.20%) before being adjusted for price inflation. Take off inflation and the volumes of consumer items being sold are substantially weaker. Expect weaker US industrial production, housing starts/permits and existing home sales data being released over this coming week.

Over the next three months both the headline and core annual inflation rates in the US are set to reduce quite sharply as the high monthly inflation increases in October to December 2021 drop out of the annual calculations. Over the last three months the headline increases have been between 0.00% and +0.40%. Similar sized increases over the next three months will replace +0.90% in October 2021, +0.70% in November 2021 and +0.60% in December 2021. Sheer mathematics!

Warnings of a financial shock “event risk” increase

In last week’s column we highlighted the risk that the financial meltdown witnessed in the UK markets could easily be repeated in the US market given the leverage and liquidity conditions. Over this last week there have been several reports from other commentators saying exactly the same thing: -

- A Deputy Director at the International Monetary Fund described the UK episode as a “warning shot”. “Markets are fragile. We have seen vulnerability that’s been building over the last decade-plus”.

- The Wall Street Journal: “Selling of Collaterised Loan Obligations – CLO’s (bundles of corporate debt) jumped in the weeks after the UK announcement. This is a part of the market that some already saw as full of financial risks”.

- “There is a general sense of unease in financial markets because we never know where the landmines are buried” – Economist Barry Eichengreen, University of Calafornia-Berkeley.

- “When we look at the safety and soundness of the financial system – we should look at not only the banks but also the non-bank-lenders” - ex Fed boss Ben Bernanke.

- According to JP Morgan-Chase bank head, Jamie Dimon the turmoil stemming from the UK appears to be a “bump in the road”. However, he also warned “There are going to be other surprises”.

- Former US Treasury Secretary and highly respected commentator on financial/investment markets, Larry Summers predicted further financial troubles after the recent turbulence in the UK, and blasted global financial chiefs for doing litttle to address some developing nations getting shut out of the bond market. “I would be surprised if we were in the seventh innings of this particular set of challenges” in a reference to the standard nine innings in American baseball.

The probability of the Fed being forced to ease off on their tight monetary policy stance a lot earlier than economic data would suggest, due to a financial landmine blowing up, is growing. The consequential outcome would be a dramatic turnaround in the US dollar’s direction as interest rate differentials favour other currencies over the USD.

