Summary of key points: -

- RBNZ reasons for NZ dollar depreciation do not stack up

- Predictions of the Chinese economy imploding also likely to be wide of the mark

- Japanese and Chinese FX market intervention not to be ignored

- Another RBA U-Turn still on the cards

RBNZ reasons for NZ dollar depreciation do not stack up

According to the Reserve Bank of New Zealand, the NZ dollar has depreciated against the US dollar and other major currencies over recent weeks due to “the interest rates of our trading partners moving higher, whereas NZ interest rates have remained stable at 5.50%”.

The RBNZ had this explanation in both their Monetary Policy Statement and in the following Q & A media conference last week. Not only is the statement inaccurate, but it also makes you wonder as to the extent of their analysis, monitoring of global financial markets and understanding of what actually drives the movements in the Kiwi dollar.

To start with, the interest rates of our two largest trading partners, China and Australia are not currently increasing. China is cutting their official interest rates to stimulate consumer spending and Australia are (rightly or wrongly!) holding their interest rates stable at 4.10%.

US market interest rates have increased, however by no more than where they have already traded higher to over the first eight months of 2023.

The impression that the RBNZ officials like to leave the public and financial markets is that the Kiwi dollar movements are totally due to offshore changes/variables and nothing to do with them. The truth is that the NZD depreciated from 0.6400 to below 0.6100 in May following the decision by the RBNZ to halt interest rate increases at 5.50% and state categorically that they would not be increasing interest rates any further. Both the Fed and the Reserve Bank of Australia are somewhat savvier than that and always leave options open to themselves by stating that “interest rates could well be increased again in the future; it all depends on the evolving economic data”. The irony is that the RBNZ pushed the NZ dollar value down in May precisely when they needed it to go the other way and appreciate to help reduce the sticky/high inflation rate we are all suffering from and which the RBNZ are charged to reduce.

Predictions of the Chinese economy imploding also likely to be wide of the mark

What has driven the NZ dollar down below 0.6000 to 0.5900 against the USD (contrary to our expectation) are three inter-related forces: -

