1. Has NZ inflation peaked and will now fall away?

The celebrations over recent days from both economists and the media alike, that New Zealand’s inflation rate has peaked and will now fall away is premature, mis-guided and alarming. One just hopes the RBNZ are ignoring this so-called “good news” and are concentrating on the areas of the economy that constantly increase their prices. The annual inflation rate coming at a lower than forecast 6.70% was largely due to fuel prices falling by much more over the three-month January to March period than what weekly fuel price monitoring/measuring indicated. There was a time not too long ago when the RBNZ excluded offshore-driven oil prices from the inflation rate for monetary policy management purposes. It is totally outside their control and can be volatile. House construction costs also reduced sharply from 18.00% per annum increase to 12.00% - hardly something to celebrate.

All other price movements in the economy appear very sticky at the elevated levels and therefore it is going to be a long hard slog for the RBNZ to return inflation to below their limit of 3.00% over coming years. Non-tradable inflation from the domestic economy remains at an 6.50% annual increase with no movement downwards in the March quarter results. The non-tradable inflation is the result of previous labour shortages causing wage-push inflation. Strong inwards immigration flows are now finally alleviating the labour market pressures; however wage/price inflation spirals are not reversed overnight.

2. What do we think of the reaction of financial markets to the two recent surprises - 0.50% OCR increase and lower annual inflation?

In normal circumstances, both the RBNZ and the FX markets would have expected the Kiwi dollar to jump upwards by one to two cents on the surprise 0.50% OCR increase on 5th April. However, the initial movement higher to 0.6350 rapidly fizzled as global events with China/Taiwan tensions, the RBA’s interest rate pause and a marginal appreciation of the USD at the time outweighed the NZ domestic forces. One of the RBNZ motivations with the surprise increase would have been to drive the NZ dollar up to assist with bringing inflation back down (reducing the cost of imported goods). The RBNZ were also looking to stop the forward interest rate markets from pricing-in interest rate cuts later in the year. The RBNZ will be disappointed with the subsequent NZ dollar movements lower.

The lower than expected inflation result last week immediately sent the Kiwi dollar lower to 0.6150 from above 0.6200. The Kiwi dollar has yet to attract any buyers at these lower levels despite the USD weakening to $1.1000 against the Euro on global FX markets.

At some point very soon, the widening interest rate differential of the NZ interest rates over US interest rates will be recognised by FX markets, investors and speculators. It has become very expensive to hold a “short-sold” NZD position with the forward point cost, whereas a ‘long-Kiwi” position commences with an immediate reward of a favourable forward points benefit.

3. Will Finance Minister, Grant Robertson’s May budget be inflationary?

The RBNZ have made it very clear that expansionary Government fiscal policies are adding to our inflation problem. However, will the Finance Minister be listening and heed the warnings? The pressure from his colleagues around the Cabinet table in an election year will be immense. The reality is that New Zealand Inc can no longer afford to borrow to pay the grocery bill. However, desperate politicians often do desperate things. The 18th May budget statement has a higher probability of being positive for the Kiwi dollar as the RBNZ have to factor in increased Government spending.

4. Is the US banking crisis over?

The crisis is far from over for the regional banks in the US, however the forex markets have quickly moved on as the potential contagion impact across global banking markets did not happen. What has resulted from the banking collapses is much tighter credit conditions in the US economy as regional banks loose deposits and therefore abruptly slash their lending volumes and tighten their loan criteria.

The resultant credit crunch in the US is already showing up In March statistics. In the sub-prime auto loan market the percentage of borrowers more than 60 days behind with their regular payments has jumped to 5.30% (higher than the GFC period in 2009). The number of US corporate bond securities falling into high-yield (junk bond) status increased to US$11 billion in the March quarter, the highest since 2020. A total of US$80 billion is forecast to be downgraded to junk bonds this year. Just the same as highly leveraged mortgage borrowers in New Zealand, many US companies took on too much debt when interest rates were close to 0% a few years back and now they are in financial stress.

