Summary of key points: -

- US banking collapses not totally unexpected

- Banking crisis is a deflationary shock for the US economy

- Will China and Australasia be recipients of safe-haven flows?

US bank collapses not totally unexpected

In our 8th October 2022 FX Market Commentary we highlighted a view that it was only a matter of time before the blow-up in the UK Government Bond market at that time, would also occur at some point in the US financial and investment markets. Our considered expectation was that excess risk taking with highly leveraged positions when interest rates were 0%, liquidity pressures and the unprecedented rapid rise in interest rates in 2022 would, all combined together, cause an evitable and similar risk event in the US market.

Quotes from our 8 October 2022 report as follows: -

- “The probability of a similar financial/investment market blow-up to what has just occurred in the UK on the other side of the Atlantic must be increasing”.

- “Do not be too surprised to see the well-proven maxims of too much leverage and insufficient liquidity causing a financial shock sometime very soon in the US markets”.

It took longer (five months) than we anticipated, and the failures were not in hedge funds or mutual funds as we pontificated, however it was a mid-sized Californian bank, Silicon Valley Bank, that had grown a lot bigger in recent years than what the markets or regulators had realised. Once trust and confidence is lost and you have a run on a bank, loyalty to a brand disappears overnight. Investors globally also immediately shifted into “risk-off” mode as news of the shock/risk event spread 10 days ago on Thursday 9th March. The US authorities have (to their credit) acted decisively and swiftly to avert a potential contagion banking crisis.

The New Zealand dollar lost some ground to 0.6150 in the immediate aftermath as equities declined on tumbling bank share prices, however, it has since recovered to 0.6260 as massive liquidity rescue packages have prevented an immediate contagious banking crisis.

How the listed Silicon Valley Bank got into such a mess without its senior management, or its Board of Directors, or Wall Street or its banking regulators seeing the potential financial risks in its asset/liability book is a sad commentary on basic risk management and related governance. The Treasury Department of the bank was running a massive unhedged interest rate and funding gap risk position by relying on short-term deposits to fund financial investments in long-term US Government Treasury bonds. The classic mistake that no bank should ever make of “borrowing short and lending long”. The value of the bonds went down as US long-term interest rates rapidly increased over the last 12 months, then the bank was forced to sell the Treasury bonds for liquidity purposes, crystallising immediate cash losses of near to US$2 billion. A botched capital raise to shore up liquidity added to their woes.

Many other regional banks in the US have also been squeezed on unhedged interest rate risk and adverse liquidity conditions. Signature Bank in New York has collapsed, and the major banks have held hands and injected US$30 billion of new deposits into First Republic Bank to save it from the same fate. Jittery equity markets punished the under-pressure Credit Suisse in Europe; however the Swiss central bank has injected US$54 billion into the bank in a rescue package. Saving banks from themselves is a dangerous moral hazard and it cannot continue ad infinitum.

Investor sentiment has improved following the bank liquidity support measures, however there are still many unanswered questions of how this timebomb went undetected. Over coming weeks the markets will continue to reflect lingering worries around bank liquidity and security, as measured by bank share prices and bank credit default swap pricing.

Banking crisis is a deflationary shock for the US economy

No matter which way you examine it, the bank liquidity problems over the last 10 days is a deflationary shock to the US markets and the US economy. The risk or probability of a hard landing for the US economy has increased as a result. Consumers, borrowers and businesses are going to be a lot more cautious about spending and investing as they express worries about the entire financial system. Whether the events are sufficiently negative to persuade the Federal Reserve to pause on further interest rate increases temporarily until things settle down is a moot point. The Fed meet this Wednesday 23 March and the markets are still pricing-in a greater than 50% probability of a 0.25% increase in the Fed Funds official interest rate. The US dollar will weaken if they do not deliver a 0.25% increase, or if the accompanying commentary mentions risks of them tightening too far (as evidenced by the banking problems).

