Summary of key points: -

- A lot further to go yet on US inflation decreases (and the US dollar)

- RBNZ stymied by RBA complacency

- China bounce back slower than anticipated, however still coming

A lot further to go yet on US inflation decreases (and the US dollar)

Over recent months it appears that both the financial/investment markets and the US Federal Reserve are spending more time looking backwards at historical US inflation figures and other economic data, rather than looking forward at what is coming up.

The historical inflation continues a trend downwards with the March CPI numbers again less than consensus forecasts last Wednesday. The annual headline CPI inflation rate plunging from 6.00% for the 12 months ending February to 5.00% for the 12 months ending March. However, the markets and a majority of Fed members remain of the view at this point that there is more to do with further interest rate increases to slow consumer demand in the economy. Adding to the fact that the US inflation rate is falling as fast in 2023 as it went up in 2022 (our stated view for several months now), US wholesale PPI prices in March decreased by 0.50%, again much weaker than consensus forecasts. Reducing energy prices was the dominant contributor to lower wholesale prices, however OPEC production cuts has lifted the crude oil price (WTI) from US$70/b to US$80 in recent weeks .

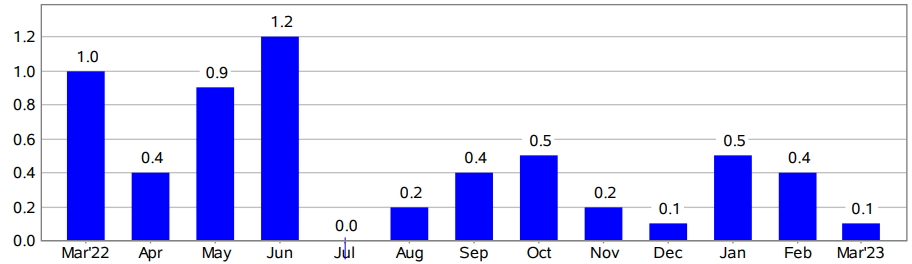

If the markets looked ahead at what is coming up over the next three months with low monthly inflation increases (0.20% to 0.30%) this year replacing the 0.40%, 0.90% and 1.20% monthly increases in April to June 2022, the headline annual rate will be close to 3.00% by 30 June (refer bar chart below). That result is also before the 12-month lagged house rental prices reverse downwards over the next six months. The Fed could have their desired 2.00% annual inflation rate a great deal earlier than anyone ever imagined. Given the reasonably severe tightening in bank credit conditions since the Silicon Valley Bank collapse in March, the probability is growing every day that the Fed may not hike interest rates the last 0.25% next month.

The past and upcoming developments with the US inflation rate have added further fuel to the selling of the US dollar in global currency markets over the last week. The USD Dixy Index currently at 100.68 falling to its lowest level in almost a year. We remain with our view that the US dollar currency value is primed for another significant leg downwards to the 95.00 area on the Dixy Index, following the depreciation from 114 to 101 from October 2022 to January 2023. By definition, the NZD/USD exchange which has again bounced back up from its 0.6200 support area to 0.6300, will re-commence its appreciating trend to the 0.6800/0.6900 region. The EUR/USD exchange rate is now trading well above $1.1000 and further Euro gains towards $1.1500 have to be expected given that the gap of US bond yields over European bond yields has reduced from over 2.00% six months ago to 1.00% currently and looks set to got to 0.50% as US yields move lower and European yields move higher.

The other interesting development in the US is the labour market has remained robust over recent months in the hospitality and leisure sectors, however it is now seeing a contraction in jobs in retail, construction and manufacturing sectors. It could well be that more people previously not seeking employment (dropped out to different lifestyles during Covid) are now being forced to return to work in the restaurants, hotels and bars as their hoarded Covid cash has run out. Like all economic data, you have to look well behind the headlines to see what is really going on. The Fed should not be interpreting the hospitality job increases as a threat to inflation as their wages are very low due to the reliance on tips/gratuities (now around 20% per check in the US) for the workers incomes.

RBNZ stymied by RBA complacency

The decision by the RBA two weeks ago to “pause” on their interest rate increases to control inflation is already looking like another monumental monetary policy blunder by the Australian central bank. The RBA for some reasons seem to believe that wage increases across the Australian economy will not lead to higher inflation. March employment numbers released on Thursday 13th will be the first in a series of Aussie economic data points that will evidence that the RBA have got this wrong again. The Australian economy produced 53,000 new jobs in March following a 63,000 increase in February. The consensus forecasts were for an increase of only 23,000 in March. The supply/demand equation in the Australian labour market points to higher wages than the current +4.00% settlements as their inflation remains nearer 7.00% and the trade unions will be seeking compensation for their members. The next Australian wages index data is not due for release until 17 May 2023.

The RBA decision to pause right at the same time that the RBNZ shocked the markets with a 0.50% interest rate increase meant that Governor Orr did not get the “bang for the buck” he was looking for. The RBNZ were uncomfortable with the NZ interest rate forward pricing building-in cuts later in the year. However, in addition the RBNZ would have been expecting the NZ dollar to appreciate one to two cents on its own on such a surprise interest rate increase. The AUD being held down by the RBA pause stance, also held the NZ dollar down. Therefore, last week we have the highly unusual situation of the Kiwi dollar depreciating, when historically it would have jumped up on its own account. The RBNZ need a higher NZ dollar to assist them to bring inflation down. The good news is that the RBA will eventually be forced to reverse their pause position, which when it happens will propel the AUD up against the USD, the NZD following suit.

The New Zealand CPI inflation numbers for the March quarter are due for release next week (20th April), the forecast 1.60% increase will maintain our annual inflation rate at 7.00%. The Australian CPI inflation data for the March quarter is due on 26 April, and the risk is that it will be above consensus forecasts of a 1.20% increase. The AUD/USD rate is already back to 0.6800 and the aforementioned anticipated back-down by the RBA suggests a return to 0.7200 it reached in early February.

China bounce back slower than anticipated, however still coming

Chinese economic data through January and February has generally been weaker than what we were anticipating from the pent-up demand being released after two years of Covid lockdowns. It seems consumers are being a bit slower to express confidence in their jobs and household finances. Citibank are of the view that the rebound wave will now come later in China, in the third and fourth quarter of this year. Whilst the NZD and AUD currencies have gone sideways over recent months, they still have the potential to appreciate more than other currencies as Chinese economic activity returns this year. Trade tensions with China are also reducing, already the Aussie are exporting coal again and it appears barley shipments will also resume.

Upcoming Chinese economic data for the month of March to watch out for over coming weeks includes: -

- GDP March quarter, Tuesday 18 April.

- Retail Sales March, Tuesday 18 April.

- Industrial Production March, Tuesday 18 April.

- Imports/Exports April, 9 May.

Stronger than forecast outcomes will be NZD And AUD positive.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.