5. Will the US Federal Reserve do a final 0.25% interest rate increase?

Various Fed Governors are still talking tough on the need to maintain higher interest rates, but the reality is that US inflation is reducing very quickly. The next Fed FOMC meeting date on May 3rd will see the final 0.25% interest rate increase and a Fed admission that the rapid tightening of credit conditions in the US economy means they will not have to do any further increases after that.

Whatever the messages are from the Fed, the decrease in US inflation and ultimately the decrease in US interest rates remain as very large negatives for the US dollar value. More and more commentators are highlighting the differential between US and European 10-year bond yields and concluding that capital flows back into Europe will send the EUR/USD exchange rate from the current $1.1000 level to $1.15000 at least.

Both the markets and the Fed cannot ignore the mathematics that will see the US core annual inflation rate continue to slide from 5.00% to below 3.00% over coming months (small 0.20% monthly increases this year replacing 1.00% monthly increases last year).

6. A hard or soft landing for the US economy?

The evidence is gathering that Jerome Powell and the Fed may have got this about right i.e. avoided a hard landing for the US economy into an abrupt and deep recession. Current listed-company earnings results on Wall Street are generally better than the pessimists predicted, therefore a shallow and relatively brief recession (soft landing) is now the preferred track. Monthly US economic data will still print on the weaker side, and this will maintain downward pressure on the USD.

The conclusion is that the mild US economic downturn, coupled with a rapid rebound in Chinese economic growth, will not mean a bad global recession. The pundits advising to sell the Kiwi dollar as a hedge against a bad global recession will be hastily revising their positions as a result.

7. Does the NZ Balance of Payments Current A/c deficit blow-out cause a credit rating downgrade?

The fundamental cause of the deficit increasing from 5.00% of GDP to the current 9.00% of GDP is the lack or foreign tourist income over the recent Covid years. The credit rating agencies will have some tolerance for this as they know the tourists and immigrants are now returning to New Zealand in large numbers.

Sovereign credit ratings and no different to corporate credit ratings, has the ability to service and repay the debt improved, deteriorated or remained the same? If our export commodity prices were tumbling at this time our ability to service debt would decrease. However, that is not the case, therefore the risk of a NZ credit rating downgrade does not appear high.

8. Will the Chinese economic rebound save the global economy from recession?

It is looking increasingly likely that this will materialise into fact. Global investment banks are all increasing their forecasts for Chinese GDP growth in 2023. As expected, Chinese retail sales and industrial production data for March released last week was stronger than expected.