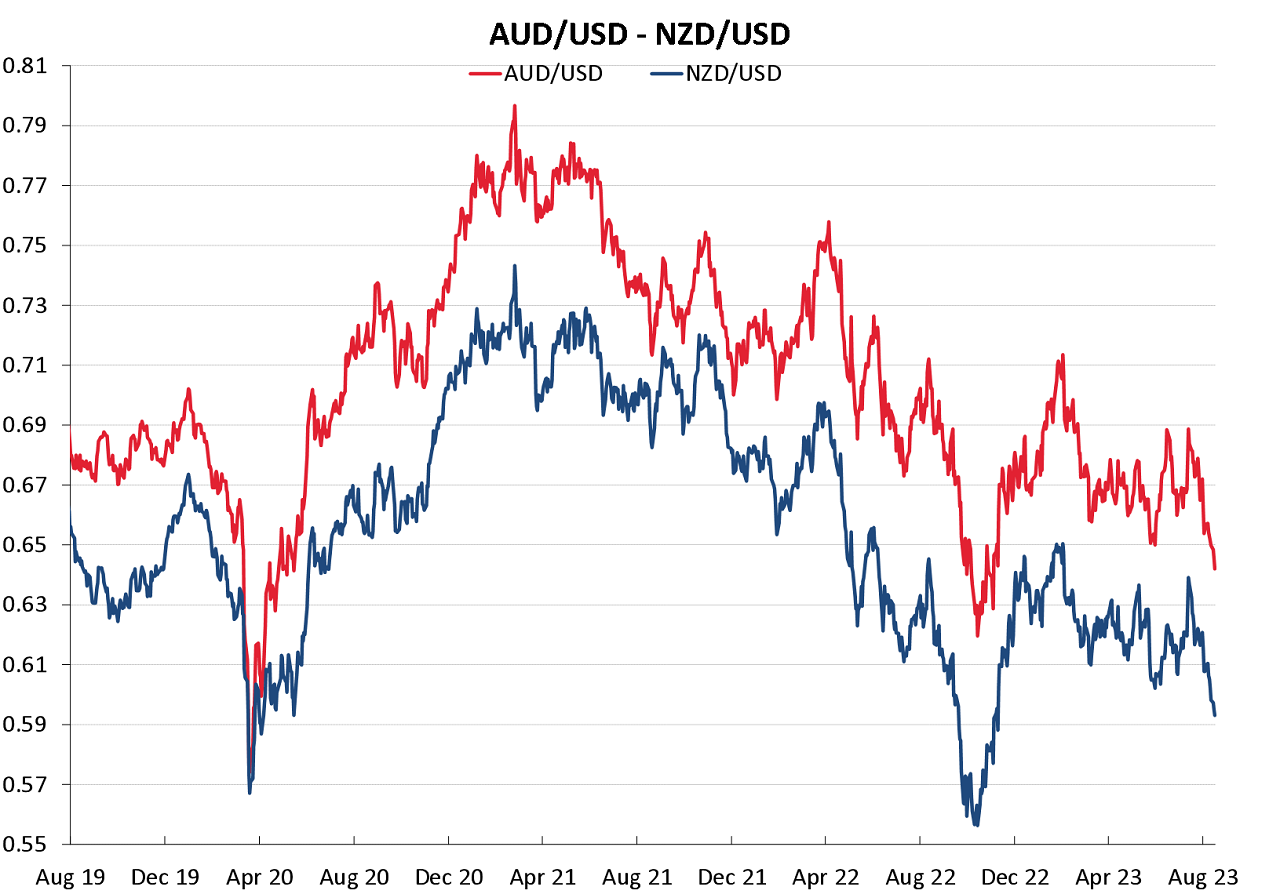

- The Australian dollar falling completely out of favour with international investors due to the RBA pausing with their interest rate increases at 4.10% (compared to 5.50% in the US and NZ) and weak Chinese economic data impacting negatively on the Australian economy. The NZD/USD exchange rate closely tracks the AUD/USD rate; however, you will never hear the RBNZ give that obvious explanation for the NZ dollar direction.

- “China risk” has certainly increased over recent weeks with weaker than expected import/export trade, retail sales and industrial production data. Add on large property developers under financial stress and the lack of response (to date) from the Chinese authorities to step in with major fiscal and monetary stimulus packages and the markets are left to speculate that the Chinese economy is about to implode. As a consequence, the Yuan exchange rate has been under downward pressure to the USD (trading over 7.3000) and both the NZD and AUD are closely linked to USD/CNY movements.

- The USD has undergone another bout of appreciation over recent weeks to 103.30 on the USD currency index, due to rising US bond yields and “safe haven” flows into the USD from the China risk uncertainties.

Looking ahead, our thesis is that the increase in US bond yields will not continue and that the perceived “China risk” factor will also abate. These two variables determining recent USD strength and NZD weakness are not sustainable in our view for the following reasons: -

- Massive speculative positioning and the absence of foreign investors in the US bond market when the US Government has a heavy issuance programme of new bonds has pushed the 10-year bond yields to above 4.30%. The yield increase has nothing to do with US inflation, the economy, or the Fed’s actions. So, not caused by underlying economic fundamentals, but merely a big catch-up in bond issuance after the debt ceiling limited bonds being issued over the first six months of the year. Watch for the 10-year bond yield to reverse sharply lower when the Fed pause with interest rate increases next month.

- Western media, economic commentators and financial markets have been periodically predicting the imminent “implosion” of the Chinese economy for more than 20 years now with contagion from credit shocks, debt crises and property bubbles bursting badly. The reality is that the communist state control and command never allows the contagion to spread to impact the wider economy. The authorities always “shore it up” and “cover it over” to prevent wider damage to the economy. The Chinese authorities have been slow to announce the inevitable economic support and stimulus packages to restore confidence, however tax/fiscal or monetary policy changes cannot be far away.

