Summary of key points: -

- New Zealand’s domestic inflation problem exposed

- RBNZ need to explore more options to lower inflation

- Mixed US economic data, however, their inflation marches lower

There was a mixture of reactions by economic commentators and the financial markets to last weeks’ NZ CPI inflation data for the December 2023 quarter. Whilst the annual headline inflation rate declined significantly from 5.6% in the September quarter to 4.7% by year-end, eliciting cheers from some economists that we had conquered the inflation problem, the reality was that there was nothing to cheer about when the detailed components of inflation were analysed. The fact that the Kiwi dollar’s reaction was not move at away from its marooned position at 0.6100 against the US dollar was particularly informative as it confirms the expectation that the RBNZ will not be raising interest rates any further, however they will also not be cutting interest rates for quite some time yet either. The increase in inflation over the December quarter at 0.50% was bang on prior market consensus forecasts, however considerably above the +0.80% RBNZ forecast published in late November.

The concerning issue with the RBNZ’s responsibility to bring inflation down to the required 1.00% to 3.00% band, is that after 18 months of consistently tight monetary policy, the domestic inflation rate (non-tradeable inflation) is still running at an annual increase of 5.90%. That result has to be particularly worrisome for the RBNZ and hopefully they will be addressing that issue and what can be done about it when they next report on 28th February. Non-tradable inflation measures the price of goods and services that do not face foreign competition, and it is an indicator of domestic demand/supply conditions. Some of the domestic prices can however be influenced by foreign competition. Tradeable inflation (largely imported goods and fuel) increased by 3.00% for the year to 31 December 2023. As has been stated previously, it appears that tradeable inflation will need to go into the negative territory to pull to overall annual inflation rate into the 1.00% to 3.00% target band. For that to happen, oil and other global commodity prices will need to fall a lot further and/or the NZD/USD exchange rate appreciate a lot more to lower import costs. Unfortunately for the RBNZ, they have been unable to really force tradeable inflation down rapidly in this monetary tightening cycle as the higher NZ interest rates up until recently have been matched by higher US interest rates, not allowing on this occasion the normal NZ dollar appreciation you would expect.

Higher interest rate has been totally ineffective in reducing domestic prices, as this column has been spouting on about for many months, because it is all supply-side factors that have caused the inflation and higher interest rates are designed to reduce demand in the economy. The previous Government’s policies on immigration and taxation have caused the labour shortages/higher wages and higher rents. The cost to build a house, maintain a house and operate a house (rates, insurance, electricity) continues to be out of control in New Zealand (contributing to the 5.90% annual non-tradeable inflation) and it seems successive Governments and the RBNZ have failed to identify the problems and find some solutions. New Zealand is experiencing sticky, wage-push inflation and that is not easy to turn around and drive downwards. As the RBNZ have stated previously, you basically need to drive the economy into recession for an extended period and push the unemployment rate up to lower the wages pressure. To most, that solution is unpalatable, therefore smarter, less damaging methods need to be found.

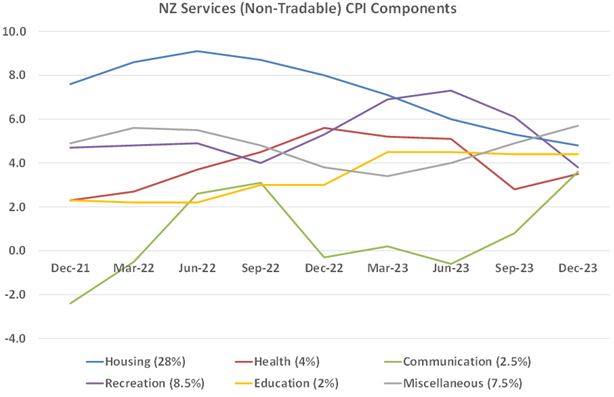

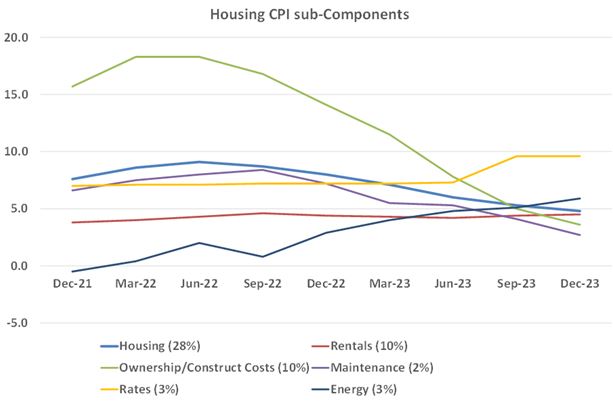

The charts below confirm the domestic inflation problem we have and many of the price trends are heading in the totally wrong direction i.e. up not down! Only recreation prices are trending down in the services/non-tradeable components. Health, communications and miscellaneous (insurance and personal care) are all trending upwards. Housing, which has a large 28% weighting in the CPI, is very slowly trending down (blue line), however it is still running at a 5.00% annual increase. In the second chart on housing sub-components, local government rates are outrageously out of control at an 10% annual increase, with rents, building costs, maintenance and energy all running close to 5.00% annual increases.

