Summary of key points: -

- Local economic gloom does not automatically send the Kiwi dollar lower

- Fed Chair Powell plays with a very straight bat

- Will the repeated waves up and down in the USD index continue per the pattern?

Local economic gloom does not automatically send the Kiwi dollar lower

One could paint a very gloomy picture of New Zealand’s current economic state and outlook for the immediate future, given the following variables: -

- Forecasts of a “double dip” economic recession with GDP economic growth likely to be negative in the September and December 2023 quarters, following negative number for the December and March quarters.

- “Worst in the world” external Balance of Payments Current A/c deficit of 9% of GDP, caused by the foreign currency earning tourism industry being decimated by Covid restrictions.

- Dairy export commodity prices plummeting as Fonterra sell-off their inventory over-hang from last season and improved domestic Chinese milk production reduces their demand for imported milk powder.

- The large domestic industry sectors of retail and house construction whacked hard by the sharp increase in interest rates required to rein-in high, sticky, and wage-pushed inflation.

- The Government’s fiscal deficit position under considerable “soon to be revealed” strain due to uncontrolled increases in Government spending, falling tax takes and massive increases in interest costs from Covid spending splurges that were all from borrowed money. How large the fiscal hole is for the current year will be disclosed at the PREFU (Pre-election economic and fiscal update) statement on September 12th.

- A failing Labour Government totally devoid of ideas and policies to grow the economic pie; however, the nation receives a barrage of daily announcements from them on how they are slicing up that contracting economic pie!

- The All Blacks just suffered their worst loss ever, 35-7 to the Springboks in London. Perhaps Eddie Jones is right when he quips that the whole nation and economy go into mourning if the AB’s lose a rugby game. However, exchange rates and economies can be like sporting results, what you see today is not necessarily the outcome you will get in a few weeks’ time!

Quite rightly, given the presence of all the above negatives, we could expect a tumbling value for the NZ dollar at this time as foreign investors have no incentive to transfer their capital into New Zealand and local investors would be justified in seeking safer and more attractive destinations for their capital offshore. The NZ dollar has depreciated somewhat of late, however there is no evidence of these capital inflows/outflows or NZD selling is due to the local economic negative factors listed above.

The NZD/USD exchange rate is down five cents to 0.5900 from the 0.6400 level of mid-July entirely due to the Australian dollar depreciating five cents from 0.6900 to 0.6400 (-7.2%) over the same time period. The Kiwi dollar tracks the Aussie dollar very closely as the very stable NZD/AUD cross-rate at 0.9200 confirms. The stable NZD/AUD cross-rate also confirms that we have not seen independent and separate NZ dollar selling due to the deteriorating and gloomy economic environment described above.

The AUD is five cents lower due to: -

- The Reserve Bank of Australia deliberately going on the “go slow” with interest rate hikes to bring their high inflation under control. With Australian official interest rates at 4.10% compared to 5.50% in the US, it is not difficult to see why the AUD is under pressure (for the meantime).

- The indeterminable delay of the Chinese authorities in responding to a severe weakening of their economic performance with widely expected fiscal/monetary policy stimulus packages.

- The US dollar itself appreciating from 100 to above 104 (+4%) on the Dixy Index due to rising US 10-year bond yields to 4.30%.

Whether the Aussie dollar can haul itself off the floor at 0.6400 and return to the high 0.6000’s is reliant on the RBA being forced to change their tune, to force their inflation down earlier than 2025 (likely), the Chinese authorities delivering more meaningful stimulus to their sagging economic fortunes (likely) and US bond yields reversing direction downwards to pull the USD back down (likely).

The expected changes in these offshore forces on the Kiwi continues to provide a higher probability of a recovery back above 0.6000 than further sustained depreciation below 0.5900. Despite the abundance of negative economic fundamentals supposedly weighing the Kiwi dollar down, the over-powering offshore forces are likely to deliver the opposite outcome.

Fed Chair Powell plays with a very straight bat

US Federal Reserve Chairman, Jerome Powell did not say anything new (at his key-note speech at the Jackson Hole jamboree of central bankers last Friday night) to anything he has already said before. The Fed is prepared to increase US interest rates further if the inflation and jobs data is stronger than expected and they are also prepared leave interest rates at current levels if the data is weaker. Powell’s speech was carefully crafted as being “down the middle”, with no bias to the hawks (higher rates needed) or to the doves (rates are high enough).

