Summary of key points: -

- Repatriation of NZ bank profits to Aussie parents likely cause of latest NZ dollar selling

- The Fed’s “D-Day” finally arrives

- Australian and New Zealand inflation remains “sticky high”

Repatriation of NZ bank profits to Aussie parents likely cause of latest NZ dollar selling

Contrary to last week’s positive expectations for further NZ dollar gains above 0.6400 against the weakening US dollar, the Kiwi has come under constant selling pressure itself over the last seven days.

The NZD/USD exchange rate has pulled back by more than two cents from the highs of 0.6412 on Friday 14th July to close at 0.6170 on Friday 21st July. Part of the NZD/USD depreciation was some mild USD strength, the USD Dixy Index moving up 1.30% from 99.50 to 101.80 over the seven days trading. Weaker Chinese economic data also weighed the NZD and AUD down. However, the Kiwi dollar has dropped 3.80% over the same period. So, we have witnessed independent and separate NZ dollar selling unrelated to global currency market movements. There has been no real negative local New Zealand economic news to prompt a wave of independent Kiwi dollar selling. The only economic release over the last week was the June quarter’s CPI inflation figures, which came in above prior consensus forecasts. That result was certainly not a negative for the NZ dollar and there have been no other apparent reasons for the heavy selling that pushed the NZD/USD rate down by more than two cents.

A clear pointer to the nature and source of the stand-alone NZD selling comes from the sharp pullback in the NZD/AUD cross-rate from 0.9320 on 14th July to the current rate of 0.9165. The concentrated selling of the NZD against the AUD in the manner seen suggests large-scale transfer of funds out of New Zealand into Australia. The additional NZD selling dragging the NZD/USD rate down a lot further than the correction back down in the AUD/USD rate from 0.6900 to 0.6725.

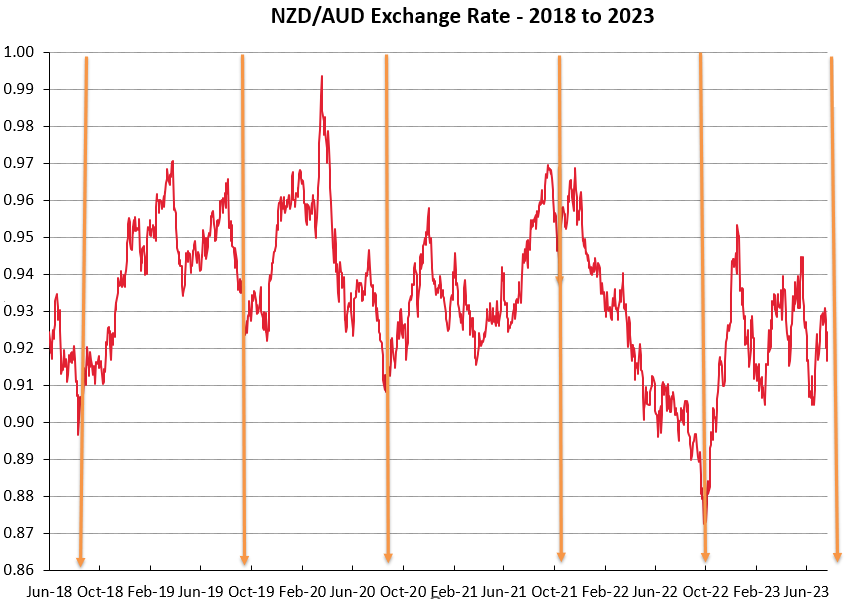

As the NZD/AUD cross-rate charts below demonstrates, there is a consistent pattern of the NZD being sold against the AUD between July and October of each year. The local big four, Australian owned, banks (ANZ, BNZ, Westpac and ASB) all repatriate their billions of dollars of profits as dividends or inter-bank debt repayment to their respective parent banks in Australia at this time of year. Typically, these big trans-Tasman capital flows occur around September/October at or following the banks’ financial year-ends. The plunge in the NZD/AUD cross-rate in October 2022 from above 0.9000 to a low of 0.8700 (briefly), was a prime example of the power of these cross-border bank cashflows. However, it is not unusual to see the NZD selling occur before September as the bank treasurers manage the FX risk and sometimes hedge forward the conversion of the NZD cash to Australian dollars. Standing in the shoes of the Treasury team within the ANZ bank in Australia, I would have been selling the Kiwi against the AUD at 0.9320 last week to hedge in advance the impending cross-border capital flows.