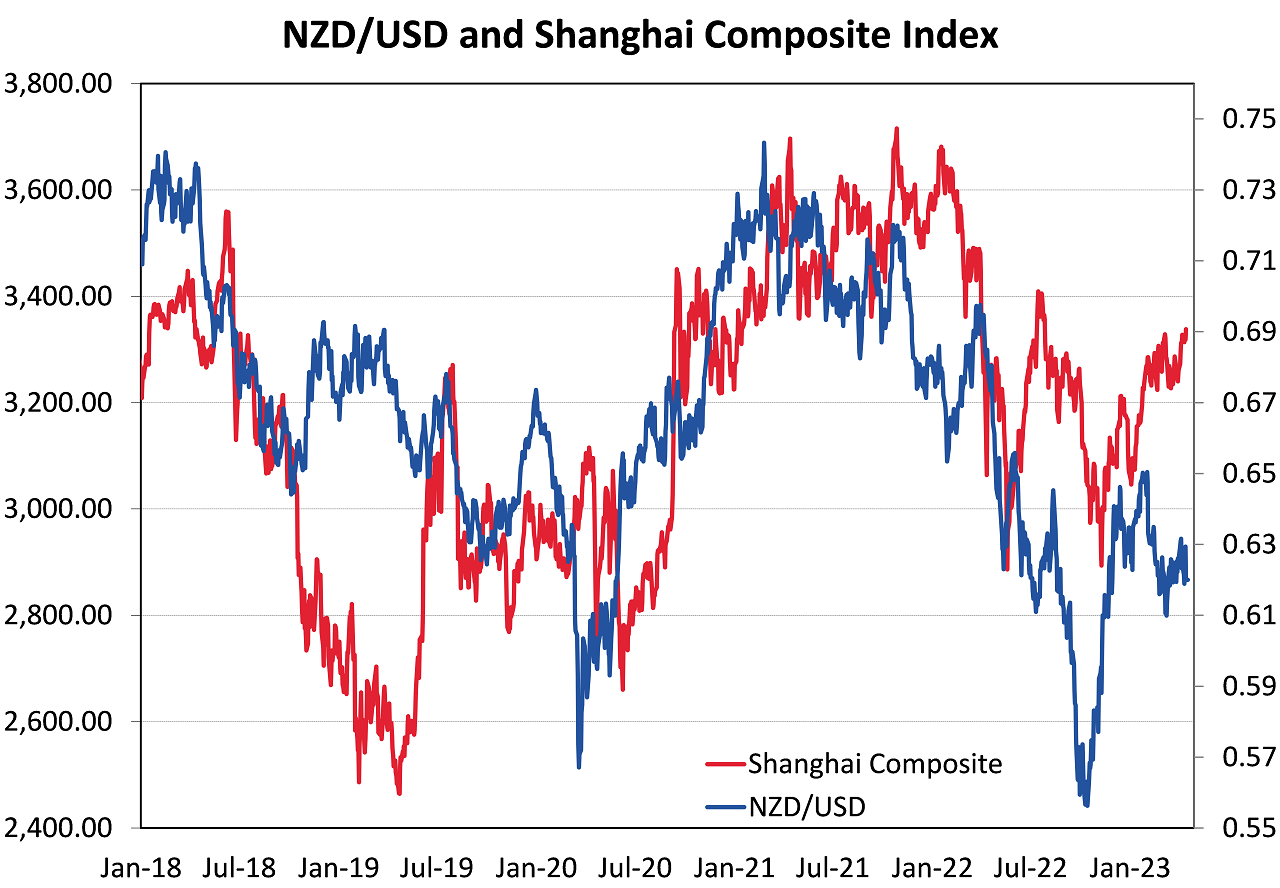

Equity markets, by their nature are the same as FX markets, they constantly build in future cashflows, profits and economic conditions into prices today. Chinese sharemarkets have been rising impressively since January as forward looking investors position themselves for the stronger economic performance in 2023. The NZD/USD correlation to the Shanghai Composite Equities Index has been pretty good over recent years (refer chart below). The current divergence with the Kiwi dollar failing to follow the equities index higher in recent months is unusual and does not look sustainable. It suggests that the NZ dollar is under-valued at 0.6150 and has a lot of catching up to do. Our economy is inextricably linked to demand in China, however uncomfortable that may be for the purists. It is economic and FX market reality that we go where China goes, and in that respect this year is looking a lot more positive than the last two years.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

5 Comments

Hopium: The metaphorical subtance that causes people to believe in a false hope. It is often paired up with copium. Opposed to copium, which represents the rationalization of the current situation, hopium represents the belief that the situation will someday improve. (Urbandictionary.com)

12 months now of this expert repeatedly telling us NZD going back to 70c soon! Broken record.

"The non-tradable inflation is the result of previous labour shortages causing wage-push inflation. Strong inwards immigration flows are now finally alleviating the labour market pressures;"

Evidence please to support these statements as non tradable inflation has been a NZ problem for a long time -masked by "imported deflation"

So will we get the wrong solution because we misidentify the problem? as there are clearly other drivers in NZ that need work

Almost every macro reckon in this article is wrong - blinded by ideology and assumption.

I'm hopeful (yeah right) that the present (outgoing at the next election) minister of finance will be responsible with his spending in the up-coming May budget. What do you reckon our chances are???

Great article Roger. While I don't agree with all the points in it, I think your observations on NZ inflation are pertinent, and much-needed dose of reality of those who think inflation has been tamed.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.