Summary of key points: -

- Kiwi dollar set-back to 0.6200 appears very temporary

- US inflation dissected: Heading sharply lower

Kiwi dollar set-back to 0.6200 appears very temporary

There was a sharp reversal in sentiment and direction in global foreign exchange markets late last week that saw the NZD/USD rate plummet from close to 0.6400 to 0.6200.

The sudden and unexpected two-cent NZ dollar depreciation has nothing to do with New Zealand, or its economy, or the confidence of international investors into the Kiwi dollar. Instead, the NZD selling was related to across-the-board USD buying in global FX markets as new worries emerged about US inflation, the US debt ceiling problem, volatility in US equity markets and the US economy heading into recession. Those economic concerns in the US sparked a wave of “safe haven” USD buying, and the Kiwi dollar has been badly caught in the crosscurrents of the sudden shift in financial market sentiment. Another interpretation of what happened late last week was that the NZ dollar was caught in the crosshairs of global forex markets, along with the Aussie dollar, as traders unwound speculative short-sold USD positions that have built up over the last two months. The EUR/USD exchange rate climbed rapidly from $1.0500 in mid-March to $1.1100 by early May, as FX markets sold the USD (bought EUR) on the expectation that the Fed would end its cycle of monetary policy tightening and pause on further interest rate increases. The FX markets got that call correct as the Fed signalled two weeks ago a likely pause in interest rate increases at their June meeting. The sheer nature of FX markets does mean that there is always a correction the other way to such strong and concerted moves in the EUR/USD exchange rate. Perhaps the six cents gain in the Euro from $1.0500 to $1.1100 needed a clean-out of speculative positions and profit-taking last week sent the EUR/USD rate sharply back to $1.0850. The 2.5 cent appreciation of the US dollar against the Euro, sent the Kiwi two cents lower to 0.6200.

The question is whether the sharply lower NZD/USD rate at 0.6200 is just a temporary FX market situation that will quickly reverse, or something more permanent that points to further NZD falls because of a fundamental change in economic circumstances or direction. The view of this column is that it is merely a temporary setback to the overall weaker US dollar depreciating trend that commenced last October at 114 on the USD Dixy index. Expectations of lower US interest rates in the future has already depreciated the USD value to 102 and our view is that further decreases in the US inflation rate from here will drive the USD right back to around 95 on the USD Dixy Index over coming months. Another 7% depreciation of the USD would push the NZD/USD rate up from 0.6200 to well above 0.6600.

The reason why this latest bout of USD strength appears temporary is that it was sparked by an innocuous survey of US consumer sentiment on Friday 12th May that was lower due to worries about higher inflation, the Government’s debt ceiling problem and the economy sliding into recession. The Michigan Consumer Sentiment survey plunged unexpectedly from 63.5 In April to 57.7 in May, well below prior consensus forecasts of staying stable at 63.5. The sub-index on future (five year) inflation expectations increased from 3.00% to 3.20%. It appears that this increase spooked the FX markets, as commentators interpreted the result as meaning the Fed would raise interest rates again in June. Without being uncharitable, most US households would not know what the household budget looks like next year, let alone where inflation will be in five years’ time! The reality is that the annual inflation rate in the US (as explained in the next section) is decreasing rapidly and for this reason the Fed will not be increasing interest rates any further.

It was not just the Michigan Consumer survey that caused the USD buying, the short-term USD gains were multi-dimensional with the US debt ceiling/default risk ironically and perversely leading to safe-haven USD buying as well. The Chinese Yuan also weakened against the USD last week with disappointment that the latest Chinese economic data is not yet supporting the expectation of a strong rebound in the Chinese economy this year.

It appears to be a massive overreaction by the FX markets to minor economic news that does not change the fact that US inflation and US interest rates are poised to move a lot lower over the coming months.

