-

Summary of key points: -

- US equity markets start to bet that the Fed will pause before Christmas

- Another RBA “about-face” on the cards?

- Are we on the brink of a massive unwind of “long-USD” speculative positions?

US equity markets start to bet that the Fed will pause before Christmas

Are we now witnessing a sea change in the direction and sentiment in global financial and investment markets that builds in an upcoming change of policy from the US Federal Reserve?

A few weeks of stronger US equity markets and the US dollar value pulling back from its previous “one-way bet” gains is maybe not sufficient evidence yet to draw a definitive conclusion. However, the recent signs are encouraging for the Kiwi dollar to recover to back above 0.6000 against the USD as fast as it dived from 0.6000 to 0.5550 in mid to late September. The month of October has delivered a different pattern of pricing/trading for the NZD/USD exchange rate with several up and back movements between 0.5550 and 0.5800 as the currency markets started to express some doubt as to the continuing sustainability of the USD appreciation against all currencies. The volatile and zig-zag movements within a defined range quite often indicate the ending of a major trend as markets become very unsure as to whether the long-standing USD strengthening trend can continue, however are not confident enough to sell the USD aggressively to start a clear new weakening USD trend. Over recent days the NZD/USD rate has decisively broken above the previous cap at 0.5800 and further gains seems likely in a rapidly changing global currency market environment.

Over this last week the mood has clearly shifted towards the likelihood and timing of the US Federal Reserve firstly pausing on their hawkish monetary policy stance (increasing interest rates) and then eventually pivoting to ultimately cut interest rates as the inflation threat is beaten into submission. Two developments in the US appear to be behind this latest shift in sentiment: -

- A Wall Street Journal article that highlighted a growing debate between Governors within the Fed as to the appropriate pace of monetary tightening from the current position. Up until recently the Fed seemed unanimous amongst its voting members that the economy was robust enough to withstand higher interest rates and that inflation had not yet peaked. Today there are many question marks challenging those two assertions.

- As expected, US housing market data has continued to dramatically weaken. Over the last two weeks house new builds, building permits issued and house prices (for August) have all plummeted. It is only a matter of time before the shelter (rents) component, which is contributing to most of the 6.60% core annual inflation rate, stops increasing and reverses downwards.

The financial and investment markets will always attempt to pre-empt the Fed’s next move as they look forward at likely future economic and inflation conditions. The US Federal Reserve is unlikely to change its current tone and message at its FOMC monetary policy statement this Wednesday 2nd November (6am Thursday NZT). They will deliver the expected 0.75% increase to 4.00% in the Fed Funds rate and still state that there is not enough evidence to conclude that inflation has peaked. The US equity markets in increasing the Dow Jones Index 15% from 1 October to 28 October are already pricing-in a growing probability that the Fed will be forced to pause on monetary tightening by the time they get to their following, 14th December meeting (where they update their full economic projections). The FX and bond markets are not yet as conclusive as the equity markets on that anticipated timing of a monetary policy change. The USD Dixy Index depreciated to a low of 109.60 last week (down 4.4% from its 114.60 high on 28 September), however it has since recovered marginally to 110.55. The US 10-year Treasury Bond yield peaked at 4.33% on 22 October and has reversed to as low as 3.91% (4.00% currently).

In the Fed’s eyes, they will want to see a weaker trend in the US employment (labour) market before they would have confidence that they have got on top of the inflation problem. The October Non-Farm Payrolls numbers due for release on Friday 4th November will therefore be vital for both the Fed and the markets. An increase in new jobs between 200,000 and 240,000 over the month is the range of forecasts, lower again on the +263,000 in September. A result at the lower end of the expected range will be positive for equities, reduce bond yields and be negative for the USD. Weaker ISM manufacturing PMI data in the US on Wednesday 2nd November would have the same market reaction.

US equity markets had a “false start” rally upward in July when the US July inflation number was lower than expected and many thought inflation had peaked. Higher than forecast inflation results in August and September reversed those equity market gains and sent the Kiwi dollar down to 0.5550. The October equities rally does not appear to be a second false start as US economic conditions (particularly housing) are clearly much weaker and the upwards price pressures in rents and airfares will inevitably reverse. Anecdotal evidence of considerably weaker US consumer demand was provided by Amazon last week, they are already foreseeing slower Christmas related retail sales.

Another RBA “about-face” on the cards?

