Summary of key points: -

- Recent lift in US interest rates (and USD value) unlikely to be sustained

- NZ interest rates “higher for longer”

- A classic Labour Government borrow and spend budget

Recent lift in US interest rates (and USD value) unlikely to be sustained

The expectation that the Kiwi dollar sell-off to below 0.6200 on 12th May would be short-lived seems to be playing out.

The NZD/USD exchange rate has recovered back to 0.6275 over this last week and depending on general US dollar movements from here, the Kiwi appears poised to (once again) challenge the resistance point at 0.6350. The NZD/USD rate has remained in the relatively tight trading range between 0.6150 and 0.6350 since mid-February and it seems it will require something of a game changing event to either push it below the 0.6150 bottom or propel it out the top of the range at 0.6350. Local economic events such as the RBNZ’s surprise 0.50% OCR hike on 5th April and last week’s NZ Government Budget have not moved the dial in respect to the NZ dollar exchange rate direction.

Whether the Kiwi dollar can appreciate above the previous resistance at 0.6350 comes back to the direction of the US dollar on global currency markets from current levels. Over recent weeks the USD has posted modest gains against the major currencies with the more positive USD sentiment coming from two sources: -

- US market interest rates have increased as market participants worry that the Federal Reserve still has to increase official rates further to ensure inflation reduces to the 2.00% target. A whole swag of Fed Governors have made hawkish speeches suggesting that a pause on interest rate increases is not appropriate and this rhetoric has spooked the bond market in particular. US 10-year Treasury Bond yields have increased from 3.30% at the start of May to 3.69% today. The USD currency index, the Dixy, has followed the yields higher over the same period from below 101 to the current 103.

- The risk of the US Federal Government defaulting on their payments if the politicians cannot reach an agreement on the debt ceiling increase. The USD benefits (perversely) from safe-haven flows in this situation as a default would be seen as catastrophic for the global economy and the USD tends to appreciate in such extreme world economic conditions.

However, looking ahead, the above two short-term positives for the US dollar do not look at all sustainable. Despite the political brinkmanship that goes with debt ceiling issue, an agreement will be reached at the 11th hour before 1 June. The announcement of an agreement will likely generate an unwinding of the USD buying that has occurred over the last two weeks.

On the rising market interest rates in the US situation, the direction and sentiment is set to reverse over coming weeks as Fed Chair Jerome Powell moved on Friday 19th May to hose-down the recent hawkish talk of his colleagues. Powell made the correct observation that interest rates will not have to increase as much as they normally would to combat inflation at this time because the stresses in the banking sector (a severe tightening of credit) are already tightening monetary conditions – “our policy rate may not need to rise as much as it would have otherwise to achieve our goals”. A Fed pause at their June meeting appears a lot more likely than another increase.

Off course, the US interest rate and forex markets will always react to the evolving economic data as it is released. The annual inflation rate is already declining sharply in the US, the next confirmation of that trend will be the PCE inflation figures for April released on 26th May. Before the next Fed FOMC meeting on interest rates on 14th June, the ISM manufacturing index for May on 2nd June and the Non-Farm Payrolls May jobs data on 3rd June will influence market direction. Weaker than forecast employment numbers will be negative for the USD as wage pressures on inflation abate.

We still contend that the US bond and FX markets have not factored-in the continuing rapid reduction in the US annual inflation rate that will come about over the next two months. From the current 4.90% level, the inflation rate will plummet to 4.30% at the end of May and sharply lower again in June to 3.60%.

NZ interest rates “higher for longer”

