Summary of key points: -

- Australian dollar surge rapidly runs out of steam

- A stronger US dollar due to a global recession? – both unlikely

- Will local political risk factors influence the Kiwi dollar?

Australian dollar surge rapidly runs out of steam

Our expectation, and the expectation of the FX markets at the time, was that the spectacular four-cent surge in the Aussie dollar against the USD from 0.6470 on 31 May to 0.6870 by 16 June would continue upwards, as the Reserve Bank of Australia (“RBA”) were signalling further interest rate hikes to combat high inflation. In hindsight, we should not have trusted the RBA to be so decisive and clear-cut. The minutes released last week of the RBA meeting on 6th June, where they increased their OCR to 4.10%, revealed that it was a very close call to agree to that hike. As a consequence on the RBA procrastination, the Aussie dollar has lost all of its upward momentum and recoiled to below 0.6700.

Identical to the US, it will be the upcoming and evolving economic data in Australia that will prompt the FX markets to buy or sell the AUD from here, depending on whether the data suggests higher inflation for longer or a softening in activity and inflation risks. The prior consensus forecasts for the Australian CPI Indicator for the month of May released this Wednesday 28th June are for the annual inflation rate to reduce from 6.80% to 6.20%. A result above 6.20% will be positive for the AUD as it will send a message to the RBA that they still have more to do with interest rate increases.

The NZD/USD exchange rate has not corrected back as far as the AUD/USD over this last week, sending the NZD/AUD cross-rate back up to 0.9200 from 0.9060.

The NZD/USD continues its sideways shuffle between 0.6000 and 0.6300. The next signposts for separate and independent NZ dollar movement on its own account will be the RBNZ OCR review on 12th July (no change) and the all-important CPI inflation for the June quarter on 19th July. Current consensus forecasts are for a 1.10% increase in inflation over the quarter, reducing the annual inflation rate from 6.70% to 6.10%. An outcome well above that level will exert considerable pressure on the RBNZ to revise their “no more interest rate hikes” stance and therefore by positive for the NZ dollar.

A stronger US dollar due to a global recession? – both unlikely

A number of Australian and international investment banks are forecasting the US dollar to remain strong in 2023 as they expect a global economic recession, and the USD always appreciates in such conditions.

The counter argument (which we favour) is that a deep global recession is unlikely given that the Chinese authorities will do whatever it takes with stimulus to their economy to ensure their economic growth rate hits the 5.00% to 6.00% target for 2023. We witnessed a hint last week of what is about the come, with key interest rates in China cut by 0.10%. Much larger interest rate reductions have to be expected over coming weeks/months as the Chinese authorities respond (as they always do) to faltering economic conditions. The Chinese monetary policy stimulus will lift consumer confidence and spending over coming months. There is a swag of Chinese economic data being released on 17th July (June GDP, retail sales, industrial production) which will be positive for the AUD and NZD if the data is stronger and above forecast.

The US dollar has not been able to depreciate any further over this last week as Fed Chair Jerome Powell appeared before Congressional committees and hinted that further interest rate increases may be necessary if their labour market remains robust and core inflation does not reduce.

Therefore, the Non-Farm Payrolls jobs figures for June due for release on Friday 7th July will be a crucial signal for near-term US dollar direction. An employment increase below 200,000 for the month will remove the bias for further rate hikes and be negative for the USD. Before that data, the PCE inflation figures on 30th June could surprise to the downside, an increase below the +0.20% consensus forecast may well eventuate with rents/shelter price trends finally reversing from positive to negative.

Inflation in the US continues to fall at a rapid rate. Even if the Fed decide to do one last 0.25% interest rate increase, the currency markets are likely to price a “one and done” outcome and sell the US dollar in the expectation that the next move in US interest rates after that will be downwards (early 2024). The same cannot be said for interest rate levels in the UK, Canada, Australia, the EU, and New Zealand where stubbornly high inflation across all those economies will mean interest rates stay higher for much longer than in the US.

Will local political risk factors influence the Kiwi dollar?