Japanese and Chinese FX market intervention not to be ignored

Direct intervention in foreign exchange markets by central banks to settle volatility and prevent excessive depreciation of their currencies is not taken lightly. However, often the mere threat of intervention is enough to cause the currency punters to reduce their speculative risk positions and the central bank ends up achieving its objective.

The Japanese Yen has weakened to 145 against the USD and at this level the Bank of Japan have previously successfully defended the currency from depreciating any further. It would help Japan’s cause with their currency value if they also moved their monetary policy away from the 0% interest rate settings which they have maintained for nearly 30 years. They have been very slow to implement this expected change over recent months.

The Peoples’s Bank of China was reported as instructing their state-owned commercial banks this last week to sell USD and buy Yuan to halt the Yuan’s recent slide. The daily exchange rate fixing by the central bank has been consistently below market exchange rates all week as well. The 7.2000/7.3000 level on the USD/CNY exchange rate has been a point that the Yuan has weakened to in the past, however it has always reversed back the other way. Time will tell whether the Chinese will stop the Yuan rot at this point, however it would be dangerous to bet against them!

Another RBA U-Turn still on the cards

Wages and employment data in Australia last week was weaker than forecast and supported the RBA’s stance that further interest rate increases are not required at this time. Whilst an interest rate hike is off the cards for the early September RBA meeting (outgoing Governor Philip Lowe’s last), the markets will not be ruling out a return to interest rate hikes at the early October RBA meeting (new Governor, Michele Bullock’s first). Australia still has an inflation rate of 6.00%, considerably above their 2.50% target and it is expected that Ms Bullock will not be setting monetary policy to not reduce that inflation rate until 2025 (as Mr Lowe has been doing). The AUD will rebound strongly upwards if Ms Bullock applies a more conventional approach to monetary policy to bring the Australian inflation rate down in 2024 (not 2025!).

The next key economic indicator for the RBA and the AUD value is the July inflation numbers released on Wednesday 30th August.

It seems the majority of the voting US Fed Governors are still of the opinion that there still exists a reasonable risk of US inflation increasing from current levels of 3.00%. The current lower price setting trends and upcoming reductions in house rents suggest otherwise. Weaker US PCE inflation results on Thursday 31st August and US jobs figures on Friday 1 September may be sufficiently soft to convince the dwindling Fed hawks to change their views. The Fed next meets on 20 September and there is a growing chorus of opinion that they will be pausing with interest rate hikes.

Before the Fed meeting, Chair Powell will be delivering a key-note speech at the Jackson Hole symposium of central bankers on Friday 25th August. It was at this venue 12 months ago that Powel reiterated a tightening of US monetary policy, he will be much more circumspect on this occasion with the plummet in US inflation from 9% to 3% since then.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

3 Comments

NZD down last week because the MILK went sour. Not mentioned. Outlook is negative.

You’re right to point out the RBNZ’s incomplete and flawed explanation of the NZD weakness, their conjecture is weak, and thanks for calling it out. It was rather shambolic, you’d expect a sharper response. They often fool the public but not the institutions especially over time. I also agree that NZD and AUD are closely correlated, so that would be a technical factor due to international hedging costs etc.

However, I would point out that I don’t agree with your analysis that the rise in US yields is just a technical factor, while they are definitely at play, the market’s perception is changing in that the inflation would average closer to 3% than 2% over next few years so the term premium and end of fed’s tightening means higher for longer. The market always pays up in yield for US 10s liquidity, I would expect it to be lower than in natural rate.

Can NZD strengthen on the back of a stellar domestic performance which is unlikely? or could it go up with China/Aus/commodity rebound or a weaker USD. Sure, there are other scenarios, but I’m not holding my breath on a decent bounce back in NZD anytime soon

CCP is omnipotent and Chinese economy not in big trouble. Yes Roger. And Fed was so in 2000-06. Until it wasn’t. The irrationality of markets encompasses extreme reactions I am afraid

NZ is plunging because it’s exports are dominated by China. China RE is facing a bit more than a small amount of stress

v Pollyanna

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.