Summary of key points: -

- Kiwi dollar largely confounds the negative forces

- Lower inflation and a pausing Fed: Negative for the USD

Kiwi dollar largely confounds the negative forces

It is a fair question to ask: ”Just how well has the New Zealand dollar performed over recent months in the face of international uncertainties and deteriorating domestic economic metrics?”

The answer is: “Arguably marginally better than what many have expected, based on the impending economic recession in New Zealand, coupled with an external Current Account deficit blow-out”.

The NZD/USD exchange rate has held above 0.6000, without being able to appreciate above the trading range resistance levels around 0.6350. It would be going too far to state that there is specific and independent NZ dollar buying support at 0.6000, the reasons why we have held above 0.6000 have more to do with events in Australia and the US.

The list of negative events and forces on the Kiwi dollar since February have been numerous: -

- Safe haven buying of the US dollar against all currencies as the debt ceiling risk in the US inevitably came down to the wire in terms of timing. The risk of debt default is now over (if there ever was much of a risk!), and it has been a little surprising we have not seen more unwinding of long-USD positions over this past week.

- In being so definitive that the last 0.25% OCR increase to 5.50% two weeks ago is the end of their monetary tightening, the Reserve Bank of New Zealand have not only painted themselves into a corner, however they also triggered a 2½-cent depreciation of the Kiwi dollar from 0.6250 to 0.6000. Odd really, when you consider that the RBNZ require a stronger NZ dollar value to reduce the stubbornly high inflation.

- The Chinese economic recovery in 2023 from two years of lockdown has been more volatile than expected and certainly a lot softer in recent months than all the prior economic forecasts. The over-supply of the residential property market has had a greater dampening impact on economic activity than was foreseen. The NZD and AUD react correspondingly to positive or negative Chinese economic data (tracking the Yuan movements against the USD), and of later the economic data have been much more on the negative side. Looking ahead, additional fiscal and monetary stimulus is highly likely in China, boosting economic activity levels over the balance of 2023.

- The increase in our external Balance of Payments Current Account deficit from the long-term structural deficit of 5% of GDP to 9% would be a large worry and negative for the NZ dollar value if there was not a clear counterforce that will correct it back to 5% within a couple of years. The counterforce is of course foreign tourists returning in large numbers as it was the absence of tourists in 2020 to 2022 that caused the blow-out. The return of foreign students to our universities is also important, sadly our Government has been too slow and cumbersome to re-energise this major foreign currency earning industry.

- The enigma that is the Reserve Bank of Australia has implemented a succession of flip-flop monetary policy decisions over recent months, deterring global currency traders and investors away from the Aussie dollar as the RBA cannot be trusted and deliver too many surprises. Despite very positive Australian economic fundamentals the AUD has been out of favour for this reason. Thankfully, the last RBA meeting saw a more decisive and determined Governor Philip Lowe, warning of even higher interest rates being required to drive inflation down.

Given all the recent negatives, it is instructive for the future direction that the Kiwi dollar has held above 0.6000 and does not seem to be attracting any aggressive sellers at these levels.

The aforementioned negatives appear to have now all run their course and the Aussie dollar has posted an impressive appreciation against the USD from 0.6450 on 30 May to 0.6750 on Friday 9th June. The Kiwi dollar has lagged that three cent jump, only lifting one cent to 0.6130. Therefore, the NZD/AUD cross-rate has plunged two cents from 0.9300 to 0.9100 over the same 10-day period. Given the interest rate gap of NZ interest rates being well above those in Australia it is hard to see the NZD/AUD cross-rate moving too much below 0.9100. In other words, further AUD gains towards 0.7000 against the USD should be matched by a similar three cent appreciation of the NZD against the USD. The Australian dollar is finally coming back into favour with global FX market participants as they seek to rotate out of long-USD currency positions.

Over the next month it will continue to be US and Australian economic releases and subsequent responses by the equity, bond and FX markets that determine NZD/USD exchange rate movements. The next significant local NZ piece of data is not until 19th July when the all-important June quarter’s CPI inflation figures are revealed. The RBNZ is forecasting a 1.10% increase in inflation for the quarter, anything above that will put question marks around their call to end interest rate increases at 5.50%.

Lower inflation and a pausing Fed: Negative for the USD

US inflation numbers for the month of May this week on Tuesday 13th (Wednesday morning NZT) will be crucial for near term USD currency movements. Consensus forecasts are for headline inflation to increase by 0.20%, sharply dropping their annual headline rate from 4.90% to 4.10%. The Federal Reserve monetary policy meeting the following day is expected to see a decision to pause interest rate increases. Both outcomes stand to weaken the USD as more foreign exchange market participants are convinced that interest rate differentials now start to favour other currencies than the US dollar. The Fed are expected to conclude that they have done enough to slow the US economy and therefore lower inflation.

