Summary of key points: -

- Fears of US inflation increasing again misplaced

- Australian inflation trending the wrong way

- Opportunities available to New Zealand to lift export performance

Fears of US inflation increasing again misplaced

Another month goes by, and it is another 0.00% change in US inflation (for the month of May as measured by the Federal Reserve’s preferred PCE measure of inflation). Fears by the financial markets, many US economists and a good number of the Fed’s members that something or someone is going to force US inflation back up again appears to be misplaced, judging by the trends in the component parts that make up the goods and services inflation.

There was not great reaction by the bond or FX markets to the further confirmation from the May PCE that the annual inflation rate is on track to reduce from the current 2.60% to the 2.00% Fed target over coming months. The probability of further reductions in the annual inflation rate to 2.00% over coming months appears to us to be significantly higher than staying at 2.60% or reversing back up again. However, the markets do not seem convinced at this point. Having reduced the forward pricing of Fed cuts from six at the start of the year to only one or maybe two today, the markets now seem reluctant or hesitant to admit that the Fed are close to having the evidence to make three cuts to interest rates of 0.25% each before the end of 2024. Readers may recall that the Fed members in their “dot-plot” interest rate forecasts made in December 2023 predicted three 0.25% cuts in 2024. On the current evidence, it does seem that this is the more likely outcome with the first interest rate cut coming in the Fed’s September meeting, then successive monthly cuts in November and December.

Following the May PCE 0.00% result (which was below the +0.10% prior consensus forecasts), the USD Dixy Index stayed firmly above 105.00 level and the 10-year bond yields perversely lifted from 4.25% to 4.39%. These initial market movements are at odds with the growing evidence that the Fed will have sufficient confidence to abandon the 5.50% very restrictive monetary policy settings as soon as September. As discussed in last week’s report, the annual PCE rate of inflation will not reduce from the 2.60% level in June and July due to the very low monthly increases in June and July 2023. However, the much higher 0.40% PCE increases in August and September 2023 will drop out of the annual inflation calculations, allowing the 2.00% target to be achieved by the end of September.

