Summary of key points: -

- Early and abrupt U-Turn by the Reserve Bank of Australia

- Kiwi dollar up two cents from its lows and poised for further gains

- Depreciating US dollar trend receives fresh impetus

- New Zealand finds more ways to dissuade foreign investors

Early and abrupt U-Turn by the Reserve Bank of Australia

The Reserve Bank of Australia added to its international reputation last week for making some weird and bizarre decisions in respect to monetary policy and interest rate settings.

A month after they stated they were pausing interest rate increases to take the time to assess their evolving economic data, they surprised all and sundry with a 0.25% interest rate hike to 3.85%. Over the course of the last month there has only been stronger wages and employment growth in March that would sway the RBA that they still had a big problem with high inflation. Let us all hope there is more consistency with their monetary policy management going forward as they implement their reforms and establish a separate monetary policy committee with external members. One would hope that their external committee members are not all university academics, as the case is with the RBNZ monetary policy committee!

The initial response by the FX markets to the unexpected Aussie interest rate increases was positive for the AUD, however the gains were more muted than what normally would be expected. The AUD/USD exchange rate jumped up from 0.6600 to 0.6700 last Tuesday when the RBA delivered their shock decision, however it did not sustain those gains over the following days. However, further weakening of the US dollar in the global forex markets over the last few trading sessions has allowed the Aussie dollar to climb to 0.6750, its highest level since mid-April.

On the basis that the RBA will no longer be the outlier central bank when it comes to higher interest rates to bring inflation back down to target ranges, the Aussie dollar has plenty of upside from here as a preferred currency to move into by FX traders and investors who are now seeking currencies to buy, and to sell the US dollar against. Australian short-term interest rate at 3.85% are still well below US short-term rates at 5.00%. However, US rates are going no higher in the future and Australian rates probably need to get closer to 5.00%. The forward points cost (interest rate differentials) to buy the AUD against the USD, which has been an impediment for AUD buyers in the past, will rapidly disappear going forward. The FX speculators who have been holding “short-sold” AUD positions now have some good reasons to close their open positions by buying the AUD. Australian economic fundamentals are strong with another record overseas trade surplus above A$15 billion posted for the year to 31 March 2023. Further positive news for the Australian economy over the next 12 months includes upgraded GDP growth forecasts for China and most Asian economies.