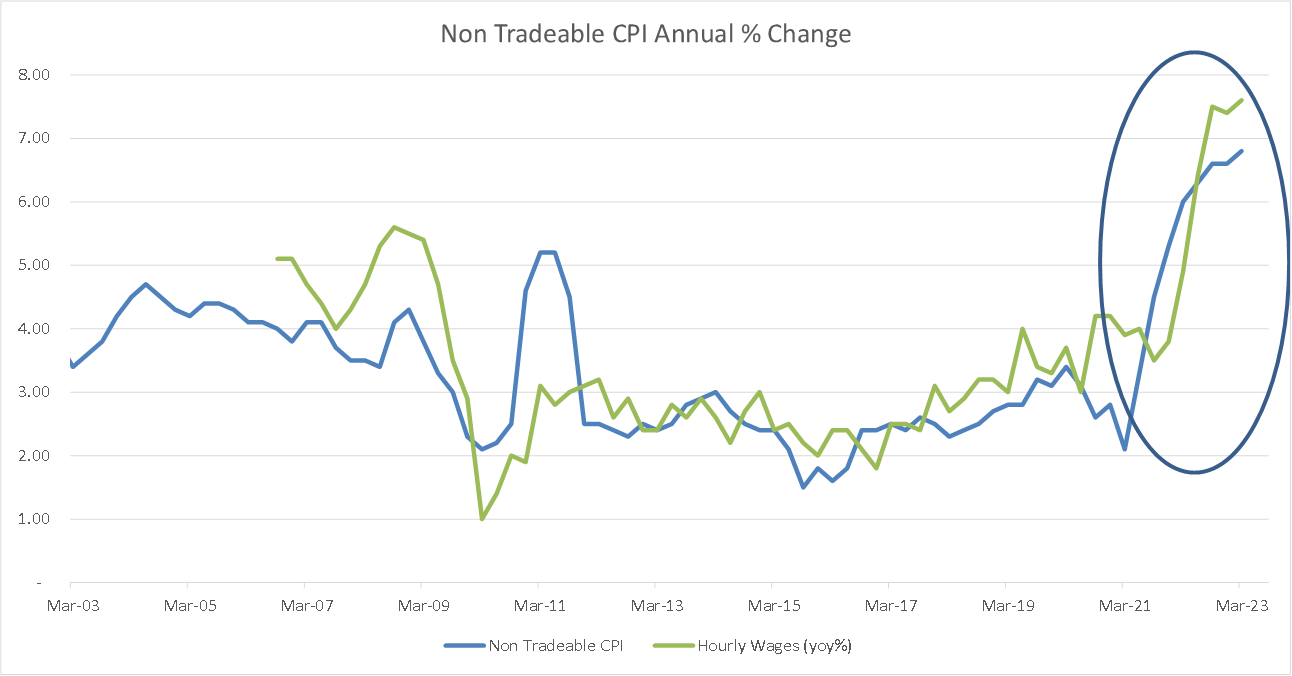

Continuing wages and food price pressures does not allow the New Zealand inflation rate to reverse sharply downwards over coming months as is occurring in the US. The wage-push inflation in New Zealand is of the more permanent “sticky” variety.

Bank economists have now increased their terminal OCR interest rate forecasts from 5.50% to 6.00%. Last week’s expansionary budget from the Government puts renewed pressure on the RBNZ as there are no signs of austerity measures that would help reduce inflation. As the first chart below confirms, the explosion in domestic, non-tradable inflation has not been curtailed by the RBNZ hiking interest rates as it was caused by the Government’s immigration policies through 2021 and 2022 producing a chronic labour shortage. Wage-push inflation is not easily reduced, the only way is an economic recession and labour costs reduced by shedding workers.