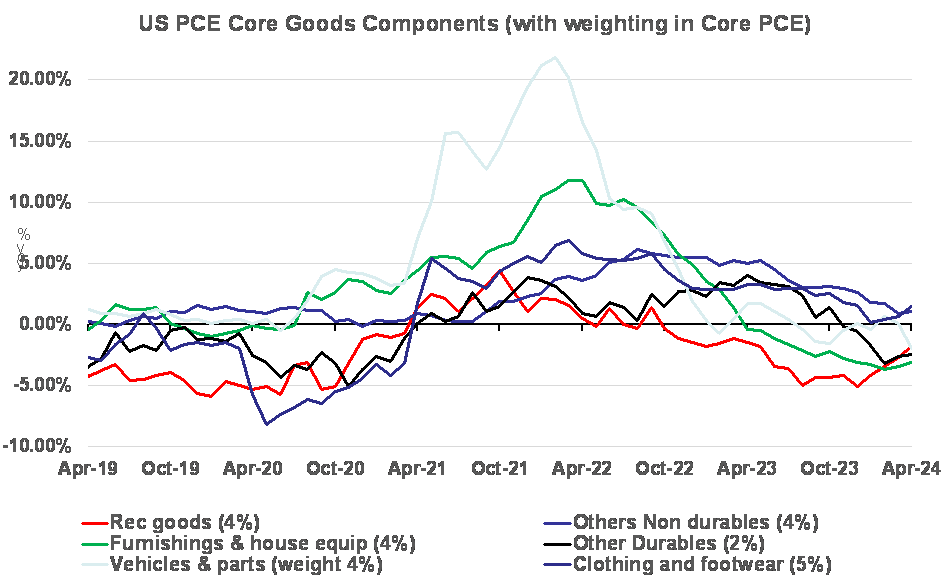

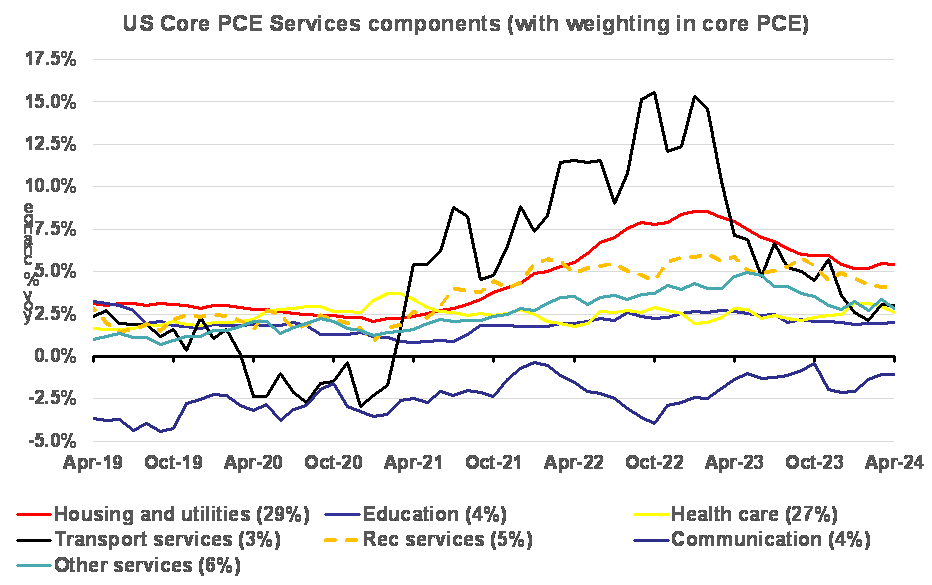

An examination of the component parts of the core PCE inflation measures in the charts below does not indicate any great risk of prices resurging upwards again. Core goods prices are already in deflation mode below 0.00% and core services prices are all trending lower. The excruciating lagged housing and utilities inflation measure continues to distort the overall numbers. Recent reports on market rents for one- and two-bedroom apartments across all US cities is only a 2.00% increase over the last year, materially below the 5.00% annual increase coming through in the PCE housing and utilities measure.

The implication for the NZD/USD exchange rate from the above analysis on US inflation and US interest rate direction over the next six months is obvious. The US Fed will be cutting their interest rates in September in a major pivot of monetary policy, the RBNZ have clearly stated that they will not be cutting our interest rates until 2025 as our inflation remains well above the 1.00% to 3.00% target band. The closing interest rate differential supports a higher NZD/USD exchange rate.

Australian inflation trending the wrong way

Australia’s monthly CPI inflation indicator was forecast to increase from a 3.60% annual inflation increase for the year to 30 April to 3.80% for the year to the end of May. The actual released last week was an increase to a 4.00% annual inflation rate. Price increases were across the board in food, electricity, rents and services. The pressure is building on the Reserve Bank of Australia (“RBA”) to increase their OCR interest rate from the current 4.35% to 4.60% at their next meeting on 6th August. It will be very much a “live” meeting for the RBA to lift interest rates as they discussed rate hikes at their last meeting, did not discuss rate cuts, and now inflation is tracking much higher than their forecasts. The “chickens have come home to roost” for the RBA as they pay the price for not increasing interest rates high enough in 2023. They thought that somehow the Australian economy was different to the US, UK, Canada and New Zealand and to get inflation under control they did not need 5.50% interest rates. They have made an embarrassing monetary policy mistake and will now be increasing interest rates over coming months when the rest (except NZ) are cutting interest rates.

The money markets in Australia are now pricing-in a 40% chance of a 0.25% hike in August and a 60% chance of a hike in September. What has also become evident in the Australian economy is that recent Federal Government and State Government budgets are all adding to inflationary pressures. The June quarter CPI inflation numbers being released on 31st July should provide the RBA with the evidence that inflation is increasing again, and they need to do something about it.

