-

Summary of key points: -

- Choppy and directionless year likely as big financial players hold differing market views

- US inflation result yet again below consensus forecasts

- The Aussie dollar is on a roll from positive economic data

Choppy and directionless year likely as big financial players hold differing market views

Differing views on future financial/economic trends and conditions is what makes markets, as well as providing robust price discovery and liquidity to those financial and investment markets. The year of 2023 is already showing signs that it will be a year of choppy and sideways movements in all financial and investment asset sectors. The lack of a clear one-way direction will contrast significantly with 2022 where the first nine months was all one-way traffic of falling equity markets, rising interest rates and a much stronger US dollar. The last three months of 2022 produced the polar opposite as the markets speculated that US inflation had peaked and thus equities rallied higher, bond yields reduced, and the USD value depreciated by 11%.

Expected market direction for this year appears much less clear cut. An example of the differing views on the future came out last week with US investment giants Fidelity Life and Blackrock both firmly of the opinion that higher inflation is not over yet and the Fed has more tightening to do. Therefore, these two massive investment funds see lower equities, higher bonds yields and no weakness in the USD in 2023. In totally the other camp is European investment conglomerate, Robeco (USD170 billion of funds under management) who anticipate falling inflation in the US and thus they are positive on both equities and bonds (lower yields). Also in the more positive camp is the monster US Californian-based fund manager PIMCO (USD1,700 billion funds under management) who believe US inflation has peaked and therefore view bond yields shifting lower.

The opposing views, and the market bets/investment strategies that go behind them, points to the weight of money cancelling each side out, therefore overall sideways market direction.

What has a little more certainty about if for this year is the stage the US Fed and European ECB central banks are at with monetary policy settings. The US is nearing the end of a tightening phase, whereas the ECB is only really just getting started with their cycle of increasing interest rates to drive their high inflation down. The interest rate differential between the USD and EUR is already closing up, which suggests the Euro recovery against the USD which started from $1.0000 three months ago, is now at $1.0800, still has a ways to run.

It also has to be remembered that FX markets are still sitting on large “long-USD” positions and therefore the US dollar continues to be vulnerable to these position being unwound (requiring selling of USD). The two factors that drove funds and speculators into the safe-haven USD last year, the energy crisis in Europe caused by the Russian/Ukraine war and the Covid-Zero policy in China, have now both been effectively reversed. The rationale for holding USD’s as a safe-haven from these risks no longer holds.

Against this global backdrop, the US dollar has further to weaken over coming months. Therefore, the NZD/USD exchange rate has much more potential to trade five cents higher to 0.6900 (equivalent of a $1.1500 EUR/USD rate and 95.0 USD Dixy Index) than five cents lower to below 0.6000.

It is not only the Euro the USD will weaken against. Lower US interest rates is positive news for emerging market economies (and currencies) who borrow in USD. Global investment funds will be attracted into emerging market currencies (particularly Asian with China returning to full-noise again), which generally correlates with the commodity/risk currencies of the NZD and AUD appreciating as well.

US inflation result yet again below consensus forecasts

For the third month in a row, the US inflation increase has printed below prior forecasts from economists. Airfares and rents are still increasing in price; however gasoline and energy prices continue to fall with the lower oil price coming through into consumer prices. In December, the annual headline inflation rate dropped from 7.10% to 6.50%, whilst the annual core inflation rate (excluding food and energy) reduced from 6.00% to 5.70%. As this column has highlighted for several months now, US inflation is already on a course to decrease from above 9.00% to 3.00% as fast as it increased from 3.00% to 9.00% over the first eight months of 2022.

