Summary of key points: -

- Another surprise from Adrian – where to from here?

- Higher USD and US bond yields set to reverse

Another surprise from Adrian – where to from here?

We all should have expected that RBNZ Governor Adrian Orr would deliver the unexpected at last week’s Monetary Policy Statement.

Governor Orr’s track-record and reputation of wrong-footing the markets and making a splash have been well documented in the past. It is hard to understand what it proves and contributes in terms of monetary policy management. The constant surprises from Orr that cause market interest rates and exchange rates to gyrate in response are arguably contrary to one of the principles of the RBNZ’s inflation target agreement with the Government – “maintain inflation stable and low without causing undue volatility in exchange rates and interest rates”. Unfortunately, the RBNZ fail to measure and report on this important aspect of their remit.

The RBNZ decision to call a halt to further interest rates increases is a bold call, however one that was always going to send the Kiwi dollar lower as it was polar opposite to the prior FX market positioning. The FX market was primed up for a 50% chance of a 0.50% interest rate hike with potentially more to come and what they received was a 0.25% increase and a message that there would be no more increases. The market reaction was swift and severe with the Kiwi dollar sold down more than two cents from 0.6275 prior to 0.6060 afterwards. Not helping the sentiment towards the NZ currency was ongoing US dollar strength against all currencies as the US Government debt ceiling saga created risk and uncertainty and therefore safe haven flows into the USD. Typically, the NZD/USD moves up or down by 1.5 to 2 cents in reaction to RBNZ surprises, however within a week the exchange rate normally returns to where it started before the RBNZ announcement.

Whether the NZD/USD exchange rate can hold above 0.6000 in the short-term and return to its previous 0.6150 to 0.6350 trading range will totally depend on USD direction over the next week in the lead up to the US debt ceiling deadline date, which has now been extended by their Treasury to 5 June. As progress is made by the US politicians to a compromise deal on spending and deficits, we are likely to see some unwinding of large, long USD positions built up in the FX markets over recent weeks as the debt ceiling crisis caused USD buying. The expected USD selling on profit-taking may well start before a deal is announced.

The RBNZ decision to pause on further interest rate increases raised more questions for market participants than it answered, the major concern being the sheer inconsistency in their economic outlook.

- What changed in the economy between the “hawkish” 0.50% OCR increase on 5 April 2023 until the “dovish 0.25% increase and done” on 24 May? In terms of inflation trends and outlook, nothing changed. It seems the RBNZ visited some companies and were told that “demand was softer.”

- What is behind their forecast of net migration reducing over the next 12 months and their statement that the impact of the current strong inwards migration on the economy is “uncertain”? The majority of bank economists increased their OCR terminal rate to 5.75% and 6.00% because of the continuing strong net migration numbers and the impact of that on inflation.

- After sending the Government a warning shot about increased spending being inflationary in April, the RBNZ acquiesced totally in May by stating that the spending does not increase in the medium term. However, the battle to bring inflation down is over the next 12 months and over that period Government spending does increase. The fiscal impulse is still inflationary over the next two years. Prior to the RBNZ decision, Finance Minister Grant Robertson said that he saw no reason for interest rates to go above 5.50% (which is highly unusual for a NZ Finance Minister). Questions over the RBNZ’s independence are rightly being asked.

- Is the RBNZ’s forecast of annual inflation plummeting from 6.10% in June 2023 to 3.70% by June 2024 based on a detailed projection of the component parts of domestic/non-tradable inflation, or is it just the inflation figure that falls out of their econometric model after they enter the GDP and unemployment variables? The stickiness and permanency of wage-push domestic inflation is well known. The “elephant in the room” with our inflation problem in New Zealand is constant price increases from the public sector and non-competitive parts of the economy. Current price trends are all upwards for insurance premiums, rents, local government rates and building costs. The annual non-tradable inflation rate increased in the March quarter and will likely move higher again when the June quarter inflation data is released on 14 July.

- Why are the RBNZ so confident that inflation peaked in the March quarter because that result was less than their own forecast? The only reason why the March quarter inflation was less than expected was an unanticipated larger fall in petrol prices, all other prices were higher than forecast. Global oil prices have since increased and the NZD/USD is lower, therefore transport/petrol prices will not be decreasing in the June quarter.

- Has the RBNZ accurately recognised the sources of inflation? The issue the RBNZ has with reducing the inflation rate is that the inflation is not coming from interest rate sensitive parts of the economy. Higher interest rates can dampen consumer demand and make saving more attractive than spending. However, the wage/price inflation spiral we have experienced stems from the supply side of the economy, particularly the previous labour shortages caused by Government policy.

There would seem to be a real risk that the RBNZ are forced to reverse their stance of not increasing interest rates any further. Economic growth over coming months would need to be stronger than their forecast. Certainly, export sector and tourism activity appears robust and the global economic downturn the RBNZ expect is appearing less likely. The next OCR review date is 12th July, just a week before the all-important June quarter CPI inflation figures on 19th July.

Another very good question to ask is why New Zealand only has quarterly inflation reporting when every other country has monthly figures? The markets are operating in a vacuum of up-to-date information on the economy.