The subsequent neutral reaction by financial and investment markets confirmed that there was no new information or nuances from this speech. Unlike 12 months ago, when Powell’s short/sharp message that they needed to tighten monetary policy a lot further, drove US interest rates higher, equity markets lower and the US dollar stronger (the NZD/USD rate dipped briefly to 0.5500 in October 2022). US equity markets made good gains on Friday as investors concluded that the Fed are near the end of their tightening cycle, if they have not finished already.

The USD interest rate markets are pricing an 88% probability of one last 0.25% increase to 5.75% at the Fed’s next meeting on 20 September. It does appear that the Fed are heavily concentrated to current economic data (which is already historical) in determining their decision as to whether they still need to hike interest rates further to get inflation sustainably down to their 2.00% target. It is surprising that they are not more forward looking on the forecast inflation track, as the impact on the economy from monetary policy changes is so lagged. The housing /rent component of inflation, due to their crazy historical measurement method, can be accurately forecast to decrease substantially over coming months, pulling the annual core inflation rate down from its current 4.20% level to well below 3.00%. It seems many of the Fed voting members are unduly worried that something new will come along in the US economy to push inflation back up again. Their overly cautious approach at this time stems back to the Fed getting it horribly wrong 18 months ago when they claimed inflation increases were only “transitory”. Therefore, they are very gun-shy at getting it wrong again and are prepared to take the risk that they tighten too far and cause a more serious economic recession.

What the Fed should be analysing right now in respect to monetary conditions prevailing in the US economy is the impact on house construction activity and consumer spending from the dramatic increase in 30-year mortgage interest rates for borrowers from 6.50% two months ago to 7.50% today. The US Government debt issuance volumes pushing up bond yields causing the increase. The interest rate market has already significantly tightened monetary conditions of late without the Fed having to do anything.

Will the repeated waves up and down in the USD index continue per the pattern?

