Summary of key points: -

- Swift and severe FX market verdict for the USD on lower US inflation outcomes

- NZD/USD rate breaks higher out of “converging wedge” formation

Swift and severe FX market verdict for the USD on lower US inflation outcomes

A tectonic shift occurred in global currency markets late last week with the US dollar being smashed down in value following a lower than forecast increase in US inflation in the month of June (released on Wednesday 12th July).

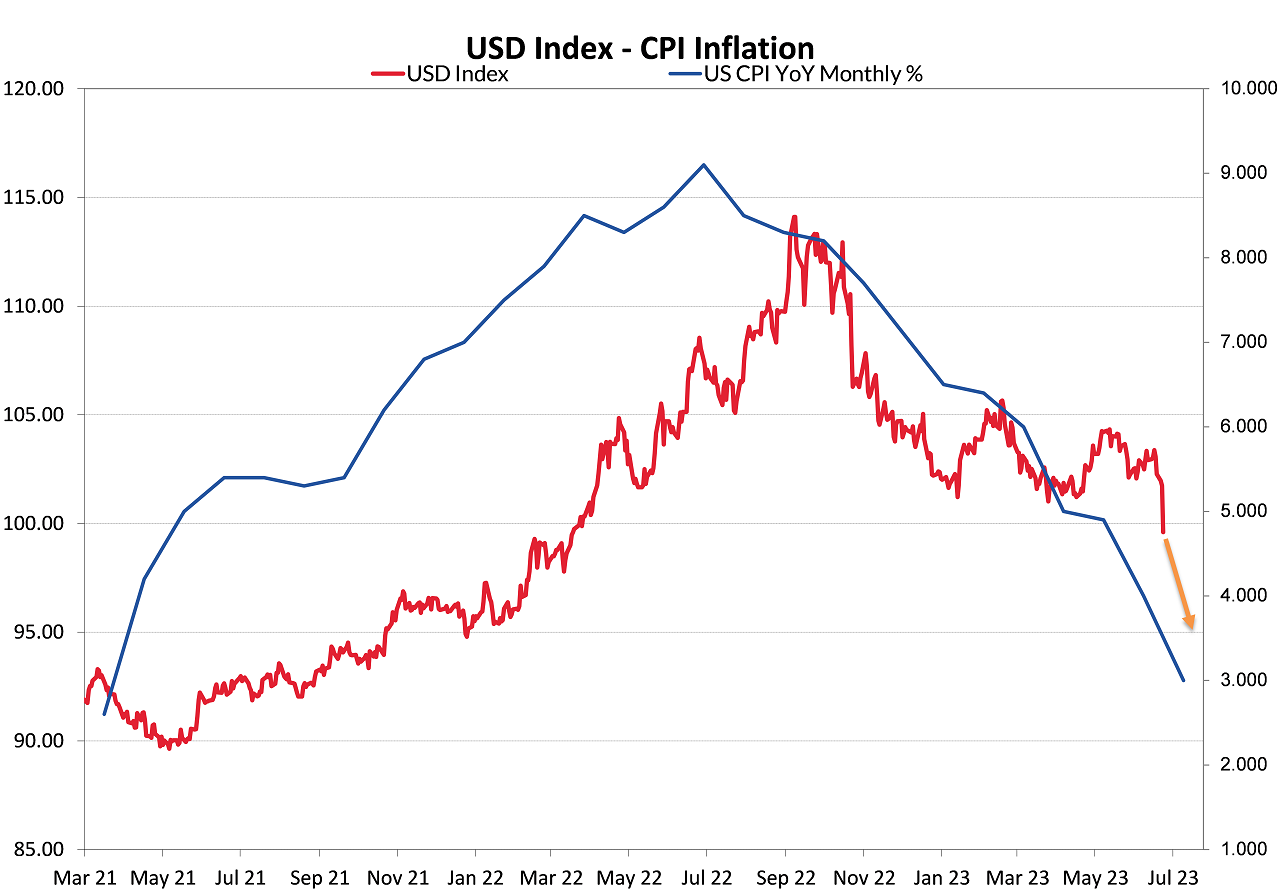

The annual headline inflation rate plunged from 4.00% in May to 3.00% in June. The annual core inflation measure was also lower than the 5.00% forecast, dropping to 4.80%.

