Summary of key points: -

- The Kiwi dollar holds above 0.6000 (just!)

- US interest rates set to reverse lower again

- Australian interest rates set to move higher

The Kiwi dollar holds above 0.6000 (just!)

The NZD/USD exchange rate traded a touch below 0.6000 very briefly last week, however it has managed a tentative recovery to 0.6060 as the market landscape for international interest rates started to change by the end of the week. After being battered down by nearly three cents two weeks ago when the RBNZ abruptly changed course to a pause on interest rate increases, the Kiwi has been unable to stage any bounce back as the sentiment in the currency markets remained firmly positive for the US dollar against all currencies (up until two days ago). However, the direction of the US dollar is poised to change as the US Congress has now passed the debt ceiling deal and therefore unwinding of the previous safe haven flows into the USD have to be anticipated.

Just why the RBNZ would choose to flummox the financial markets with such a surprise move that was only going to drive the value of the NZ dollar downwards remains a mystery. However, financial market participants and local economists have just about given up on attempting to explain the RBNZ’s rationale and changeable outlook on the economy. As we have stated previously in this column, one powerful method to reduce inflation in a high import-penetration economy such as New Zealand, is to push the value of your currency up to decrease import costs. To date, the RBNZ have pursued a policy of doing exactly the opposite, resulting in increased inflationary pressures through a lower exchange rate value. Local retailers selling imported product have now sold out of the previous higher inventory levels (due to earlier supply chain disruptions) priced above 0.6500 and will now be pricing more recent imported inventory at 0.6000.

Over coming weeks it will be offshore financial and investment market developments in the US and Australia that will determine the direction of the NZD/USD exchange rate from the current 0.6060 level. The next important signposts locally will not be until 19th July with the June quarter CPI inflation figures and inexplicably the next RBNZ OCR review a week beforehand on 12th July. Why the RBNZ schedule their OCR review a week before the quarterly inflation figures is another mystery most struggle to explain!

How the US dollar and the Australian dollar currency markets respond to their respective changing interest rate conditions and outlook over coming weeks will determine AUD/USD direction from here, therefore the closely tracking NZD/USD direction.

US interest rates set to reverse lower again

The puzzle that is the US labour market continued to confound the analysts last Friday. There were 339,000 more jobs created over the month of May, well above the prior consensus forecasts of a 190,000 increase. On the surface, such a continuing strong employment increase would suggest further threats to inflation and cause continuing interest rate increases form the Federal Reserve. However, countering that positive outcome for the economy was a sharp increase in the unemployment rate from 3.40% in April to 3.70% in May. Clearly, fewer people are looking for jobs, decreasing the numbers available for work. The increase in the unemployment rate to 3.70% is the highest since April 2020. Adding to the confusing and complex labour market picture was another increase in wages (average hourly earnings) of only 0.30% for the month, below forecasts of +0.40%. Both the hawkish and the dovish members of the Fed would have had something from the May labour market data to support their respective positions.

However, of the 12 voting members of the Fed’s monetary policy committee (the total Fed membership is 18 members) the majority seem to side with Jerome Powell’s view that it is now time to pause on interest rate increases and observe the economic response to all the rates hikes over the last 12 months.

Wall Street certainly liked the May jobs reports with the Dow Jones Index rocketing up over 700 points on Friday 2nd June. The equity market reacting to the prospect of no further interest rate increases, but also not an economic recession. A continuation of the “risk-on” sentiment in equity markets over coming weeks should be positive for the NZD and AUD currency values.

Forecasts for the US inflation figures for the month of May on 13th June are for a 0.30% increase, dropping the annual rate to 4.70% from the current 4.90%. A result lower than forecast is very much on the cards as the quirky and idiosyncratic methods the US use to measure housing rents means that we are now about to see significant monthly reductions in rents after all the large increases over the last 12 months. The measurement methods cause a 12-month lag in the data compared to actual market rental levels.

We anticipate that 10-year Treasury Bond yields will continue to unwind their recent increases from 3.30% to 3.80%. The 10-year interest rate is already back to 3.70% and a soft inflation result on 13th June, coupled with a pausing Fed the following day, will drive the yields lower. The USD Dixy Index (currently at 104) is set to follow the 10-year yields lower.

At a time when the US come to the end of their monetary tightening cycle of increasing interest rates, the Europeans are signalling the need for two or three more 0.25% hikes in their interest rates. Whilst European inflation was less than forecast last week, ECB Chair Christine Lagarde warned that they still have much to do to bring their inflation rate down. The Euro exchange rate against the USD which weakened from $1.1100 to $1.0700 over the month of May, seems destined to reverse in the other direction over June/July as the US:EU interest rate differential closes up.

