-

Summary of key points: -

- NZ monetary policy needs to tighten further to combat persistent domestic inflation

- Higher NZ interest rates through 2023 may see the return of the NZD “carry-trade”

- Rural sector mood turns darker for good reasons

- Cryptocurrency collapse no “black swan” event

NZ monetary policy needs to tighten further to combat persistent domestic inflation

It is a question of credibility!

The Reserve Bank of New Zealand’s dented reputation as an independent, progressive and authoritative central bank is on the line this week.

They have to step up, and rise above the wishy-washy employment, house prices and climate change impositions the Ardern Government has shackled onto them in recent years and address the debilitating problem of a wage-push inflation spiral that the New Zealand economy is now facing. Their primary and really only purpose is to protect the value of our savings and future spending power by maintaining low and stable inflation.

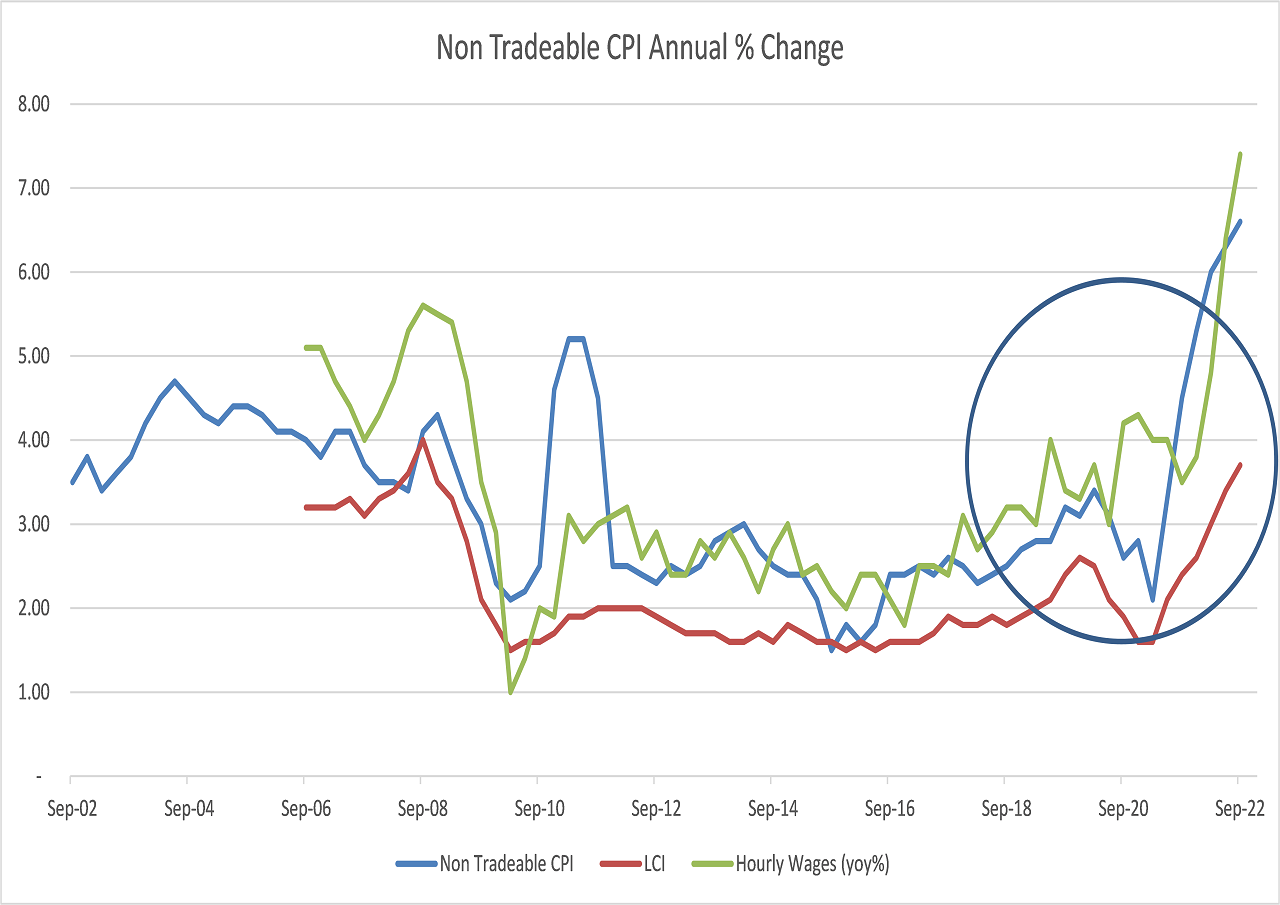

They are under pressure to act decisively at this point in time, because so far, their monetary tightening policies over the last 12 months have not stopped the wage-push inflation we are now experiencing. Instead of attempting to manage rising prices with only a reactive monetary policy response (ambulance at the bottom the of the cliff), the RBNZ need to stand up, put their “big-boy’s pants on” in a proactive manner and address the underlying root causes of the permanently high and increasing domestic/non-tradable inflation. That requires calling out the current Government for adopting fiscal, employment and immigration policies over recent years that have led to a chronic labour shortage in all sectors of the economy, unsustainable wage hikes without related productivity increases just to keep business firms wheels turning, which in turn has led to a cost of living crisis and misery for everyone.

The RBNZ needs to resurrect their credibility by identifying and offering solutions to reduce the high permanent non-tradable/domestic inflation that financially hurts every household in New Zealand. Standing outside the tent and continuously raising interest rates to clobber consumer demand that sends the economy into recession as their only method to reduce inflation is not cutting it. They need to get inside the tent, and ask the hard questions as to the sources of our high supply-side inflation, e.g. why have local government rates increased by 7% every year over the last decade?