We are often asked “to what extent will the upcoming October general election influence the direction of the New Zealand dollar?”.

The short answer is “not much!”.

Given the evenness, at this point, in the political opinion polls it is unlikely that currency market participants will be placing bets either way on the Kiwi dollar over the next few months in the lead up to the election. However, depending on the outcome there may well be some volatility in the Kiwi after the result is announced. Whether that post-election movement in the currency value is up or down may well come down to the clarity of the result. A clear-cut National/ACT victory would be seen by offshore observers as a government of tighter fiscal management and more business-friendly economic policies. All other things being equal, that outcome would be mildly positive for the Kiwi dollar. A Labour/Greens coalition needing the support of Te Pāti Māori to form a government would most likely see a continuation of the current “spend, borrow and hope!” economic policies adopted by Grant Robinson and Chris Hipkins. It is difficult to see that result being positive for the NZ economy and therefore potentially negative for the Kiwi dollar.

To borrow the old investment management adage that “historical return performance is not a good guide to future investment return performance” (however, it is better than nothing!), it is interesting to look back in years to observe whether political change in New Zealand has shifted the value of the Kiwi dollar.

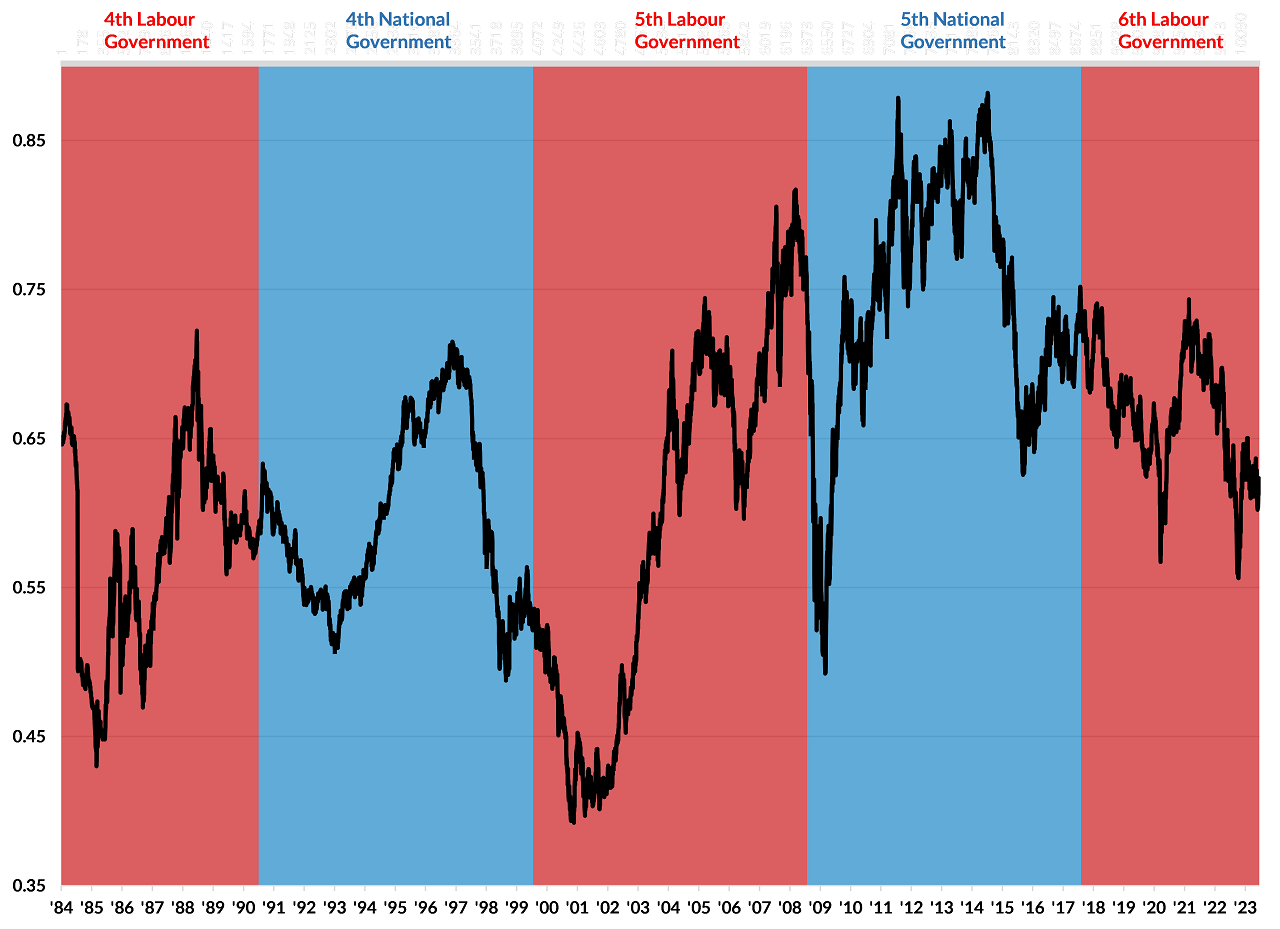

The election results that have produced a change in government in New Zealand, since the economic revolution that followed the late David Lange’s Labour Party victory in 1984, have coincided with the following NZD/USD exchange rate movements (chart below): -

- 4th Labour Government 1984 to 1990: The period commenced with a 20% currency devaluation, the free-floating of the Kiwi dollar in 1985 and subsequent NZD appreciation from 0.4500 to above 0.6500 as global investors were attracted to our high interest rates and free-market economic policies of the “Rogernomics” era.

- 4th National Government 1990 to 1999: The 1990 to 1992 economic recession produced lower export commodity prices and a depreciation in the NZ dollar from 0.6500 to near 0.5000. The improvement in the NZ economy in the mid-1990’s delivered a recovery in the currency back to 0.7000. However, the Asian financial crisis in 1999 and again lower commodity prices sent it back to 0.5000 again.