Australian interest rates set to move higher

Also in contrast to the US, Australia’s fight against higher inflation is far from over. Australia’s annual inflation rate increased substantially above forecast in April - an annual inflation increase of 6.80%, compared to prior forecasts of 6.40%. Adding to the upwards inflationary pressures in Australia was a ruling by their Fair Work Commission last Friday to increase the minimum wage by 5.75%. As we have seen in New Zealand, lifting the minimum wage causes knock-on, ripple impacts as workers above the minimum wage demand increases as well, to maintain their relativity to the lowest paid jobs. RBA Governor, Phillip Lowe has been warning the unions and employers in Australia not to agree high wages increases without corresponding increases in productivity. His warnings have landed on deaf ears, so expect several more interest rate hikes form the RBA from their current relatively low 3.85% level. Market participants are now starting to price-in three more 0.25% interest rate hikes, which will take their terminal OCR rate to 4.60%.

The local FX markets are already reflecting the end to NZ interest rate increases, however continuing Australian interest rate hikes, with the NZD/AUD cross rate plunging 2.70% from 0.9460 on 23rd May to 0.9170 today.

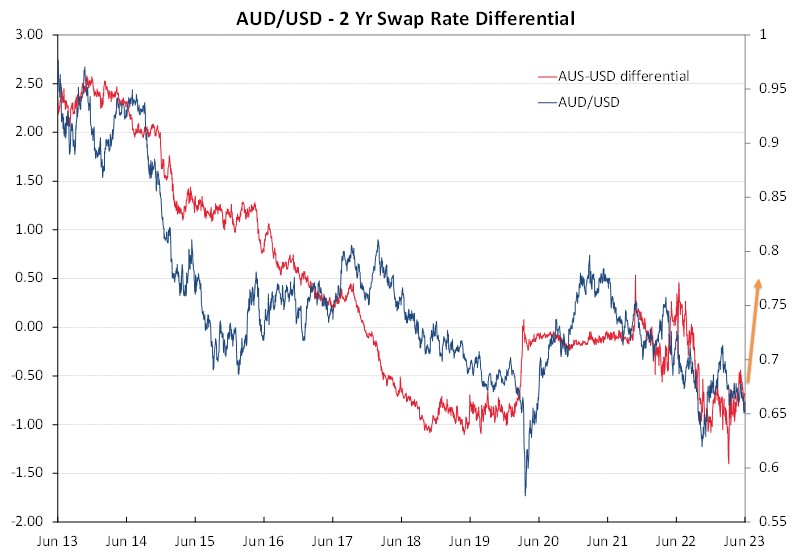

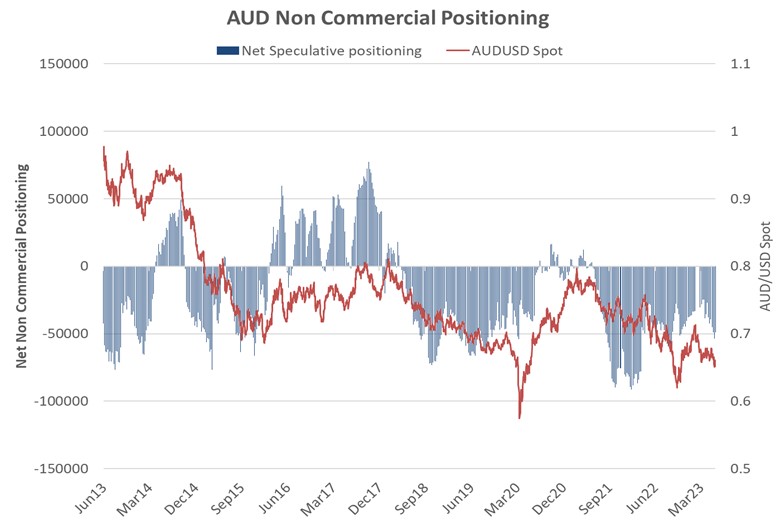

The significance of further interest rate increases in Australia over coming months when US interest rate are expected to decline on much lower inflation outcomes, will be reflected in the AUD/USD exchange rate movements. As the two charts below depict, the Australian dollar has depreciated when Australian interest rates trade below US interest rates (2-year swap rates). June 2018 to June 2020 was the first period of AUD weakness when Aussie interest rates reduced to 1.00% below those in the US. The second period commenced in June 2022 with the interest rate differential decreasing from 0.00% to around -1.00% (Australian rates 1.00% below the US). Today the gap in the 2-year swap rates is -0.70% (Australia 3.85%, US 4.55%). Hence the AUD/USD exchange rate is not far off its lows at 0.6600. Over the next two to three months, Australian 2-year swap rates are set to increase to at least 4.35% with three RBA hikes. US 2-year swap rates are poised to reduce to 3.75% with the Fed pause and rapidly reducing inflation. The Aussie:US interest rate differential is therefore likely to increase from the current -0.70% to +0.60% (refer to the orange arrow on the first chart). The correlation of the interest rate differential to the AUD/USD should result in strong AUD gains against the USD.

When currency speculators are paid to short-sell the AUD against the USD (borrow the AUD at 3.85%, invest the USD at 4.55% - therefore forward points favourable to AUD short-sellers), the AUD short-sold positions are large, and the AUD depreciates. The second chart confirms the two periods of AUD weakness when this occurs (June 2018 to June 2020 and June 2022 to date). Once the interest gap swings the other way, the short-sold AUD positions are inevitably unwound through AUD buying. The AUD is forecast to appreciate to near 0.7500 by December due these interest rate changes.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.