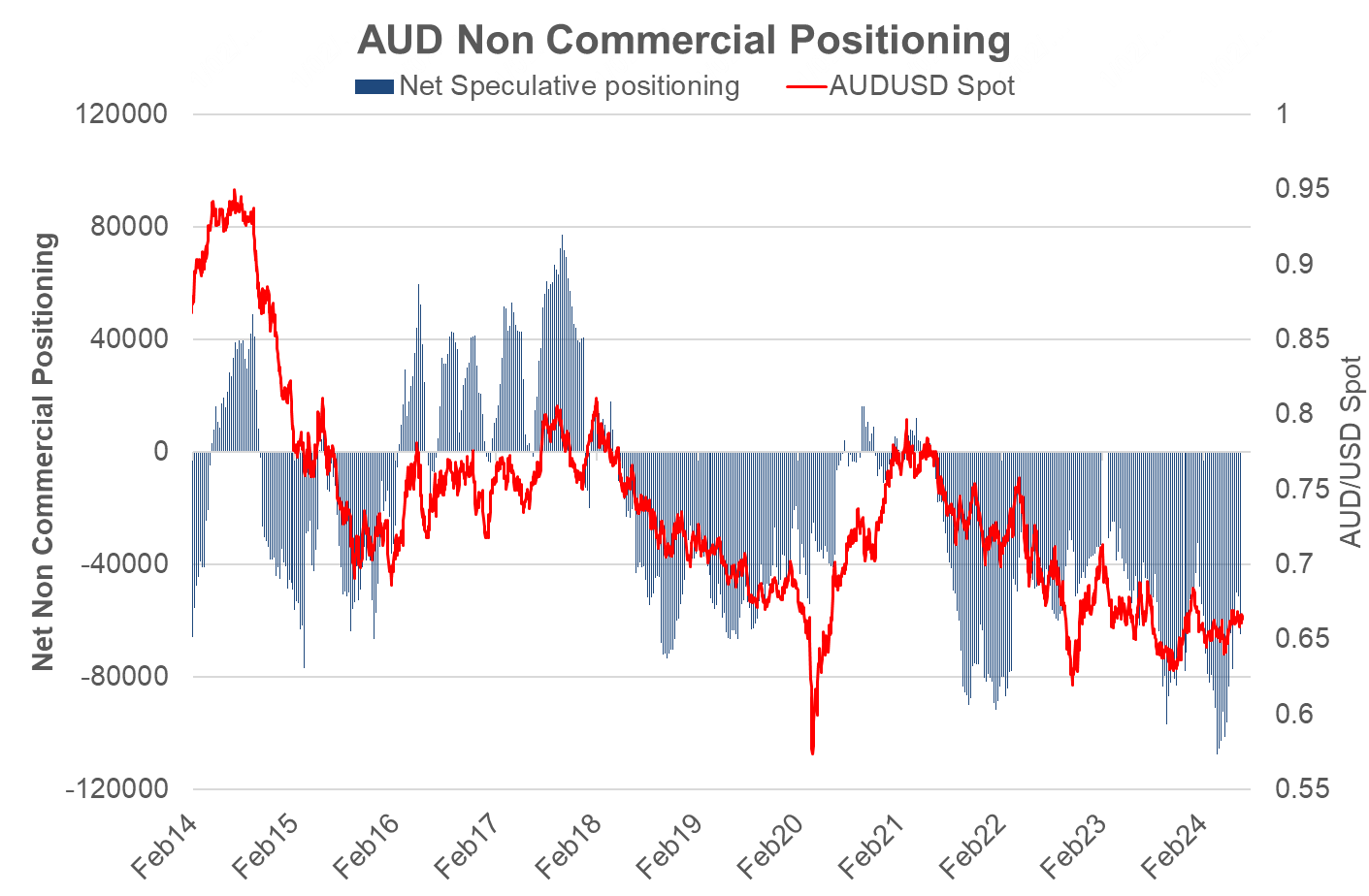

The FX traders and speculators in the AUD/USD market have already pulled back their “short-sold” AUD positions (blue bars in the chart below) as they anticipate the interest rate gap closing up over coming months with Australian rates rising and US interest rates being cut. We would expect this change to continue over coming weeks, the resultant AUD buying sending the AUD/USD exchange rate up through its 0.6700 resistance to much higher levels.