- 5th Labour Government 1999 to 2008: The FX markets delivered a swift and telling verdict on the new Labour Government led by Helen Clark and Michael Cullen, selling the Kiwi down from 0.5500 to 0.4000 in 2000/2001. However, Finance Minister Cullen proved them all wrong with prudent fiscal management and the Kiwi dollar appreciated 87% from 0.4000 in 2001 to 0.7500 by 2006 (helped by a weaker USD at the time).

- 5th National Government 2008 to 2017: The GFC and plummeting commodity prices in 2008/2009 yet again caused another NZD sell-off to 0.5000. A China-induced mining boom in Australia sent the AUD sky-high in 2011 to 2013, pulling the correlated NZD/USD rate up from 0.5000 to above 0.8500 by 2014. Lower dairy prices and a stronger USD forced the Kiwi dollar back to 0.6500 in 2015/2016.

- 6th Labour Government 2017 to 2023: The trend in the Kiwi dollar has largely been downwards since the “accidental” Government of Jacinda Ardern came to power in 2017. A weaker US dollar on the Fed’s money printing in 2020 allowed a brief return to 0.7500, however New Zealand has been off the radar for international investors and currency traders since that time.

The conclusion from our FX history lesson is that major global economic events have played a dominant role in determining the NZ dollar value. Local political changes have been on the margin in terms of NZD direction, as New Zealand’s fundamental economic settings have not really changed since the freeing-up of the economy in the late 1980’s.

The five general elections since 1984 have not generated sufficient political risk to independently move the dial on the Kiwi dollar’s value. That pattern is likely to continue this October.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

1 Comments

If Labour were foolish enough to embrace the Greens' wealth tax, it is possible that would have some bearing on the exchange rate, given the capital outflows from New Zealand that would occur. I know people who are already shifting their money overseas in anticipation of leaving NZ if that tax becomes a reality. As well, I know people overseas who were going to immigrate to NZ and invest large sums of capital but who decided not to when they read about the proposed tax.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.