In any economic slowdown, the last indicator to turn downwards is always employment data. The time lags of adjusting workforces to economic and financial reality are not short! That paradigm has certainly proven to be the case with the softening of the US economy in 2023, with monthly Non-Farm Payroll job increases over recent months remaining near to the +340,000 per month average for the last 12 months. Last week’s jobless claims (numbers signing on to the unemployment benefit) data in the US for May recorded an increase of 261,000, the largest monthly increase over the last 18 months. Finally, perhaps, some signs that the economic slowdown is feeding into a weaker labour market, which would be further evidence to support the Fed’s decision to pause on interest rate hikes.

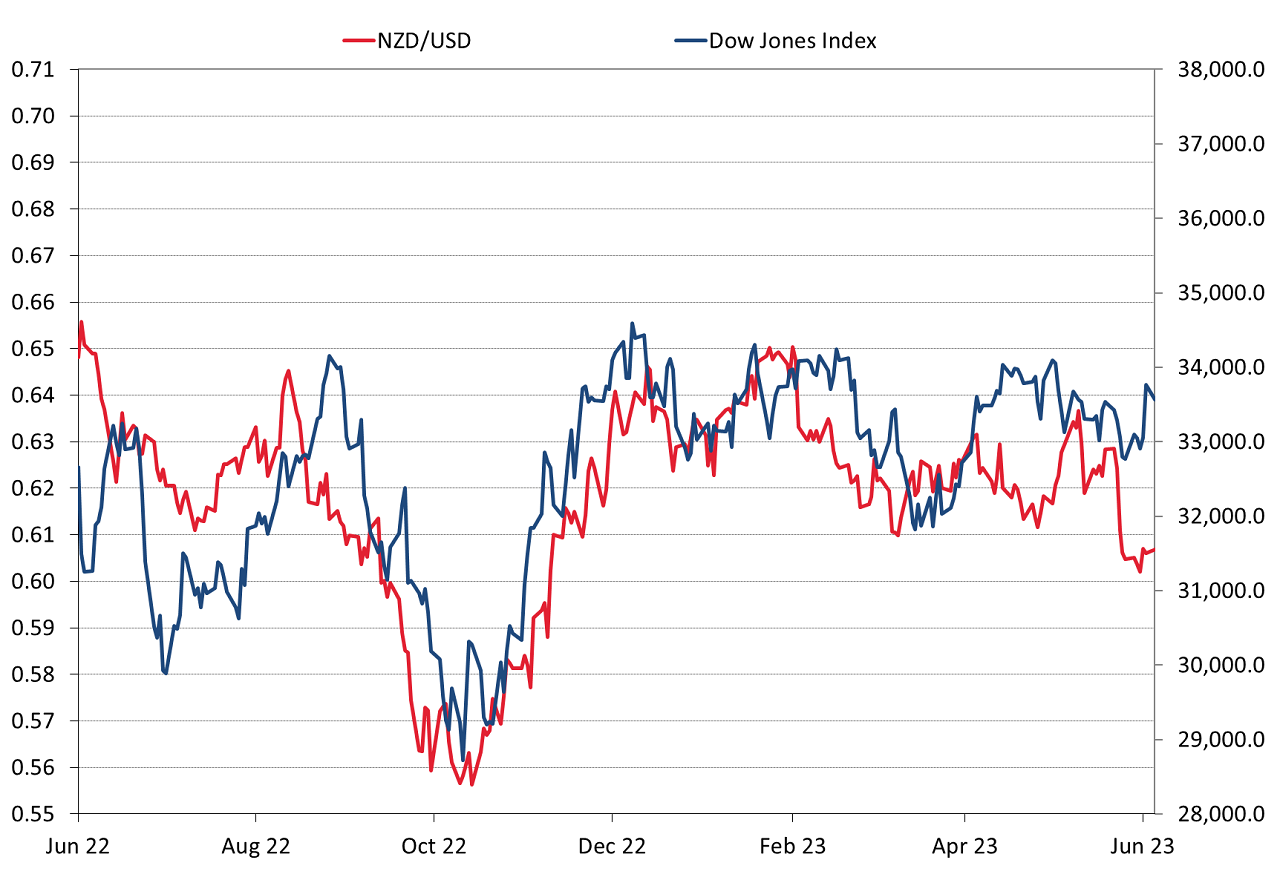

Being a “risk-on/risk-off” sentiment currency, the Kiwi dollar never deviates too far from the movement of US equity markets (refer chart below). Historical correlations would suggest that the current divergence of the Kiwi moving much lower than the Dow Jones Index, will not last too long. A pausing Fed this week will be positive for US equity markets.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

3 Comments

If the current govt. in NZ is re-elected and the Greens get their wealth tax, watch the outflows of capital. NZ dollar will soon be 40 cents U.S.

The current govt have no idea of what to do next. Giving the vote to 16 year olds is the peak of their current ideological creativity & we all know how unreliable 16 year olds can be. Getting children to vote for children. Oh pa-lease.

That chart of NZD v Dow Jones shows the last three times when our currency dived the DJIA was soon to follow....... June 2022, Aug/Sep 2022 and Feb 2023.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.