- FX markets deliver a different verdict on the Fed’s “hawkish pause”

- Australian dollar suddenly back in favour

- Dire warnings from the IMF and S&P have no impact

FX markets deliver a different verdict on the Fed’s “hawkish pause”

Price action in global currency markets since the US Federal Reserve’s ”hawkish pause” on interest rates last Thursday morning has been telling and quite instructive as to future direction.

Despite the immediate media headlines being that the Fed would be increasing interest rates by a further two 0.25% hikes over coming months, the forex markets have taken a different view. By selling the US dollar, the FX markets have priced-in an outcome of no further increases. The weaker USD reflects and expectation by the markets that the Fed have finished with interest rate increases and the next move in US interest rates will be downwards, sometime early next year. Whilst the FX market verdict is that US interest rates will move no higher, the USD losses against the major currencies reflects the situation that the Europeans, the UK and Australia still have some more to do with their central banks lifting their interest rates by at least another 0.50% from current levels to bring inflation under control. Rapidly changing interest rate differentials point to buying of Euro’s and Aussie dollars, and the selling of the USD.

There is no guarantee that the Fed will actually increase their interest rates in July and August, following the June pause. The “dot plot” interest rate forecasts of still higher rates needed over the next 12 months is not an official Federal Reserve forecast. They are merely the separate forecasts of individual Fed members at this point in time. Their individual views can, of course, change with time if the evolving economic data proves that both inflation and employment turn out to be weaker than current estimates. Fed Chair Jerome Powell believes they are closer to their destination in terms of monetary tightening; therefore they can afford to go slower with interest rate increases. They have bought some more time to collect additional economic data to assist the decision of whether they have done enough already (or not) with interest rate hikes.

The following two economic data releases before the next Fed meeting on 26 July will hold the key to the Fed confirming no more rate hikes, or alternatively that further increases are required: -

- PCE Price Index for May (the Fed’s preferred inflation measure) on 30 June. A 0.20% increase is forecast, reducing the annual PCE index to 4.10% from 4.40% last month.

- Non-Farm Payrolls jobs data for June on Friday 7 July – an increase below 250,000 for the month may well confirm other recent evidence that the labour market in the US is finally starting to soften.