US inflation dissected: Heading sharply lower

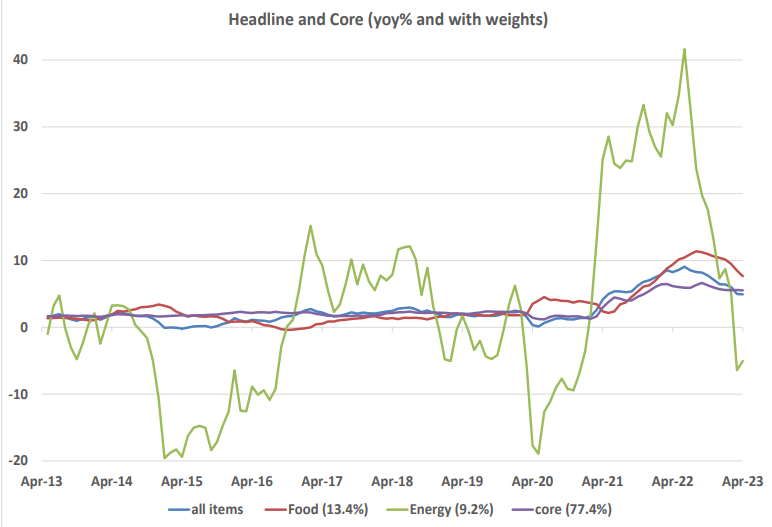

Earlier last week US interest rates decreased, and the USD weakened, when US headline inflation for the 12 months ended 30 April reduced fractionally from 5.00% to 4.90%. The inflation result was more moderate than expected and confirmed that the Fed were correct in their assessment that interest rates do not need to increase any further to bring inflation down. As we have stated previously, the FX and bond markets in the US do not appear to be looking too far ahead currently and are just reacting to historical inflation and economic data as it is released. If they looked ahead to what the annual inflation rate will look like after the May and June monthly results the reaction would be considerably more negative for the USD value. On the assumption that May and June will record monthly inflation increases of 0.30% (the average of recent months), the annual headline inflation rate will dive from 4.90% to 4.20% after the May result in mid-June and from 4.20% to 3.60% after the June result. Mathematics means the large 1.00% and 0.90% monthly inflation increases in May and June 2022 drop out of the annual figures.

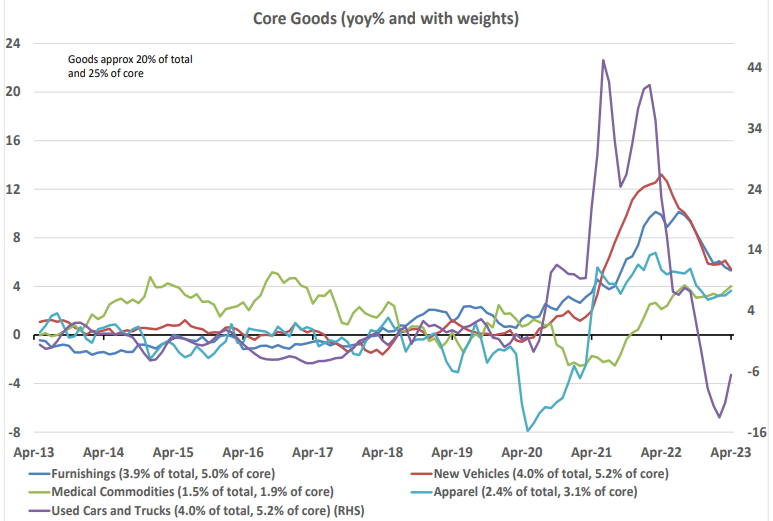

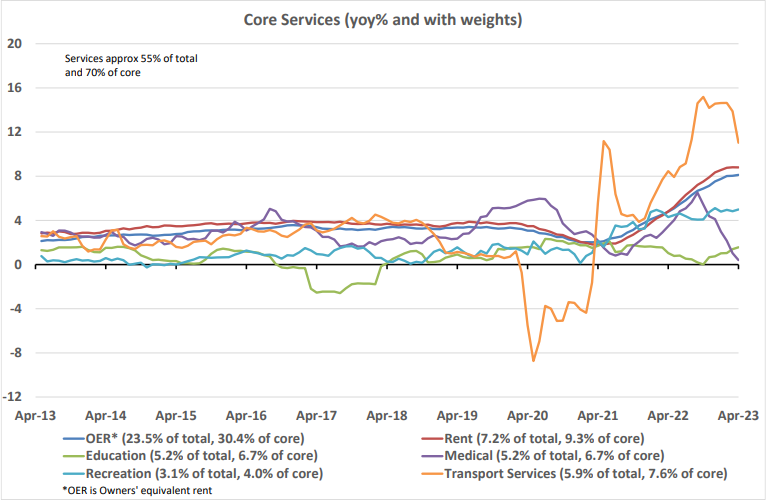

It also pays to look beyond the headlines when it comes to inflation trends. Dissecting US inflation requires diving into the detail of the component parts that make up the US Consumer Price Index. The Shelter (actual house rents and owner’s equivalent rents) component is the only price that has been increasing over recent months. The flawed method the US Bureau of Labour Statistics use to record rent increases means that the data is lagged by 12 months. Over coming months the Shelter CPI will stop increasing and start to decrease as the time lag works through.

The following three charts on US headline and core inflation prove that the previous price increases in food, energy, transport services (airfares), motor vehicles and other goods/services are now all rapidly reversing as supply increases and demand returns to more normal levels.

The FX markets are not focused on this detail; however they will react by selling the US dollar down further when the evidence is in front of them that US inflation has plummeted from 9.00% to 3.00% over the last nine months, as fast as it increased to 9.00% over the first half of 2022.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

1 Comments

US long term inflation expectations reach 12 year high

https://pbs.twimg.com/media/Fv73ns1WwAEnIIl?format=jpg&name=medium

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.