Summary of key points: -

- Big week ahead for central bank interest rate decisions

- Does de-dollarisation weaken the US dollar value?

- Has the New Zealand economic doom and gloom gone too far?

Big week ahead for central bank interest rate decisions

How global currency markets react (including whether the Kiwi dollar can claw its way back up to above 0.6200 or not) to the interest rate decisions and accompanying guidance/outlook from three central banks over this coming week will dominate near-term FX market direction.

The Reserve Bank of Australia (“RBA”) are the first cab off the rank at 4.30pm (NZT) on Tuesday 1st May and the financial markets are not pricing for any change to the current OCR interest rate setting at 3.60%. The AUD currency value lost ground when the RBA moved to “pause” mode with interest rate changes last month. Therefore, maintaining that stance should not generate any further AUD selling in the forex markets this week.

The fact that the RBA currently meet monthly is not necessarily all that helpful to their assessment of the economy and evolving data to determine whether interest rates should be adjusted or not. Since their last meeting, Australian inflation for the March quarter was largely in line with prior forecasts, although the headline annual rate at 7.00% was marginally above consensus forecasts of 6.80%. Monthly jobs growth in March (released 13th April) was well above the forecast of +25,000, at +53,000. Their labour market still has demand exceeding supply which suggests upward wages pressures continuing.

The reason for the RBA pause is that they want to have more time to evaluate more trends in the economy before deciding whether they have done enough already with interest rate hikes to dampen down demand and thus reduce inflation. Over the last 30 days there has just not been sufficient data to accumulate the economic evidence. Under the reforms of the RBA recently announced, they will move to a six week gap between meetings (the same as the RBNZ) and also implement an independent monetary policy committee with external members, rather than having their full Board of Directors making monetary policy decisions. Hopefully, more consistent management of monetary policy and interest rates will stem from these changes, as the RBA’s track record in this respect has been abysmal in recent years. The next key piece of economic data for the RBA will be the wages index for March on 17th May.

There is a good probability that the annual increase in wages will increase sharply from 3.30% to over 4.00%, forcing the RBA to revise their current stance and return to further interest rate increases in June. It is not only wages that are increasing in Australia, housing rents in their big cities are also being forced significantly higher. The RBA cannot afford to continue with their current complacency on inflation, therefore it is very positive for the Aussie dollar when they are forced to change tact once again. The FX markets will pre-empt such a shift in advance.

The US Federal Reserve make their next interest rate decision at 6am (NZT) on Thursday morning this week. The final 0.25% increase in their official interest rate to 5.25% has already been baked-in by the markets, therefore the attention will be on the forward guidance/commentary from the Fed.

The expectation is likely to be that the Fed will signal that they are now entering their “pause” mode as all the economic evidence points to further rapid reductions in their inflation rate from the current 5.00% to below 3.00% over coming months. US economic data has continued on the weaker side over recent weeks with consumer confidence lower and overall GDP growth for the March quarter much lower than forecast at +1.10% (+2.00% forecast). Business investment and inventories were both lower, which tells you a lot about a slowing economy.

Expect the US dollar to weaken further from its current 101.43 level on the USD Dixy Index as the market’s price significant US interest rate decreases in 2024 (much earlier than all other major currencies).

The European Central Bank (“ECB”) make their next decision on interest rates at 12.15am Friday morning (NZT). Whether the ECB increases rates by 0.50% to 4.00%, or just by 0.25% to 3.75% is the debate. Inflation trends in Euroland would suggest the former is needed. Stubbornly high core inflation is their problem, so why would they go slow with interest rate increases?

The continued strengthening of the Euro over recent weeks to above $1.1000 against the USD suggests the markets anticipate another 0.50% lift. As the ECB continue to increase their interest rates over coming months and the Fed move to no change, the EUR/USD exchange rate has much further to travel towards $1.1500 in our view. The ongoing Euro strength coming from investment capital returning to Europe from the US as the gap between US 10-year bond yields (which are falling) and European bond yields (which are rising) closes up from 1.00% to 0.50% (US yields above Euro yields).

Does de-dollarisation weaken the US dollar value?

There is increasing discussion and debate in global trade, investment, and foreign exchange market circles that the continuing growth in the use of other currencies for trade and investment, instead of the traditional US dollars, will reduce the power and influence of the USD as the world’s reserve currency. Half of China’s export trade is now settled in Yuan, compared to 25% five years ago. The Ukraine/Russian war has seen international trade in oil move away from being solely transacted in US dollars, with China and India buying oil from the Russians in Rubbles and Yuan. Brazil and Argentina have commenced selling commodities to China in Yuan, not USD. The BRIC nations (Brazil, Russia, India and China) are meeting in South Africa in August where they will endorse the continuation of de-dollarisation.