The US inflation figures for the month of February came out last week in line with prior forecasts, however that inflation news has since been swamped by the media coverage of the banking crisis. Food, airfares and housing rents remain as the prices that are still increasing. The rents (shelter) component, that makes up 40% of the core inflation measure, increased once again by 0.80% for the month. The historical/backward method of measuring rents continues to completely distort current inflation trends. Wholesale prices in the US economy (PPI Index) decreased by 0.10% in February, significantly lower than the +0.40% consensus forecasts. US retail sales in February decreased by 0.40%, again weaker than the -0.20% forecast. The US economy is slowing up as expected under the tight monetary conditions, the inflation risks are receding and the banking crisis is an additional negative force in the economy. All three trends are negative for the US dollar value.

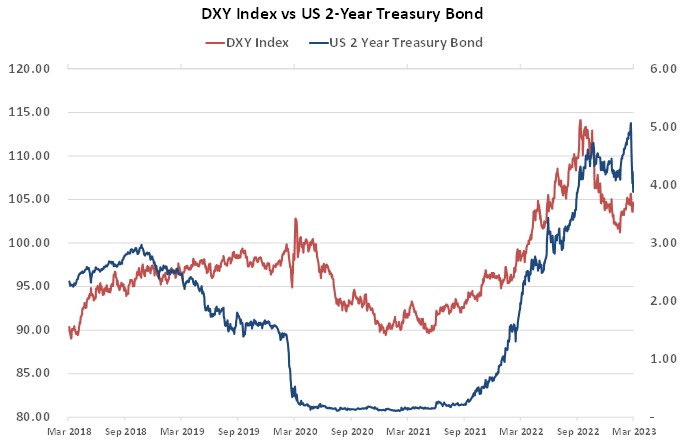

How quickly financial market sentiment and pricing changes when a risk event/shock is encountered is best demonstrated by the chart below. The 2-year Treasury Bond interest rate has plummeted from just under 5.00% to 3.88% over the last 10 days (blue line). It suggests a turnaround back down in the USD Dixy Currency Index (red line), which was previously moving up in February and early March.

Adding to the current deflationary forces in the US economy is the continuing reduction in the crude oil price to below US$70/barrel (WTI). The decrease in the oil price partially coming from Goldman Sachs’ clients being forced to close down “long” oil price speculative positions they put on nine months ago when the investment bank was forecasting an increase in the oil price to US$150/barrel!

Will China and Australasia be recipients of safe-haven flows?

New Zealand’s economic news has been weaker than forecast over this last week. The Balance of Payments Current Account deficit to 31 December 2022, at NZ$9.46 billion, was larger than expected with credit rating agency Standards & Poor’s expressing some concern at the negative trend. GDP for the December 2022 quarter contracted by a larger than expected -0.60%. Meat and dairy production was lower due to climatic conditions and labour shortages. The RBNZ forecast of a 0.70% increase in GDP for the quarter was again well wide of the mark. The weaker economic data does not automatically mean the RBNZ will ease-off on their current tight monetary policy stance. They need to see wage increases moderating before they will do that. For this reason the NZ dollar value will not be depreciating due to the poor Balance of Payments and GDP data.

Many readers will recall the strengthening of the NZ dollar in 2012 on international safe haven capital flows coming into New Zealand when the Greek debt and banking crisis forced global funds to seek a safe and secure destination far away from the problems in Europe.

It may seem counter-intuitive to state it, but Chinese and Australasian banks today stand out as safe beacons of light for global funds to flow towards, well away from the current financial uncertainties in the US and Europe. The Australian dollar is often regarded as an immediate and liquid proxy for all things related to China. Chinese economic data is on the improve and therefore the AUD is poised to make gains from this source, as well as the expected safe haven capital flows.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

2 Comments

NZD fell US10c in 10 days in 2008 during the worst weeks of the GFC............ will this time be different? Not long to wait.

Once again, NZ's poor and worsening Balance of Payments is a worry. We've borrowed billions and wisely invested it in making housing expensive. We can't do anything about that now - the train has left the station, and if finance gets pricier for NZ we will just have to pay one way or another.

What did Dirty Harry say? "You have to ask yourself one question: Do I feel lucky? Well do ya, punk?"

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.