The FX market’s response to the inflation figures was swift and severe, the USD Dixy Index nosediving 2.70% lower from 102.40 a week ago to 99.60 at Friday’s market close. The forex markets are already pricing in the fact that the Federal Reserve will conduct one last interest rate hike on 26th July to 5.25%/5.50% and after that they will signal an end to any further interest rate increases. The FX markets are pricing the USD value down because the US has completed its monetary tightening cycle well ahead of others, with further interest rate increases still to come in Europe, the UK, Australia, and Canada. The US interest rate markets are still pricing a 95% probability of a 0.25% increase on 26th July, however the probability of a second 0.25% hike after that has plummeted to only 13%.

Wholesale prices (PPI Index) in the US for June released a day later on 13th July were also lower than prior forecasts. The annual PPI Index increase now stand at just 0.10%. Both sets of inflation data make a mockery of recent hawkish speeches by various Federal Reserve governors stating that inflation was still “too high and not coming down”. The FX markets have sent a telling message that the views of these Fed Members should not be taken as gospel as they can be as horribly wrong on economic outcomes as anyone else.

The constant view of this column over recent months has been that US inflation will decrease in 2023 as fast as it went up in 2022, leading to a weaker US dollar. That expectation has transpired into reality, the inevitable USD sell-off allowing the NZD/USD exchange rate to make the gains we have been expecting and forecasting.

The nirvana outcome that the US Federal Reserve has been seeking is to bring inflation back down to their 2.00% target without causing a bad recession in the US economy i.e. the “soft landing” economic scenario. It looks like they are achieving that goal with inflation much lower today than most imagined and consumer confidence picking up in June, the Michigan Consumer Sentiment Index up to 72.6 from 64.4 previously. Lower US interest rates and the avoidance of a bad economic recession is very good news indeed for US equity markets. Expect rising US equity markets over coming months to add to the positive environment for the two “risk currencies”, the NZD and the AUD.