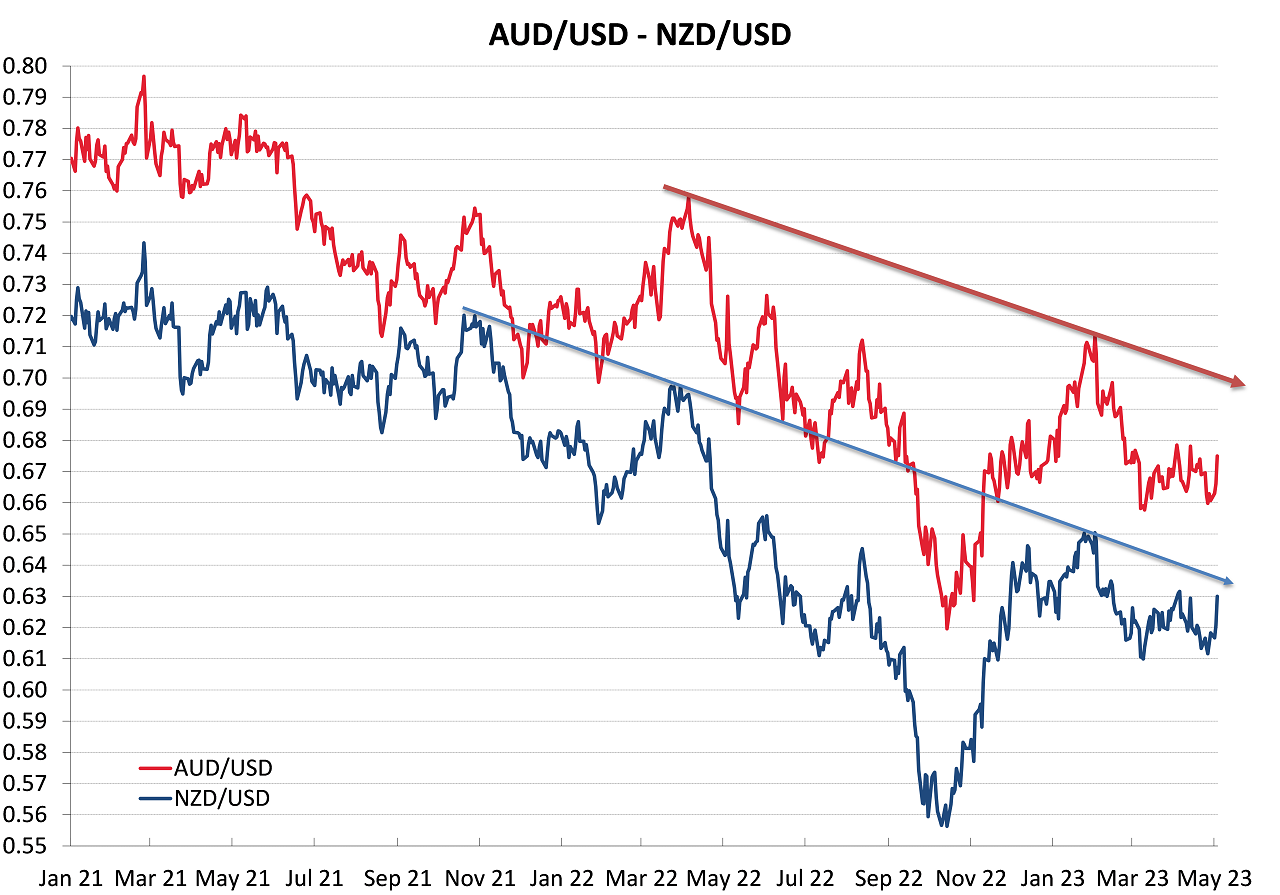

The AUD does not break-out of its two-year downtrend against the USD until it trades up to above 0.7000 (refer chart below). However, that 2 ½ cent climb may well occur a lot sooner than most expect over coming weeks with stronger Chinese economic data and weaker US data.

Kiwi dollar up two cents from its lows and poised for further gains

The NZ dollar has posted impressive gains against the USD over this last week due to stronger local wages/employment data and a weaker USD against the AUD and UK Pounds Sterling. The 4.50% increase in wages for the 12 months to 31 March 2023 (up from 4.20% to 31 December 2022) is a timely reminder to the RBNZ that they still have much to do to lower the debilitating wage-push inflation problem in New Zealand. Aiding the NZD gains was another good increase in whole milk powder prices at the GDT dairy auction last week, echoing returning Chinese demand and new concerns on the global supply side.

As we have pointed out over recent weeks, the divergence of the NZD/USD exchange rate away from the EUR/USD rate over the last two months was viewed as unsustainable, given the high historical correlation between the two. With the EUR appreciation against the USD running into some resistance just above $1.1000 (due to the ECB only lifting their interest rates by 0.25%, whereas many expected a 0.50% increase), the Kiwi dollar is now catching up as we anticipated it would.

If the Aussie dollar continues its recovery higher, and the Kiwi dollar follows in the normal fashion, the NZD/USD rate above 0.6350 (currently 0.6300) breaks the Kiwi dollar out of its two-year downtrend (refer chart below).

Depreciating US dollar trend receives fresh impetus

The US Federal Reserve increased their official interest rates by 0.25% last week, however changed their statement wording sufficiently from the previous meeting to confirm that they are now in “pause” mode with monetary policy and interest rate increases have come to an end. It is certainly negative for the USD value over coming months that US market interest rates will move lower, whereas the Europeans and other central banks are still raising their interest rates. The US two-year Treasury Bond yield is now back below 4.00% and likely to be heading lower to 3.50% over coming weeks as the markets do what they do best – build in interest rate cuts in 2024 well in advance.