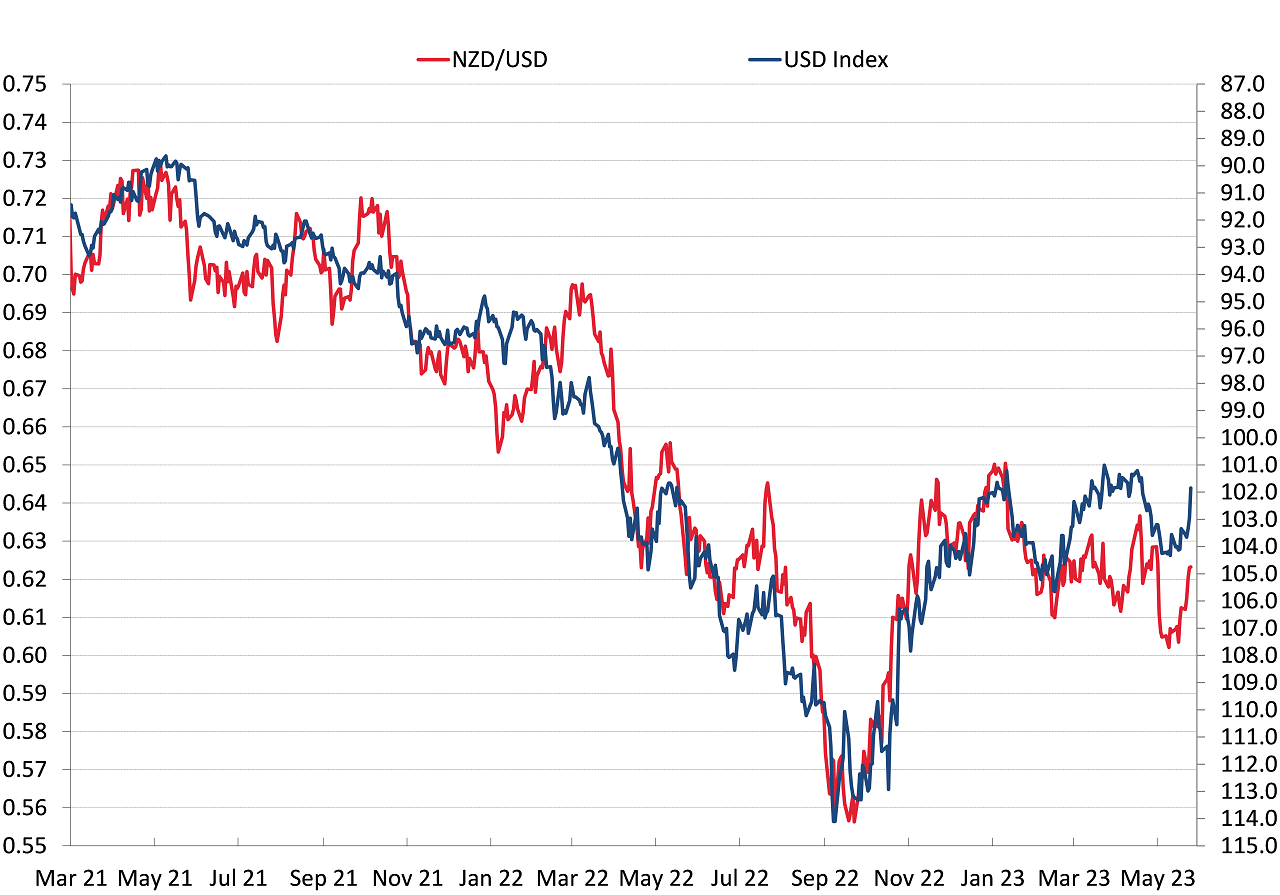

The USD Dixy currency index has dropped away from 104.50 on 31 May to 101.85 currently - a 2.50% depreciation over the last fortnight. Further USD weakness has to be expected over coming weeks as US economic data prints on the weaker side and the above two indicators negate the need for the Fed to increase interest rates any further.

- The Euro has appreciated 2.70% from $1.0660 to $1.0950 over the same 14-day period.

- The Aussie dollar has appreciated a whopping 6.20% from 0.6470 to 0.6870 over the last 14 days.

- The Kiwi dollar has appreciated a marginally smaller 4.00% from a 0.6000 low on 31 May to the current 0.6240 spot rate.

Adding to the downward pressure on the US dollar over coming months will be a reversal in direction of US 2-year and 10-Year Treasury Bond yields from their current levels of 4.72% and 3.76% respectively. US Treasury yields have increased over recent weeks due to the US Federal Government liquidity disruptions from the debt ceiling standoff. The Government has been required to issue additional bonds in a compressed period to fund the short-term cash shortfalls, because they could not borrow any more once they hit the debt ceiling a month ago. The increased supply of new bonds has forced the yields higher. However, from here the liquidity position will normalise and therefore a return of the 10-year bond yields to the 3.40% area is likely. The highly correlated USD Index will follow those yields lower.

The sole driver of the NZD/USD exchange rate continues to be the overall direction of the USD (through the USD Index). Had the RBNZ not wrong-footed the FX markets and forced the Kiwi dollar down two cents on 24 May with their overly-definitive “no more interest rate increases”, the NZD/USD rate would be trading two cents higher at 0.6450 today – in line with the USD Index at 101.85.

Australian dollar suddenly back in favour

The four-cent rebound upwards in the Australian dollar against the USD over the last two weeks has been nothing short of spectacular. The sudden re-rating of the Aussie dollar comes about as global currency traders and investors gain some confidence that the Reserve Bank of Australia is finally serious and consistent about hiking interest rates to bring their inflation rate down. For a considerable period up until a few weeks ago, the offshore participants in the AUD were happier to sell the AUD against the USD as they had no confidence in the RBA with their flip-floppy/inconsistent monetary policy stance of pause/raise/pause/raise. As Australian interest rates were set significantly blow those in the US, the FX punters holding short-sold AUD positions were rewarded with forward points in their favour as well.

A number of factors have now caused the RBA to get the “bit between their teeth” with raising interest rates and signalling more to come, which will likely lift their OCR from 4.10% to 4.85% over the next three months: -

- The inflation rate to the end of May at 6.80% being materially above the previous 6.30% and prior forecasts of an annual rate of 6.40%. Inflation is rising again, not going down.

- A higher than anticipated minimum wage ruling of a 5.75% increase.

- Continuing strong labour market with an increase of 75,900 new jobs in May.

- The residential property market showing signs of turning up again (despite sharply higher mortgage interest rates). The Australian Government announced a A$2 billion house building subsidy programme over the weekend to help first home buyers.

The forex markets have been buying the AUD aggressively ahead of the next RBA meeting on Tuesday 4 July. Further AUD gains are highly likely as global currency speculators reverse their current “short-sold” AUD positions to going long AUD. From the current 0.6870 level it would not be too surprising to see continuing AUD strength against the weaker USD to the 0.7200 area over coming weeks. The Kiwi dollar will always follow the AUD higher, so 0.6500 in the NZD/USD rate cannot be ruled out.

Dire warnings from the IMF and S&P have no impact

Despite both the IMF and credit rating agency Standard & Poors’ highlighting New Zealand’s current economic and credit risks of large dual deficits last week, the NZ dollar value did not depreciate as many may have expected. The Kiwi dollar actually appreciated on a weaker USD and stronger AUD as discussed above.

Our external Balance of Payments Current Account deficit reduced from 8.90% of GDP in December 2022 to 8.50% by March 2023. On the non-trade/invisibles side of the Current A/c the absence of foreign tourists in 2020 and 2021 caused the deficit to blow out. The tourists are now returning in large numbers and over the next few years that alone will return to Current A/c deficit back to the long-term average of 4.00% of GDP. On the trade side of the Current A/c, the closing of the Marsden Point oil refinery has caused a massive increase in the trade deficit (refer the ANZ chart below). The now full importation of refined petroleum products, plus the earlier increase in crude oil prices, is the major reason for the trade deficit blow out. New Zealand should be ruing the day we allowed the closure of the oil refinery.

Luckily, our primary export volumes and values continue to climb to record high levels and imports of consumer goods will reduce as we have the economic recession, we unfortunately need to endure, to bring inflation back down. It all could have been a lot less painful for Kiwi households if the Government had controlled its own spending, regulatory largesse, and price setting behaviour.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.