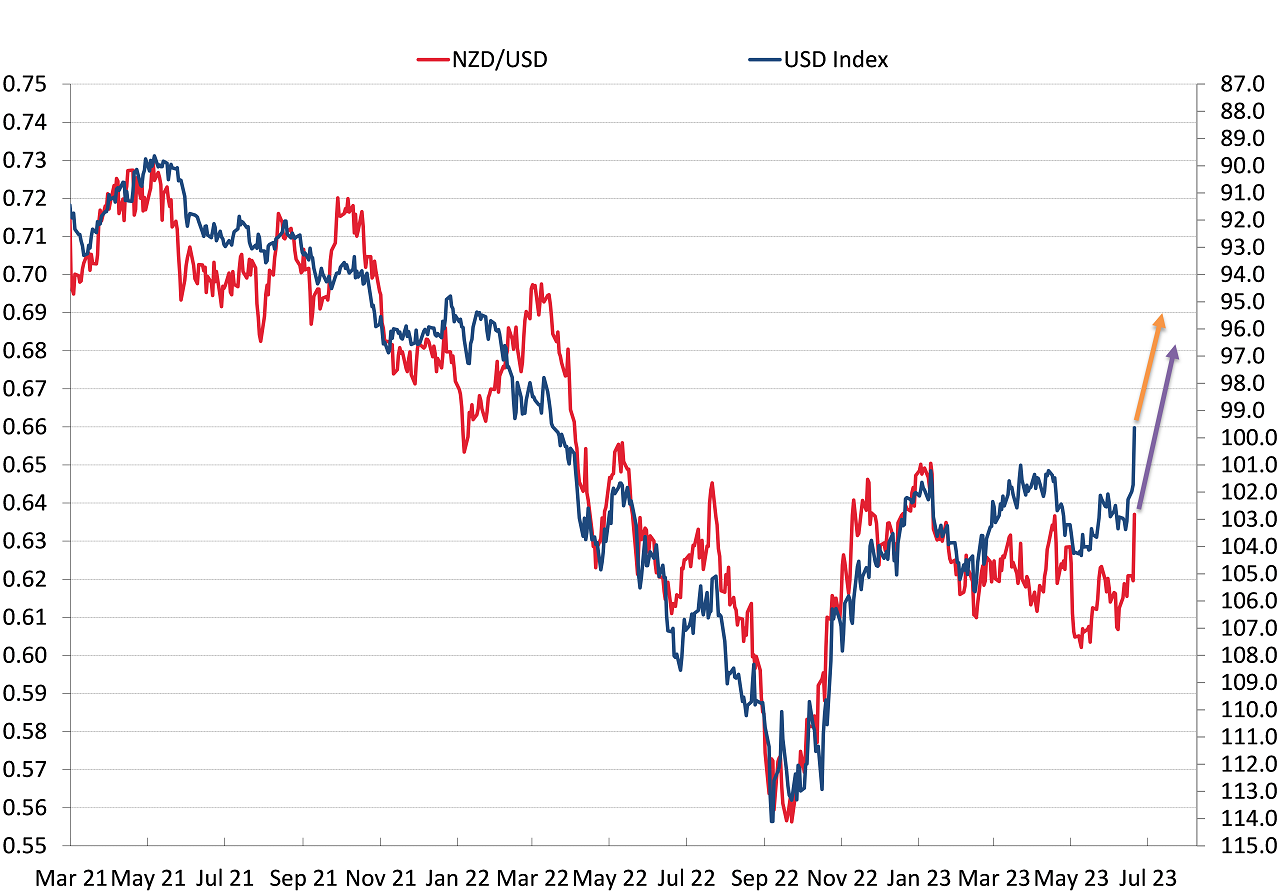

NZD/USD rate breaks higher out of “converging wedge” formation

The spike upwards in the NZD/USD exchange rate from below 0.6200 to almost 0.6400 on Thursday and Friday last week has resulted in a break-out to the top-side of the “converging wedge” chart formation the NZD/USD rate has remained between since September last year. The NZD/USD rate has remained below the top downtrend line since 0.7200 in September 2021 (refer chart below). The break above that line is very significant from a technical/chart perspective and it is now likely to attract further NZ dollar buying interest.

Our column has held the firm and documented view over the last six months that the NZD/USD rate would hold above 0.6000 and eventually a weaker US dollar on lower US inflation would propel the NZD/USD rate higher above the initial 0.6300 resistance line and then a lot further beyond that. It was only a matter of time before the FX markets would aggressively sell the US dollar on the outcome of US inflation going down in 2023 as fast as it went up in 2022.