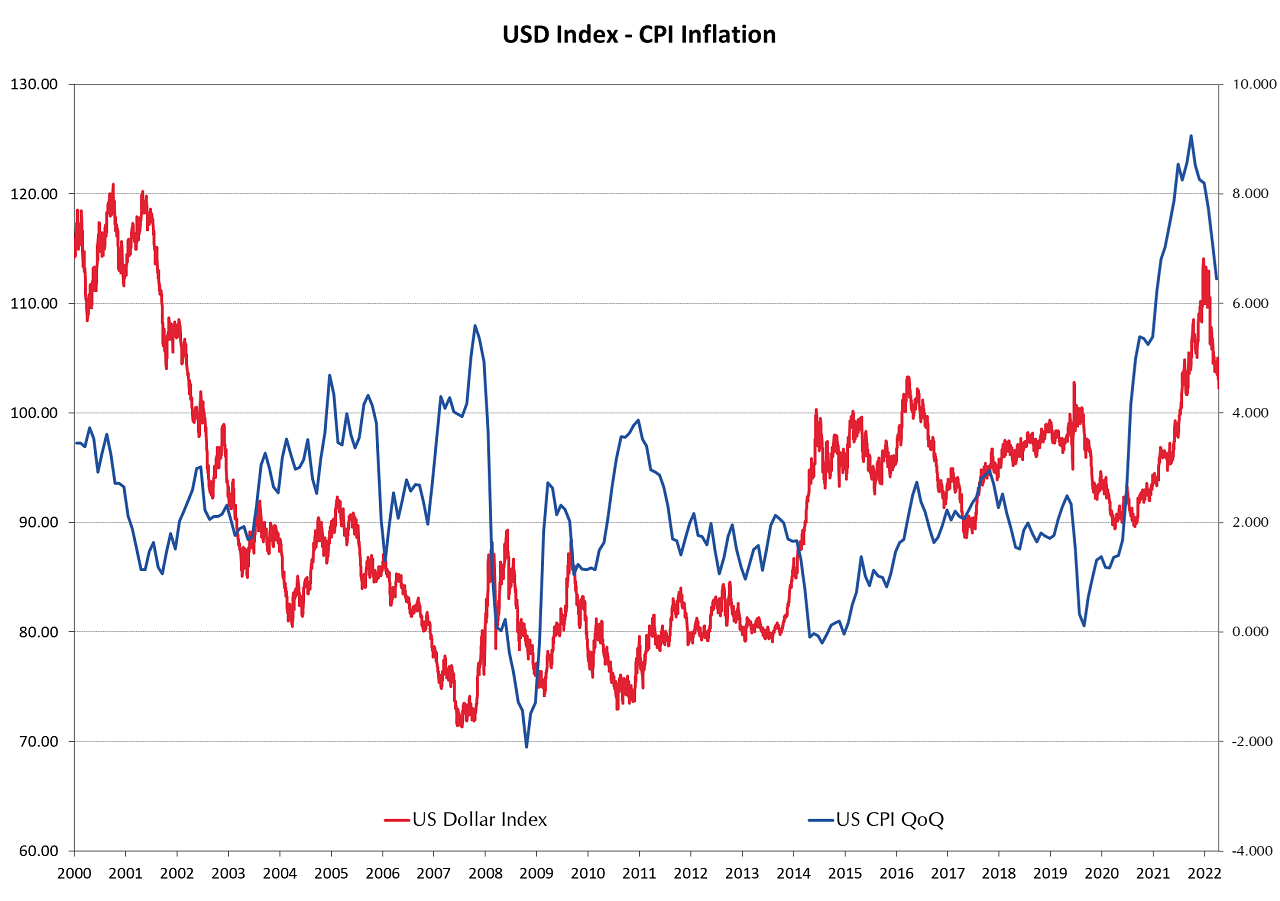

The implications of US inflation falling back down as fast as it went up, is that the US dollar value tracks the annual inflation rate (through interest rate increases and subsequent decreases). The chart below confirms how the USD value follows US inflation trends. US annual CPI headline inflation has already reversed from 9.00% to 6.50% over the last four months of 2022. A further 2.50% reduction to 4.00% over coming months (as monthly price increases in early 2023 are much less than the equivalent months in early 2022) should see the USD Index fall to at least the 95.00 region, if not lower (currently at 102.00).

The Aussie dollar is on a roll from positive economic data

Three separate pieces of economic data released last week in Australia have combined to push the AUD stronger against the USD (to 0.6980) and the NZD (to 0.9150). The Aussie dollar fell right out of favour with global currency investors for large chunks of last year. Firstly, over the first four months of 2022 as the RBA dithered around and did not think they had to raise interest rate until 2024! Secondly, towards the end of the year when the RBA indicated that they would start to “go slow” with further interest rate increases. However, no currency depreciates for long if their economic data is superior to other comparable economies.

Last week, the AUD was propelled higher from: -

- November retail sales increased 1.40%, well above forecasts of +0.30% to+0.60%.

- November trade surplus (exports over imports) of A$13.2 billion, against a forecast of A$10.5 billion.

- The monthly CPI inflation indicator increasing from 6.90% in October to 7.30% in November.

Whilst economic data can be volatile month to month, the Australian economy is certainly outperforming the NZ economy at this point. Since mid-December the NZD/AUD cross-rate has plummeted sharply lower from above 0.9500 to 0.9150 as a result.

We typically examine interest rate differentials and commodity price differentials as reliable lead-indicators for the direction of the NZD/AUD cross-rate. Commodity price differentials currently suggest 0.9000, whilst the interest rates differentials suggest higher at 0.9600. How respective nations are represented on the global stage by Government ministers is also important to international perceptions. The very savvy, well connected and well-travelled Australian Foreign Minister, Penny Wong has rapidly returned Australia to China’s good books. The comparison to our “reluctant traveler” Foreign Minister could not be more extreme.

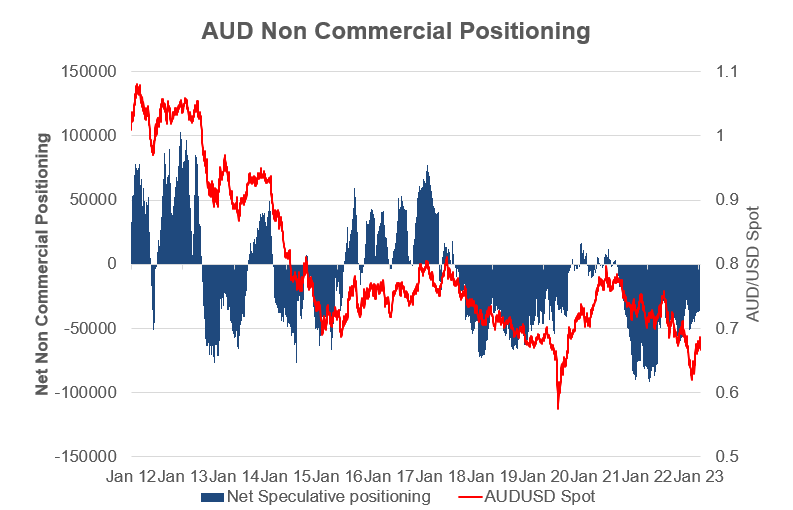

The AUD/USD rate is expected to move back above 0.7000 again with ease and looks set to make further strong gains on the back of China re-opening its economy again. Currency speculators continue to hold “short-sold AUD” positions and these punters must be close to unwinding to stop their losses becoming bigger or profits becoming a lot smaller. The chart below suggests that there is a substantial amount of AUD to be bought to close down the short-sold positions (blue bars = 40,000 futures contracts short sold).

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

2 Comments

Milford Asset Management assessment of outlook for global profits

https://www.nzherald.co.nz/business/investors-brace-for-terrible-earnin…

Do I cash in my Active Growth fund now it has unshrunk a bit??

Great FX overview as always

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.