RBNZ need to explore more options to lower inflation

The RBNZ do have some choices when it comes to making monetary policy decisions from here to achieve their 1.00% to 3.00% inflation objective. Option one is to increase interest rates further to prolong and deepen the economic recession to push those problematic domestic prices downwards. A second option is to “jawbone” the NZ dollar currency value upwards to pull tradeable inflation into the negative a lot sooner than would otherwise be the case. Previous RBNZ Governors often commented about the NZ dollar value and its impact on inflation, however the current RBNZ regime under Governor Adrian Orr seems totally reluctant to even mention the NZ dollar. It is a legitimate tool to use from their toolkit to control inflation and it seems odd that they have disregarded it. Talking about the need for a higher currency value to pull inflation lower is likely to be more effective in 2024 than 2023, as the US Federal Reserve are now indicating interest rates cuts in 2024. All Governor Orr has to do is deliver as more hawkish statement than what the markets expect on 28th February and stop talking about the NZ dollar depreciating because international interest rates are rising more than New Zealand’s!

Over the next 12 to 18 months a NZD/USD exchange rate appreciation to somewhere near 0.7000 to reduce inflation would not hurt the export sector as most exporters are currently very highly hedged. The RBNZ should be aware of this level of hedging and therefore should not be making comments that a higher NZD would be negative for the economy as exporter’s returns are less. To be fair to the RBNZ, the failure of the NZD to appreciate on 5.50% interest rates is also due to their counterparts at the RBA conducting a very inconsistent and haphazard monetary policy over recent years that has left Australian interest rates below those of the US and therefore a weaker AUD currency value has resulted (which the NZD closely follows).

Mixed US economic data, however, their inflation marches lower

Retail sales, manufacturing and employment data was generally stronger in the US economy during December than what prior market forecasts had indicated. The “Goldilocks” outcome for the US economy in 2023 of positive economic growth and rapidly falling inflation (not too hot, not too cold) has been a commendable achievement by the Federal Reserve. Whilst these conditions have been fantastic for equity markets over recent times, the FX and bond markets have become stuck in a rut over recent weeks. The decline in US 10-year-bond yields has stopped at levels just above and below 4.00% and the USD Dixy Currency Index is hovering around 103.00. The FX and bond markets are now questioning and second-guessing themselves on the previous December aggressive pricing-in of over 150 points of cuts to the Fed Funds interest rate in 2024.

Our view is that confidence will return to the FX and bond markets about the level of interest rate decreases this year when they observe upcoming jobs and inflation data. All the indicators point to jobs increases in January, February and March slowing up considerably to around 150,000 per month. On the inflation front, the PCE index that the Fed prefer as an inflation measure was again vey muted in December. The core PCE index only increased 0.10% (below consensus forecasts of +0.20%) in December, the annual core rate now 2.90%. The overall PCE index increasing 0.20% for an annual rate of 2.60%. Analysing the component parts of the PCE index gives no cause for concern or risk of prices suddenly turning back up again. The 12-month lagged rents data is only heading one way and that is significantly lower over coming months.

Only elevated global geo-political tensions, it seems, can prevent a re-commencement of the US dollar downtrend to below 100 on the USD Dixy Index over coming weeks/months. In assigning probabilities to these counteracting risks for the USD value, the lower US jobs and inflation outcomes looks a more certain bet than some new geo-political risk event that causes fresh safe haven flows into the US dollar.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

4 Comments

A retrenchment of central Govt payroll and a focus on value for money from services matched to continual messaging about the waste from the previous govt will all assist with a reduction in inflation - lots of price movements and inflationary impacts are emotional processes/decisions after all.

Now we just need NZRB to make the right noises as well, as RJK notes above

First thing that can be done, is amalgamate the local Councils. Christchurch, Selwyn and Waimak for starters. Currently ratepayers are paying millions in duplicated overheads. And one council is paying astronomical costs for facilities utilised by the ratepayers of other councils without any contribution.

Hawkes Bay always makes me laugh. 6 councils (not sure why Taupo is on the below page).

Although Wellington is just as tragic. Supplied a couple of infrastructure jobs last year, within 5km driving distance. One was in Wellington City ward and the other Porirua. So things like the toby box lids for people's houses needed to be a different colour.

http://www.localcouncils.govt.nz/lgip.nsf/wpg_url/Profiles-Councils-by-…

According to the RBNZ all we need is more people unemployed. I vote we start with those on the highest payrolls in govt positions and especially with those in the RBNZ. After all they could easy put out as much bad planning with only half the morons in charge as they have now.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.