Being very large one-off FX transactions all occurring at once, it does give the interbank NZD/USD forex market indigestion for a period, resulting in the rapid NZD depreciation to 0.6170. However, as we have seen on many previous occasions the NZD has a consistent habit of bouncing back up against the AUD from these regular dips below 0.9200 on the NZD/AUD cross-rate. The NZD/AUD chart also confirms that the cross-rate generally recovers its lost ground rather quickly following the September-October bank-induced NZD sell-off’s.

The NZD/USD exchange rate closely follows the AUD/USD rate 80% of the time in daily FX market trading, however it is these large and periodic NZ/Australian capital flows that disrupt that reliable correlation and cause NZD under-performance from time to time.

Local USD exporting companies should be taking advantage of the current pullback in the NZD/USD exchange rate to below 0.6200 ahead of this Thursday’s (6am NZT) US Federal Reserve meeting, wherein Chairman Powell may well be officially signalling the end of US monetary tightening/interest rate increases. You have to expect the international FX markets will be selling the US dollar down again ahead of and following such a Fed confirmation.

The Fed’s “D-Day” finally arrives

Emerging softness in the US labour market, coupled with lower than forecast inflation outcomes (again!), point to the US Federal Reserve finally confirming the end to their monetary tightening cycle at this week’s meeting. There is certainly now sufficient evidence coming from the US economy that the earlier ramping up of interest rates have done their job to bring the inflation rate down. The annual headline inflation rate is already down to 3.00% and headed for 2.00% over coming months as the 12-month lagged house rents data finally turns negative from the previous increases. The hawkish members of the Federal Reserve Committee will now be struggling to find a justification for the continuation of interest rate increases.

Two potential scenarios seem like to play out this Thursday morning: -

- The Fed raise their official interest rate a final 0.25% and signal that there will be no further increases (a la Adian Orr at the RBNZ). Such a decision is already fully priced-in to US interest rate and FX markets.

- The Fed surprise the markets with a “no change” and indicate that future adjustments to interest rates will be “data-dependent” (they always state that!).

Either result suggests a continuation of recent USD selling as the FX markets conclude that the Fed will the first central bank in the world to be cutting interest rates something in early 2024. The closing of interest rate differentials being the fundamental reason why investors will reduce USD denominated holdings over coming months.

Tha Australians and the Europeans still have at least two 0.25% interest rate hikes to implement, whereas we are about to get the official confirmation that the US Fed has finished with theirs.

Australian and New Zealand inflation remains “sticky high”

New Zealand’s June quarter inflation result was close to prior expectations, however, the domestic/non-tradable annual inflation rate remaining “sticky high” at 6.50%. There is a real possibility that the September quarter inflation increase could come in above the September 2022 number of +1.80%, therefore the annual inflation rate remaining stable or even increasing. The various economic commentaries stating that New Zealand’s battle to get inflation back down is over and it will be a nice orderly decline back to 3.00% are in for a rude shock. The vast majority of our high non-tradable inflation is due to Government policies on immigration, minimum wages, and over-powering regulation. For the Finance Minister to claim that 90% of the increase in house construction cost comes from offshore is a monumental stretch of the truth. Perhaps the steel, glass and door handles are imported, but not much else.

We will have another read on how sticky Australia’s inflation rate is this coming Wednesday with the release of their June quarter inflation numbers. Consensus forecasts are for a 1.00% increase, reducing the annual headline rate from 7.00% to 6.20%. An increase above that figure will be positive for the Aussie dollar and impart more pressure on the RBA to lift interest rates again at their next meeting on Tuesday 1st August. Wholesale prices (PPI Index) and Retail Sales data on Friday 28th July may also provide evidence that there is still plenty of life in the Aussie economy.

Australian monthly employment figures for June were again a lot stronger than forecast (+32,000 new jobs compared to +14,000 forecast). The new RBA Governor, Michele Bullock does not get her feet under the desk until mid-September, however she has already upset the Government Treasurer and the Trade Unions by stating that Australian unemployment rate will need to increase from the current 3.50% to 4.50% to get inflation under control. Early signs that she is no wilting dove on monetary policy, and she will not continue with the wishy-washy monetary management under her predecessor, Philip Lowe.

The Australian dollar still stands as one currency that will be the largest beneficiary of funds moving out of the US dollar over coming months. The AUD/USD rate increased by 10 cents in 2000 when currency speculators unwound their short-sold AUD positions. It has the potential to repeat that movement and the Kiwi dollar will follow it up.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

2 Comments

"Could Jay Powell and his colleagues keep hiking the Fed funds target rate through 6%?

You bet"

https://www.interest.co.nz/currencies/123170/us-dollar-defies-popular-o…

10% Interest Rates This Year, Guaranteed !

Zero mentions of China, CNY or Yuan. Completely irrelevant?

Chart of NZDUSD and CNYUSD:

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.