-

Summary of key points: -

- Lower than expected US inflation sparks massive financial market reactions

- RBNZ have no alternative but to tighten monetary policy further

- Aussie and Chinese influences also important for the Kiwi dollar

Lower than expected US inflation sparks massive financial market reactions

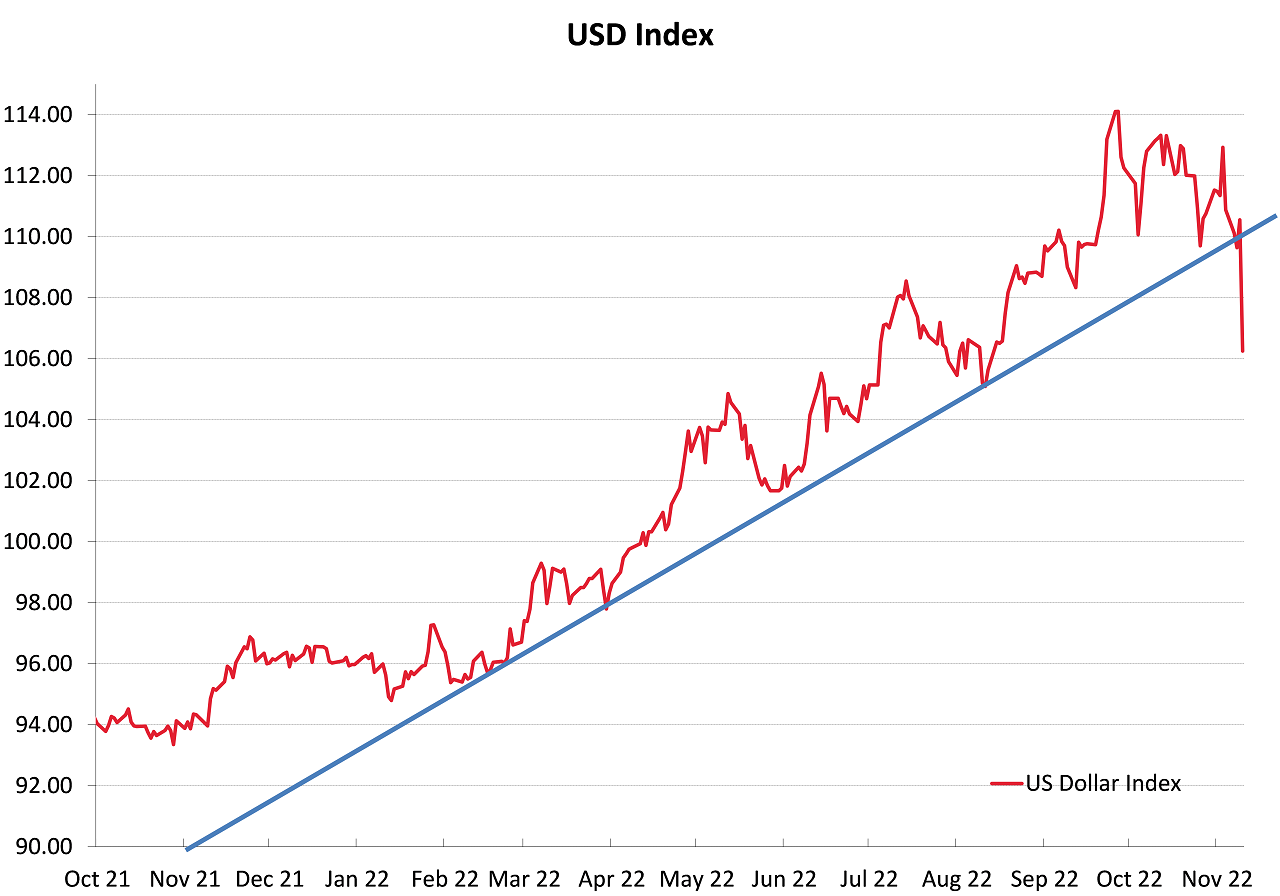

The pressure had been building in global currency markets over recent weeks that the “one-way bet” sentiment and conviction of buying and holding US dollars was starting to waver, as evidenced by the recent the up-down-up volatility between 110 and 114 on the USD Dixy Index (refer chart below).

The FX markets were displaying an uncertainty as to whether the strong USD uptrend, that has been in train since the Russian/Ukraine war started in February, was running out of steam. However, it needed a special catalyst to break the USD bulls and stimulate aggressive USD selling. Last Thursday’s US October CPI inflation numbers delivered that trigger, the core inflation monthly increase coming in at just +0.30% compared to prior consensus forecasts of +0.50% to +0.70%. Equities markets rallied big-time, bond yields tumbled, and the US dollar was hit hard as long-USD speculative position holders all rushed the exit door at once. What the financial markets were instantaneously reflecting was a belief that US inflation had finally peaked, and the Federal Reserve would soon need to change their tune and start to pause on the rapid increases in interest rates to tighten monetary policy. The evidence of the US economy abruptly slowing, and demand better matching supply has accumulated to the point that the markets are now convinced and are pricing-in the inevitable Fed pause on monetary policy.

The US dollar has nose-dived by 6.00% over the last eight days from 113.00 on the Dixy Index on 3 November to a close of 106.25 on 11 November. As a consequence of the widespread USD selling, the NZD/USD exchange rate has soared 6.30% higher from 0.5750 on 3 November to 0.6115 today. The “plunge and recovery” historical pattern of the Kiwi dollar has indeed repeated as we expected it to.