Countries with external current account surpluses have always invested those reserves in US dollars, however the USD’s dominance has reduced from 73% of global reserves 20 years ago to around 58% today. The fundamental reason the USD still dominates as the world’s reserve currency is that fact the US allow unfettered entry and exit of capital into their massive capital markets. If other nations want their currencies to be important trade and investment reserve currencies, they have to open up their domestic capital markets to unrestricted entry and exit of foreign capital. China is progressing to that goal, but they have a long way to go. Currently, the Yuan is not a free-floating exchange rate and is still controlled by the Chinese government.

Another issue with do-dollarisation is that commodity markets (and their related futures contracts/exchanges) continue to be traded in USD’s. However, there is no reason why futures contracts outside the US could not be traded in local currencies.

However, as more and more international trade and investment is conducted in currencies other than USD, the underlying demand to buy USD’s every day across FX markets to settle such transactions must reduce in volume. Another excellent reason as to why the US dollar will suffer another leg downwards in value over the next 12 months on top of its 11% depreciation already from October 2022 to today.

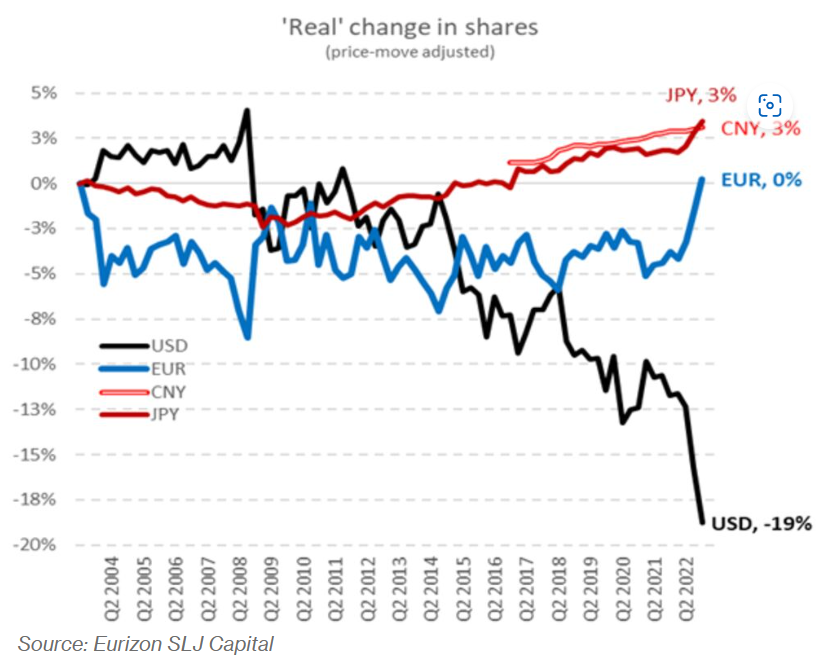

Stephen Jen of Eurizon SLJ Capital in London illustrates the US dollar’s reducing significance with the following chart on equity returns: -

Has the New Zealand economic doom and gloom gone too far?

It most probably currently suits National Party politicians, ahead of October’s general election, to paint a picture of economic doom and gloom caused by economic policy mismanagement by the current Labour Government. Last week’s ANZ business confidence survey downturn suggests more business folk are also talking themselves into a bad recession. However, all politicians think they have much more influence over our economic fortunes than what they have in reality. “Companies trade, not Governments” is a slogan that is a truism we should never forget. Amidst the daily news of high inflation, mortgage arrears, some worker layoffs and faltering business investment it should always be remembered that the New Zealand economy is heavily dependent on our export industries. Across the export sectors output, production and confidence is not faltering. Indeed, it has finally been able to expand to full potential as immigration inflows end the previous shortages of labour restraint.

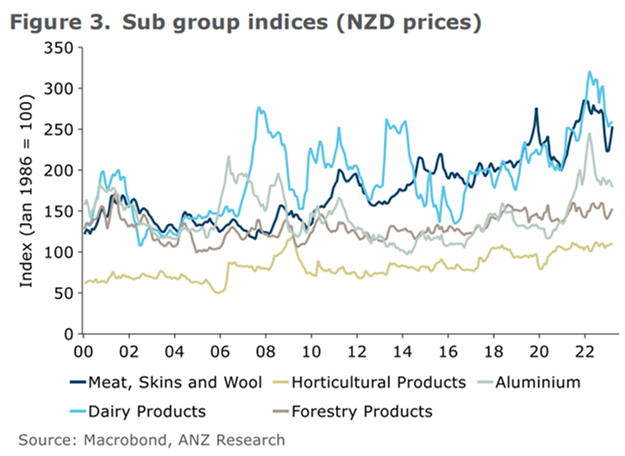

As the ANZ chart of export commodity prices (in NZD terms) below confirms, our major export prices are near to historical highs. Whilst dairy prices have corrected downwards somewhat from their highs of last year, the overall price trend and position is positive for the NZ economic outlook. Add on the rapid return of foreign tourist numbers and the forward projection of our Current Account deficit will not be as dire as the current 9% of GDP shortfall.

It is appearing increasingly likely that our export economy will once again save the overall economy from a bad recession.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.