Higher USD and US bond yields set to reverse

The strong US dollar gains on global forex markets over the last three weeks is not only due to the debt ceiling risk, but also hawkish rhetoric from some US Federal Reserve members that inflation threats are still high and US interest rates need to be increased further. The Fed’s next meeting on 14 June is headed for a right royal showdown of conflicting views as Chairman Jerome Powell is in the opposite camp, that substantially tighter credit conditions in the US negate the need for any further interest rate increases. Last Friday’s PCE inflation number for the month of April at +0.40% being marginally above +0.30% prior forecasts will be fuel for the hawks. The May CPI inflation data is released on Tuesday 13th June, the day before the 14th June Fed meeting. A monthly increase below the 0.30% consensus forecast will strengthen Powell’s position of pausing on further interest rate increases.

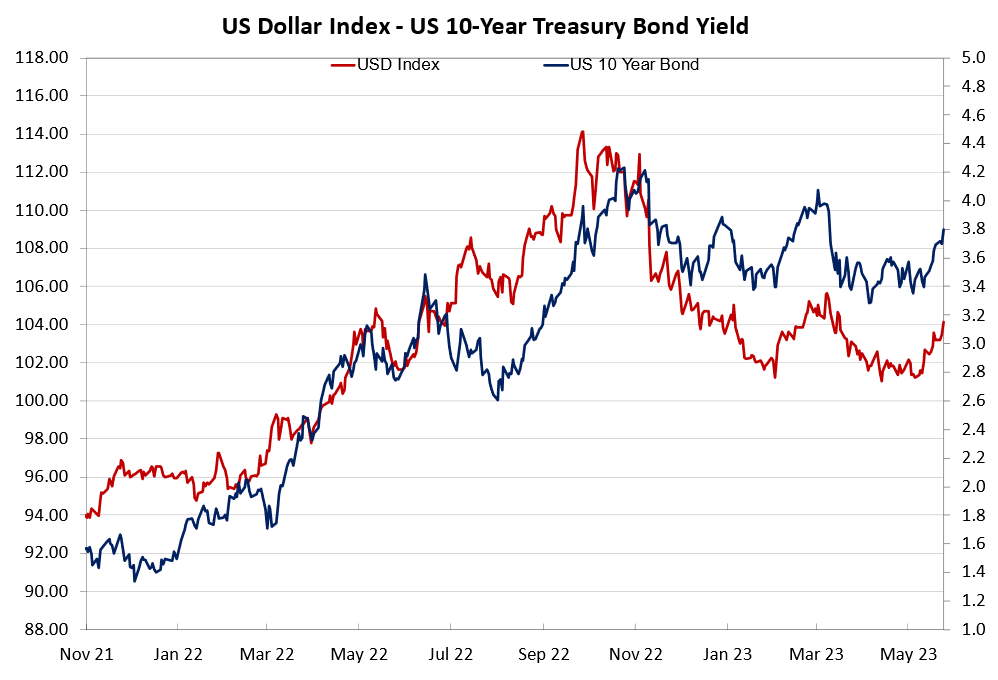

The USD Dixy Currency Index has followed US 10-year Treasury Bond yields higher over recent weeks in a very similar pattern to witnessed in February/March when inflation and jobs data was temporarily stronger than expected (refer chart below). A resolution to the debt ceiling crisis before 5 June and a pause from the Fed on 14 June stand to reverse both the USD and US interest rates sharply back downwards again. If that scenario unfolds as expected, the Kiwi dollar will have a good chance of recovering its lost ground.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

24 Comments

One of the first articles of Roger’s that i completely agree with.

Im surprised around the rhetoric of no further OCR rises given their track record of forecasting inflation correctly.

I would have just left the door open for rate hikes or cuts or remaining stable and said ‘we’re raising by 0.25 and will see what the data presents us with leading into the next review’. Anything else could be quite misleading and backs one into a corner if they get it wrong.

The RBA had to restart after a pause as the Housing Market got a wind up... Possibly what will save RBNZ is depressed winter housing market and oncoming recession will present before they have to make a call, but agree, they should have paused on data watch.

I cannot work out Orr and neither can the market.

Can see it now, bunch of FHBs go out and buy houses based upon the recent hype that the OCR has peaked (recent spruiker spin). Then Orr comes out and starts raising the OCR again at the next review. Then the whinging will start along the lines of ‘but you promised this was the peak’.

If I were him I wouldn’t make any such commitments - either directly stated or implied. It can be too misleading for people - especially those who can’t deal with uncertain.

What Orr is doing with FHBs, is akin to sending in new, gumby, ill prepared, Russian prisoners - as front line Cannon Fodders........

These poor sops will be buying into the falling market, maybe slowing is precipitus fall a little (suckers rall!)......until it picks up pace anew downwards.

Would not be surprised to see on all recent and near term borrowers in negative equity in the coming years and crying in the Granny herald and TV news.

Buy only at DTIs of 4 to 6x and no more! Ye all are warned!