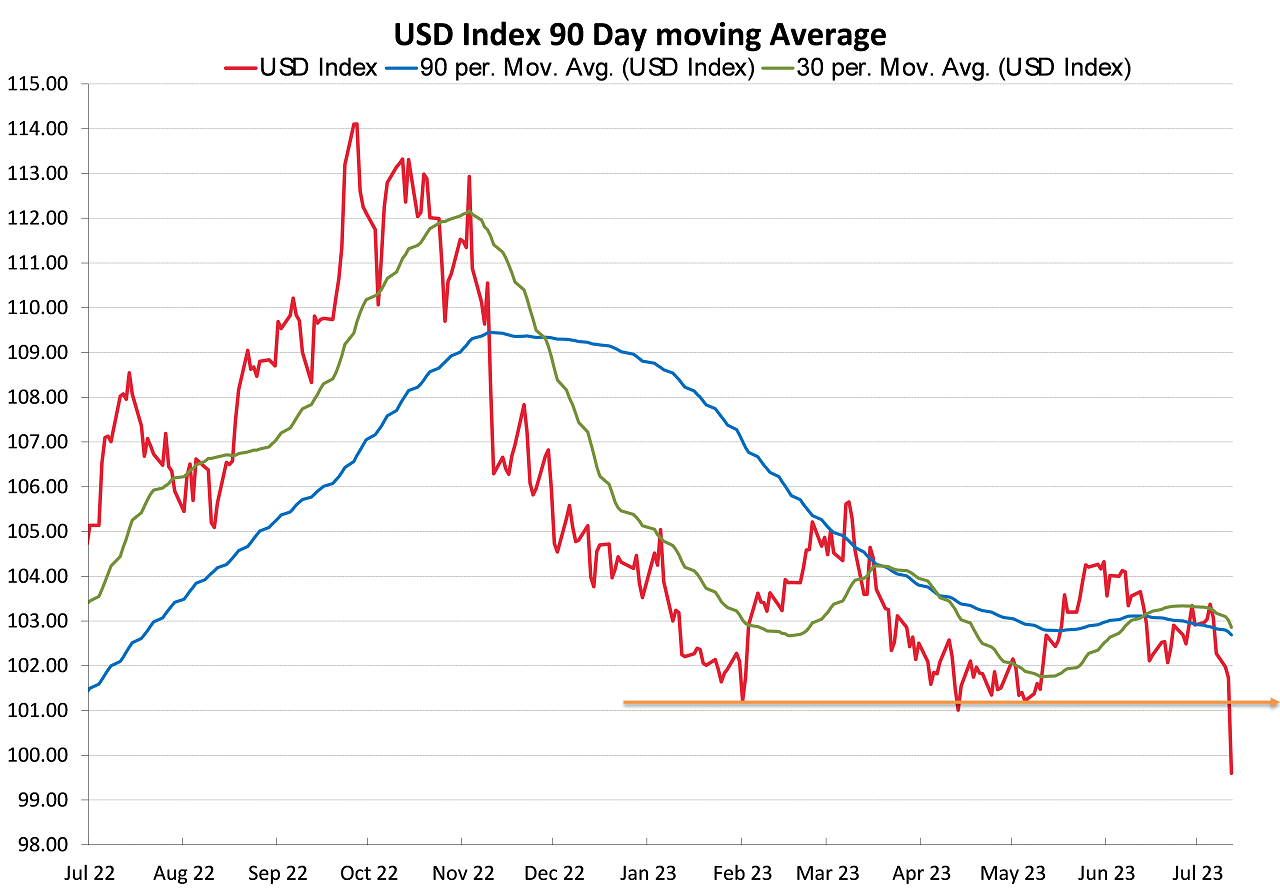

The immediate sell-off in the US dollar following the lower-than-expected US June CPI data on Thursday 13th July has seen the USD Dixy Index close well below the previous support level of 101.00 (refer chart below). That support level for the USD held firm from February until last Thursday, however it has now been decisively broken to the downside. The 30-day and 90-day moving averages for the USD Dixy Index are about to cross-over (30-day trading below the 90-day average) to signal a new overall downtrend. As discussed in this column last week, the zig-zag USD sideways trading pattern has been held in place up until now by stronger than forecast employment data matching off against generally lower than expected inflation data. The events of the last two weeks have seen both sets of economic data turn weaker in June.

3.00% to 9.00% over the first half of 2022 and the equally spectacular fall in US inflation over the last 12 months from 9.00% to 3.00%. As the chart below indicates, the ending of US interest rate hikes by the Fed (due to the much lower inflation result) appears destined to send the USD value a lot lower yet to at least 95.0 on the USD Index.

The forex market sentiment towards the US dollar will now be categorically negative as the reality of US interest rate no longer rising, when others are, sinks in. We continue to hold our long-held view that there will be another significant leg down in the US dollar value over coming months, taking the USD Dixy Index well below 100 to somewhere close to 95.00. The NZD/USD exchange rate equivalent to a 95.00 USD index is 0.6800. The continued depreciation of the USD sending the USD Index back to pre-February 2022 levels (commencement of the Russian/Ukraine war) i.e. below 95.0.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

6 Comments

NZ dollar on the up and up unless we get the coalition of chaos, with Greens and Maori parties demanding a wealth tax.

Had to be right about one of his predictions eventually I guess but let’s just wait until the dust settles shall we. One weeks data does not make a trend. So bearish on the USD in all your articles it’s almost like you have a fair bit of skin in the game or something?

Optimists in virtually all markets are ignoring a tsunami of negative news from around the world as they run out far beyond the low tide mark, gathering up all the stranded flapping fish in ecstasy of this "nirvana" development. Oh dear, what is that approaching them over the horizon?

https://fred.stlouisfed.org/graph/?g=178uw I see Jaws......

NZD ended this week at US 61.7c

Eight weeks later and NZD is glued to US59c.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.