Local USD exporters who continued to maintain their forward hedging levels at maximums of policy limits over recent months by replacing all maturing hedges at exchange rates between 0.6000 and 0.5550, have been well rewarded for their risk management patience and discipline. The high levels of hedging will need to be maintained going forward as the massive unwinding of long-USD positions still “has a ways to go” (to quote the world’s leading central banker). As previously highlighted, the fact that we are in November and close to the end of the 31 December US financial year will be further motivation for the speculative hedge funds to close-down their USD positions before the USD weakens further and reduces their profits. The tide has finally turned on the once mighty US dollar and further heavy USD selling has to be expected over coming weeks. In these dramatically changed global FX market conditions, the Kiwi dollar could easily trade higher to 0.6400 or 0.6500 by the end of the year, or early next year.

Adding to the case of just how quickly the economic conditions have slumped in the US over recent months, last Friday’s Michigan Consumer Confidence survey for November fell away from the previous 59.9 level to 54.7. High inflation and much higher interest rates have hit US consumer spending hard, it is therefore going to be a tough Christmas for retailers. US retail sales figures for October are released this Wednesday 17th November and a result well below consensus forecasts of +0.90% would have to be expected. The US housing market has collapsed into recession and the negative “wealth effect” from falling house prices will now be seen in much lower consumer demand. Ultimately, the largest contributor to the current elevated US core inflation, shelter-rents, will also reduce sharply. However, there is a considerable time-lag with the rents data as evidenced by the October inflation numbers where rents were still increasing by 0.70%.

RBNZ have no alternative but to tighten monetary policy further

The priorities and decision-making by the RBNZ has been under intense media and political scrutiny over recent weeks with the re-appointment of Governor Adrian Orr for another term and the release of the RBNZ’s own performance appraisal report of themselves!

The RBNZ’s next Monetary Policy Statement on 23 November will therefore attract more attention than usual. There is no question that the fight against higher inflation is not yet over for the RBNZ, despite the Governor indicating a few weeks back that he was nearing the end of the tightening cycle. The RBNZ now have to address serious wage-push inflation as the labour shortages throughout both the public and private sectors reach acute levels. Hourly wage rates increased by over 7.00% in the September quarter and business firms are being forced to pay up big-time to attract and just keep staff. The question is whether the so-called independent central bank will directly address the root cause of the wage-push inflation problem i.e. call out the Government for their botched immigration policy in the post Covid era that has created the labour shortages. It may be too much to ask the RBNZ to identify and address the underlying causes of inflation, as they have failed miserably to recognise the reasons for the consistently high non-tradable inflation (home-grown domestic inflation) over the last 10 years i.e. Government bureaucracy, legislation and regulatory compliance.

A more hawkish tone has to be expected from the RBNZ and that should generate further NZ dollar buying. Looking ahead into next year, in addition to general USD depreciation in global FX markets, the NZ dollar may attract buying interest on its own account as interest rate differentials to the USD widen. Currently, the NZ two-year swap interest rate at 4.95% is 0.50% above the US two-year rate of 4.45%, not sufficiently wide enough to attract offshore investors into the Kiwi dollar. My mid-2023 the US Fed will be reducing their interest rates as inflation falls as fast as it went up in 2022. Due to the stickier and more permanent wage-push inflation in New Zealand, the RBNZ will need to hold interest rates higher for longer in 2023. The net result is another NZD positive factor as the US:NZ interest rate differential potentially widens out to 2.00% and attracts offshore inflows into the Kiwi dollar. We have not seen independent NZD strength for quite some time, but the double-whammy of a weaker USD and widened interest rate differentials points to sustainable NZ dollar gains next year.

The forecast NZ dollar appreciation will come at a time when the NZ economy itself is looking somewhat sicker with export prices now falling back and the domestic economy already in recession. Local USD importers need to keep hedging levels at bare minimums with the expected NZD gains and decreasing FX exposure forecasts due to the weaker economy.

Aussie and Chinese influences also important for the Kiwi dollar

Both the NZD and AUD remain highly correlated to the Chinese Yuan currency value due to the economic inter-dependencies. The Yuan’s value reversed dramatically last week from above 7.30 against the USD to 7.09 as the USD weakened and China announced some adjustments to their Covid Zero policy with reduced quarantine times. Further progress on relaxing their stringent Covid policies will be positive for the Yuan, and therefore also positive for the NZD and AUD.

The Australian dollar has been lagging NZD gains against the USD due to the RBA taking a slower path to the RBNZ with interest rate increases. The RBA will be forced to review their “go slow” monetary stance if upcoming economic data proves that inflation is still rising. Australian wages data this Wednesday will be important is assessing whether inflation is peaking, or not. September quarter wages are forecast to increase by 1.20%, much higher than previously. Australian employment numbers the next day on Thursday 17 November will confirm that their labour market remains tight as well. The next RBA meeting to decide interest rate settings is Tuesday 6 December. A less dovish stance form the RBA than what the markets expect would see the NZD/AUD cross-rate give up some of its recent gains from 0.8750 to 0.9140.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

2 Comments

"the underlying causes of inflation, as they [current government] have failed miserably to recognise the reasons for the consistently high non-tradable inflation (home-grown domestic inflation) over the last 10 years i.e. Government bureaucracy, legislation and regulatory compliance.the underlying causes of inflation."

If Labour/Greens are re-elected, we will be on the same par as Argentina 3 years from now.

I myself suspect a global markets and economic crisis is imminent, which will see the USD and UST's strengthen in the most massive flight to safety ever seen.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.