There appears to be a very persistent narrative around this, claiming that the Reserve Bank said they won't be raising the OCR any higher. From the article:

The RBNZ decision to call a halt to further interest rates increases is a bold call

I am yet to see any evidence that this "bold call" was ever made. People seem to be misinterpreting forecasts given in the MPS to mean that rates can only fall from here, and using that as the basis for making false statements about what the RBNZ apparently "said".

I have no idea which direction the next movement will be, and neither does anyone else, Adrian Orr included.

I’m in the same boat - retail banks are expecting more hikes and they are the ones who set mortgage rates/provide mortgages so who knows!

Banks are also the ones creaming it in profit... for them right now it'd be perfect if more are fixing long term out of fear.

Anyway... I thought you didn't care about last weeks events - it didn't matter apparently laughining off any suggestion it created more optimisim in the property market. Now you're suggesting more might go out and buy as a result...?

Can see it now, bunch of FHBs go out and buy houses based upon the recent hype that the OCR has peaked

I don't know. I think his team is really worried about the data they are seeing. Businesses and households are paying off debt as fast as they are taking it out, consumer spending is down in real terms (off the cliff on durables), and any objective risk analysis would conclude that the risk of a major recession far outweighs the risk of renewed inflation.And, as Roger notes, it is also pretty obvious that interest rates are not influencing prices (other than house prices of course). My guess is that RBNZ looked at the Treasury budget, the current account deficit, and concluded (rightly) that if households can't be tempted to start borrowing again, we will be in real trouble.

"and any objective risk analysis would conclude that the risk of a major recession far outweighs the risk of renewed inflation"

Good point, I have stated before that this is the crux because I believe there is no other choice in the future but to have to accept either higher inflation or destruction of the economy. I for one, think the central banks will err on the "save the economy side" bw on the other hand thinks central banks will favour crushing inflation. Of course they will be a bit of both but one side will ultimately have to be given priority. Orr flip flopping between being hawkish and dovish, is a clear sign that he has not yet chosen a camp.

Any if they had any talent and ability they would conclude that the Treasury assessment was ridiculously optimistic, especially in terms of residential investment.

Exactly, the forecasts are literally based on restarting the housing ponzi!

Orr is easy to work out. He is a smart mouthed simpleton who has allowed the RB fiscal governance to be compromised by radical government policy thus compromising his ability to achieve fiscal brilliance.

Common Hemi, you can hide your true character better then that

The wage/price inflation spiral we have experienced stems from the supply side of the economy, particularly the previous labour shortages caused by Government policy.

What wage / price 'spiral? There is no evidence of this effect being material on prices. We saw some limited real terms wage increases in some sectors that lost staff during lockdowns and then had to pay more to get staff back quickly (hello hospo, tourism etc). There is far more evidence of an interest rate / price spiral!

That could be the trigger for wage price spiral though as people demand higher wages to cover their costs - consumption/input costs and interest rate expenses.

Really no surprises from the RBNZ here, they did what they said they were going to do a year ago now. What the plan must be now is actually more inflation so it inflates away the debt. Increased inflation and increased wages inflates away existing debt at a fast pace, it's the only way to get out of this current hole.

The RBNZ decision to call a halt to further interest rates increases is a bold call

Can you Roget Kerr or someone please supply a quote from A Orr to substantiate this claim. If it's true, I think it's extremely reckless and naive, but I don't want to judge him as I have not read or heard him state that the OCR has reached its peak.

Thank you.

PS, this is a great article Roger, you raise many great questions including why NZ doesn't provide monthly inflation figures, which would be so helpful.

How long until we start getting told that a period of inflation is actually a good thing........war is peace....

The RBNZ has become a tool of the Left-wing government, no independence at all.

What changed in the economy between the “hawkish” 0.50% OCR increase on 5 April 2023 until the “dovish 0.25% increase and done” on 24 May?

Perhaps the Q1 inflation release being a long way below forecasts?

Next OCR Review 12 July.

Next CPI release 19 July.

Surely the OCR review dates could be set more appropriately...

Let me rephrase the Labour puppets at the RBNZ - "there will be no more interest rate rises until after the election".

NZD will decline against USD until Orr reverses his decision and becomes "Data Dependent"

An agreement on the US Debt Ceiling and subsequent INCREASE will require the issue of new US Treasuries. Therefore, expect a strengthening of the USD. Expect the KiwiPeso to go sub .60 and approach .55 in coming months. Powell has 1-2 more increases and then a long hold period. US markets are moving towards this, although not entirely aligned.

(NZ Trade Balance is vey Negative).

Canada paused their OCR recently and then made a U-Turn.

Just back from Australia and interesting to compare prices. It is about 1/3 cheaper over there for everyday living. This is due to incompetence from the Reserve Bank emanating from their loose policies during COVID 19 and the Socialists' inability to create competition in the NZ economy.

Orr and his team have made bad decisions, displayed no understanding of economic and monetary equations. Worse still he is a patsy for the Socialists. Who put the fat kid in charge of the tuck shop? At Least David Seymour stood up and stated that Orr should be sacked (5 year contract not to be paid out due to non-performance IMHO).

NZ has experienced "The lost 5 Years"

Excellent article.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.