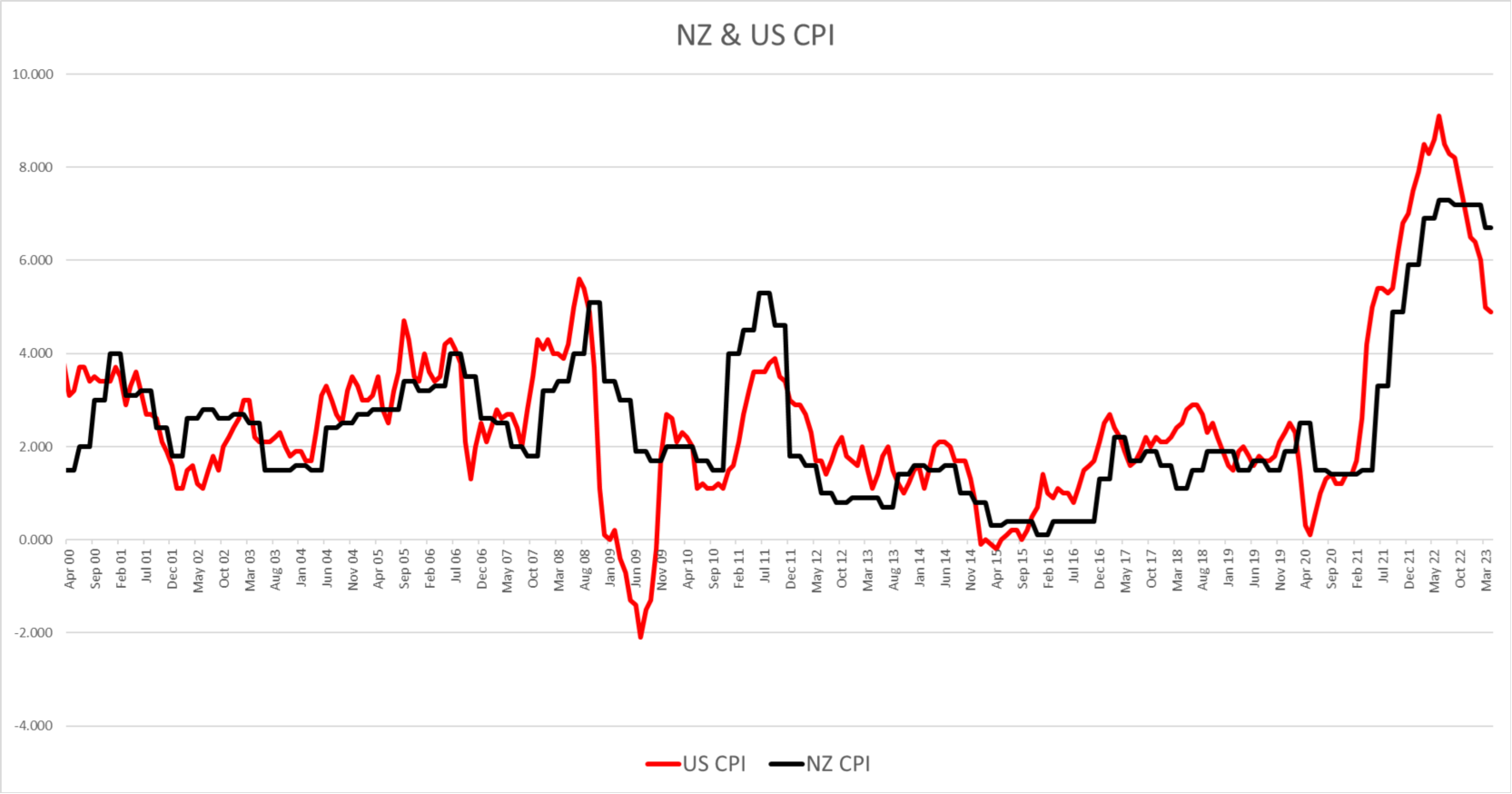

The second chart confirms that over the last 20 years New Zealand’s inflation rate has been very similar to the US annual inflation rate. Not surprising really when you consider that the respective central banks inflation mandates are identical in targeting a 2.00% outcome.

However, over the next six months the US inflation rate will be getting back to near the 2.00% target, whereas the wage-push inflation in New Zealand will be elevated for some time yet. The sharp divergence in inflation rates means that as US interest rates reduce over coming months, NZ interest rates will be staying stable or even moving marginally higher. The implications for the NZ dollar exchange are clear as the interest rate differential rewards buying NZD positions and makes “short-sold” NZD positions expensive to maintain. The RBNZ Monetary Policy Statement this Thursday 24th May will confirm the difficult situation the NZ economy is in with continuous domestic inflation being bedded-in by Government policies that the RBNZ seem unwilling to challenge as the root cause.

A classic Labour Government borrow and spend budget

Local media coverage of Finance Minister, Grant Robertson’s budget statement last week has been extensive with varying views as to whether it was “constrained” or “expansionary”. Standing back, and taking a big picture observation, the only conclusion was that the current Labour Government know how to slice the pie (re-distribution policies), but have no idea how to increase the size of the pie i.e. grow the economy. There was hardly a mention of business and farming that produce the jobs and foreign income the economy is dependent upon. Absolutely no sign of policy initiatives that would assist a faster growing economy that pays for the increased education, health, and welfare spending.

The increase in Government spending and the reduction in revenue coming into the Government since the December fiscal update forecast is alarming, a staggering $20 billion difference. Any “borrow and hope” strategy always runs into inevitable constraints. Credit rating agency, Standard and Poor’s response of the budget was that the NZ Government was at risk of using up more fiscal and debt “headroom”. For the meantime there is no real risk of a credit rating “negative watch” or downgrade as our Government debt ratio metrics sit in the middle of the “AA” borrowers that S & P credit rate. As a small, narrow-based commodity export economy we need to maintain much lower debt levels than other countries as we are more susceptible to global downturns or shocks. The high borrowing of recent years has reduced New Zealand’s ability to handle such external risk events.

Whilst New Zealand’s financial health and resilience is more challenged currently, it does not mean that the NZ dollar value depreciates. A weaker USD globally, a wider interest rate differential to the US and a stronger AUD on the back of resurging Asian/China economic growth all point to the Kiwi dollar moving into the high 0.6000’s against the USD, rather than remaining in the low 0.6000’s.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

2 Comments

Excellent article! Certainly if Labour is re-elected and the Greens and Maori get their wealth tax (which includes the family home), then we will see capital flight to Australia and elsewhere from NZ. This would impact the exchange rate with the U.S. dollar. The wealth tax as proposed by the Greens would simply kill any investment in NZ and nobody in their right mind would try to save to start a business.

We're at our tipping point. I know RJK is a right-of-centre boy but he nails it in this summary. Without ambition & lots of hard work we're going backwards & this govt doesn't have a clue on how to even think about this sort of stuff. They are killing us with their kindness, sadly.

Then, add in co-governance [an Iwi elite takeover of the whole country] & if Labour & friends get another term, that will just about about do it. New Zimbabweland.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.