Summary of key points: -

- Counteracting US inflation and jobs data holds the Kiwi dollar in its range

- Balance of probabilities favours continuing depreciation of the US dollar

- Will the RBA surprise us again?

Counteracting US inflation and jobs data holds the Kiwi dollar in its range

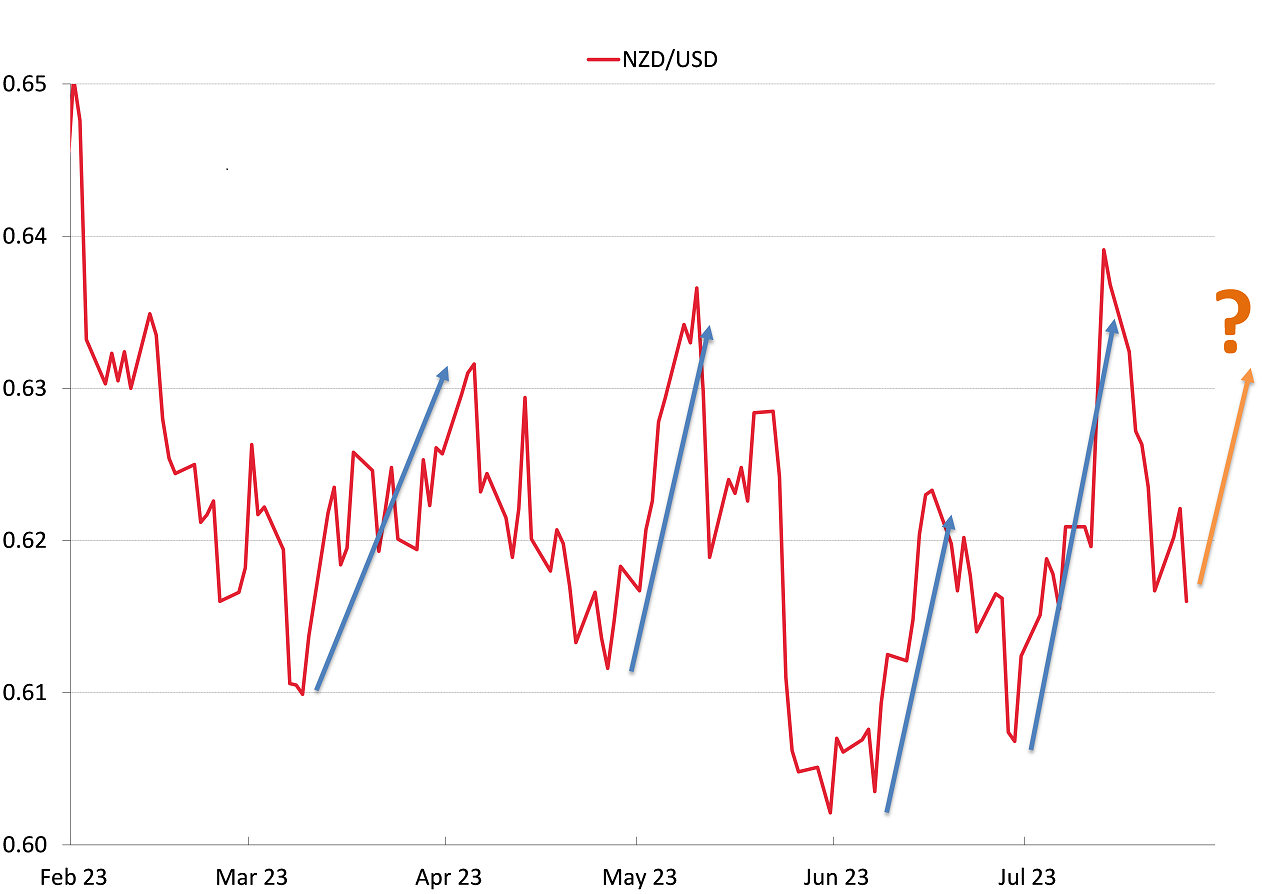

Following the lyrics of the 1997 one-hit wonder song “Tubthumping” by the group Chumbawamba, “I get knocked down. But I get up again. You're never going to keep me down”, the Kiwi dollar’s value against the US dollar has once again been pushed to the bottom end of its six-month trading range of 0.6000 to 0.6400.

The Kiwi has managed to rebound back up again from the 0.6000/0.6100 region from similar selloffs on four separate occasions since February.

Will it be able to repeat that pattern and “get up again” over coming weeks/months?

We can deduce several reasons as to why the NZ dollar is constantly sold down to the 0.6000/0.6100 area, however it always manages to recover back up to over 0.6300 as the NZD selling volumes across the market are not sustainable. Only one on occasion has the NZD selling been related to local New Zealand factors. The Kiwi dollar was sold on its own account in late May following the surprise announcement by the RBNZ that there would be no further interest rate increases above 5.50%. All the other selloffs and recoveries are related to US economic data and the responses by the forex markets to that data in terms of what the change may mean for the US Federal Reserve in setting interest rates.