No surprises expected with NZ inflation figures

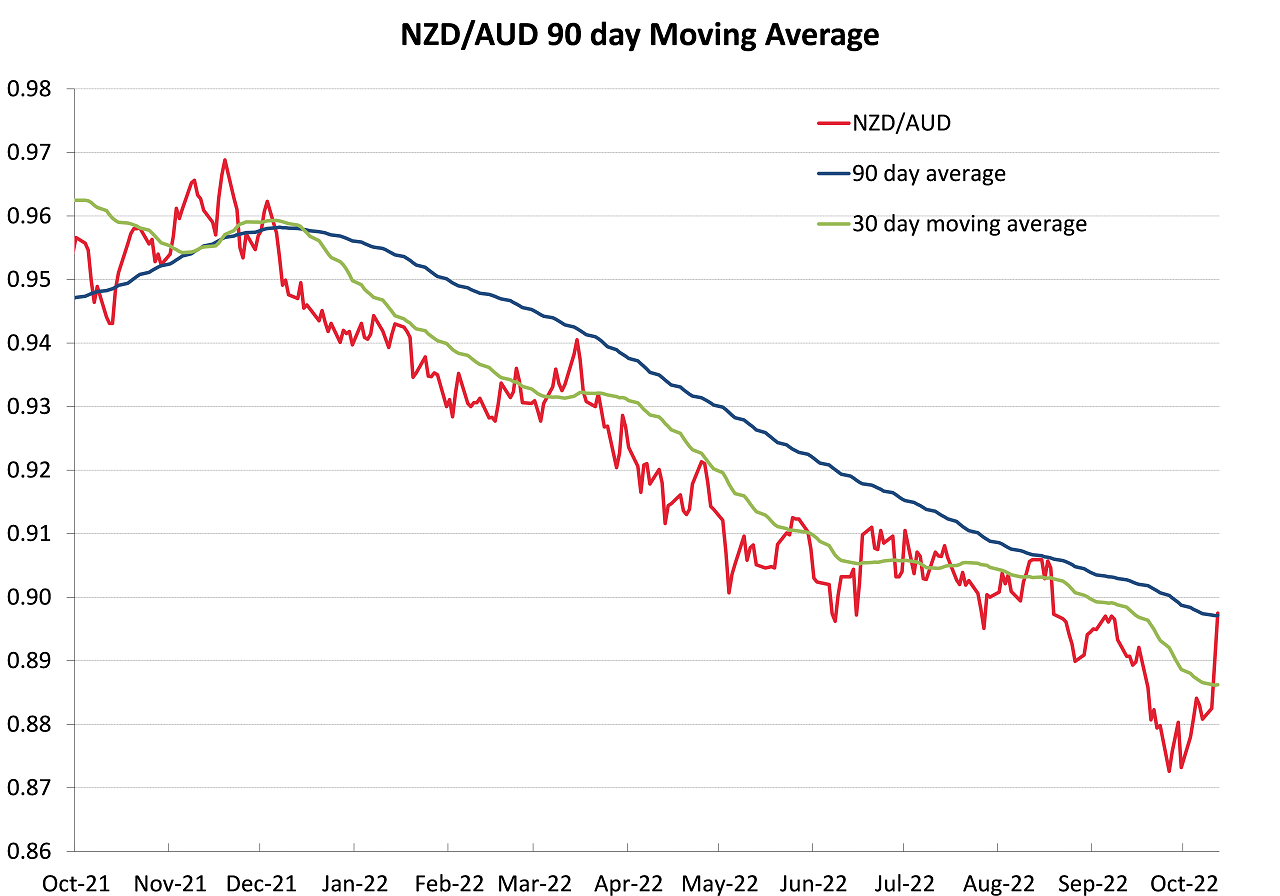

The June quarter inflation numbers are released by Statistics NZ on Tuesday 18th October and no surprises are expected. Prior consensus forecasts range from +1.60% to +2.00% for the quarter, marginally reducing the annual rate of inflation from the current 7.30% to between +6.60% to +7.10%. Inflation will not reduce in New Zealand as fast as it went up this year (as is likely to occur in the US) due to the chronic labour shortages pushing up wages and endless price increases from an out-of-control public sector. Adding to the increasing inflationary pressures is the depreciation of the NZ dollar, not only against the USD, however alarmingly against the UK Pound and Euro. The NZD/GBP cross-rate is trading below 0.5000 at 0.4780, which makes no sense whatsoever given the UK’s current woes. The NZD is expected to make further gains against the AUD (recently up from 0.8750 to 0.8970) as the FX markets re-price the NZD/AUD rate as the RBA are now going slower on interest rate increases compared to the RBNZ. The NZD/AUD spot rate has ramped up to be above the 30-day and 90-day moving average rates (refer chart below), likely to prompt the speculators to unwind short NZD/long AUD positions by buying the NZD back against the AUD.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

3 Comments

Thank you Roger for writing about the lag of inflation measures, I have been banging on for quite some time. Having timely data is of upmost importance, as is understanding that inflation is measured over 12 months, I hope more will come to understand this but given the total absence of any comments in over 4 hours since you article, I'm not holding my breath

Here is a re-post of a comment I wrote last week, which I believe is on point with the above article.

by Yvil | 13th Oct 22, 12:38pm

DELAY, it's all-out delay and few seem to understand this point.

Delay between the RB raising the OCR and mortgages coming to their term, people re-fixing and then, after a few months realising how much less money is left for lattes. Yes people know the squeeze is coming, but many only adjust their spending when they are really forced to. As I have stated before the squeeze on spending from the increasing OCR is only going to start being felt in 2023

Delay between the rising OCR and the CPI stopping rising. Remember the CPI is being measured year-on-year, meaning that any inflation from the last 9 months and there's plenty, is also included in the latest CPI figure. In conclusion it will take even longer for the CPI to stop rising and it will only do so meaningful when the 2022 first quarter CPI rise drops out, in other words when the 2023 first quarter CPI will be released, which will be in… May 2023 !!! So it's pointless expecting a meaningful drop in CPI before May 2023.

In conclusion, because of the delay explained above, the OCR is going to get raised far too high (most likely 5%), NZ will be in recession in Q1 2023 but this will only be reported in the GDP in June 2023 (we're so slow in NZ) by then CPI will be lower but not yet in the target range of 1-3%, the RB will think "we're heading in the right direction", the next set of data will be Q2 GDP deeply negative reported in September 2023 and Q2 inflation confirming its continued drop towards 1-3% reported in August 2023 and then, the RB will panic and drop the OCR back down aggressively.

So expect a much lower OCR by end of 2023 after a likely peak of 5% earlier in the year.

Agree.

Total vol of global debt means when the punch finally hits it will be devastating and just as they did on the way down the rbnz/FED using only Proportional control algorithms and attempting to model that which can not be modeled accurately makes for huge likihood of big rates reversal as it becomes clear the vol. of debt can't be valued (i.e price thereof) at such a high level with so much on so many peoples books.

It being a global and US, EU lead problem im thinking rbnz might wise up sooner but no guarantees in anything anymore.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.