Opportunities available to New Zealand to lift export performance

It is becoming very clear that the only way New Zealand is going to pull itself out of its current predicament of a contracting economy with sticky/high inflation is through an export-led economic recovery. The signs are already promising with export receipts for the month of May the highest ever at $7.16 billion. However, as many folks have accurately pointed out over many years, New Zealand needs to grow its exports (as a percentage of total GDP) by adding more value to the products we export rather than just shipping out raw commodities. Easier said than done, when you have an uncompetitive high inflation rate and low “economies of scale” due to our small size. The danger is that you just add cost to the export product rather than adding value. The answer partially lies in expanding new, non-agriculture related export industries where we might have a competitive advantage compared to others. We already do well in computer software and medical-related products and services.

Prior to the Covid pandemic, selling education services to foreign students was a large $3.70 billion per annum and growing export earner. The industry took a major hit from the closed borders and has never really recovered, with current international student numbers only about 50% of pre-Covid levels. However, the world moves on, and New Zealand needs to be alert to new opportunities. As Roger Partridge of the New Zealand Initiative recently adroitly pointed out (NZ Herald article 27 June 2024), Australia has imposed a limit on the number of foreign students they take each year. Australia, for their own reasons, is about to turn its back on $7 to $10 billion in annual export earnings. If we were smart enough, we could capture a good part of those international students previously planning on Australia and entice them into coming to New Zealand universities. As Roger argues, the reasons for increasing international students into New Zealand are compelling, the major one being the invaluable links and connections that are made for New Zealand doing business with Asian countries later in the student’s life. Australia promotes and markets its international education offering around the globe through one central vehicle, the Australian Trade and Investment Commission. Education New Zealand, a Crown Entity, supposedly fulfils that role of promoting our education services to the world through “empowering, connecting and partnering”. It is hard to obtain information on how effective or successful Education New Zealand has been in their mission. They do have an International Education Strategy 2022 to 2030, however there is not one individual on their Board of Directors of six with any experience or background in global marketing! A simple question would be: Why isn’t Education New Zealand under the umbrella of NZ Trade and Enterprise? The reality is that the University of Auckland, Massey University and the Otago University will all probably be in Shanghai on the same day, doing their own thing, in marketing/promoting their education products. Unfortunately, that is the New Zealand way of doing things in our typical parochial, piecemeal, disjointed and cottage industry sort of way that produces sub-optimal outcomes for the economy. We largely operate “single export desks” in kiwifruit and dairy, why not organise ourselves the same way in international education?

Further to the commentary is last week’s report, enacting solutions to reduce the entrenched +3.00% every year domestic/non-tradeable inflation should be a key priority for the National Coalition Government. One solution not mentioned last week, is to ride over the restrictive provincial/parochial attitudes across New Zealand by enforcing amalgamations of local government councils. The outrageous 10% plus per year increases in local government rates year after year is just not sustainable as households (through rates and rents) just cannot afford it. The major reason for rates increases is central Government-imposed regulation and legislation requiring councils to increase staff numbers to deliver to such requirements. The overhead costs of councils has increased far in excess of population growth over the last decade, therefore radical reform is both justified and required. Local parochial attitudes prevent council amalgamations to spread overhead costs over larger rating bases. Central Government needs to take the lead here to alleviate this inflation burden on households.

Similar to promoting education services globally, the Government needs to display some leadership to change how we do things.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

3 Comments

Local councils have generally been captured by the Left, with ever more spending on non-essentials, greater and grander projects to make the council look good. Councils like Nelson need to be reined in. Their spending is simply out of control and rate increases of 15% per annum follow..

Not only have the RBA failed to get on top of Inflation, Stage 3 tax cuts come into effect today.

Good article well researched.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.