The RBNZ’s credibility and reputation is also under pressure when you observe respected former RBNZ officials such as Dr Arthur Grimes and Grant Spencer openly criticising how monetary policy has been conducted over the last few years. Governor Adrian Orr needs to return to the basics by addressing the true sources of our inflation problem. Whether he has the intestinal fortitude to do that is a question.

The RBNZ can no longer deflect or dodge the responsibility by stating that our high inflation has all come from offshore and therefore beyond anyone’s control (as our politicians are all too eager to hide behind), as that is no longer the case. The outbreak of the Russian/Ukrainian war in February did send oil prices skyrocketing to US$120/barrel, however today’s oil prices at US$80/barrel are lower than before the war.

Commodity, freight and food prices have also been reduced and are no longer the cause of high inflation around the world. Our high non-tradable/domestic inflation comes from rising health costs, house building costs and rent/rates – all due to higher wage rates and regulatory overburden. Government policies on minimum wage rates, additional statutory holidays, additional sick-leave and a minimum $28/per hour for immigrant labour are also contributing to the wage-price spiral. It will all end in tears of course when manufacturers and suppliers of goods/services can no longer achieve price increases due to slumping consumer demand, therefore they start cutting their workforces to reduce labour costs. Laid-off workers can look to Grant and Jacinda for being some of the cause of these upcoming deteriorating economic conditions.

Higher NZ interest rates through 2023 may see the return of the NZD “carry-trade”

In this challenging economic environment, the RBNZ need to increase the OCR by 75 basis points on Wednesday 23 November as actual inflation and inflationary expectations continue to increase. Their updated economic forecasts will have to show the economy contracting into recession next year, but that does not mean they will be cutting interest rates in 2023 because our high inflation is now the sticky/permanent wage-push variety. The US and Australia are not experiencing the same wage-push inflation that we have created, therefore their central banks could well be cutting interest rates in late 2023 at a time when our interest rates need to be held higher, for longer. A 0.75% OCR increase and a stern message on the need for tight monetary conditions for longer will lift the Kiwi dollar on its own account.