US Treasury Secretary Janet Yellen highlighted another negative for the USD value last week with concerns that the US Federal Government will run out of cash and will not be able to pay its bills as early as 1 June if a political agreement on the debt ceiling increase is not reached beforehand. Adding to the USD’s woes last week was increasing risks around US regional banks, although some regional bank share prices recovered strongly on Friday after earlier heavy selling.

US Non-Farm Payrolls jobs data for April came out stronger than expected at +253,000 (+180,000 forecast), however that will not change the Fed/interest rate/USD situation as there were very large revisions downwards in the February and March jobs numbers. The three-month rolling average for new jobs is +225,000 and continues to decline.

The near-term focus of FX markets will be on this weeks’ US CPI inflation figures for the month of April (Wednesday night 10 May NZT). Consensus forecasts are for a 0.30% increase in inflation for the month, further reducing the annual headline rate to 4.90%. A lower result will be USD negative (and vice-versa).

New Zealand finds more ways to dissuade foreign investors

For a nation that requires copious amounts of inwards foreign investment every year to funds its permanent/structural external Current A/c deficit, you would think we would adopt economic and business policies that are attractive and enticing to such investors. Sadly, the current Government is on a clear path to do the precisely the opposite.

Consider these policy changes over recent times and potential future policy changes that are major “turn-off’s” for foreign investors: -

- The draconian overnight axing of oil and gas exploration by former Prime Minister Jacinda Ardern a few years back, a decision that sent a message to all current and potential future foreign investors into New Zealand that our Government cannot be trusted as they change the rules without notice.

- The proposed three waters policy change for our water utilities. The required capital spend is enormous over coming years to upgrade our water supply infrastructure. However, bond investors and lenders (both onshore and offshore) will be scared away by the over-riding Te Mana o Te Wai statements from Iwi that potentially disrupt the normal owners and Board of Directors control of the water entity’s assets. Adding more risks and uncertainties to infrastructure investment offerings is not all that smart.

- The potential future tinkering by the Climate Change Commission of the carbon emissions trading scheme is yet another example of introducing risk, inconsistency and uncertainty for investors into forestry and agriculture.

- Prime Minister Chris Hipkins has ruled out tax changes in the upcoming budget, however he will not state what the Labour Party’s manifesto on tax policy will be for the October general election. Business investment is already low enough in New Zealand without creating another uncertainty and unknown that delays/cancels investment decisions.

Over the next 12 months, the only way we will attract in any foreign investment in to fund the Current A/c deficit is to hold our interest rates substantially higher than US, European and Asian interest rates. The implications for the NZ dollar value from that are obvious i.e. higher.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

5 Comments

Great article from Roger Kerr! Speaking of turn off to foreign investors, I know people in the United States with substantial capital who wanted to immigrate to NZ and invest here. But then they heard about the proposed Green Party wealth tax, with a threshold of only a million dollars NZ. What sane person would want to invest here in any business given the prospect of a wealth tax on the family home and savings, in addition to income tax? The wealth tax would simply kill investment in NZ. New Zealand already has wealth taxes, such as financial arrangements tax, FIF and other taxes on unrealised gains. The Greens' proposed tax would be the nail in the coffin, and would cause a very substantial drop in the value of the NZ currency as capital flees to Australia along with business.

the effect on a wealth tax is just eating into a country's principal capital, so everyone is 'equal' but poor.

I'd just be happy with interest rates above inflation.

"draconian overnight axing of oil and gas exploration by former Prime Minister Jacinda Ardern a few years back" I guess someone had to show some balls and make the tough decision.

"potential future tinkering by the Climate Change Commission of the carbon emissions trading scheme is yet another example of introducing risk, inconsistency" It's a pity the lobbyists wouldn't show consistency, but then they have a media run whine fest to back up their public opinion drive.

We import oil and gas now, instead of using our own.

We plant trees but do not reduce emissions.

We subsidise cars when the world has insufficient resources to make the transition.

We import fertilisers from failed states when we have thousands of tonnes on our doorstep.

We continue to import thousands of the most ferocious consumers of resources on the planet.

We continue to encourage breeding by failed adults.

I guess somewhere we must be doing something encouraging and enlightening.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.