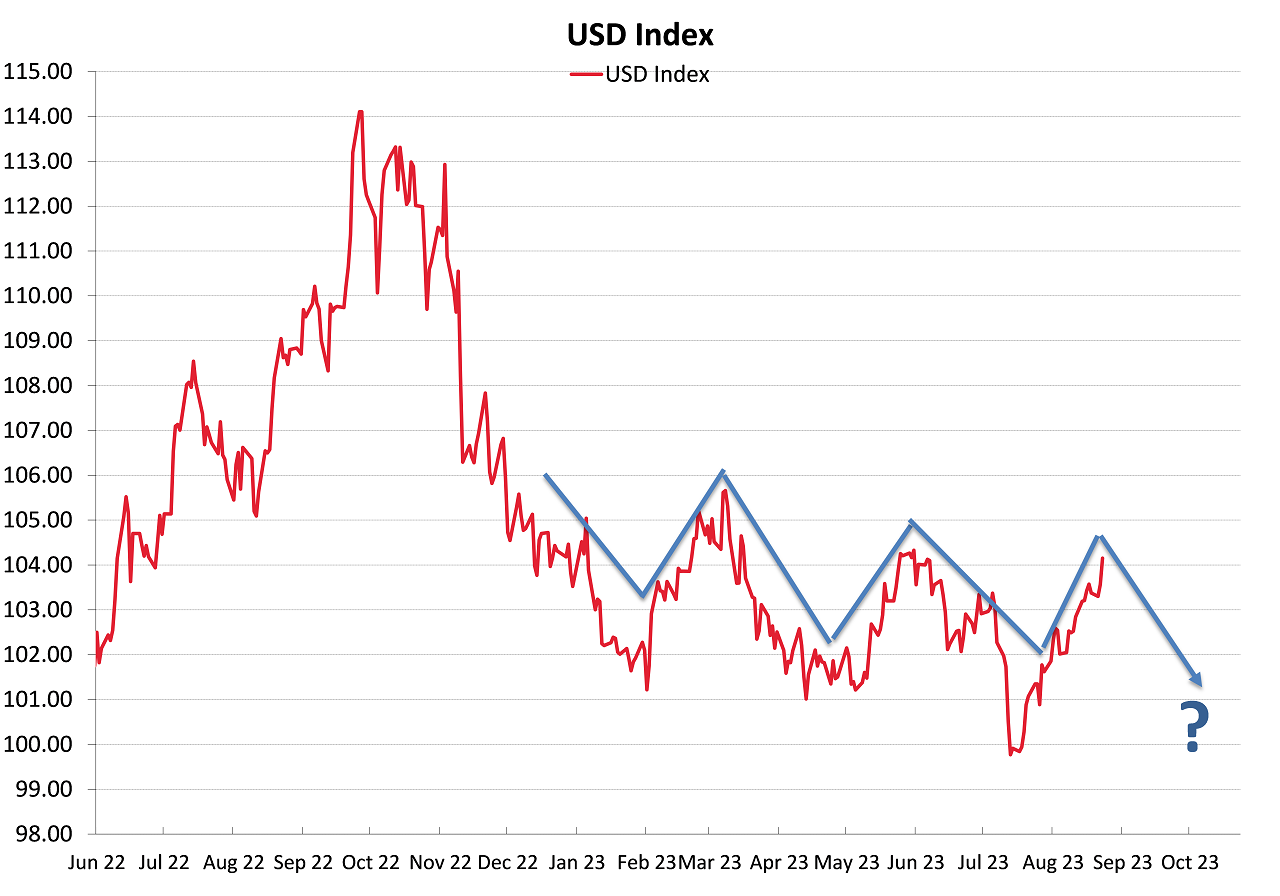

If historical patterns of movement in exchange rates are more likely to repeat, then we should expect the US dollar value to reverse engines and weaken over coming weeks. As the chart below shows, since the sharp US depreciation over the November 2022 to January 2023 period, the USD Index has moved up and down in repeated smaller waves. Stronger than expected jobs data caused the two USD gains during March and June. Weaker than forecast inflation outcomes caused the three USD selloffs in February, April, and July. The latest gain back to 104 in the USD Dixy Index is due to the rapid increase in US bond yields as large bond supply increases outweighs investor demand for bonds.

If the upcoming US inflation and jobs data prints on the weaker side, there will be good reasons for the USD bulls to take their recent profits and sell the USD lower. PCE inflation figures for July on Thursday night 31st August are forecast to increase by 0.20%, which will lower the PCE annual inflation rate to 3.00%. Non-farm Payrolls jobs numbers on Friday night 1st September for August are forecast to increase by a much lower 180,000 for the month. Hourly wages earnings in August are expected to stay stable at 4.40% pa.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

8 Comments

Thing to watch for is China - both AUD and Kiwi are traded as a default currency to track China.

If China keeps heading south and the prices of our key exports - well personally think both currencies will track south.

That however then brings in the RBNZ because if Kiwi does weaken further - it increases inflation and accordingly how will they respond.

RBNZ will then be left with a terrible decision - allow the Kiwi to depreciate further to assist exporters with declining product prices or ramp up interest rates further to further address inflation issues.

For NZ next month or two will be all about China - good news out of there and currency appreciates back up to mid 60's. If China continues to head south (and if China allows RMB to depreciate further) then Kiwi is heading lower probably to 55, where it should find a great deal of support.

Yes 55 is the big one, and given we are flirting with 58 already, I think we could go below that depending on market conditions.

Nzdusd is in a strong trend since mid july, and with no reversal at Jackson hole, I think that this trend is going to continue for a while yet.

Positive US news, and their still hot economy, is also a big factor imo. The negative news out of China, especially if it’s of the credit event variety is going to really push the nzd down.

The RBNZ must raise rates as soon as possible, and by at least 50 basis points.

Rodney Jones is a person who I rate and on Q&A his prognosis on China and our Dairy exports was very gloomy and likely to remain so for many years. We are very reliant on China and we are going to regret not having pivoting away earlier. So too is Australia and they are you our second largest customer, so we are going to be doubly hit. The outlook is dire.

I just watched that. He had some great insights.

The subtext I feel was that we are fked, and we need to get our a into g collectively.

Agreed, depressed by the fact we have gifted our technology to China but it is what it is.

Our options are incredibly limited, trimming the sales for light breezes makes more sense than pointing to the stands.

Yeah, I wasn't aware of this until a commenter on here mentioned it a few weeks ago. Pretty shortsighted, but probably on brand.

We have been warned and warned for years about having all our eggs in the Chinese basket but it’s been too easy to do nothing and now we are going to pay.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.