Only the mandarins at the Reserve Bank of Australia (RBA) could time their next monetary policy statement and interest rate decision on the same afternoon as the Melbourne Cup horse race on this coming Tuesday!

The RBA surprised all and sundry last month with a lower than expected 0.25% OCR increase and indicated a slower pace for future increases. Their problem is that subsequently the September quarter inflation figures came out substantially above both market and their own prior forecasts. The 1.80% increase for the quarter was much higher than the 1.10% to 1.60% range expected. The increase in their annual inflation rate to 7.30% does not really allow the RBA the luxury of now increasing interest rates at a slower pace. There is a reasonable probability that we will see another RBA U-turn on Tuesday with a 0.50% OCR increase when the market just expects 0.25%. Yet another surprise from the RBA would be positive for the Australian dollar in its own right.

Are we on the brink of a massive unwind of “long-USD” speculative positions?

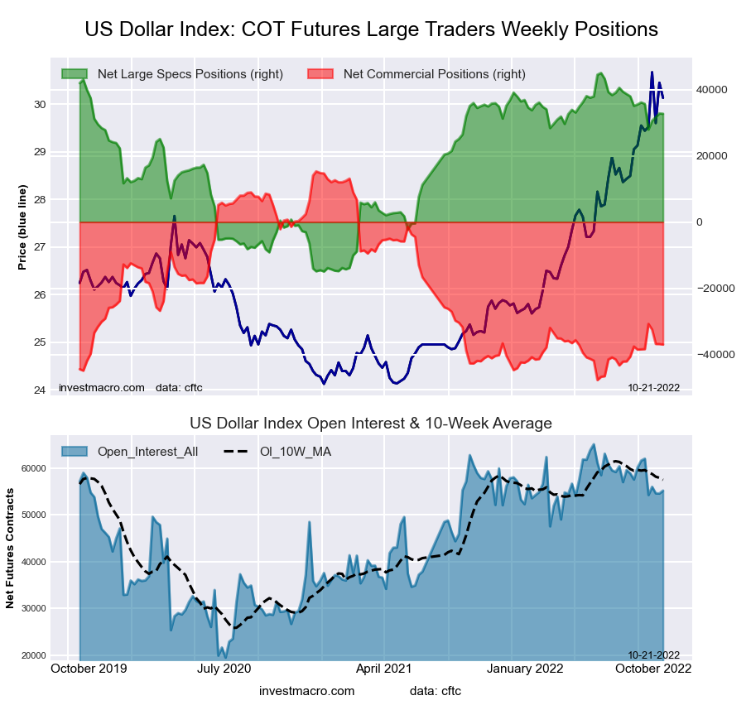

The level of open FX futures contracts placing speculative bets on the USD value is just one of the many measures of FX market positioning. As the charts below indicate, the number of futures contracts for “long-USD” speculative positions (green shaded area) expecting the USD to appreciate is starting to reduce. In June 2022 there were 45,000 long USD contracts in place, today there are 32,000. The USD punters are starting to lose their conviction about the USD continuously appreciating. The rapid USD appreciation, from 96.0 on the Dixy Index in February 2022 to above 110 recently, is starting to waiver.

In late 2019, the were also 45,000 long-USD futures contracts betting that the USD would continue to appreciate. By mid-2020 all those long USD FX positions had been unwound to zero (selling the USD to do so). The USD Dixy index depreciated from 99.0 in late 2019 to below 90.00 by mid-2020.

The punters currently holding long USD currency positions have made very good unrealised profits over recent months with the appreciation of the USD. Do not be at all surprised that they cash up their profits through the month of November (selling the USD to do so) before their 31 December financial year-end in the US and the Christmas holiday period. If the US equity markets are correct that the Fed will pause on the tight monetary policy stance before Christmas, the forex markets will soon start to reflect that same sentiment. The NZD/USD exchange rate well above 0.6000, on a weaker USD globally by year-end, has to be a reasonable probability. If that happens as expected, the “Fed Error” plunge in the NZD/USD rate we highlighted in our 3 October 2022 report will have reversed as quickly as all the previous Kiwi dollar plunges/recoveries.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

4 Comments

You and your colleague Nick Smyth forget to factor in the continuous massive current account deficit New Zealand has! I believe this will limit the upward trend of the New Zealand Dollar sustainably.

Aren’t commodities in some trouble?

I'm seeing the NZD sub 50c US by New Years Eve myself..... chances of a major crisis effecting markets very negatively going forward is through the roof.

Roger's call - sell the USD. You read it here first.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.