The pattern with the US dollar value and US economic data since February has been a weaker USD (higher NZD/USD rate) on monthly inflation figures generally coming out below prior consensus forecasts, resulting in a dramatic reduction the both the core and headline annual inflation rates. Counteracting the inflation trends has been monthly jobs data, which up until June were generally above expectations. The FX markets repeated reaction to the stronger labour market data has been to buy the USD (lower NZD/USD rate) as the robust jobs environment causes the Fed to worry about higher wage settlements pushing up inflation again. The Fed’s policy to date has been not to stop raising interest rates until the labour market weakens and the risks to inflation reduce. The June Non-Farm Payrolls employment increase released three weeks ago was weaker than anticipated, promoting market participants to sell the USD as they expected to the US pause on interest rate hikes.

It seems that the pattern of lower inflation/stronger employment data in the US that has caused the repeating up/down NZD/USD movements (within a very defined range over the last six months) may finally be coming to an end.

The question is whether the inevitable break-out will be out the top end above 0.6350 or to the bottom side below 0.6050?

We remain firmly of the view that it will be to the topside as US employment data over coming months continues to print on the weaker side, causing the FX markets to price-in no further Fed interest rate hikes above the 5.50% and accordingly selling the USD down.

Balance of probabilities favours continuing depreciation of the US dollar

It was a very volatile week in global currency markets last week as sentiment swung wildly both ways following the US Federal Reserve’s meeting on Wednesday 26th July and US economic data releases over the subsequent two days.

Whilst the Fed raised their interest rate by 0.25% to 5.50%, the overall impression was that there was a marginally dovish tone to Powell’s commentary in the following media conference. The US dollar was sold following the statement, equity markets lifted, and both the NZD and AUD made gains.

However, stronger than forecast US GDP growth data for the June quarter on Thursday 27th July (+2.40% annual growth rate compared to prior forecasts of +2.00%), coupled with robust durable goods and lower jobs claims numbers combined to propel the US dollar higher. The NZD/USD exchange rate reversing and plummeting from 0.6260 on Wednesday to a low of 0.6123 on Friday.

Yet again, lower than forecast US PCE inflation numbers for June on Friday night stopped the USD buying and allowed the Kiwi dollar to recover a touch to 0.6160.

The direction of the NZD/USD rate from here over coming weeks will continue to be dictated by overall USD movements, and that in turn will be determined by the “balance of probabilities” on US inflation and employment data over the next two months. Expect the FX markets to build in their own bias to those balance of probabilities in advance as the data evolves.

Federal Reserve Jerome Powell made it very clear last week that future interest rate decisions will be solely “data dependent”, in particular inflations and jobs results for the months of July and August. First cab of the rank is the July Non-farm Payrolls employment figures on Friday 4th August. An employment increase below the +200,000 consensus and a lower average hourly earnings (wages) result (<0.40% increase) will be USD negatives as it increases the probability that the Fed have finished with monetary policy tightening.

US inflation results for July and August released on 11 August and 14 September respectively can be expected to confirm another significant reduction in their annual headline inflation rate from the current 3.00% to potentially below 2.00% (the Fed’s target). Material reductions in the shelter/rents component of the CPI is already pre-ordained over these two months as the 12-month lag in these statistics comes through. The balance of probabilities from the US inflation outcomes is certainly for another USD currency selloff.

The balance of probabilities for the US equity market over coming weeks/months is also one of strong gains as a US economic recession is avoided and long-term market interest rates reduce from the current levels due to lower inflation and weaker jobs data. The anticipated positive forces in the equity markets will spill over into the FX markets with the “risk on” currencies the Kiwi and Aussie dollars benefiting the most.

Will the RBA surprise us again?

Australian interest rate markets are only pricing-in a 30% chance of the Reserve Bank of Australia increasing their interest rates by 0.25% on Tuesday 1 August. However, just over 50% of economists surveyed expect an interest rate hike. Weaker than expected inflation for the June quarter and retail sales for the month of June last week have dampened expectations. Therefore, another pause on interest rates by the RBA would be no surprise to the markets and would be neutral for the AUD currency value. However, the RBA have certainly built a reputation over recent years of springing unexpected surprises and adopting a very inconsistent approach to the management of monetary policy. It would certainly propel the AUD/USD exchange rate higher on Tuesday if the RBA delivered a surprise hike. Australia’s annual inflations rate is still 6.00% and will remain “sticky-high” over the next nine months as a tight labour market causes higher wage settlements. Wage price index data on 15th August for the June quarter may well surprise to the upside, above the 3.80% forecast. There is certainly sufficient evidence to convince the RBA that they have more to do with interest rate increases to get their inflation under control.

The closing interest rate differential between Australia and the US (US market interest rates lower from here and Australian interest rates higher) remains as massive AUD positive factor as currency speculators decide to close-down their current short-sold AUD positions.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.