The implications of this different inflation/interest rate track for New Zealand is that the Kiwi dollar may well once again attract “carry-trade” offshore investors enticed by a potential 2% interest rate return differential and the distinct possibility to NZ dollar appreciation as well. We have not seen the NZD/USD exchange rate being influenced by domestic NZ factors for the last two years, however 2023 could be a whole lot different. The risk of further strong NZD gains to the mid and high 0.6000’s has increased due to the aforementioned expected interest rate differentials in 2023 and a weaker US dollar generally in global forex markets.

The fact that the NZ economy will be slipping into recession as export returns reduce next year and the domestic economy contracts under high mortgage interest rates, does not mean that the NZ dollar will underperform other currencies against the USD. The RBNZ actually need a higher NZ dollar value across the board to reduce import prices and help bring down inflation. They are already getting that lift with the NZD/AUD cross-rate now trading above 0.9200 and the NZD/JPY rate above 86.0.

Rural sector mood turns darker for good reasons

The mood in rural New Zealand and around our big agribusinesses is becoming grumpier by the day.

Export commodity prices for sheepmeat, beef, dairy, horticulture and logs are now falling, therefore profitability will be down and with that investment and spending reduces.

Farmers are also up in arms about how they were blackmailed into a methane emissions scheme/policy by a Government only interested in world media headlines on leading climate change policies. Our Prime Minister claims that our farmers will be more than compensated when they reduce their sheepmeat/beef livestock numbers by 20% with an additional 20% price premium in export markets as our product is from a low emissions source.

Why would any farmer trust the PM’s word on this as what would she know about global meat markets and (unlike farmers) she has never ever had her income subject to market forces. The lazy media should be asking the international sales and marketing managers at AFFCO, Alliance and Siler Fern Farms whether New Zealand product will command such a 20% premium. Sri Lanka’s recent experience with going organic with agriculture production probably tells you the answer.

Cryptocurrency collapse no “black swan” event

The collapse of cryptocurrency trading platform FTX, whilst seemingly inevitable, is not the US market blow-up/shock that we were warning about a few weeks back.

The total size of the cryptocurrency investment universe of some US$800 billion is very small compared to the trillions market-sizes of equities, bonds and foreign exchange. Knock-on, contagion-type impacts are reverberating through the world of cryptocurrency, however it is only a ripple in the wider scheme of things and will not cause any concern or adjustment of policy by the US Federal Reserve.

Some local fund managers who have dabbled in cryptocurrency investments will be wishing they did not do so, and one large NZ professional services firm will now be quietly distancing itself from once endorsing cryptocurrencies/blockchain technology as a replacement of the banking system!

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

6 Comments

Spot on analysis from Roger Kerr. Wish the current government would listen. NZ will become the next Argentina if the current government is re-elected, with 100% inflation and a devalued currency..

The re-election of the current Government would be catastrophic to the NZ economy and social fabric.

Wage-price spiral...got a 7% pay rise for July 2022 to Dec 2023 and 5% for Jan 2024 to July 2025. Hopefully that will keep up with inflation!!!

The problem with $80 oil is it is not currently being passed back to the consumer so its having no effect on reducing inflation. Doesn't matter what the price of oil is if it doesn't extrapolate to the consumer.

Hence huge Oil Company Profits these late quarters.

"Commodity, freight and food prices have also been reduced and are no longer the cause of high inflation around the world" - unfortunately looking at global price charts won't give a good idea of the conditions NZ businesses are facing or what their reaction will be over the next 12 months.

Many NZ business will need to raise prices over the next year to offset the large increase to their USD cost base over the past 6 months. Right now many businesses are planning for next year so this will likely be baked in regardless where the currency moves next year.

Moreover while freight rates are reducing for most of the world NZ and Australia are not included. Having seen this cost increase as transitory last year many businesses have held off increasing prices but as a result of the stubbornly high shipping rates the price increases will be coming soon.

From where I sit the these are two the main drivers of inflation - 6% salary increases are barely registering in the discussion due to relatively low impact but every business is different.

Good article. Tough love is what's needed.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.